Lutetium-177 Market Size, Share & Industry Analysis, By Drug (LUTATHERA {lutetium Lu 177 dotatate}, PLUVICTO {lutetium Lu 177 vipivotide tetraxetan}, and Others) By Age Group (Adults and Pediatrics), By Application (Neuroendocrine Tumor, Prostate Cancer, and Others) By End-User (Hospitals, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

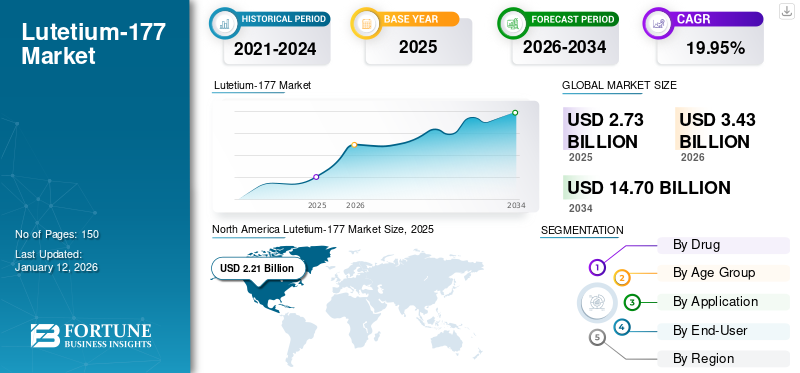

The global lutetium-177 market size was valued at USD 2.73 billion in 2025. The market is projected to grow from USD 3.43 billion in 2026 to USD 14.7 billion by 2034, exhibiting a CAGR of 19.95% during the forecast period. North America dominated the lutetium-177 market with a market share of 80.95% in 2025.

The global lutetium-177 market has shown robust growth, with projections indicating a continued upward trajectory. Some of the key players operating in the market include Novartis AG, Lantheus Holdings, Inc., and Telix Pharmaceutical Limited. Lutetium-177 (Lu-177) is a radioactive isotope utilized in nuclear medicine. This radioisotope is widely used in targeted radionuclide therapy, particularly for treating neuroendocrine tumors and certain types of prostate cancer. It offers targeted radiation with minimal damage to surrounding healthy tissues, making it a valuable treatment in oncology.

Furthermore, the increasing prevalence of cancer and rising demand for targeted therapy are driving the growth of the market. Also, the presence of key players with extensive research and development activities and product launches to expand the offering in the Lu-177 for treating various cancers is expected to bolster the market’s growth.

- For instance, in December 2023, Lantheus Holdings, Inc., in collaboration with POINT Biopharma Global Inc., announced topline results from the pivotal Phase 3 SPLASH study. This study evaluated the efficacy and safety of 177Lu-PNT2002, a prostate-specific membrane antigen (PSMA)-targeted radioligand therapy, in patients with metastatic castration-resistant prostate cancer (mCRPC) who have progressed after treatment with an androgen receptor pathway inhibitor (ARPI).

Global Lutetium-177 Market Key Takeaways

Market Size & Forecast

- 2025 Market Size: USD 2.73 billion

- 2026 Market Size: USD 3.43 billion

- 2034 Forecast Market Size: USD 14.7 billion

- CAGR: 19.95% from 2026–2034

Market Share

- North America dominated the lutetium-177 market with a 80.95% share in 2025, driven by a high prevalence of cancer, robust reimbursement policies, and significant production capacity, particularly in the U.S., which hosts the largest Lu-177 production facility in the region.

- By age group, the adult segment accounted for the largest share in 2024, driven by the high prevalence of prostate cancer in men aged 65 and older.

Key Country Highlights

- United States: Accounts for a significant portion of the North American market, driven by the presence of leading companies like Novartis and Lantheus, and investments such as SHINE Technologies’ Lu-177 production facility in Janesville.

- Canada: Expanding access through reimbursement of Pluvicto across provinces for prostate cancer patients, strengthening the regional adoption.

- United Kingdom: Opening of a dedicated Nuclear Medicine Therapy Centre in Sutton supports greater adoption of Lu-177 PSMA therapy for cancer care.

