Low Voltage AC Drive Market Size, Share & Industry Analysis, By Voltage (Below 100V, 101 to 350V, and 351 to 700V), By Application (Pumps, Conveyers, Compressors, Electric Fan, Extruders, and Others), By End-User (Food & Beverage, Oil & Gas, Power Generation, Building Automation, Metal & Mining, Water & Wastewater, Chemicals & Petrochemicals, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

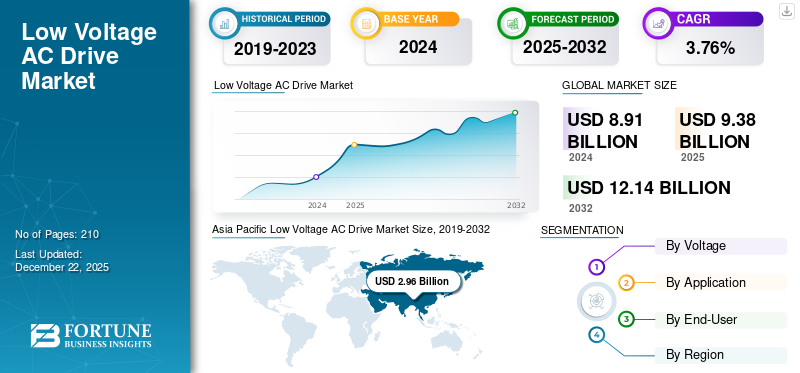

The global low voltage AC drive market size was valued at USD 8.91 billion in 2024. The market is projected to grow from USD 9.38 billion in 2025 to USD 12.14 billion by 2032, exhibiting a CAGR of 3.76% during the forecast period.

A low-voltage AC drive, also known as a Variable Frequency Drive (VFD) or Adjustable Speed Drive (ASD), is a type of power electronic device used to control the speed and torque of an electric motor. It adjusts the frequency and voltage of the power supplied to the motor. These drives typically operate at low voltages and are designed to optimize motor performance, energy efficiency, and process control.

Low-voltage AC drives are widely used in industrial processes for crucial applications such as pumps, fans, conveyors, and machine tools, enabling precise control over various industrial operations. Hence, the market is expected to grow significantly in the near future.

- In May 2025, the State Government of Maharashtra announced the development of a large-scale industrial park through collaboration with Xsio Logistics Parks and Horizon Industrial Parks. This initiative aims to create more than 10 state-of-the-art, sustainability-compliant industrial and logistics parks across the state.

The increasing automation of industrial processes across various sectors, such as manufacturing, oil & gas, and chemicals, is driving the demand for AC drives. Several factors, including increasing industrial automation, the need for energy efficiency, and rising adoption in various end-user industries, drive their demand.

Danfoss holds a prominent position in the market, recognized as a global leader in the field. It offers a wide range of drives designed for various applications, emphasizing reliability, user-friendliness, and energy efficiency. Its products are designed to minimize energy consumption, reduce operational costs, and optimize motor control in diverse industrial settings.

MARKET DYNAMICS

MARKET DRIVERS

Growth of HVAC and Infrastructure Industries to Drive Market Growth

The HVAC and infrastructure industries are significant drivers for the low voltage AC drive market growth. These industries rely on AC drives for efficient motor control in various applications, including heating, ventilation, and air conditioning systems, and in various infrastructure projects such as smart grids and power generation.

- In July 2024, LG announced plans for large-scale investments in the Indian HVAC industry through the development of System Air-Conditioners (SAC), which are mainly used in industrial and commercial applications. Such developments are expected to boost the market growth over the forecast period.

HVAC systems, including air conditioning, are energy-intensive. AC drives, particularly Variable Frequency Drives (VFDs), are crucial for optimizing energy consumption in these systems by controlling motor speeds based on demand, leading to significant energy savings. The increasing adoption of smart buildings and sustainable construction practices is boosting the demand for energy-efficient HVAC solutions, further driving the need for AC drives.

Furthermore, the ongoing trend of industrial automation is also driving the demand for AC drives in various sectors, including manufacturing, where they are used to control motors in production lines and other machinery.

MARKET RESTRAINTS

High Upfront Costs Can Hinder Market Growth

High upfront costs are indeed a significant barrier to the wider adoption of low-voltage AC drives. While low voltage AC drives offer long-term energy savings and improved efficiency, the initial investment in purchasing and installing them can be a major deterrent, particularly for smaller businesses with limited budgets. The overall expenses of purchasing the AC drive, including engineering, installation, and integration with the existing infrastructure, can be substantial. Small and medium-sized enterprises (SMEs) often have tighter financial constraints, making the upfront cost of AC drives a significant hurdle.

