Veterinary Diagnostics Market Size, Share & Industry Analysis, By Product Type (Instruments and Reagents & Consumables), By Technique (Hematology, Immunodiagnostics, Molecular Diagnostics, Diagnostic Imaging, Clinical Biochemistry, and Others), By Animal Type (Livestock and Companion), By End User (Veterinary Hospitals & Clinics, Veterinary Reference Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

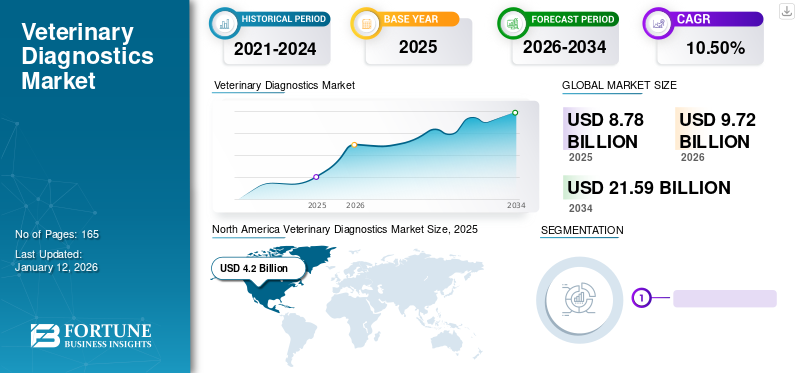

The global veterinary diagnostics market size was valued at USD 8.78 billion in 2025 and is projected to grow from USD 9.72 billion in 2026 to USD 21.59 billion by 2034, exhibiting a CAGR of 10.50% during the forecast period. North America dominated the veterinary diagnostics market with a market share of 47.82% in 2025. Moreover, the U.S. veterinary diagnostics market size is projected to grow significantly, reaching an estimated value of USD 6.96 billion by 2032, driven by colossal expenditure on pet care and favorable reimbursement scenario.

Veterinary diagnostics are tests carried out by analyzing blood, tissue, urine, or stool to detect disease presence, antibodies, proteins, or general indicators of overall health of various animals. The rising prevalence of veterinary diseases, increasing pet ownership, and growing government support to prevent the spread of zoonotic diseases are projected to fuel the market growth.

- For instance, according to an article published by the National Institutes of Health (NIH) in 2022, the Centers for Disease Control and Prevention (CDC), the Department of the Interior, and the U.S. Department of Agriculture's report mentioned the eight most important zoonosis in the U.S. These constituted the West Nile virus, influenza, coronaviruses, salmonella, plague, rabies, Brucella, and Lyme disease.

Molecular and immunodiagnostic tests are commonly performed for the diagnosis of complex conditions. Such factors are augmenting the growth of the market. Moreover, increasing pet insurance demand and the establishment of new diagnostic laboratories by various industry players across the globe is expected to drive the veterinary diagnostics market growth. Similarly, significant efforts by key market players to launch new tests and strategic activities to expand their geographical presence propels the market expansion. For instance, in June 2023, Boule Diagnostics launched H50V, a new 5-part veterinary solution, for cost-effective diagnostics in Europe. It is equipped with 13 predefined animal profiles and over 30 analyzed parameters, making it a flexible system that meets the requirements of many veterinary clinics and laboratories.

In 2020, the COVID-19 pandemic had a slight positive influence on the global market. In the first half of 2020, veterinary diagnostic services were halted due to travel restrictions and disruptions in the supply chain created by the COVID-19 pandemic. However, the market witnessed overall growth during the pandemic as veterinary diagnostic clinics were reopened in the second half of 2020. In 2022, veterinary visits were back to the pre-pandemic levels. Such a scenario caused the companies’ revenue to stabilize. Owing to these factors, the market is anticipated to record a growth rate that was registered during the pre-pandemic period from 2025 to 2032.

Global Veterinary Diagnostics Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 8.78 billion

- 2026 Market Size: USD 9.72 billion

- 2034 Forecast Market Size: USD 21.59 billion

- CAGR: 10.50% from 2026–2034

Market Share:

- Region: North America dominated the market with a 47.82% share in 2025. This is due to the robust adoption of pets, colossal expenditure on pet care, a favorable reimbursement scenario, and significant initiatives by key players to establish new diagnostic laboratories.

- By Technique: The immunodiagnostics segment held the leading position in the market. Its dominance is driven by its expanding application areas and its widespread use as a practical and effective tool for detecting critical conditions and various diseases in animals.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific market, growth is propelled by rising awareness about the risks associated with zoonotic diseases and increased spending on animal health and wellness.

- United States: The market is driven by a very high rate of pet ownership, with 66.0% of households owning a pet. Growth is further supported by significant government support, such as USDA funding, to enhance early detection capabilities for emerging animal diseases.