- Australia: Home to key players like Telix and Radiopharm Theranostics; research and clinical trials are supported by national organizations like ANSTO for Lu-177 supply.

- United Arab Emirates: Burjeel Holdings launched a new cancer institute in Abu Dhabi offering targeted therapy with Lu-177, boosting demand in the Middle East.

MARKET DYNAMICS

MARKET DRIVERS

Rising Prevalence of Cancer to Propel the Demand for Lutetium-177

The increasing global prevalence of cancer, particularly prostate cancer, neuroendocrine cancer, and others is driving the demand for this radioisotope. Lu-177 is used as a targeted therapy that binds to specific receptors on cancer cells, such as prostate-specific membrane antigen (PSMA) in prostate cancer. It delivers radiation directly to the tumor while minimizing damage to surrounding healthy tissues. Such benefits associated with the treatment bolster the lutetium-177 market growth.

- For instance, according to the American Cancer Society, Inc., 313,780 new cases of prostate cancer are estimated in the U.S. in 2025. Such a large number of cases increases the demand for targeted therapy to reduce the damage to healthy tissues and thus drives the growth of the market.

MARKET RESTRAINTS

High Cost Associated with Lu-177 Treatment to Limit Market Expansion in Lower-Middle Economic Countries

One of the key factors that limits the adoption of Lu-177 treatment is the higher cost associated with it, which poses significant barriers to its market expansion in lower-middle-income countries. The expenses associated with radiopharmaceutical production, specialized equipment, and trained personnel contribute to the overall financial burden leading to the higher cost of the drug.

- According to the data from Bookimed, the cost of a single dose of Pluvicto varies significantly by country. In Turkey, a single dose costs between USD 5,000 and USD 12,000, while in Mexico, it ranges from USD 5,500 to USD 10,000.

- Typically, patients require an average of six doses for the treatment, which can significantly increase the financial burden. Such high treatment costs are anticipated to restrict its adoption among the low and middle income population.

Additionally, the lack of required infrastructure, such as radiotherapy centers and standard regulatory frameworks to support the safe use of nuclear medicine, and inadequate reimbursement policies are also restricting the market growth.

MARKET CHALLENGES

Regulatory Hurdles and Production Complexities to Challenge Market Growth

The production of high-purity Lu-177 presents significant challenges due to its complex and costly manufacturing processes that necessitate specialized facilities and materials. Furthermore, stringent regulatory guidelines for radioactive materials also make it difficult for manufacturers to fulfill the demand effectively. These factors collectively create a complex landscape for companies looking to develop and distribute Lu-177, limiting their ability to meet growing demand and advance therapeutic applications in nuclear medicine.

MARKET OPPORTUNITIES

Increasing Number of Clinical Trials Targeting New Application Areas to Offer Lucrative Growth Opportunity

The rising prevalence of cancer and growing demand for targeted treatment have created a significant opportunity for the growth of Lu-177 market. The high demand for radiopharmaceuticals has shifted the focus of pharmaceutical companies to expand their research and development capabilities for Lu-177 for treating advanced cancers.

Furthermore, the increasing number of regulatory approvals for the new Lu-177 candidates for the treatment of various types of cancers is expected to propel the growth of the market during the forecast period.

- For instance, in October 2021, Y-mAbs Therapeutics, Inc. announced that the U.S. Food and Drug Administration (FDA) has granted a Rare Pediatric Disease Designation (RPDD) for its 177Lu-omburtamab-DTPA lutetium-labeled omburtamab antibody program. 177Lu-omburtamab-DTPA is used for the treatment of medulloblastoma, a type of brain cancer affecting children. Such advancements aimed to expand the market’s growth during the forecast period.

LUTETIUM-177 MARKET TRENDS

Increasing Usage of Combination Therapy Identified as a Potential Market Trend

The integration of Lu-177 with other therapeutic modalities, such as immunotherapy and chemotherapy, is emerging as a prominent strategy to enhance treatment efficacy and overcome resistance. Combination therapies leverage the synergistic effects of different treatment mechanisms, allowing for more comprehensive cancer management and also minimizes side effects by allowing lower doses of each treatment. Moreover, many key players in the market are expanding their research capabilities by collaborating with pharmaceutical companies to launch advanced combination therapies.

