Legionella Testing Market Size, Share & Industry Analysis, By Type (Culture Media, Urine Antigen Testing (UAT), Polymerase Chain Reaction (PCR), Serology, and Direct Fluorescent Antibody (DFA) test), By End-User (Hospitals & Clinics, Clinical Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

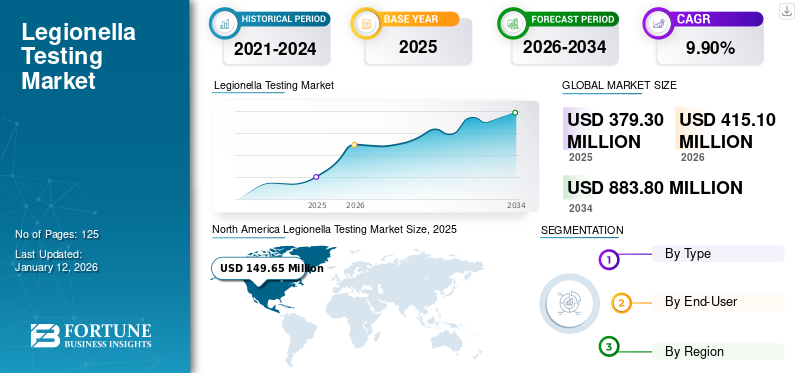

The global legionella testing market size was valued at USD 379.3 million in 2025. The market is projected to grow from USD 415.1 million in 2026 to USD 883.8 million by 2034, exhibiting a CAGR of 9.90% during the forecast period. North America dominated the global market with a share of 39.50% in 2025. Increasing use of rapid testing techniques, such as PCR and urine antigen testing will augment the adoption of legionella testing solutions.

The global market is predicted to experience significant growth due to the increasing prevalence of Legionnaire's disease, Pontiac fever, and pneumonia. Moreover, the growing awareness about sanitation and a heightened emphasis on preventing infectious diseases are expected to boost the demand for Legionella testing kits. Legionella is a bacterial species that predominantly thrives in freshwater sources such as showers, bathtubs, ponds, swimming pools, and other water sources. Stringent regulations were established for the regular testing of freshwater sources, especially after the prevalence of Legionella infection in the U.S. in 1997. The rising occurrence of the disease is anticipated to drive the growth of the global market.

- For instance, according to the World Health Organization (WHO) 2022 data, in the U.S., Europe, and Australia, about 10-15 cases are detected per million population per year. Additionally, commonly used tests include the microbial culture method, urine antigen testing, and the more recently launched advanced PCR technique. In response to the COVID-19 outbreak, most countries around the world implemented lockdown conditions.

Water in many commercial building storage systems was left unused for extended periods, making it susceptible to the growth of Legionella species. Many countries' governments have recommended mandatory testing of these water sources before resuming operations at these sites to prevent a Legionella outbreak.

- For instance, Wirehouse, an Employment Law & Health and Safety Service provider from the U.K., recommends Legionella testing service visits at workplaces to ensure the absence of Legionella species growth.

The market witnessed slow growth during the pandemic due to the temporary halt in manufacturing, disruption in the supply chain, and a shift of the healthcare system's focus toward managing COVID-19. The clinical presentation of Legionella disease is similar to COVID-19 infection, leading to higher testing rates for the coronavirus and a reduction in Legionnaires' disease testing, thus hampering market growth.

However, the market is expected to grow significantly in the post-pandemic era. The pandemic-related lockdowns resulted in stagnant water in empty buildings, potentially increasing the proliferation of Legionella bacteria.

- For instance, according to the article "Reopening Buildings After Prolonged Shutdown or Reduced Operation," published by the Centers for Disease Control and Prevention in 2021, facilities such as schools and buildings should test hot tubs/spas for Legionella before returning to service. All testing decisions should be made in consultation with facility water management program staff and relevant public health authorities.

Thus, the rising government emphasis on testing water for the presence of Legionella in the post-pandemic period is increasing the demand for Legionella testing, contributing to market growth.

Legionella Testing Market Snapshot & Highlights

Market Size & Forecast

- 2025 Market Size: USD 379.3 million

- 2026 Market Size: USD 415.1 million

- 2034 Forecast Market Size: USD 883.8 million

- CAGR: 9.90% from 2026–2034

Market Share

- North America dominated the Legionella testing market with a 39.50% share in 2025, attributed to well-established healthcare infrastructure, high awareness levels, and stringent regulatory requirements for water system monitoring in the U.S. and Canada.