- China: The market is experiencing rapid growth due to increasing awareness of zoonotic diseases and rising disposable income leading to higher spending on animal care, making it a key driver in the Asia Pacific region.

- Europe: The market is advanced by improved healthcare facilities, high adoption rates for veterinary testing, and strategic industry activities, such as Boule Diagnostics launching a new 5-part veterinary solution to meet the needs of clinics and labs.

Veterinary Diagnostics Market Trends

Growing Adoption of Point-of-Care in Animal Diagnostics due to its Potential Advantages

Over the past few years, one of the most prominent trends in the market has been the growing adoption of point-of-care diagnostics for the veterinary process. The point-of-care techniques have improved diagnostics' speed, standardization, and efficacy. These techniques require limited healthcare personnel and can overcome the issue of cross-trained, less-experienced staff at diagnostic services.

Similarly, prominent players' increased focus and initiatives on developing point-of-care diagnostics are expected to drive the growth of the market.

- For instance, in March 2022, Randox Laboratories Ltd. introduced VeraSTAT-V and VeraSTAT in its point-of-care (POC) diagnostics portfolio for equine health.

More companies are launching new and advanced diagnostic tests to expand livestock and companion animal diagnostics globally. The growing technological advancements aid in the high adoption of these services, propelling the market expansion.

Download Free sample to learn more about this report.

Veterinary Diagnostics Market Growth Factors

Increasing Outbreaks of Veterinary Diseases and Positive Government Support to Boost Adoption

Livestock disease outbreaks can be a severe economic burden for countries whose economies depend on animals. Thus, timely diagnosis of the animals becomes necessary. This is anticipated to contribute to the increased demand for veterinary diagnostics.

- As per the European Centre for Disease Prevention and Control article published in 2022, the cases of campylobacteriosis and salmonellosis increased in 2021 compared with 2020. The commonly used tests for these diseases are Enzyme Immunoassay (EIA) or Polymerase Chain Reaction (PCR). Such a rise in the prevalence or incidence of zoonotic diseases is expected to surge the demand for veterinary tests over the forecast timeframe.

Active government support and increased awareness among livestock owners led to an increased demand for animal disease diagnostic tests and kits, which is projected to fuel the market growth. Similarly, certain laboratories funded by government bodies are enhancing early disease detection capabilities. This scenario is expected to fuel the growth of the veterinary diagnostics market.

- In November 2023, The Michigan State University Veterinary Diagnostic Laboratory was selected to enhance diagnostic capabilities for the early detection of emerging diseases in the Midwest region. This partnership was funded through the U.S. Department of Agriculture (USDA) Animal and Plant Health Inspection Service (APHIS).

Such initiatives are expected to boost the market expansion.

Rise in Pet Ownership and Willingness to Spend on Pet Well-being to Propel Growth Prospects

The rising number of pet owners can mainly be attributed to the growing trend of nuclear families and rapid adoption of modern lifestyles. Most households prefer to pet a dog or cat as compared to other animals. The increased disposable incomes and affection toward pet animals are primary factors leading to a surge in pet ownership.

- For instance, according to a Forbes article, in 2024, approximately 66.0% of the U.S. households (86.9 million homes) own a pet.

The rising trend of adopting foster pets is also one of the reasons for increasing the number of pet owners. Along with the increasing pet ownership, rising investment by owners in their pets is another crucial factor propelling the demand for veterinary diagnostics. Such a rise in ownership and increased pet care spending are expected to drive the market growth.

RESTRAINING FACTORS

Shortage of Skilled Veterinary Healthcare Providers to Hinder Industry Growth

One of the substantial hindrances to market growth is the lack of skilled professionals for veterinary diagnostics, especially in major emerging countries. Generally, well trained and qualified professionals are required to operate the highly advanced diagnostic tools. Shortage of skilled and qualified labor plays a significant barrier in the market.

- For instance, as per a HealthforAnimals article published in 2022, about 41,000 veterinarians will be needed in 2030 to meet pet care needs in the U.S., according to a Mars Veterinary Health study.

- According to an article published by Frontiers Media S.A. in 2021, the most commonly reported challenges for providing diagnostic laboratory services are insufficient or lack of supplies, equipment, and reagents, costly reagents, inadequate or lack of laboratory staff to perform tests, and inadequate training of laboratory staff.

As a result, veterinary care has remained partly inaccessible for many livestock owners in developed and emerging countries. Many animals remain deprived of veterinary assistance, subsequently impacting the demand for veterinary diagnostics.

Veterinary Diagnostics Market Segmentation Analysis

By Product Type Analysis

Reagents & Consumables Segment to Dominate due to Increased Frequency of Veterinary Tests

In terms of product type, the market is segmented into reagents & consumables and instruments. The reagents & consumables segment is projected to dominate the market with a share of 76.69% in 2026. The segment growth is attributed to increased frequency and surge in spending on veterinary tests and services globally. The increased prevalence of animal diseases, growing disposable income, and a strong emphasis on developing advanced reagents and kits by leading players will further propel the market growth.

