Japan Cloud Computing Market Size, Share & Analysis, By Type (Public Cloud, Private Cloud, and Hybrid Cloud), By Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, IT and Telecommunications, Government, Consumer Goods and Retail, Healthcare, Manufacturing, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

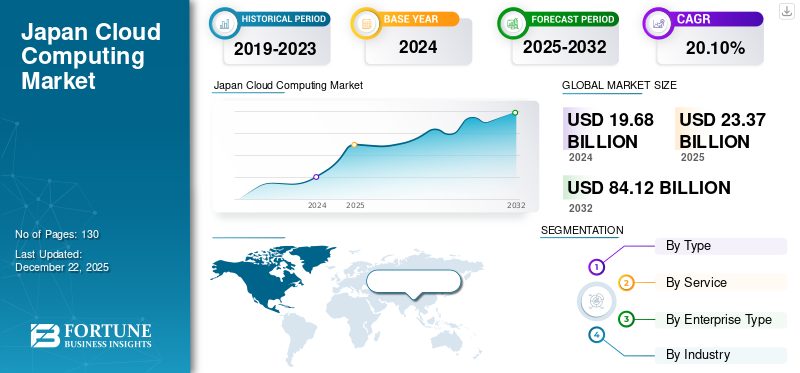

Japan cloud computing market size was valued at USD 19.68 billion in 2024. The market is projected to grow from USD 23.37 billion in 2025 to USD 84.12 billion by 2032, exhibiting a CAGR of 20.10% over the forecast period.

The cloud computing market in Japan is rapidly evolving from a cautious IT landscape to a digital leader. This emphasis on high-performance infrastructure, data residency, and cybersecurity is creating a unique localized cloud ecosystem. Increased investments by the domestic marketplace and global players, combined with Japanese government assistance for digital transformation, has accelerated the pace of adoption in sectors such as government services, manufacturing, and healthcare. Japan’s journey continues to balance innovation with policy compliance, but it is creating broader pathways for both cloud maturity and digital resilience within the Asia-Pacific region.

Japan Cloud Computing Market Trends

Collaborations and Partnerships to be Key Driver for Market Growth

Cloud service providers are forming partnerships with local technology companies, governments, and academic institutes of higher education at an increasing rate in Japan. While these partnerships will foster new innovation opportunities by combining cloud capabilities with local knowledge and resources, they also enable providers to grow the base of cloud infrastructure across the country and ensure more reliable and extensible services.

- In October 2024, Oracle and NTT DATA Japan are partnering to expand Japan’s sovereign cloud services using Oracle Alloy. This will boost cloud adoption, AI capabilities, and ensure data stays within Japan to meet regulatory requirements, supporting the country’s digital transformation efforts.

Key takeaways· The Japan Cloud Computing Market is projected to be worth USD 19.68 billion in 2032. · In the by type segmentation, public cloud accounts for around 59.9% of the Japan Cloud Computing Market in 2024. · In the by service segmentation, Infrastructure as a Service (IaaS) is projected to grow at a CAGR of 21.6% in the forecast period. · In the enterprise type segmentation, Large Enterprises accounted for around 50.5% of the market in 2024. |

Japan Cloud Computing Growth Factors

Advancements in Cloud Security Solutions to Boost Market Growth

The advancement of cloud security technologies is one of the factors fueling Japan cloud computing market growth. Better protection tools such as advanced encryption, real-time threat detection, and stronger access control mechanisms have improved businesses' perceptions of moving data into the cloud. In parallel with increased awareness of cybersecurity practices and regulatory requirements, these improvements have mitigated anxiety around data safety and protection risks. This increase in trust enhances the probability of cloud trust, thereby adoption rate of cloud solutions, and supports growth across the Japanese market.

- In April 2024, Microsoft announced to invest USD 2.9 billion to expand AI and cloud infrastructure in Japan, train 3 million people in AI skills, open a new research lab, and boost cybersecurity in partnership with the government to drive Japan’s digital transformation.

Japan Cloud Computing Market Restraints

Security Concerns and Financial Constraint Limit Market Growth

Security risks and costs are still the key barriers to cloud adoption in Japan, especially among SMEs. Organizations will need to weigh their risk tolerance for moving sensitive data and mission-critical systems into the cloud, meaning they need to implement strong protection measures such as encryption or access controls and monitoring. Setting up and maintaining these security systems can be expensive, limiting the options for small business or smaller to mid-sized enterprises (SMEs).

- In fiscal year 2024, Japan recorded more than 21,000 incidents involving breaches of personal information, reflecting a concerning rise of 58% compared to the previous year.

Japan Cloud Computing Market Segmentation Analysis

By Type

Based on type, the market is divided into public cloud, private cloud, and hybrid cloud.