- For instance, in July 2023, Telix Pharmaceuticals initiated a Phase I study, STARSTRUCK, combining its targeted radiation therapy, TLX250, with Merck's DNA-PK inhibitor, peposertib. The trial aimed to evaluate safety and efficacy in patients with carbonic-anhydrase IX (CAIX)-expressing solid tumors that have failed standard treatments. The combination is expected to enhance treatment potency by inducing DNA damage and preventing repair, potentially improving outcomes at lower radiation doses.

Download Free sample to learn more about this report.

Segmentation Analysis

By Drug

Demand For Targeted Treatment Using LUTATHERA To Drive The Segment’s Growth

Based on the drug, the market is classified into LUTATHERA (lutetium Lu 177 dotatate), PLUVICTO (lutetium Lu 177 vipivotide tetraxetan), and others.

The LUTATHERA (lutetium Lu 177 dotatate) is expected to hold the dominant global lutetium-177 market share of the segment in the market in 2024. This is driven by the rising prevalence of neuroendocrine tumors and increasing demand for targeted treatment for minimizing damage to healthy tissues.

- For instance, in September 2022, according to a report by Neuroendocrine Cancer UK, between 1995 and 2018, the incidence of neuroendocrine cancers in England experienced a significant increase of 371.0%. This substantial rise in cases has increased the demand for treatment options including LUTATHERA (lutetium Lu 177 dotatate).

On the other hand, PLUVICTO (lutetium Lu 177 vipivotide tetraxetan) is expected to hold a substantial portion of the market and is estimated to grow with a significant CAGR during the forecasted timeframe. The increasing demand for radiation therapeutics for prostate cancer and rising government initiatives to reimburse Pluvicto to boost its adoption by patients.

- For instance, in March 2025, Novartis AG, Canada, welcomed the Government of Alberta's decision to publicly reimburse Pluvicto, a radioligand therapy for patients with PSMA-positive metastatic castration-resistant prostate cancer (mCRPC). This move aligns Alberta with Ontario and Nova Scotia, further expanding access to this innovative treatment across Canada. Such activities further boost the segment’s growth in the market.

By Age Group

Rising Prevalence of Cancer in Geriatric Population to Boost the Growth in Adult Segment

Based on age group, the market is divided into adults and pediatrics.

The adult segment is expected to account for a larger share of the market in 2024. The growth of the segment is augmented by the increasing prevalence of prostate cancer in the geriatric population, thus leading to increased demand for LU-177 therapy amongst adults.

- For instance, according to the data published by the American Cancer Society, Inc., prostate cancer is more prevalent among older men, with approximately 6 in 10 diagnoses occurring in those aged 65 and above. At the same time, it is uncommon in men under 40. The typical age for a man's first diagnosis is around 67. Such a large number of vulnerable populations affected by prostate cancer drives the demand for the products in the market.

In contrast, the pediatrics segment is anticipated to experience significant growth during the forecast period. This growth is driven by regulatory approvals for the use of Lu-177 in treating pediatric cancer patients.

- For instance, in April 2024, Novartis AG announced that the U.S. FDA has approved LUTATHERA (lutetium Lu 177 dotatate) to treat pediatric patients 12 years and older with somatostatin receptor (SSTR)-positive gastroenteropancreatic neuroendocrine tumors (GEP-NETs). Such approvals are expected to boost the segment’s growth in the market.

By Application

Increasing Prevalence and Product Launches for Prostate Cancer to Drive Segment’s Growth

On the basis of application, the market is divided into prostate cancer, neuroendocrine tumors, and others.

In 2024, the prostate cancer segment held the maximum portion of the global market. Owing to the increasing prevalence of prostate cancer and the strong focus of operating players in the market on prostate cancer therapeutics, the segment is anticipated to witness a considerable growth in the coming years. Lu-177 products are specifically designed for castration resistance prostate cancer, leading to the growth of the segment in the market.