- For instance, according to an article published by Allianz Global Investors in 2021, veterinary care, including diagnostics, is the second largest area of spending for pet parents, next to food.

The instruments segment is projected to register a moderate CAGR over the forecast period. This is due to the rising number of veterinary hospitals and research institutes or initiatives for companion and livestock animals.

By Technique Analysis

Immunodiagnostics Segment to Lead Driven by Growing Demand for Advanced Diagnostics

Based on technique, the market is segmented into hematology, immunodiagnostics, molecular diagnostics, diagnostic imaging, clinical biochemistry, and others. The immunodiagnostics segment is expected to account for 25.33% of the market share in 2026. Immunodiagnostic tests have become a practical and widely used tool for diagnosing animal diseases due to its expanding application areas, such as detecting critical conditions, including arboviral disease.

The clinical biochemistry segment held a significant share in the global market. This is attributable to the growing number of diagnostic tests for the analysis of blood plasma/serum to detect the levels of various substrates, such as hormones, enzymes, proteins, electrolytes, and others, in the body.

The molecular diagnostics segment held a substantial market share in 2024. Significant product launches in this section augment the market growth. In June 2022, the University of Nairobi's Faculty of Veterinary Medicine launched a state-of-the-art Animal Health, Molecular, and Diagnostics laboratory. The lab is a collaborative initiative of the University of Nairobi and Washington State University through the Feed the Future program.

To know how our report can help streamline your business, Speak to Analyst

By Animal Type Analysis

Rising Pet Care Expenditure to Drive the Companion Segment

Based on animal type, the market is bifurcated into livestock and companion. The companion segment is anticipated to hold a 51.96% market share in 2026. Acknowledgment of human and animal companionship and increasing spending on pet care especially in developing countries, are some factors anticipated to boost the segmental growth. The growing launch of various products for companion animal diagnostics is propelling the market expansion.

- In August 2022, PepiPets launched a mobile diagnostic testing service. The service allows clients to receive diagnostic testing at home for their pets.

The livestock segment is expected to grow at a notable rate over the forecast period. This is due to the demand for dairy products and rising emphasis on ensuring livestock animal health. Similarly, the growing attention to preventing food-borne diseases and expanding the poultry sector is propelling the segmental growth prospects.

By End User Analysis

Launch of Veterinary Reference Laboratories by Key Players to Boost the Segment’s Growth

By end user, the market is divided into veterinary reference laboratories, veterinary hospitals & clinics, and others. The veterinary reference laboratories segment is forecast to represent 47.41% of the total market share in 2026. The segment growth is attributed to the growing importance of reference laboratories due to the high standards of diagnostic practices and data reliability. Moreover, the increasing focus on key players in launching reference laboratories with advanced product and service offerings propels the market expansion.

- For instance, in June 2022, IDEXX Laboratories, Inc. launched reference laboratory tests and services. The newly introduced tests were Fecal Dx, FGF-23, and PCR Direct testing. Such initiatives are expected to drive the market growth.

The veterinary hospitals & clinics segment is expected to grow at a lucrative rate over the forecast period. This is due to the rising preference for government veterinary hospitals and clinics in emerging countries such as India.

REGIONAL INSIGHTS

In terms of geography, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Veterinary Diagnostics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America generated a revenue of USD 3.91 billion in 2024. Robust adoption of pet animals by the population in the U.S. and Canada, colossal expenditure on pet care, growing employment in the veterinary sector, and favorable reimbursement scenario are major contributors to the region's dominance. Similarly, robust initiatives by key players to add new diagnostic laboratories in the U.S. are expected to boost regional growth. The U.S. market is projected to reach USD 4.17 billion by 2026.

Europe

Europe held a substantial share in the global market due to improved healthcare facilities and higher adoption of veterinary testing for the on-time diagnosis of veterinary diseases. Several strategic acquisitions to expand companies' capabilities by providing certain software for easy end-user workflow promote market growth. The UK market is projected to reach USD 0.28 billion by 2026, while the Germany market is projected to reach USD 0.61 billion by 2026.

- In January 2022, Heska Corporation acquired VetZ GmbH to scale and expand its capabilities and for the well-being of animals in Europe.

Asia Pacific

Asia Pacific is projected to record a maximum CAGR during 2025-2032. Growing awareness about risks associated with zoonotic diseases and increasing spending on animal care are likely to drive the market growth in emerging countries such as China and India. Furthermore, the launch of several initiatives by various bodies to enhance the veterinary workforce are expected to propel market expansion. The Japan market is projected to reach USD 0.43 billion by 2026, the China market is projected to reach USD 0.69 billion by 2026, and the India market is projected to reach USD 0.19 billion by 2026.