- By type, Urine Antigen Testing (UAT) held the largest market share in 2024 due to its affordability, rapid results, and suitability for use in resource-limited and developing regions. Meanwhile, PCR testing is witnessing rapid growth owing to its high sensitivity, accuracy, and increasing adoption for onsite and hospital-based diagnostics.

Key Country Highlights

- Japan: The rising prevalence of Legionella-related infections and a strong focus on elder care infrastructure have led to increased testing efforts. National policies emphasize hygiene monitoring in healthcare and community settings.

- United States: The CDC and OSHA recommend regular testing of stagnant water systems in schools, commercial buildings, and hospitals, especially after long shutdowns. This has accelerated the uptake of advanced diagnostic methods such as PCR and UAT.

- China: Rapid industrialization and urban water infrastructure expansion have heightened the risk of waterborne diseases. Growing awareness about Legionella infections is leading to increased investment in environmental water testing and preventive diagnostics.

- Europe: The region accounts for the second-largest market share due to rising Legionella outbreaks and broader acceptance of high-cost molecular testing solutions like real-time PCR. Countries such as Poland and Italy are implementing strong surveillance protocols as part of the European Working Group for Legionella Infections (EWGLI).

Legionella Testing Market Trends

Growing Adoption of Rapid Testing Methods such as Urine Antigen Testing and PCR to Accelerate Market Growth

The technologies powering molecular diagnostics are rapidly evolving to address the rising cases of infectious diseases. The conventional Legionella testing method, utilizing microbial culture technology, is time-consuming and laborious. However, it was the most preferred test method over the urine antigen test until the emergence of the PCR test, primarily due to its ability to detect Legionella species serogroups. PCR is highly sensitive, with a sensitivity of 95-99%, can detect all serotypes of Legionella species, and provides rapid results. The increasing availability of real-time PCR kits and its expanded geographic reach have resulted in enhanced adoption of this test method globally.

Download Free sample to learn more about this report.

Legionella Testing Market Growth Factors

Growing Prevalence of Legionnaire Disease to Stimulate Market Growth

Legionella bacterial species are commonly found in freshwater reservoirs with an average temperature of 20 to 40 degrees Celsius. They are responsible for causing a respiratory disease known as Legionnaire’s disease. The market is expected to grow rapidly during the forecast period, driven by the increasing incidence and prevalence of this disease, leading to a rise in demand for testing kits.

- For instance, according to statistics published by the U.S. Department of Labor, about 6,000 Legionella cases are reported each year in the U.S.

Moreover, the rise in the incidence of hospital-acquired Legionella infection and the increasing frequency of testing in these facilities due to stringent regulations will drive the demand for such effective products in the near future.

- According to a study published by the International Society for Infectious Diseases, out of 16 hospitals located in Taiwan, 10 hospitals (63%) tested positive for Legionella Pneumophila. The hospital's potable water system was found to be the primary source for hospital-acquired Legionella disease.

Stringent Regulations for Regular Water Testing to Spur Market Growth

The presence of various Legionella bacterial species in water reservoirs such as ponds, lakes, swimming pools, warm water showers, and water supply pipes of commercial buildings is a growing public health concern. Outbreaks of Legionellosis result in an increased risk of morbidity and mortality among exposed individuals. Therefore, the suspicion of an outbreak warrants immediate action. The World Health Organization (WHO) provides information and guidance on the assessment of Legionella risk and its proper management in seven principal documents. These documents offer guidance on the evaluation and management of risks associated with water sources, pools, cooling towers, and spa baths. The governments of many countries have enacted regulations to manage Legionella in various types of water systems.

- For instance, the European Union (EU) formed the European Working Group for Legionella Infections (EWGLI) to control the prevalence of these diseases in various types of water systems. Thus, stringent monitoring of water reservoirs and the launch of rapid testing methods for onsite water testing are anticipated to promote Legionella testing market growth.

