Light Soda Ash Market Size, Share & Industry Analysis, By Manufacturing Process (Solvay Process and Natural Soda Ash (Trona)), By Application (Glass, Soaps & Detergents, Chemicals, Alumina & Mining, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

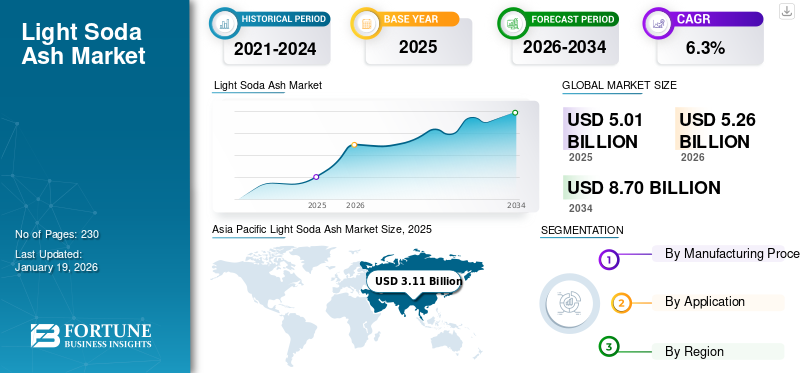

The global light soda ash market size was valued at USD 5.01 billion in 2025. The market is projected to grow from USD 5.26 billion in 2026 to USD 8.7 billion by 2034, exhibiting a CAGR of 6.3% during the forecast period. Asia Pacific dominated the light soda ash market with a market share of 62% in 2025.

Light soda ash, also known as sodium carbonate (Na₂CO₃), is a white, water-soluble inorganic compound widely used across diverse industrial applications. The light soda ash compound is primarily consumed for its alkaline properties, acting as a vital ingredient in the production of glass, soaps and detergents, chemicals, and various metallurgical processes. Its low bulk density and fine, powdery form distinguish it from dense soda ash, making it ideal for processes requiring easy dissolution and fast reactivity. Light soda ash is produced either synthetically through the Solvay process or mined naturally from Trona ore. Rising demand from the glass and chemical sectors, supported by urbanization and infrastructure development, will significantly drive market growth. Key players operating in the market include Solvay, Tata Chemicals Ltd., Şişecam, InoChem., and GHCL Limited.

LIGHT SODA ASH MARKET TRENDS

Growing Product Demand from Flat Glass and Solar Glass Applications to Support Market Progress

The rising demand for flat glass and solar panel glass is creating robust growth opportunities for light soda ash producers. As a key ingredient in glass manufacturing, soda ash plays a crucial role in the production of glass for various applications. The global expansion of construction, automotive, and renewable energy sectors is further driving the product demand. The surge in solar energy projects has significantly increased the need for high-purity solar glass, where soda ash ensures clarity, chemical stability, and thermal resistance. Additionally, urbanization in emerging markets is accelerating the need for flat glass used in buildings and infrastructure, further contributing to the light soda ash market growth.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rising Investments in Infrastructure and Increased Urban Development to Boost Product Demand

Global demand for flat glass and container glass is steadily rising, particularly in sectors such as automotive, construction, and packaging. Light soda ash is a critical raw material in glass production due to its role in reducing the melting temperature of silica, thus lowering energy consumption. Developing nations are investing heavily in infrastructure and urban development, leading to more commercial and residential construction activities that require glass windows, doors, and facades. Additionally, consumer demand for aesthetically pleasing and energy-efficient architectural designs further supports the growth of the glass sector. Hence, the expansion of the automotive and construction industries is expected to boost demand for light soda ash in the coming years.

MARKET RESTRAINTS

Stringent Environmental Regulations Could Limit Market Growth

Stringent environmental regulations regarding emissions and waste disposal in soda ash production are posing major challenges for manufacturers. The production process, especially the Solvay method, releases carbon dioxide, calcium chloride, and other pollutants, contributing to air and water pollution. Regulatory authorities across North America, Europe, and parts of Asia are tightening environmental standards, compelling companies to invest heavily in emission control technologies and waste treatment systems. These upgrades significantly raise operational and capital expenditure, reducing overall profitability.

