Latex Agglutination Test Kits Market Size, Share & COVID-19 Impact Analysis, By Test Type (Antibody Detection and Antigen Testing (Streptococcus, Staphylococcus Aureus, Escherichia Coli, and Others)), By Sample Type (Blood, Urine, Cerebrospinal Fluid (Lumbar Puncture), and Others), By End-user (Hospital-based Laboratories and Standalone Clinical Laboratories), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

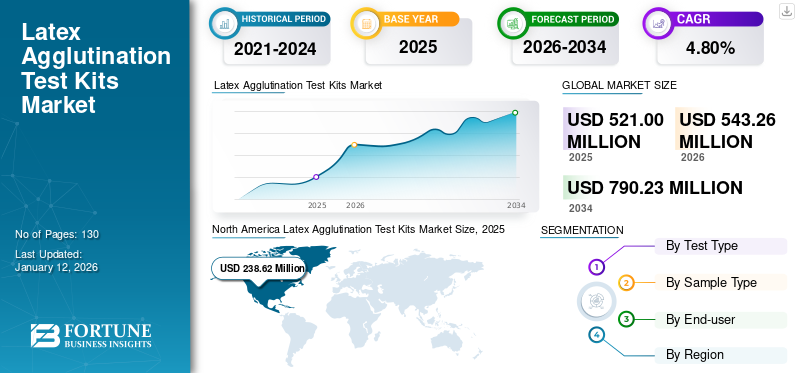

The latex agglutination test kits market size was valued at USD 521 million in 2025 and is projected to grow from USD 543.26 million in 2026 to USD 790.23 million by 2034, exhibiting a CAGR of 4.80% during 2026-2034. North America dominated the global market with a share of 45.80% in 2025.

Based on our analysis, the global market exhibited a growth of 5.0% in 2024 as compared to 2019. Latex agglutination test kits are widely used to detect antibodies or antigens in body fluids such as cerebrospinal fluid (CSF), blood, urine, and saliva. The test kits comprise coating either antigen or antibody on an artificial carrier particle, latex bead. The rising incidence of infectious and autoimmune diseases, coupled with the diversified application areas of these kits strongly contribute to the product adoption. According to an article published by the National Institutes of Health (NIH) in 2021, the global incidence of meningitis is estimated to be 20.0 cases per 100,000 people, representing about 1.2 million cases. It is also reported that most outbreaks occur in Sub-Saharan Africa. The greater presence of such tests in these regions provides an effective measure to combat these diseases as these kits are simple to use and cost-effective. Robust R&D initiatives to evaluate the sensitivity and efficacy of the product and rising infectious disease awareness favor market growth opportunities during the forecast period.

Global Latex Agglutination Test Kits Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 521 million

- 2026 Market Size: USD 543.26 million

- 2034 Forecast Market Size: USD 790.23 million

- CAGR: 4.80% from 2026–2034

Market Share:

- Region: North America dominated the market with a 45.80% share in 2025. This leadership is driven by the diverse application areas for these kits across various diseases, the robust usage of these tests, and a large number of CLIA-certified laboratories in the region.

- By Test Type: Antigen testing held the dominant market share. Its leading position is due to the large patient population affected by various bacterial, viral, and fungal diseases where antigen testing is the recommended method for diagnosis.

Key Country Highlights:

- Japan: The market is impacted by the high burden of infectious diseases in the Asia Pacific region. A reduction in community-acquired pneumonia admissions was noted during the pandemic, highlighting the role of diagnostic testing in managing infectious diseases.

- United States: Market growth is supported by a strong healthcare infrastructure, including approximately 330,000 CLIA-certified laboratory entities. The presence of major operating players also contributes to the high adoption of these test kits.

- China: The effectiveness of latex agglutination tests has been demonstrated in local studies, such as one at a children's hospital in Hangzhou that showed high sensitivity and specificity for detecting rotavirus and adenovirus antigens, supporting their use in the country.