- For instance, in June 2021, a Virtual Regional Awareness-Raising Workshop was held on the veterinary workforce and veterinary para-professionals (VPPs) in the Asia Pacific region. The workshop was aimed at promoting awareness about veterinary workforce development, the role of VPPs in Veterinary Services, and the availability of the World Organization for Animal Health’s (WOAH) support available to members through the PVS Pathway.

Furthermore, Latin America and the Middle East & Africa markets are growing due to their huge livestock populations and initiatives focused on creating awareness regarding diagnostic care.

List of Key Companies in Veterinary Diagnostics Market

Robust Offerings and Strategic Acquisitions by IDEXX Laboratories, Inc., Zoetis Services LLC, and Heska Corporation to Support their Market Dominance

The competitive landscape of the global market is consolidated. IDEXX Laboratories, Inc., dominated the global market share in 2023. The company’s market dominance is due to its robust companion and livestock animal diagnostics product portfolio and market presence. The company introduced the latest instruments, the Catalyst Dx on the chemistry side and the ProCyte Dx for hematology applications.

- In June 2023, IDEXX Laboratories, Inc. launched the IDEXX cystatin B test, the first veterinary diagnostics test for detecting kidney injury in cats and dogs. The company shared plans to launch this test in Europe in 2024.

Zoetis Services LLC and Heska Corporation are prominent players in the veterinary diagnostics sector due to their adoption of strategic acquisitions and partnership initiatives. Other players, such as Virbac, Zomedica Corp., and Shenzhen Mindray Bio-Medical Electronics Co., Ltd., are expanding their market presence to strengthen their industry positions.

LIST OF KEY COMPANIES PROFILED:

- IDEXX Laboratories, Inc. (U.S.)

- Zoetis Services LLC (U.S.)

- Heska Corporation (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Avante Animal Health (U.S.)

- Virbac (France)

- Randox Laboratories Ltd. (U.K.)

- VCA Animal Hospitals (Mars, Incorporated) (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd (China)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Center Point Bio-Tech, LLC (CPB) launched AlphaION at the 2024 Veterinary Meeting & Expo in the U.S. AlphaION is a novel, patent-pending veterinary practice diagnostic system.

- November 2023: Antech opened a new U.K. veterinary diagnostics laboratory in Warwick. The move would expand the company’s U.K. lab network.

- March 2023: QIAGEN N.V. partnered with Servier to develop a companion diagnostic test for TIBSOVO, an isocitrate dehydrogenase-1 (IDH1) inhibitor. The solution was launched for treating blood cancer Acute Myeloid Leukemia (AML). Under this collaboration, QIAGEN would develop and validate a real-time in vitro PCR test that can be used to detect IDH1 gene mutations in AML patients in whole blood and bone marrow aspirates.

- February 2023: Heska Corporation announced the availability of VolitionRx Limited’s Nu. Q Vet Cancer Test for pre-order through its point-of-care segment.

- February 2023: Virbac opened its research and development center dedicated to warm water aquaculture in Vietnam. It also serves as a diagnostic center.

- October 2022: Avante Animal Health and Vetiqure AB, a subsidiary of ChemoTech, signed a letter of intent to get into a distribution agreement and install approximately six vetIQure systems at various university hospitals and leading clinics.

- January 2022: IDEXX Laboratories, Inc. extended the reference laboratory menu by including innovative genomic diagnostics. The initiative helped expand the company's oncology offerings.

REPORT COVERAGE

An Infographic Representation of Veterinary Diagnostics Market

To get information on various segments, share your queries with us

The global veterinary diagnostics market research report provides a detailed market analysis. It highlights key segments such as product type, technique, animal type, end user, and geography. Moreover, the report highlights insights into market dynamics, the prevalence of key veterinary diseases, pet ownership statistics, pet insurance scenarios, industry developments, industry trends, technological advancements, prominent players, and the COVID-19 impact on the market. Similarly, the report provides various dynamics that contribute to the overall market development.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.50% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Technique

|

|

|

By Animal Type

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size stood at USD 7.97 billion in 2024 and is projected to reach USD 17.67 billion by 2032.

The market is projected to grow at a CAGR of 10.5% during the forecast period.

The North America c size stood at USD 3.58 billion in 2024.

Based on product type, the reagents & consumables segment leads the global market.

North America held the dominant share in the global market in 2024.

The rising prevalence of veterinary diseases, increasing pet ownership, and favorable government policies regarding diagnosis awareness are set to drive the global market growth.

IDEXX Laboratories, Inc., Zoetis Services LLC., and Heska Corporation are the key players in the market.

The increasing pet care spending and a surge in strategic initiatives by key players to offer suitable diagnostic products are key factors contributing to the adoption of diagnostic procedures.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic