Radiotheranostics Market Size, Share & Industry Analysis, By Radioisotope (Lutetium-177, Radium-223, Iodine-131, and Others), By Application (Neuroendocrine Tumors, Prostate Cancer, and Others), By End-User (Hospitals & Clinics, Diagnostic Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

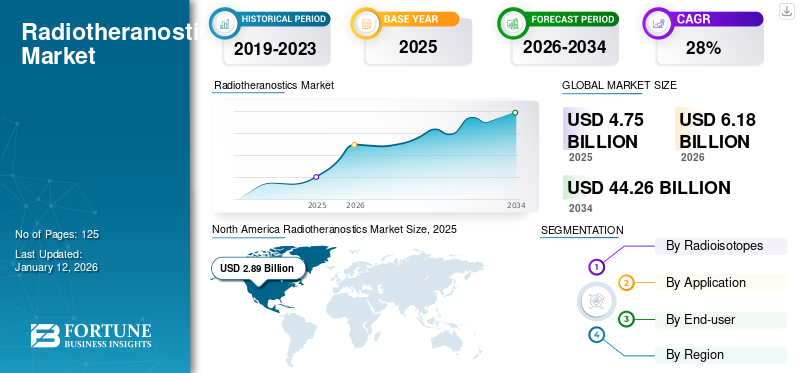

The global radiotheranostics market size was valued at USD 4.75 billion in 2025. The market is projected to grow from USD 6.18 billion in 2026 to USD 44.26 billion by 2034, exhibiting a CAGR of 27.90% during the forecast period. North America dominated the radiotheranostics market with a market share of 60.80% in 2025.

Radiotheranostics refers to therapeutic radiopharmaceuticals or products that are a combination of diagnostic and therapeutic radiopharmaceuticals, which can be used to diagnose and treat diseases, especially different forms of cancer. It is emerging rapidly with the development of new radiopharmaceuticals, advancements in imaging techniques, and a surge in the widespread application of existing products. In addition, rising approvals of new radiotheranostic agents and increased public-private funding for R&D activities are further accelerating the market growth.

- For instance, in June 2024, Clarity Pharmaceuticals received a USD 6.6 million R&D Tax Incentive refund from the Australian Federal Government’s R&D Tax Incentive program. This funding aims to offer further development of various products for different cancer indications with the Targeted Copper Theranostics (TCT) platform.

Moreover, the pharmaceutical companies are focused on developing newer radioisotopes for therapeutics with longer half-lives and better treatment outcomes, which is likely to create growth opportunities for the market.

Key pharmaceutical companies, such as Novartis AG, Bayer AG, and others, with robust product portfolios and strong research programs, focus on the development of innovative therapy options to strengthen their positions in the market.

Global Radiotheranostics Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 4.75 billion

- 2026 Market Size: USD 6.18 billion

- 2034 Forecast Market Size: USD 44.26 billion

- CAGR: 27.90% from 2026–2034

Market Share:

- Region: North America dominated the market with a 60.80% share in 2025. This leadership is driven by an increase in the prevalence of cancer, comparatively higher diagnosis and treatment rates due to advanced diagnostic facilities, supportive reimbursement policies, and high expenditure for cancer care.

- By Radioisotope: Lutetium-177 held the dominant market share. Its growth is fueled by the rising prevalence of cancer, increasing demand for radiation therapies, and its ability to deliver targeted therapy directly to tumors, which minimizes damage to healthy tissue.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, Japan's market is driven by a rising prevalence of cancer and the expansion of key companies with advanced strategies, clinical studies, and regulatory approvals, which are increasing the availability of innovative treatments.

- United States: The market is propelled by a high number of regulatory approvals and the establishment of new manufacturing facilities. For instance, Clarity Pharmaceuticals signed a master services agreement with Nucleus RadioPharma to manufacture its drug products at a new state-of-the-art facility in Rochester.

- China: Growth is supported by strategic collaborations to bring novel diagnostic and therapeutic agents into the market. A key example is Blue Earth Diagnostics' partnership with Sinotau Pharmaceutical Group to provide a prostate cancer PET diagnostic imaging agent to the Chinese market.

- Europe: The market is advanced by strong research and development initiatives from key players. For example, Ariceum Therapeutics opened new laboratory facilities in Berlin to house R&D for its next-generation radiopharmaceutical pipeline candidates.

MARKET DYNAMICS

MARKET DRIVERS

Rising Cancer Prevalence to Boost Market Growth

The extensive increase in cancer prevalence globally is one of the most critical drivers that has positively impacted the market. Increasing lifestyle changes and environmental factors are contributing to the growth of such diseases. As technology plays a significant role in the fight against cancer, there is an increase in demand for targeted treatment options for chronic diseases such as cancer.

- For instance, in October 2024, according to data provided by the Centers for Disease Control and Prevention (CDC), six in ten Americans live with at least one chronic disease, such as heart disease and stroke, cancer, and diabetes. These, with other chronic diseases, are the leading causes of death and disability in America.

Additionally, the increasing incidence of cancers, such as neuroendocrine tumors, prostate cancer, breast cancer, and lung cancer, is increasing exponentially, leading to a rising burden of diseases and devastating effects on patients and caregivers. Thus, treating patients with prominent options leads to potential demand for products such as radioligand therapy for accurate and targeted treatment.

- For instance, according to the data published by the American Cancer Society, Inc., prostate cancer is more prevalent among older men, with approximately 6 in 10 diagnoses occurring in those aged 65 and above. At the same time, it is uncommon in men under 40. The typical age for a man's first diagnosis is around 67. Such a large number of vulnerable populations affected by prostate cancer drives the demand for products in the market.

MARKET RESTRAINTS

High Costs and Limited Reimbursement for Therapeutic Radiopharmaceuticals to Hinder Market Growth

High development costs associated with therapeutic radiopharmaceuticals increase the cost of finished products, thus restraining the adoption and growth of the market. Developing radiation pharmaceuticals includes significant R&D costs that consist of a series of clinical studies and approvals. The complexity of these agents, which often involve specialized manufacturing processes and stringent quality control, adds to the overall expenses.

Additionally, the production of radiopharmaceuticals needs advanced technology and facilities, which can be expensive to maintain. Additionally, the short half-lives of many radiopharmaceuticals necessitate on-site production or rapid distribution, further increasing the costs.

- For instance, according to Novartis AG, the Wholesale Acquisition Cost (WAC) of LUTATHERA is USD 54,800 per dose (200 mCi ±10%) in the U.S. On average, a patient needs four doses of PLUVICTO. Such high costs associated with the product, limits its adoption by the lower economic population.

Additionally, limited reimbursement coverage for innovative treatments also limits the adoption of radiotheranostics, as many health insurance providers have restrictive policies regarding reimbursement for new and innovative treatments, thus restraining access for patients.

MARKET OPPORTUNITIES

New Application Areas for Treatment Contribute to Future Growth Prospects

Key players operating in the market have undertaken numerous research and development initiatives to launch radiation therapeutics for new applications and are poised for significant growth in the market. As research continues to explore the unique properties of radiolabeled compounds, opportunities are expanding into various malignancies, including breast, ovarian, and colorectal cancers, where targeted therapies can enhance treatment efficacy. This helps in the precise localization of tumors, delivering therapeutic radiation directly to cancer cells and minimizing damage to surrounding healthy tissues.

Additionally, an increase in demand for personalized medicine and advancements in molecular imaging techniques are enabling more tailored approaches to patient care, further driving the demand for these products. Major market players are raising their research capabilities to expand their product offerings for different cancer types and thus boost the growth of the market during the forecast period.

- For instance, in July 2024, Ariceum Therapeutics announced the initiation of Phase 1 in-human clinical trial of 123I-ATT001, I-123 labeled PARP inhibitor, in patients with recurrent glioblastoma.

MARKET CHALLENGES

Shortage of Radioisotopes and Stringent Regulatory Guidelines to Challenge Market Growth

The market faces significant challenges that hinder its growth and accessibility. A shortage of essential isotopes, such as actinium-225, limits the availability of radiopharmaceuticals necessary for developing innovative treatments. Additionally, the stringent regulatory landscape governing the approval of new radiopharmaceuticals poses additional hurdles, often leading to delays in market entry, increased development expenses, and reduced availability. Together, these factors create a complex environment that complicates the advancement and accessibility of radiotheranostic options for patients in need.

- In June 2024, a press release published by IBC Advanced Technologies noted that there was a global supply shortage of actinium-225 (Ac-225), which is impacting the supply of this radioisotope in clinical trials.

RADIOTHERANOSTICS MARKET TRENDS

Utilization of Artificial Intelligence and Machine Learning for Radiotheranostics Development

The rising adoption and utilization of AI for drug development and discovery is one of the prominent trends in the market. The utilization of AI and ML in the development of these products is a transformative trend in the healthcare industry. Radiotheranostics, which combines therapeutic and diagnostic capabilities using radiopharmaceuticals, is significantly enhanced by AI and ML technologies that analyze vast datasets to identify patterns, optimize treatment plans, and predict patient responses.