Public cloud services hold the majority in the Japan cloud computing market share, owing to their advanced infrastructure and suite of services. However, concurrently the hybrid cloud segment is expected to grow with the highest CAGR as businesses are focusing more on aspects of data security and regulatory compliance. Organizations in Japan are embracing hybrid solutions so that they can keep control of sensitive data on-premises while leveraging the speed and efficiency of cloud platforms.

By Service

Based on service, the market is trifurcated into infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS).

SaaS holds the majority share in Japan due to flexibility, convenience, and efficiency to support operational efficiency, collaboration among businesses. IaaS solutions are expected to grow with the highest CAGR due to companies seeking for flexible and scalable infrastructure to support complex applications and push their digital transformation agendas forward.

By Enterprise Type

Based on enterprise type, the market is segmented into large enterprises and SMEs.

Cloud adoption in Japan started with large companies seeking to modernize legacy systems and improve operational efficiency. Today, these organizations are beginning to use next-generation cloud technologies to facilitate innovation, enable AI options, and analyze data in real time. At the same time, many small and medium-sized companies are diving into the cloud scene which have more accessible pricing and straightforward deployment.

By Industry

Based on industry, the market is segmented into BFSI, IT and telecommunications, government, consumer goods and retail, healthcare, manufacturing, and others.

In Japan, the IT and telecommunications industry holds the majority in cloud adoption; adopting cloud infrastructure has allowed a complex support of networks, 5G, and real-time data. The healthcare industry, previously slow due to the conservative nature and privacy laws, is becoming an increasingly larger consumer of cloud, as secure telemedicine platforms, electronic medical records, and artificial intelligence (AI)-assisted diagnostics is in demand. More and more use cases for specific industries are being used to move traditional conservative markets in Japan toward cloud computing technology, resulting in broader usage and depth of cloud adoption.

List of Key Companies in Japan Cloud Computing Market

The cloud computing market in Japan is poised for growth by numerous domestic players, such as NTT DATA Inc., Fujitsu, NEC Corporation, and Sakura Internet, capitalizing on their local expertise to provide trusted and compliant cloud service solutions. NTT DATA, Fujitsu, and NEC are focused on providing large enterprises and governments with cloud integration, implementing a sovereign cloud model and digital transformation projects.

NEC is utilizing AI-empowered infrastructure to drive innovation and Sakura Internet is appealing to start-ups and medium-sized corporations with less costly, scalable solutions. These firms not only contribute to the enhancement of Japan's digital resilience but also anticipate themselves as established players in a cloud market defined by security, localization, and sector-specific clients.

LIST OF KEY COMPANIES STUDIED

- NTT DATA Inc. (Japan)

- Fujitsu (Japan)

- NEC Corporation (Japan)

- Sakura Internet (Japan)

- KDDI Corporation (Japan)

- Rakuten Symphony (Japan)

- GMO Internet Group (Japan)

- ITOCHU Techno-Solutions Corporation(Japan)

- Kasanare (Japan)

- Soft Gear (Japan)

- W.G Inc. (Japan)

- Loglass (Japan)

KEY INDUSTRY DEVELOPMENTS

- November 2024: Kyndryl announced the launch of a dedicated AI private cloud in Japan, developed in collaboration with Dell Technologies and NVIDIA. The platform offers a secure, sovereign environment for businesses and academic institutions to develop, test, and deploy AI and generative AI applications.

- April 2024: Oracle Corporation Japan recently announced an investment of USD 8 billion over the next 10 years to expand the company’s cloud and AI capacity. The initiative will expand Oracle Cloud Infrastructure (OCI) across Japan with focus on digital sovereignty and strong local support in Tokyo and Osaka.

REPORT COVERAGE

The Japan cloud computing market is undergoing a dynamic transformation, driven by the nation’s accelerated digitalization and demand for secure, scalable, and AI-ready infrastructure. This market report offers an in-depth analysis of current trends, including rapid expansion of hybrid and multi-cloud strategies, growing importance of data sovereignty, and significant investments in hyperscale data centers. It highlights how industries such as finance, healthcare, manufacturing, and retail are leveraging cloud technologies to modernize operations and enhance competitiveness. The report also covers strategic collaborations, government-led initiatives, and emergence of innovative cloud-based services that are shaping the next chapter of Japan’s digital economy.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 20.10% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Public Cloud · Private Cloud · Hybrid Cloud |

|

By Service · Infrastructure as a Service (IaaS) · Platform as a Service (PaaS) · Software as a Service (SaaS) |

|

|

By Enterprise Type · SMEs · Large Enterprises |

|

|

By Industry · BFSI · IT and Telecommunications · Government · Consumer Goods and Retail · Healthcare · Manufacturing · Others |

Frequently Asked Questions

Fortune Business Insights says that the market was worth USD 19.68 billion in 2024.

The market is expected to exhibit a CAGR of 20.10% during the forecast period.

By industry, the IT and telecommunications industry is set to lead the market.

NTT DATA, Fujitsu, NEC Corporation, and Sakura Internet are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us