- Europe: The market is driven by rising R&D initiatives to evaluate the efficacy of these kits. For instance, a pilot study conducted in a Madrid hospital demonstrated the positive results and potential of using a latex agglutination test for the rapid detection of COVID-19.

LATEX AGGLUTINATION TEST KITS MARKET TRENDS

Download Free sample to learn more about this report.

Adoption of Point of Care (POC) Techniques/Rapid Diagnostics for Infectious and Autoimmune Diseases to Determine Future Market Growth

Recently, the global market has witnessed one of the prominent trends, which is the rising adoption of rapid and POC technology. These test kits are included under POC or rapid diagnostics. It requires a small amount of samples for detection. Various types of samples, such as Cerebrospinal Fluid (CSF), blood, urine, and saliva, can be used in this method. These products are easy to standardize and provide quick results. For instance, according to an article published by Medline Plus in 2021, latex agglutination kits provide results in 15 minutes to an hour. Multiple benefits offered by these test kits increase their adoption across the globe.

Furthermore, the rising prevalence of infectious and autoimmune diseases has resulted in increased disease as well as an economic burden. These kits are cost-effective and efficient, thus easily accessible in emerging nations. These factors led to an intense need for these products in the market.

More efficacy of Latex Agglutination Assay (LAA) over other POC technologies is propelling the demand for these test kits. According to an article published by Springer Nature in 2021, in the study, the performance of the Lateral Flow Assay (LFA) with LAA was compared from blood and CSF samples. LFA and LAA had sensitivities of 100% and 93% for the CSF sample. The study shows that the LAA test has suitable efficacy from CSF sample. Such trends are predicted to contribute significantly to the global latex agglutination test kits market growth.

COVID-19 IMPACT

Increased Usage of Latex Agglutination Test Kits among COVID-19 Affected Patients Supported Market Growth

The pandemic exerted a slight positive impact due to surge in certain tests (C-reactive protein (CRP) and D-Dimer) conducted during the COVID-19 pandemic. Meanwhile, decrease in the number of diagnoses of other diseases, such as E.coli, pneumonia, and autoimmune disease, negatively impacted the market due to decline in the number of patient visits to healthcare facilities.

The COVID-19 pandemic represented an unpredictable situation for latex agglutination test kit manufacturers due to disruptions in the supply chain during the period. The decline was observed due to various factors such as drop in the number of autoimmune, E Coli, pneumonia tests conducted, decline in the number of overall patient visits to the hospitals & diagnosis, reduced capacities of hospitals for the diagnosis of other diseases than COVID-19, and others. For instance, according to an article published by the National Institutes of Health (NIH) in 2022, there was 44.0%-53.0% reduction in community-acquired pneumonia admissions in Japan.

In 2021, the diagnosis rate of other diseases increased due to the reopening of healthcare facilities, smoothness in the supply of test kits, and increasing patient visits to clinics for the diagnosis & treatment of various diseases, including pneumonia, rheumatoid arthritis, meningitis, and others. The global market resumed pre-pandemic level growth.

LATEX AGGLUTINATION TEST KITS MARKET GROWTH FACTORS

Diverse Application Areas of Latex Agglutination Test Kits to Favor Market Growth

Latex agglutination test kits are commonly used for hepatitis, meningitis, rheumatoid arthritis, tonsillitis, and other streptococcal infections. Usage of these kits for the diagnosis of various infectious and autoimmune diseases suggests a positive growth trajectory for this market in future. For instance, some commercially available products include the Wellcogen Strep B Rapid Latex Agglutination Test, Wellcogen Strep B 30 Pk for Staphylococcus, Waaler Rose Latex Kits for rheumatoid arthritis, E. coli O157 Latex Test for E.coli, and ASI Rubella test for Rubella Virus.