These advanced algorithms facilitate the integration of imaging data with genomic and clinical information, enabling personalized treatment approaches that improve patient outcomes. Additionally, the collaboration between radiopharmaceuticals and AI and ML represents a powerful partnership, combining molecular targeting with the analytical strength of machine learning algorithms. This collaboration enhances the accuracy of radiopharmaceutical treatment, with AI algorithms efficiently navigating through extensive datasets to uncover subtle patterns and anomalies that humans could overlook.

- For instance, in November 2024, GE HealthCare collaborated with DeepHealth to advance AI in medical imaging. The collaboration aims to develop SmartTechnology solutions that improve imaging interpretation and reporting efficiency to elevate patient care through improved clinical and operational workflows.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 had a negative impact on the market. Different issues, such as the risk of COVID-19 transmission, lack of workforce and staff, and the drop in diagnostic procedures, hampered the market expansion in 2020. Furthermore, this decline was mainly attributed to the logistical challenges, disruptions of supply chains, and the adoption of safety precautions, which were difficult to maintain in the centers. Moreover, partial and complete lockdowns in most of the countries restricted the air transportation of radiopharmaceuticals, which were the key bottlenecks for product distribution to the hospitals. Additionally, the sales and revenue of major radiopharmaceuticals of key players dropped in 2020.

However, in 2021 and 2022, the market recorded significant growth owing to the ease of regulations enforced by the governments of various countries. In 2024, the market stabilized and is expected to grow exponentially during the forecast period due to an increase in investments in R&D activities, new product launches, and strategic initiatives of key players.

SEGMENTATION ANALYSIS

By Radioisotope

Strong Sales of Lutetium-177 Products Contribute to the Segment’s Dominance

Based on radioisotope, the global market is categorized into Lutetium-177, Radium-223, Iodine-131, and others.

The lutetium-177 segment held a dominant global radiotheranostics market share by 55.49% in 2026. The growth of the segment is driven by the increasing prevalence of cancer and the rising demand for radiation therapies for cancers. Additionally, these radioisotopes allow targeted therapy by specifically binding to cancer cells, delivering radiation directly to the tumor, and minimizing damage to healthy tissue. Moreover, increasing LU-177 clinical studies and product launches by key players are expected to propel the segment’s growth in the market.

- • For instance, in December 2023, Lantheus Holdings, Inc., in collaboration with POINT Biopharma Global Inc., announced topline results from the pivotal Phase 3 SPLASH study evaluating the efficacy and safety of 177Lu-PNT2002 in patients with metastatic castration-resistant prostate cancer.

The others segment held a substantial share of the market, augmented by the presence of key players with high R&D initiatives and expenditure that propelled the development and launch of new radioisotopes for chronic disease treatment.

Additionally, an increase in the number of clinical studies with different radioisotopes is expected to propel the segment’s growth.

- In November 2023, Clarity Pharmaceuticals completed the first stage of cohort 3 in its Phase I/IIa SECuRE trial for 64Cu/67Cu-SAR-bisPSMA in patients with mCRPC.

The Radium-223 and Iodine-131 segments are expected to grow with moderate CAGR during the forecast period. The rising demand for newer radioisotopes for cancer treatment is decreasing the adoption of these radioisotopes. Thus, these segments are expected to grow at a slower rate.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Rising Prevalence of Prostate Cancer Leading to Increased Demand for New Products Boosts Segmental Dominance

Based on application, the market is divided into neuroendocrine tumors, prostate cancer, and others.

The prostate cancer segment dominated the global market. The dominant share of the segment is augmented by the rising prevalence of prostate cancer globally, increasing the demand for these products for targeted and precise treatment. This segment is anticipated to forecast a CAGR of 54.36% during the forecast period.

- For instance, the Global Cancer Observatory's GLOBOCAN 2022 report indicates that prostate cancer was the fourth most common cancer, with approximately 1.47 million new cases diagnosed in 2022. This increasing number of individuals affected by prostate cancer each year heightens the demand for effective treatment options, consequently driving the global radiotheranostics market growth.

On the other hand, neuroendocrine tumors held a substantial share of the market. The rising prevalence of neuroendocrine tumors and the increasing demand for targeted therapies boost the segment’s growth. The segment is expected to dominate the market share of 28.8% in 2025.

- For instance, in September 2022, according to the Neuroendocrine Cancer UK report on the incidence and prevalence of neuroendocrine cancers in England, the incidence of neuroendocrine cancer rose by 371.0% in England between 1995 and 2018. Such a sharp rise in cases increases the demand for these products and thus propels segmental growth.