Alternatively, the neuroendocrine tumors segment is expected to grow with notable CAGR from 2025 to 2032. The expected growth is determined by the rising prevalence of neuroendocrine tumors and growing research and development activities by key players for launching Lu-177 products for treatment.

- For instance, in July 2024, Curium submitted a 505(b) (2) New Drug Application to the U.S. FDA for Lutetium Lu 177 Dotatate Injection. This application seeks approval for treating somatostatin receptor-positive gastroenteropancreatic neuroendocrine tumors (GEP-NETS).

The other segment is expected to grow moderately during the forecast period. The segment’s growth is driven by rising research and development activities by the key players to introduce Lu-177 radiation therapeutics for various cancer conditions such as glioblastoma, medulloblastoma, and others.

By End-User

Presence of Advanced facilities and Rising Collaboration to Propel Hospitals Growth

Based on end-user, the market is segmented into hospitals, specialty clinics, and others.

The hospital segment dominated the market in 2024. Hospitals are highly equipped with specialized equipment for the administration of radioactive materials such as Lu-177 and, thus, are expected to hold a significant portion of the market segment. Also, increasing collaboration between biotechnology companies and hospitals to manufacture Lutetium-177 for treating cancer is expected to propel the segment’s growth.

- For instance, in January 2024, Akiram Therapeutics partnered with a prominent Swedish university hospital to manufacture 177Lu-AKIR001, a radiopharmaceutical intended for treating solid tumors. This collaboration is a crucial step toward initiating a Phase I first-in-human clinical trial for 177Lu-AKIR001, expected to treat thyroid cancer, head and neck squamous cell carcinoma, and non-small cell lung cancer.

Specialty clinics and other segments are expected to grow considerably during the forecast period. The increasing research and development activities in the academic and research institutes for launching Lu-177 for various cancer treatments boost the growth of the segment in the market.

LUTETIUM-177 MARKET REGIONAL OUTLOOK

By geography, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America Lutetium-177 Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held a major portion of the global market with an 80.95% share. The region generated a revenue of USD 2.21 billion in 2025. The rising prevalence of cancer and the presence of robust reimbursement policies for cancer care boost the growth of the region in the global market.

The U.S. market held a significant share of the North America market. The country has advanced healthcare facilities to offer radiation therapeutics. Along with this, the presence of key market players with robust manufacturing facilities for the production of radiopharmaceuticals is also boosting the country’s growth.

- For instance, in June 2023, SHINE Technologies, LLC announced the opening of the largest Lu-177 production facility in North America. This facility would operate in Janesville to produce Lu-177 for targeted cancer therapies. Such initiatives are aimed for the easier supply of the isotope to fulfill the growing demand, thus expected to propel the country’s market growth.

Europe

Europe held the second-largest share of the global market. The rising number of new cancer cases and increasing demand for targeted therapies have majorly driven the regional market growth. Along with this, the presence of advanced healthcare facilities, and robust reimbursement policies for expensive treatment further propel the region’s growth.

- For instance, in July 2024, The Royal Marsden, a leading nuclear medicine therapy center in the U.K., inaugurated a state-of-the-art, purpose-built Nuclear Medicine Therapy Centre at its Sutton location. This dedicated facility is specifically designed for the administration and management of radionuclide therapies, including Lu-177 PSMA therapy, enhancing the hospital's capabilities in delivering advanced cancer treatments. Such launches promote the adoption of Lu-177 and thus propel market growth in the region.

Asia Pacific

Asia Pacific region is projected to be the fastest-growing region, with considerable CAGR in the forecast period. The rising geriatric population and lifestyle modification are increasing the number of cancer cases in the region. Also, the presence of key market players that are actively involved in research and development initiatives to launch radiation therapeutics products is further propelling the region’s growth in the market.

- For instance, in November 2022, Radiopharm Theranostics Ltd secured an agreement with Australia's Nuclear Science and Technology Organisation (ANSTO) for the supply of non-carrier added Lu-177 for use in clinical trials in Australia. The isotopes were utilized in the Phase I therapeutic dose escalation trial to treat patients with non-small cell lung cancer. Such agreements promote the launch of new therapy options with Lu-177 and also boost the region’s growth.

