Ladder Cable Tray Market Size, Share & Industry Analysis, By Type (Swaged Ladder and Welded Ladder), By Material (Steel, Aluminum, Fiber Reinforced Plastic, and Others), By Application (Power, Construction, Manufacturing, IT and Telecommunications, and Others), By End-User (Residential, Commercial, and Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

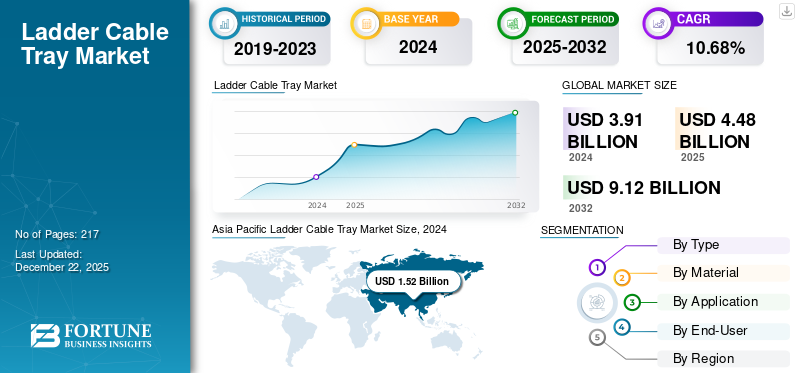

The global ladder cable tray market size was valued at USD 4.48 billion in 2025. The global market is projected to grow from USD 5.1 billion in 2026 to USD 11.24 billion by 2034, exhibiting a CAGR of 10.37% during the forecast period. Asia Pacific dominated the ladder cable tray market with a market share of 33.93% in 2025.

The ladder cable table is used in industrial and commercial settings to support and route electrical cables. The market for ladder cables is growing due to several key drivers. Rapid growth in power plants, oil and gas, manufacturing plants, and commercial buildings is increasing demand for structured and efficient cable management, particularly in developing countries in the Asia Pacific, the Middle East & Africa. The cable tray market in residential buildings is growing due to a combination of urban development, technology integration, and the increasing demand for efficient cable management systems.

The market share is growing due to increased industrial activity, infrastructure development, and rising demand for durable, compliant, and efficient cable management systems across energy, telecom, and commercial sectors. Commercial and industrial ladder tray are witnessing growth due to its practicality, durability, and sustainability for complex wiring systems. Thus, the ladder cable tray market is projected to reach significant growth due to its durability and ease of installation.

Niedax Group, Eaton, and Legrand are few major vendors in the market due to their global presence, wide product portfolios, compliance with international standards, and strong engagement in industrial and infrastructure projects.

MARKET DYNAMICS

MARKET DRIVERS

Expansion of Industrial and Infrastructure Projects to Drive the Market

Industrial plans and infrastructure projects require the routing of multiple heavy-duty power and communication cables. Ladder trays offer high load-bearing capacity and long span support, making them ideal for these complex wiring networks. Infrastructure such as airports, metro systems, refineries, and power plants involves long cable routes that need durable and ventilated trays. These factors contribute to the ladder cable tray market growth.

In November 2024, the Abnex joint venture (JV) expanded its options and promoted opportunities in the expanding North American cable management market. The newly established business will be able to provide a wide range of cable tray solutions and services to electrical contractors, distributors, and systems integrators in Canada, the U.S., and Mexico by integrating the engineering and manufacturing skills of ABB's Installation Products Division with the Niedax Group.

MARKET RESTRAINTS

High Installation and Material Costs to Hinder Market Growth

Ladder trays are typically made from galvanized steel, stainless steel, aluminum, or FRP, all of which are costly compared to alternatives such as plastics or wire mesh trays. FRP and stainless steel trays, preferred for corrosive environments, can be especially expensive. Due to their rigid and heavy-duty construction, ladder trays often need more support structures compared to lighter tray systems, adding to material and labor costs.

Installing ladder trays in large industrial projects or long-distance runs requires skilled labor, safety equipment, and planning, leading to higher installation time and cost. In developing markets or small-scale facilities, the initial investment required for ladder trays discourages its adoption in favor of cheaper cable management solutions.

MARKET OPPORTUNITIES

Urbanization and Smart City Projects to Create Lucrative Opportunity for Market

Urbanization is driving large-scale development of metro rail networks, airports, IT Parks, hospitals, smart roads, and commercial buildings. These projects require extensive power distribution and communication networks, which need reliable cable management ladder trays that are ideal for such applications.