RESTRAINING FACTORS

Limited Awareness about the Disease in Underdeveloped Countries to Restrain Market Expansion

Legionella infection is a well-recognized and commonly occurring health concern in developed nations. In response to this, various governments have enacted stringent regulations for diagnosing associated diseases and conducting regular testing of potential sources of infection. On the other hand, there is limited awareness about the bacteria and the diseases associated with it in emerging regions of the world. Also, the failure to diagnose this disease is mainly due to a lack in clinical awareness. The disease is underdiagnosed in many countries due to a lack of proper definition, guidelines, and diagnostic facilities, posing a significant challenge to market growth of Legionella testing.

Studies regarding awareness of this infection in India have found that sporadic cases often go unnoticed due to the burden of other diseases such as bacterial and viral pneumonias and tuberculosis. Thus, limited awareness about the diseases, insufficient diagnostic infrastructure, and slow adoption of advanced diagnostic tools with high costs, such as real-time PCR, are some of the major factors hampering the growth of the market.

Legionella Testing Market Segmentation Analysis

By Type Analysis

Urine Antigen Testing (UAT) Segment Dominates Owing to Rising Preference from People in Developing Regions

Based on type, the market is segmented into culture media, urine antigen testing, Polymerase Chain Reaction (PCR), serology tests, and direct antibody fluorescent methods. The urine antigen testing segment held the largest market share in 42.12% 2026. This is the most commonly used laboratory test for detecting the Legionella bacterium in urine. It can provide results on the same day of sample collection, unlike culture media methods that require 7 to 8 days. Moreover, it is a cost-efficient test and is more preferred among people in underdeveloped or developing regions. These factors are set to drive the segment's growth over the forecast period. However, the test can only detect LP1 species of Legionella, which may affect the segment's growth to some extent.

On the other hand, the Polymerase Chain Reaction (PCR) segment is anticipated to witness lucrative growth in the forecast period. PCR results in accurate, sensitive, and precise results, making it a preferable choice for testing samples. In recent years, PCR (specifically, quantitative PCR) testing has emerged as an effective method for the detection of pathogens. In terms of speed, accuracy, and ease of use, this method is preferred by several public health experts. Apart from this, PCR testing offers several advantages, such as requirement of a small amount of sample and minimum time for the detection of bacteria. Due to these advantages, biopharmaceutical companies are adopting the PCR method for the detection of bacteria, which will lead to the segment’s growth.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Clinical Laboratories Segment Dominated Market Due to the Increasing Disease Prevalence

Based on end-user, the market is segmented into hospitals and clinics, clinical laboratories, and others which including environmental testing sites. Among them, the clinical laboratories segment registered the highest revenue and is anticipated to continue this dominance during the forecast period. This is attributable to the growing prevalence of Legionnaire's disease, increasing awareness, and a rise in the penetration of advanced tests for Legionella infection diagnosis. The Diagnostic Centers segment is projected to dominate the market with a share of 43.96% in 2026.

The others segment, which includes environmental testing apart from the clinical testing of Legionella bacterium, is anticipated to expand at a rapid rate over the study period. This is owing to the introduction of onsite testing methods and the enforcement of stringent regulations for routine water check-ups. To ensure that water systems are free of dangerous legionella bacteria, various organizations are turning to environmental testing laboratories.

- For instance, in September 2019, B&V Chemicals launched a test strip for rapid Legionella onsite testing.

REGIONAL INSIGHTS

Geographically the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Legionella Testing Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

North America market size was valued at USD 149.65 million in 2025. The market in this region is characterized by high diagnosis rates for Legionnaire's disease, the presence of world-class healthcare infrastructure, high awareness about the disease, and stringent water testing regulations. The presence of a large number of geriatric populations that are vulnerable to the infection easily, coupled with the high risk of mortality due to associated pneumonia among such patients, prioritizes Legionella testing in the U.S., boosting the regional market growth. Furthermore, several companies are introducing legionella detection kits to control the spread of the legionella infection throughout the region. The U.S. market is expected to reach USD 146.4 billion by 2026.

- For instance, in January 2021, Thermo Fisher Scientific introduced the Qualyfast DNA Extraction kit, a rapid DNA extraction solution tailored for identifying Legionella in clear water samples.

Europe

Europe held the second largest Legionella testing market share. This is due to the growing adoption of high-cost PCR tests and increasing Legionella outbreaks in the region. The U.K. market is projected to reach USD 12.73 billion by 2026, while the Germany market is anticipated to reach USD 28.87 billion by 2026.