Also, some studies have been performed to evaluate the efficacy and specificity of these latex agglutination test kits. Such clinical studies provide a scientific basis regarding the efficacy of these test kits, favoring their adoption in the market. According to an article published by the National Institutes of Health (NIH) in 2021, a rapid and accurate agglutination-based testing for SARS-CoV-2 antibodies was developed. It showed excellent sensitivity of the latex agglutination assay, and it was concluded that it might be used to detect antibody response in the early stages of viral infection and monitor its dynamic changes over time. Hence, the abovementioned factors drive the global market during 2022-2029.

Rising Prevalence of Infectious and Autoimmune Diseases Augments the Market Expansion

In the current market scenario, latex agglutination kits are available for common infectious diseases such as meningitis, pneumonia, hepatitis, Haemophilus influenzae, typhoid, and tuberculosis. The rising prevalence of these infectious diseases will provide an impetus for the demand for these test kits as they provide rapid diagnosis. According to an article released by the World Health Organization (WHO) in October 2022, on a global level, tuberculosis (TB) is the 13th leading cause of death and the second leading infectious disease after COVID-19 (above HIV/AIDS). In 2021, a total of 10.6 million cases of tuberculosis (TB) were estimated, of which 6.0 million were men, 3.4 million were women, and 1.2 million were children.

Furthermore, rising cases of autoimmune diseases, such as lupus, rheumatoid arthritis, and the availability of these kits in emerging nations favor the rapid adoption of the products. In the market, the SLE Latex Kits for lupus and Waaler Rose latex agglutination test kits for rheumatoid arthritis are available. Therefore, such factors augment the market growth rate.

RESTRAINING FACTORS

Emergence of New and Reliable Alternate Diagnostics to Hinder Market Expansion

Despite several advantages of latex agglutination test kits in diagnostic care, one of the substantial hindrances to market growth is the emergence of new and reliable alternate diagnostics, especially in high-growth regions such as the United States and Europe. These test kits are very simple, rapid, and inexpensive. Standardization is also necessary, or else it will produce false positive reactions. Due to certain limitations of these kits and greater technological advancements in infectious diseases diagnostics, the market is expected to register limited growth prospects. For instance, according to an article published by the International Journal of Microbiology in 2020, Nucleic Acid Amplification Tests (NAATs)-based technologies provide better options for diagnosing infectious gastroenteritis, and it helps in overcoming some of the challenges faced in the traditional microbiological and culture methods. These NAAT-based technologies can diagnose diseases from a small number of specimens and are more specific and sensitive than these test kits.

Furthermore, technological advancements such as point-of-care devices for diagnosing infectious diseases in various settings, including hospitals, also impact market growth. Thus, it could decrease the rate of these test kits globally.

SEGMENTATION

By Test Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Increased Infectious Disease Outbreaks Aided Dominance of Antigen Testing Segment in 2021

Based on test type, the market is segmented into antibody detection and antigen testing. The antigen testing segment is further sub-segmented into streptococcus, staphylococcus aureus, escherichia coli, and others. The antigen testing segment held a share of 62.56% in 2026, and dominant global latex agglutination test kits market share owing to a large number of patient population being impacted by various bacterial, viral, and fungal diseases. In most of these cases of infectious diseases, antigen testing is recommended for disease diagnosis. According to an article published by the Journal of Clinical Laboratory Analysis in 2020, a study was conducted in the Children's Hospital of Zhejiang University, School of Medicine (Hangzhou, China). It was found that this test showed positive results and was efficient in detecting rotavirus and adenovirus antigens. The sensitivity and specificity of this test for detecting rotavirus A were 81.0% and 97.4%, respectively.

The antibody detection segment is projected to witness growth prospects in the market. Increasing adoption of antibody testing by these test kits and the rising prevalence of diseases such as rheumatoid arthritis in which rheumatoid factor (RF) is calculated through these test kits are likely to augment the segment's growth.