In January 2024, Panduit, a worldwide pioneer in solutions for network and electrical infrastructure, introduced its next-generation cable management solution, the Wire Basket Cable Tray Routing System. This is made to route and manage copper data cables, fiber optic cables, or power cables inside data centers, connected buildings, and industrial facilities.

Ladder Cable Tray Market Trends

Modular and Easy to Install Designs in an Emerging Market Trend

The demand for modular and easy-to-install ladder cable tray systems is significantly increasing across industrial, commercial, and infrastructure projects. These designs offer faster installation with reduced labor costs, tool-less assembly or snap fit mechanisms for convenience, and prefabricated sections for quick deployment on-site. This trend is especially robust in data centers, manufacturing plants, renewable energy projects, and smart buildings, where efficiency and speed of deployment are critical. As a result, manufacturers are focusing on developing customizable, lightweight, and pre-engineered ladder trays that align with modern construction practices and lean project timelines, contributing to the increase in cable tray market trends.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Increased Adoption of Swaged Ladder in Industrial and Energy Projects to Drive the Segment Growth

The market by type covers swaged ladder and welded ladder.

Swaged ladder is the dominating segment in the ladder cable tray market. Rising demand from data centers, oil & gas facilities, and power plants is driving adoption of efficient, durable cable management systems such as swaged ladders. They give a greater strength-to-weight ratio which aids them to support heavier cable bundles without sagging.

Welded ladder is the second leading segment in the market. Growth in the energy, petrochemical, and big industrial sectors has necessitated rugged cable support systems such as welded ladders. Welded ladder trays can be customized for particular projects such as unique spacing of rungs and widths, thus driving the segment growth.

By Material

High Strength and Load-Bearing Capacity Feature to Drive the Steel Growth

The market by material covers steel, aluminum, fiber-reinforced plastic, and others.

Steel segment held the highest ladder cable tray market share. Steel ladder trays support heavy electrical cables over long spans, making them ideal for industrial and power-intensive applications. Steel ladder trays are readily available globally, with strong supply chains and many vendors offering custom options for specific industrial needs.

Aluminum is the second largest segment in the market. Aluminum trays are much lighter than steel, which reduces transportation costs, installation time, and labor on-site. It is ideal for applications requiring frequent adjustments or retrofits.

By Application

Increasing Energy Infrastructure Projects to Drive Power Segment Growth

By application, the market is segmented into power, construction, manufacturing, IT and Telecommunications, and others.

The power segment dominates the market. Rising investment in power generation, transmission, and distribution projects is creating strong demand for reliable cable management systems. Expansion of thermal, hydro, solar, and wind power plants is also fueling ladder tray installations.

IT and Telecommunication is the fastest growing segment in the market. Massive growth in data centers driven by cloud computing, 5G infrastructure, and AI and IoT applications contributes to the segment growth. These facilities require structured cabling systems with high reliability. Ladder cable trays offer efficient cable support and organization.

By End-User

Rising Smart Home Globally to Lead Residential Segment Growth

By end-user, the market is segmented into residential, commercial, and industrial.

The residential segment dominates the market. Growth in smart homes, with devices including home automation systems, smart lighting, and security systems contributes to the segment’s development. These systems require organized and expandable cabling, making ladder trays useful in basements, service ducts, and utility areas.

The commercial segment is growing at the highest pace in the market. The commercial segment is growing due to infrastructure expansion, smart system integration, safety compliance, and the need for scalable, organized, and fast install cable management in modern buildings.

LADDER CABLE TRAY MARKET REGIONAL OUTLOOK

The market has been divided geographically by North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

The North American ladder cable tray is witnessing steady growth due to a combination of infrastructure modernization, industrial expansion, and rising demand for organized cable management systems. Large-scale investment in upgrading electrical and utility infrastructure in the U.S. and Canada, thus driving demand for durable cable tray systems. Ladder trays are preferred in retrofitting older plants and facilities due to their ease of installation and scalability.

U.S.

The U.S. is one of the leading markets for ladder cable trays, due to several strong industry and infrastructure trends driving its growth. Major tech companies such as Amazon, Google, and Microsoft are rapidly expanding data centers to support cloud services, AI workloads, and 5G and IoT devices. These facilities require high capacity and organized cable routing provided by ladder trays.

Europe

Europe is leading the shift toward clean energy, with massive investment in solar farms, wind energy, and battery energy storage systems. These projects require durable and weather-resistant cable trays for routing power and control cables. Rapid growth in data centers and telecom infrastructure, especially in countries including Germany, Ireland, the Netherlands, and the Nordics. Ladder trays are essential in these facilities for structured, high-volume cable routing with proper ventilation and separation.