- For instance, as per the data published by the National Center for Biotechnology Information (NCBI) in October 2023, the European Centre for Disease Prevention and Control documented a rise in both reported Legionella outbreaks and confirmed cases across its member nations.

- Similarly, according to the data released by the WHO in September 2023, Poland reported a total of 166 cases of legionellosis, resulting in 23 fatalities.

Asia Pacific

Asia Pacific is projected to expand at the highest CAGR during the forecast period on account of economic development, an empowered healthcare industry, and increasing awareness about available test products in the region. Furthermore, the increasing focus on expanding Legionella testing services in the region also contributes to market growth. The Japan market is expected to reach USD 17.92 billion by 2026, the China market is projected to reach USD 20.17 billion by 2026, and the India market is anticipated to reach USD 7.47 billion by 2026.

- For instance, in April 2023, Townsville City Council’s laboratory in Australia received approval from the National Association of Testing Authorities (NATA) for testing water samples for Legionella pneumophila and other strains of Legionella.

Latin America and the Middle East & Africa regions are likely to emerge as new expansion opportunities for leading market players to establish footprints globally.

List of Key Companies in Legionella Testing Market

Key Players Adopt Collaborative Strategies to Expand Consumer Base

The Legionella testing sector is consolidated in nature owing to the presence of a few players serving the global demand. Most of the players are engaged in expanding their portfolio to accommodate advanced testing methods such as UAT and PCR. Moreover, the key players are adopting collaborative strategies such as mergers and acquisitions, product launches, and joint ventures, among others, to expand their consumer base.

- For instance, in October 2017, Abbott entered the market by acquiring Alere Inc. The leading players in the market are Albagia Ltd, Abbott, Quidel Corporation, Merck KGaA, Thermo Fisher Scientific, and others.

LIST OF KEY COMPANIES PROFILED:

- Quidel Corporation (U.S.)

- Abbott (Alere) (U.S.)

- Merck KGaA (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- BD (U.S.)

- bioMérieux (France)

- IDEXX Corporation (U.S.)

- Eurofins Scientific (Luxembourg)

KEY INDUSTRY DEVELOPMENTS:

- September 2022 - Bio-Rad Laboratories, Inc. received AFNOR validation for the iQ-Check Legionella PCR protocol.

- May 2022 - ChemREADY, a manufacturer of wastewater and water treatment chemicals, launched a Legionella testing product line and services to curb waterborne infections.

- December 2021 - Pace Analytical Services, a provider of in-lab and onsite regulatory testing and analysis services, acquired Special Pathogens Laboratory, one of the prominent players in Legionella testing and detection.

- August 2020 - IDEXX Corporation revealed that its Legiolert culture testing technique for Legionella pneumophila received approval from the U.K.’s Standing Committee of Analysts.

- September 2019 - B&V Chemicals teamed up with Hydrosense to introduce a new generation of instant (self) Legionella diagnosis tools. The solution aimed at helping the maintenance staff spot-check water and point of use locations as part of a Legionella control management strategy.

- August 2018 - Nalco Water, an Ecolab company, introduced a molecular-based test for Legionella that provides results 14 times faster than current culture testing methods.

REPORT COVERAGE

The global Legionella testing market research report provides a detailed analysis of the market, focusing on key aspects such as leading companies, product types, and the primary applications of the product. The report also offers insights into the current global market trends, competitive landscape, and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several aspects that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.90% from 2026-2034 |

|

Unit |

Value (USD million) |

|

Segmentation

|

By Type

|

|

By End-User

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global market was valued at USD 379.3 million in 2025 and is projected to reach USD 883.8 million by 2034.

The value of the North America legionella testing market in 2025 was USD 379.3 million.

Recording a CAGR of 9.90%, the market will exhibit a steady growth over the forecast period of 2026-2034.

By type, the Urine Antigen Testing (UAT) is the leading segment in the market.

The increasing prevalence of legionella infection is the key factor driving the market.

Quidel Corporation, Abbott (Alere), Merck KGaA, Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., BD, bioMerieux, IDEXX Corporation, and Albagaia Ltd. are the leading players in the global market.

North America held the highest share in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us