Rest of the World

The markets in the rest of the world region that comprises of Latin America and Middle East & Africa are expected to witness considerable growth in the near future. Increasing demand and rising government initiatives to promote radiopharmaceuticals is projected to propel the region’s growth during the forecast period.

- For instance, in July 2024, Burjeel Holdings launched The Burjeel Cancer Institute (BCI) in Abu Dhabi. The institute aimed to offer treatments, including targeted therapy and precision medicine. Such launches are expected to propel the region’s growth in the market.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Novartis AG Accounted for the Highest Market Share Owing to the Diversified and Robust Product Portfolio

The global market is consolidated with few major players accounting for a significant market share in 2024. Novartis AG held a significant portion of the market due to the presence of robust product offerings, regulatory approvals for Lu-177, and a strong geographic presence.

Additionally, many other prominent players, such as Telic Pharmaceuticals Limited, Ariceum Therapeutics, and Lantheus Holdings Inc., with strong Lu-177 pipeline and research activities expected to propel their market share during the forecast period.

LIST OF KEY LUTETIUM-177 COMPANIES PROFILED

- Novartis AG (Switzerland)

- Telix Pharmaceuticals Limited (Australia)

- Ariceum Therapeutics (Germany)

- Radiopharm Theranostics Limited (Australia)

- Lantheus Holdings, Inc. (U.S.)

- Y-mAbs Therapeutics, Inc. (U.S.)

- GLYTHERIX (Australia)

- Curium (France)

KEY INDUSTRY DEVELOPMENTS

- December 2024- Ariceum Therapeutics announced a global supply agreement with Eckert & Ziegler for the supply of medical radionuclides Actinium-225 (Ac-225) and Lu-177. The supply agreement aimed to accelerate Ariceum’s novel targeted radiopharmaceutical pipeline programs.

- October 2024- GLYTHERIX partnered with Eckert & Ziegler to leverage GMP-grade Lutetium-177 chloride for GlyTherix's clinical trials, focusing on the treatment of aggressive cancers using cutting-edge antibody radiopharmaceuticals.

- June 2024- Lantheus acquired Life Molecular Imaging’s global rights to 177Lu-DOTA-RM2 and 68Ga-DOTA-RM2, a clinical-stage radiotherapeutic and radio diagnostic pair to address unmet medical needs in prostate and breast cancer treatment.

- January 2024- Lantheus Holdings, Inc. announced that the U.S. Food and Drug Administration (FDA) has accepted its Abbreviated New Drug Application (ANDA) for Lutetium Lu 177 Dotatate (177Lu-PNT2003), a generic version of LUTATHERA. It is used to treat somatostatin receptor-positive gastroenteropancreatic neuroendocrine tumors (GEP-NETs) in adults, affecting various parts of the gastrointestinal tract.

- December 2022- Novartis AG announced that the European Commission (EC) approved Pluvicto (lutetium (177Lu) vipivotide tetraxetan) in combination with androgen deprivation therapy (ADT) as a targeted radioligand therapy to treat metastatic castration-resistant prostate cancer (mCRPC).

REPORT COVERAGE

The global lutetium-177 market analysis provides market size & forecast by all the segments included in the report. The global lutetium-177 market report comprises of details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the prevalence of cancer in key regions/countries, key industry developments, new product launches, and details on partnerships, mergers & acquisitions. The report covers a detailed competitive landscape with information on the market share and profiles of key players and the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 19.95% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Drug

|

|

By Age Group

|

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.43 billion in 2026 and is projected to reach USD 14.7 billion by 2034.

In 2025, the market value stood at USD 2.21 billion.

The market is expected to exhibit a CAGR of 19.95% during the forecast period.

The LUTATHERA (lutetium Lu 177 dotatate) segment led the market, by drug.

The key factors driving the market are the increasing prevalence of cancer and the rising geriatric population.

Novartis AG and Lantheus Holdings, Inc. are the top players in the market.

North America dominated the lutetium-177 market with a market share of 80.95% in 2025.

Increased awareness for targeted therapies and an increasing number of applications for Lutetium-177 are some of the factors that are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us