MARKET OPPORTUNITIES

Expansion of Renewable Energy Projects to Create Opportunities for Market Growth

The expansion of renewable energy projects is poised to create lucrative opportunities for the market in the coming years. As renewable energy sources such as solar and wind power are integrated into the grid, the demand for efficient and reliable AC drives will increase significantly.

- In 2023, the European Union adopted the Renewable Energy Directive to reduce greenhouse gas emissions by 55% by 2030 and achieve carbon neutrality by 2050. Such initiatives are expected to propel investment in renewable power generation across Europe. Hence, it is expected to foster demand for low-voltage AC drives in the coming years.

Initiatives such as India's target of 500 GW of non-fossil fuel capacity by 2030, coupled with increasing renewable energy generation globally, are driving the demand for AC drives in wind and solar power generation.

LOW VOLTAGE AC DRIVE MARKET TRENDS

Shift Toward Compact & Energy Efficient Solutions for Low Voltage Drives to Boost Market Trends

The shift toward compact and energy-efficient low-voltage drive designs is a major trend in the current market, driven by the need for increased efficiency, reduced energy consumption, and space optimization. This trend is reshaping the market with innovations such as multi-axis drives and integrated motor-drive systems. Innovations in semiconductor components (SiC, GaN), motor design, and Variable Frequency Drives (VFDs) are contributing to better performance and energy savings. The market is expected to continue its growth, fueled by ongoing technological advancements, increasing demand for energy-efficient solutions, and the growing adoption of electric vehicles.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Voltage

101 and 350V Segment Projected to Dominate Owing to Its Increased Adoption in Industrial Applications

By voltage, the market is segmented into below 100V, 101 to 350V, and 351 to 700V.

Low-voltage AC drives, typically operating between 101 and 350V, are expected to dominate the market as these drives are widely used in various industrial applications to control the speed of AC motors. These applications include pumps, fans, compressors, conveyors, and other machinery where adjustable speed control is needed for efficiency and process optimization.

Furthermore, low-voltage AC drives within the 351 to 700V range are commonly used in various industrial applications to control the speed and torque of electric motors. Low voltage AC drives offer precise control and energy savings in applications such as pumps, fans, compressors, and conveyors, and in specialized areas such as robotics and material handling. Growth of end-use industries is expected to fuel market growth in the coming years.

By Application

Pumps Segment Dominates Owing to Large-scale Prominence in Wastewater Treatment and Industrial Processes

The market, by application is segmented into pumps, conveyers, compressors, electric fan, extruders, and others.

The pumps segment accounts for the largest low voltage AC drive market share, supported by growing demand for energy-efficient motor control across sectors such as water and wastewater treatment, HVAC, agriculture, and industrial processes. Low voltage AC drives allow pumps to operate at variable speeds based on real-time demand, significantly reducing energy consumption and maintenance costs.

Low-voltage AC drives control the speed of electric motors in various applications, including compressors. They offer advantages such as precise control, energy savings, and reduced wear and tear on equipment, specifically in compressor applications. Variable Frequency Drives (VFDs) with Direct Torque Control (DTC) can be used to match the compressor's output to the required demand precisely, optimizing energy consumption and maintaining stable pressure.

By End-User

Rising Demand for Energy Efficiency across Numerous Industries Drives Power Generation Segment Growth

The market, by end-user, is segmented into food & beverage, oil & gas, power generation, building automation, metal & mining, water & wastewater, chemicals & petrochemicals, and others.

The power generation segment is expected to dominate the market. This segment is experiencing significant growth within the broader market due to increasing demand for energy-efficient solutions and precise control in power generation processes. Low-voltage AC drives are crucial in this sector for optimizing motor performance in various applications, such as pumps, fans, and compressors used in power plants.

- In January 2024, Honeywell launched an advanced control building system that utilizes a BMS platform for energy efficiency, enhancement of digital connectivity, and advanced signal conversion across various building automation applications. Hence, the development of such technologies will boost the requirement for low-voltage AC drives in the near future.

The oil & gas industry is a significant end-user of low-voltage AC drives due to the need for reliable energy management solutions in processes such as extraction, refining, and distribution. Low voltage AC drives are crucial for controlling motor-driven equipment such as pumps and compressors, enabling energy efficiency and precise control of motor speeds and torque, which is vital for optimizing performance and reducing power consumption.

LOW VOLTAGE AC DRIVE MARKET REGIONAL OUTLOOK

The market has been studied across five central regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Asia Pacific Low Voltage AC Drive Market Size, 2019-2032 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North American market is experiencing substantial growth, driven by increasing industrial automation, energy efficiency mandates, and the adoption of electric vehicles. The market is characterized by a significant number of key players focusing on technological advancements, expansion of energy capacity, and infrastructure investments, particularly in sectors such as oil & gas, food processing, and power generation.

According to the U.S. Energy Information Administration, U.S. electricity consumption is expected to increase from 3% to 5% in 2026. Increasing electricity consumption will fuel grid upgradation and investments in the power generation sector, which will positively impact the market growth in the near future.