Asia Pacific

Asia Pacific Ladder Cable Tray Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 1.76 billion in 2025 and USD 2.03 billion in 2026. Asia Pacific is the dominating region in the market owing to its rapid infrastructure development, industrialization, and rising energy needs across the emerging countries in the region. The Asia Pacific region is the fastest-growing market. Countries such as China, India, Japan, South Korea, and Southeast Asia are investing heavily in manufacturing plants and power generation facilities. Growing internet usage and 5G rollout across Asia Pacific are driving the construction of data centers, telecom towers, and IT hubs.

Latin America

Countries including Brazil, Mexico, Chile, and Argentina are investing in power generation and grid modernization. These projects require durable and corrosion-resistant cable trays for efficient cable management. Rising industrial development in automotive, mining, oil and gas, and chemical sectors is driving the need for heavy-duty trays for power and control wiring.

Middle East & Africa

The Middle East & Africa are home to some of the world’s largest oil and gas operations. Ladder cable trays are widely used in these sectors due to their durability in harsh environments, resistance to heat, chemicals, and corrosion. Major power infrastructure projects, including solar parks (e.g., Mohammed Bin Rashid AI Maktoum Solar Park, Benban Solar Park) and wind farms, are expanding.

COMPETITIVE LANDSCAPE

Key Industry Players

Surging Investment by Leading Companies for Product Advancement to Increase their Market Share

Leading companies such as Niedax Group, Eaton, Legrand, and others, in the ladder cable tray market are focusing on innovation, quality enhancement, and strategic expansion to maintain a competitive edge. They are investing in advanced manufacturing technologies to produce trays with higher load-bearing capacity, corrosion resistance, and ease of installation. Materials such as aluminum, stainless steel, and fiberglass are being optimized for durability and performance in various industrial environments. To meet the growing demand from sectors such as construction, energy, and telecommunications, key players are expanding their global distribution networks and offering customizable solutions. Digital tools, such as BIM (Building Information Modeling), are also being integrated to support project planning and design efficiency.

List of Key Ladder Cable Tray Companies Profiled

- Legrand (France)

- Niedax Group (Germany)

- OBO Bettermann (Germany)

- Eaton/Copper B –Line (U.S.)

- Schneider Electric (France)

- ABB (Switzerland)

- Nexans (France)

- Elcon Global (India)

- MEM (India)

- Innospacer Engineering (India)

- Technimont Engineering (India)

- Metal Impacts (India)

- Slotking India Storage System Pvt Ltd. (India)

- Aeron Composite (India)

KEY INDUSTRY DEVELOPMENTS

- In July 2025, RTE, the French electricity transmission system operator, is integrating its knowledge with Nexans, a firm that specializes in the design and manufacture of cable systems and services. The two businesses are announcing the debut of a comprehensive recycling solution for industrial aluminum used in the production of power cables.

- In May 2025, Ralbo recently opened a manufacturing plant in Greater Noida to enhance its ladder cable trays production capabilities. This new center is designed to improve manufacturing effectiveness, boost production, and uphold the quality standards that customers have become accustomed to.

- In June 2023, without the need for any cable ties, HellermannTyton introduced a line of cable markers that may be put in place both during and after installation. With the addition of distinctive TAGPU LOOP marker, HellermannTyton, a specialist in the cable management industry, has broadened its selection of cable identification products.

- In September 2022, ABB is spending USD 13 million on its production plant. The plant belongs to the company's Installation Products section. The company, which is headquartered in Zurich, Switzerland, claims that the funds are being used to expand manufacturing capability and open a research and development facility at its international hub of excellence for cable tray production.

- In May 2022, the assets of Talon Products, LLC, a manufacturer of unique, non-metallic, injection-molded cable cleats for use in power distribution systems, were acquired by Atkore Inc. ("Atkore"). The Talon Cable Cleats are sold in intervals along the cable's length to support and retain electrical cables.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product/service processes, competitive landscape, and the leading ladder cable tray market. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.37% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Material

|

|

|

By Application

|

|

|

By End-User

|

|

|

By Geography

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 4.48 billion in 2025.

In 2025, the Asia Pacific market value stood at USD 1.76 billion.

The market is expected to exhibit a CAGR of 10.37% during the forecast period of 2026-2034.

The residential segment led the market by end-user.

Expansion of Industrial and Infrastructure Projects to Drive the Market

Some of the top major players in the market are Legrand, Niedax Group, Schneider Electric, and Others.

Asia Pacific dominated the market in 2026.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us