MARKET OPPORTUNITIES

Expansion of Water Treatment Infrastructure to Bring Opportunity for Market Players

Increasing investment in water treatment infrastructure across developed and developing countries presents a key opportunity for light soda ash producers. Soda ash is commonly used to adjust the pH of water and reduce acidity, making it essential in municipal water treatment plants, industrial effluent treatment systems, and even household purification solutions. Moreover, the enforcement of tightening regulatory requirements regarding wastewater discharge is driving industries to adopt more advanced chemical treatment solutions, many of which depend on soda ash due to its affordability, availability, and non-toxic nature, offering a favorable option to other alkalis.

- As per the Central Ground Water Board (CGWB), India, the world’s largest consumer of groundwater, consumes 87% of its groundwater for irrigation and 11% for domestic use. However, CGWB studies indicate that 80% of India’s groundwater is contaminated and not suitable for drinking, posing significant public health issues. This brings a major opportunity for the market in wastewater treatment, especially in countries grappling with severe water quality issues.

MARKET CHALLENGES

Competition from Substitute Chemicals Poses a Major Challenge to Market

The increasing availability and adoption of substitute chemicals in certain end-use applications present a notable challenge to the soda ash market. Alternatives such as sodium bicarbonate, caustic soda, and synthetic water softeners are being used in various industrial and consumer applications previously dominated by soda ash. In detergent manufacturing, phosphate-based or enzymatic alternatives are gaining traction due to better performance in low-temperature washes. Similarly, in water treatment, certain industries prefer liquid caustic soda for pH regulation due to ease of handling and storage.

Segmentation Analysis

By Manufacturing Process

Solvay Process Accounts for Largest Share Due to Its Economic Scalability

Based on the manufacturing process, the market is classified into the Solvay process and natural soda ash (Trona).

The Solvay process segment holds the largest light soda ash market share globally due to its economic scalability and raw material availability. This synthetic process involves the reaction of limestone, salt, and ammonia, producing a consistent, high-quality product suitable for a broad range of industrial applications. It is particularly favored in regions lacking access to natural soda ash deposits. The process is known for its high efficiency and integration into large-scale production systems, making it ideal for meeting the high-volume needs of end-use sectors such as glass, chemicals, and detergents.

Natural soda ash, primarily derived from Trona ore, has gained significant traction in the market due to its lower environmental footprint and cost advantages. The extraction of soda ash from natural sources consumes less energy compared to synthetic methods such as the Solvay Process, resulting in reduced carbon emissions and lower operational costs. Natural soda ash is chemically equivalent to synthetic soda ash and finds similar applications, including glass production, detergents, and chemical processing, making it a sustainable, attractive alternative.

By Application

Glass Segment Leads Market Due to Growing Automotive Innovation

Based on application, the market is classified into glass, soaps & detergents, chemicals, alumina & mining, and others.

The glass segment holds the dominating market share. Light soda ash functions as a fluxing agent, reducing the melting temperature of silica, which in turn lowers energy consumption during glass manufacturing. It plays a crucial role in producing flat glass, container glass, fiberglass, and specialty glasses used across the construction, automotive, food packaging, and electronics sectors. Growing demand for lightweight and energy-efficient glass products, driven by green building codes and automotive innovation, continues to fuel consumption in this segment.

In the soaps & detergents industry, light soda ash plays an important role as a water softener and pH regulator, enhancing the cleaning efficiency of surfactants. Its alkaline nature helps remove grease, oil, and acidic stains from fabrics and surfaces, making it a key ingredient in laundry powders, household cleaners, and industrial detergents. With rising hygiene awareness and increasing demand for personal and household cleaning products, especially in the post-pandemic era, soda ash consumption in this sector is growing steadily.

Light soda ash is an initial chemical in various industrial manufacturing processes, making the chemicals segment another core end-use application. It is widely used in the production of sodium-based compounds such as sodium silicates, sodium bicarbonate, and sodium chromate. These derivatives are essential for applications ranging from water treatment to paper manufacturing, dyes, and metallurgy. Moreover, the increasing focus on value-added chemicals for applications in electronics, construction, and environmental technologies supports long-term consumption.

Light Soda Ash Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Light Soda Ash Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the largest share in the market, driven by rapid industrialization and urbanization in countries such as China, India, and Southeast Asia. The region’s strong demand is fueled by its dominant glass, chemical, and detergent manufacturing sectors. China stands out as both a major producer and consumer of light soda ash, with large-scale applications across the construction, automotive industries. The region benefits from the cost advantages, supportive government initiatives, and ongoing investment in manufacturing infrastructure, all of which enhance its market attractiveness.

North America

North America holds a significant share of the market, primarily due to huge natural Trona reserves in the U.S. The U.S. is one of the major producers and exporters of natural soda ash globally, offering a cost-effective and eco-friendly production. Major end-use industries such as glass, detergents, and chemicals continue to drive domestic consumption. Regulatory support for sustainable manufacturing and rising investments in mining infrastructure further strengthen the region’s position.

Europe

The market in Europe is shaped by the region’s strict environmental regulations and high demand from the glass and detergent industries. Countries such as Germany, France, and the U.K. exhibit strong domestic consumption, especially for flat glass used in construction and automotive applications. Due to limited natural reserves, the region relies heavily on the Solvay process for soda ash production, which faces increasing scrutiny due to its environmental impact.

Latin America

Economic expansion and increasing consumer spending power in Latin American countries are key factors driving demand for products across various end-use industries. Moreover, environmental regulations promoting cleaner production methods have led to inventions and adaptations within the sector, supporting sustainable market growth in the region.

Middle East & Africa

The Middle East & Africa region presents emerging growth potential for the market.

Escalating natural soda ash production in countries such as Saudi Arabia and Turkey contributes significantly to the market's growth in the Middle East & Africa.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies Focus on Sustainability to Strengthen Their Market Presence

The light soda ash market is highly competitive, with leading players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key global companies include Solvay, Tata Chemicals Ltd., Şişecam, InoChem., and GHCL Limited. These companies compete on the basis of product innovation, cost efficiency, and regional reach. While established global leaders maintain dominance in developed markets, regional players are expanding their footprints in emerging economies, intensifying competition across the industry.

LIST OF KEY LIGHT SODA ASH COMPANIES PROFILED

- Solvay (Belgium)

- Tata Chemicals Ltd. (India)

- Sudarshan Mineral (India)

- Şişecam (Turkey)

- Angel Chemicals Private Limited. (India)

- InoChem. (Saudi Arabia)

- GHCL Limited (India)

- Tianjin Crown Champion Industrial Co., Ltd. (China)

- STPP Group (China)

- Tokuyama Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS

- December 2024: Şişecam acquired all of Ciner Group’s shares in Sisecam Chemicals Resources LLC and Pacific Soda LLC in the U.S. With this acquisition, Şişecam now fully owns Pacific Soda LLC, which is developing a natural soda ash facility.

- December 2023: Solvay introduced a new soda ash production process named e.Solvay Process. This new technology promises to cut CO₂ emissions by 50%, reduce energy, water, and salt consumption by 20%, and decrease limestone use and residues by 30%.

- June 2023: Tata Chemicals announced a USD 968.0 million capex plan, including a 380 KT salt capacity addition in the U.K. and Mithapur, India. This expansion will boost the company’s global salt capacity to 2.3 MT and India’s to 1.8 MT. The investments aimed to support growth, sustainability, and increased production across key product lines.

- May 2022: Solvay acquired the remaining 20% minority stake from AGC in their Green River, Wyoming, soda ash joint venture for USD 120 million, making Solvay the sole owner of the facility. This move strengthens Solvay’s leadership in trona-based soda ash production and aligns with its sustainability goals by expanding the supply of lower carbon-intensive soda ash.

- September 2019: Solvay increased its soda ash production capacity by 600 KT at its Green River, Wyoming, USA facility to meet rising global demand, especially for glass manufacturing and lithium extraction.

REPORT COVERAGE

The global light soda ash market analysis provides market size and forecast for all segments included in the report. It includes details on the market dynamics and market trends expected to drive the market over the forecast period. It offers information about the key regions, key industry developments, new product launches, details on partnerships, mergers & acquisitions, and a number of light soda ash manufacturers in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.3% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kilotons) |

|

Segmentation |

By Manufacturing Process

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 5.01 billion in 2025 and is projected to reach USD 8.7 billion by 2034.

In 2025, the market value stood at USD 3.11 billion.

The market is expected to exhibit a CAGR of 6.3% during the forecast period (2026-2034).

The Solvay process segment leads the market by manufacturing process.

Growing demand for soda ash within the glass industry is a key factor driving market growth.

Solvay, Tata Chemicals Ltd., Şişecam, InoChem, and GHCL Limited are some of the leading players in the market.

Asia Pacific holds the largest share of 3.11 billion in 2025 of the market.

Increasing demand in glass manufacturing, coupled with its growing usage in automotive applications, is expected to drive product adoption in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us