Europe

In Europe, the demand for low-voltage AC drives is expected to increase steadily, driven by stringent energy efficiency regulations, the push for industrial automation, and the modernization of aging infrastructure. European industries, particularly in manufacturing, water treatment, HVAC, and renewable energy, have increasingly adopted low voltage AC drives to optimize energy consumption and enhance operational efficiency. Moreover, Germany, Italy, and France are at the forefront due to a strong focus on sustainability and digitization.

Asia Pacific

The Asia Pacific dominated the global market owing to increasing industrialization, urbanization, and a strong focus on energy efficiency. China and India are leading the market due to rapid industrial growth and government initiatives promoting energy conservation.

- In June 2024, the Government of China announced plans to invest USD 140 billion in robotics and industrial technological advancements. Hence, large-scale investments in end-use industries of the low voltage AC drive market are expected to boost market growth in the region.

The region's growing manufacturing sector, coupled with supportive policies and rising demand for energy optimization, is further propelling the market. Technological advancements, such as the integration of IoT and Industry 4.0, are also contributing to the market's expansion.

Latin America

The Latin American low voltage AC drive market is experiencing growth, driven by industrial modernization and increasing demand for energy efficiency across various sectors. While the region faces challenges such as policy inconsistencies and infrastructure limitations, growing investments and government support are improving the market's prospects. Key sectors such as energy, automotive, and construction are adopting low voltage AC drives to improve operational efficiency and meet sustainability goals.

Middle East & Africa

The Middle East & Africa market is experiencing significant growth, driven by urbanization, industrial development, and increased investments in infrastructure. This growth is fueled by the need for energy-efficient motor control solutions, particularly in sectors such as oil & gas, mining, and utilities, as well as the expansion of manufacturing and Industry 4.0 initiatives. Furthermore, the region's focus on renewable energy development and water treatment facilities is also contributing to the demand for these drives over the forecast period.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Are Engaged in New Product Launches to Increase Market Share

The competitive landscape of the market is characterized by several key players and emerging trends. Major players include ABB, Siemens, Fuji Electric, Danfoss, Schneider Electric, WEG, and others. These companies are innovating a wide range of AC drives, from micro and machinery drives to industrial and industry-specific solutions. For instance, in April 2024, ABB launched a new ACQ80 Variable Speed Drive (VSD) used in water pumping, featuring maximum power point tracking logic, which optimized the operational performance. Furthermore, the drive has a voltage capacity from 225 V to 800 V. The market is driven by the need for energy efficiency and is experiencing growth due to rapid industrialization and the adoption of automation technologies.

List of Key Low Voltage AC Drive Companies Profiled

- ABB (Switzerland)

- Danfoss Group (Denmark)

- Schneider Electric (France)

- Siemens (Germany)

- Fuji Electric (Japan)

- Infineon Technologies AG (Germany)

- Parker Hannifin (U.S.)

- Rockwell Automation (U.S.)

- Toshiba International Corporation (Japan)

- WEG (Brazil)

- Yaskawa Electric Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS

- In June 2025, ABB launched low low-voltage Titanium Variable Speed Motor, which offers a combination of Variable Speed Drive (VSD) and energy-efficient motor technology in a compact and customizable solution. This motor is expected to lower costs, reduce consumption, and minimize carbon emissions.

- In March 2025, Danfoss and Innomatics announced a strategic partnership for technological developments. The strategic partnership aims to provide comprehensive drive solutions through the development of efficient and compatible products with numerous applications.

- In November 2024, Sprint Electric unveiled an AC regeneration drive at the SPS 2023 exhibition in Nuremberg, Germany. The drives are equipped with a power capacity up to 22 kW and are expected to control all closed and open-loop motor types, maximizing application range.

- In June 2024, Danfoss India launched new gen intelligent drives named iC2 and iC7. The company claims that the iC2 drive improves efficiency by 40% and is compatible with IM, IPM, and SPM motors. The products are mainly positioned to cater to industries such as Power, HVAC, Food and Beverage, Sugar & Ethanol, industrial machinery, conveyors, water & wastewater treatment, and any other systems.

- In November 2022, IDEC Corporation introduced a new line of VF1A Doesa Variable Frequency Drives (VFD) with application in electric motors used in a wide range of industries.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as leading companies, product process, and competitive landscape. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 3.76% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Voltage

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 8.91 billion in 2024.

In 2024, the Asia Pacific market value stood at USD 2.96 billion.

The market is expected to exhibit a CAGR of 3.76% during the forecast period.

By end-user, the power generation segment is leading the market.

Industrialization and the growth of the HVAC & infrastructure industries are driving the market growth.

Some of the top major players in the market are ABB, Danfoss Group, Schneider Electric, Siemens, Fuji Electric, and others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us