By Sample Type Analysis

Strong Utilization of Blood as Sample for Disease Detection to Enable the Segment to Occupy Significant Market Share in 2021

Based on sample type, the market is segmented into blood, urine, cerebrospinal fluid (lumbar puncture), and others. The blood segment dominates the market with a share of 69.52% in 2026, as it is widely used in antigen and antibody latex agglutination test kits. Various bacterial and fungal detections require blood or serum samples. Such factors contributed to the segment’s expansion. For instance, according to an article published by the National Institutes of Health (NIH) in 2020, a retrospective review of patients with cryptococcosis from 2002 to 2019 at Barnes-Jewish Hospital found that sensitivity for serum CrAg latex agglutination was estimated to be 94.7%.

The urine segment held a substantial market share in 2021, as urine samples are commonly taken to detect human chorionic gonadotropin (hCG) hormones and fibrin. It is also utilized for parasitic diseases such as kala-azar.

The cerebrospinal fluid (lumbar puncture) segment accounted for the lowest market share in 2021. Generally, E. coli meningitis and some fungal infections, such as C. neoformans, might require CSF samples for latex tests. The others segment comprises saliva and fecal.

By End-user Analysis

Robust Patient Admissions at Hospital-based Laboratories Led to Segment Dominance in 2021

Based on end-user, the market is segmented into hospital-based laboratories and standalone clinical laboratories. The hospital-based laboratories segment dominated the market with a share of 70.70% in 2026, due to favorable health reimbursement policies for infectious diseases diagnostics and rising awareness regarding the early diagnosis of infectious diseases. For instance, according to an article published by the National Institutes of Health (NIH) in 2020, hospital-based laboratories conduct more tests than all other laboratories and provide easy access to diagnosing infectious diseases. Such benefits of hospital-based laboratories are a contributing factor to the segment’s growth.

The standalone clinical laboratories segment occupied the second-largest market share in 2021. The increase in the number of standalone clinical laboratories conducting infectious disease diagnostics, including latex agglutination tests, is anticipated to contribute to the expansion of the standalone clinical laboratories segment.

REGIONAL INSIGHTS

Region-wise, the global market is segmented into North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America Latex Agglutination Test Kits Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The North America market size stood at USD 248.87 million in 2026 and is anticipated to dominate the global market. Diverse application areas of these kits in various diseases and the presence of major operating players in North America enabled it to hold a dominant position in the global market. The robust usage of these test kits and the increasing number of Clinical Laboratory Improvement Amendments (CLIA)-certified laboratories are expected to drive the market's growth in the region. As per estimates published by the Centers for Disease Control and Prevention (CDC) in 2022, there are approximately 330,000 CLIA-certified laboratory entities across the U.S. The U.S. market is projected to reach USD 235.68 billion by 2026.

Europe

The Europe market was anticipated to be the second-leading region in 2024. Rising R&D initiatives to detect the efficacy of these kits and increasing government expenditure to provide diagnostic care for patients are factors attributable to the market growth in Europe. According to a research article published by Austin Journal of Clinical Case Reports in 2021, a pilot study was conducted in the emergency department of the Hospital Puerta de HierroMajadahonda in Madrid (Spain). It was a rapid test for the detection of COVID-19 disease by using latex agglutination. It showed positive results and could be considered as a complementary method to the techniques used for the detection of SARS CoV-2. This is poised to surge the market growth. The UK market is projected to reach USD 27.61 billion by 2026, while the Germany market is projected to reach USD 37.07 billion by 2026.

Asia Pacific

Asia Pacific is projected to grow with the highest CAGR during the forecast period. The region possesses a significant proportion of the global burden of infectious diseases. According to an article published by NIH in 2021, the national population-based study (2010 to 2018) states that a total of 119,644 hospitalizations and 58 deaths were identified due to pediatric meningitis in South Korea. The rising number of hospital based laboratories and standalone laboratories will boost the promotion of latex agglutination testing. The Japan market is projected to reach USD 29.01 billion by 2026, the China market is projected to reach USD 36.7 billion by 2026, and the India market is projected to reach USD 13.67 billion by 2026.

Furthermore, the rest of the world, including Latin America, the Middle East, and Africa, is expected to witness growth prospects due to the rising adoption of these test kits, which are easy to use and cost-effective.

KEY INDUSTRY PLAYERS

Strong Product Portfolio and Market Presence of Thermo Fisher Scientific Inc. and Hardy Diagnostics Enabled them to Gain Leading Positions.

The global market is highly fragmented, with various global and domestic players. Regarding the competitive landscape, some of the market leaders include Thermo Fisher Scientific Inc. and Hardy Diagnostics, which account for a significant proportion of the market share owing to a large customer base and a robust presence of healthcare professionals in their network. For instance, Thermo Fisher Scientific Inc. holds one of the largest product types of these test kits across the globe.

Atlas Medical GmbH, HiMedia Laboratories, and Liofilchem S.r.l. are some other prominent players operating due to their increasing strategic initiatives in the market. Other players, such as Bio-Rad Laboratories, Inc., Pro Lab Diagnostics Inc., Arlington Scientific, Inc., and Biotec (Novacyt), hold slightly lower shares in the global market. Increasing market presence through advanced launches and strategic initiatives is anticipated to fortify the companies' market position, as mentioned earlier.

LIST OF KEY COMPANIES IN LATEX AGGLUTINATION TEST KITS MARKET:

- Atlas Medical GmbH (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- HiMedia Laboratories (India)

- Pro Lab Diagnostics Inc. (Canada)

- Arlington Scientific, Inc. (U.S.)

- Hardy Diagnostics (U.S.)

- Liofilchem S.r.l. (Italy)

- Biotec (Novacyt) (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- February 2025 – Strategic Acquisition of Stilla Technologies

Bio-Rad announced its intent to acquire Stilla Technologies, a next-generation digital PCR developer. This acquisition aims to enhance Bio-Rad’s digital PCR portfolio, supporting applications in oncology diagnostics, cell and gene therapy, organ transplant testing, infectious diseases, and food and environmental testing. - November 2024 – IVDR Certification for BCR-ABL Monitoring Kit

Bio-Rad achieved In Vitro Diagnostic Regulation (IVDR) Class C certification for its QXDx BCR-ABL %IS Kit, designed for monitoring patients with Chronic Myeloid Leukemia (CML). This certification enables precise, highly sensitive quantification of nucleic acids, enhancing patient monitoring during treatment.

- January 2025 – Launch of Innovative Analytical Instruments

Thermo Fisher introduced several high-impact products, including the Thermo Scientific™ Iliad™ Scanning Transmission Electron Microscope and the Thermo Scientific™ Stellar™ mass spectrometer. These instruments aim to advance scientific research by providing enhanced analytical capabilities. - October 2024 – Website Enhancements for Improved User Experience

Thermo Fisher updated its website to simplify product searches, allowing users to access key information such as pricing and stock availability, compare product variations, and review detailed specifications more efficiently.

REPORT COVERAGE

The report comprises an exhaustive global market analysis. It focuses on major aspects such as test type, sample type, end-user, and geography. The report depicts insights into market dynamics, key industry developments, disease incidences, economic burdens, key players, and the impact of COVID-19 on the market. Furthermore, the report covers numerous factors that have favored the growth of the global market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Test Type

|

|

By Sample Type

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 543.26 million in 2026.

The market is exhibited to grow at a CAGR of 4.80% during 2026-2034.

The North America market stood at USD 238.62 million in 2025.

The antigen testing segment is the leading segment of the market.

The North America region dominated the global market in 2025.

The rise in infectious and autoimmune disease incidence, robust R&D initiatives to demonstrate the efficacy and safety of kits, and an increasing number of hospital-based laboratories drive the global market growth.

Thermo Fisher Scientific Inc., Hardy Diagnostics, and HiMedia Laboratories are the significant players.

These kits are easy to use, efficient, and cost-effective. Thus, they can be used in low settings, which is a major contributing factor for the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us