The others segment is expected to grow with a significant CAGR during the forecast period. The segment’s growth is augmented by rising research and development activities by key players to introduce radiation therapeutics for various cancer conditions such as breast cancer, lung cancer, and others.

In January 2025, Ariceum Therapeutics cleared its investigational new drug (IND) application from the U.S. FDA to initiate a Phase I/II clinical trial for 225Ac-SSO110, a radiolabeled peptide, in patients with small cell lung cancer (SCLC) or Merkel cell carcinoma (MCC).

By End-User Analysis

Presence of Advanced Facilities and Skilled Professionals Made Hospitals & Clinics Dominant Segment

Based on end-user, the market is sub-segmented into hospitals & clinics, diagnostic centers, and others.

The hospital & clinics segment held a dominant share of the market in 2024. Presence of advanced infrastructure with skilled professionals for the treatment of cancer with radiation therapeutic products, is propelling the demand for radiation therapeutics in these settings and thus boost the segment’s growth in the market. The segment is expected to dominate the market share of 68.51% in 2026.

Additionally, increasing collaboration among the key players and the hospitals to research novel radiopharmaceuticals for different diseases will propel the segment's growth in the market.

- For instance, in February 2021, Telix Pharmaceuticals Limited collaborated with Heidelberg University Hospital in Germany with the aim of developing novel theranostic radiopharmaceuticals for urologic oncology. Such collaborations boost the segment's growth in the market.

The other different segments are cancer research institutes and academic research institutes, which hold a substantial share of the market segment. The growth of these segments is attributed to the rising number of cancer research programs and clinical studies, and funding for the development of advanced radiotheranostics with novel radioisotopes.

- For instance, in October 2024, the Cancer Research UK City of London Radiation Research Centre of Excellence, King’s College London, and UCL were awarded USD 22.9 million to advance their innovative research into cancer radiation therapy, including USD 7.5 million from Cancer Research UK.

Diagnostic centers are expected to grow with a moderate CAGR of 26.19% during the forecast period. However, the increasing number of radiopharmaceuticals for diagnostics purposes is leading to an increase in the number of diagnosed cases, resulting in rising demand for radiation therapeutics.

RADIOTHERANOSTICS MARKET REGIONAL OUTLOOK

Based on the region, the market is studied across Europe, North America, Asia Pacific, and the rest of the world.

North America

North America Radiotheranostics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market in 2025, generating a revenue of USD 2.89 billion. In 2023, the regional market value stood at USD 1.69 billion. The growth of this region is due to the increase in the prevalence of cancer and comparatively higher diagnosis and treatment rates due to advanced diagnostic facilities.

Additionally, the presence of reimbursement policies and high expenditure for cancer care boosts the region’s growth. Furthermore, the presence of key players in the market with strategic initiatives and product launches bolsters the region's growth.

- For instance, in October 2023, Canadian Nuclear Laboratories, in collaboration with ITM Isotope Technologies, launched a company named Actineer with an aim to focus on the production of Actinium-225 (Ac-225).

Moreover, the U.S. dominated the North American region. The country's significant share is due to the presence of key market players, greater regulatory approvals, and the opening of new manufacturing facilities for the production of novel radiopharmaceuticals. The U.S. market is expected to hold USD 3.56 billion in 2026.

- In November 2024, Clarity Pharmaceuticals signed a master services agreement with Nucleus RadioPharma. The agreement allowed Nucleus RadioPharma to manufacture 67Cu-SAR-bisPSMA drug products at their new state-of-the-art facility in Rochester, U.S.

Europe

Europe is anticipated to account for the second-highest market size of USD 1.09 billion in 2026, exhibiting the second-fastest growing CAGR of 27.48% during the forecast period. The increasing prevalence of cancer and the presence of key players with advanced facilities and initiatives propel the region’s growth.

Additionally, the increasing awareness programs and rising regulatory approvals for radiation therapeutic products in the region are driving the market growth.

- For instance, every year, the month of November is globally recognized and celebrated to raise awareness for prostate cancer in males. In November 2024, Europa Uomo members in Hungary and Italy raised awareness of prostate cancer by launching testing programs during the "Movember" Campaign. Such programs are expected to increase the adoption of radiotheranostics for cancer treatment.

Asia Pacific

Asia Pacific region is to be anticipated the third-largest market with USD 0.99 billion in 2026. It is expected to grow with the highest CAGR from 2026 to 2034. The region is growing due to the rising prevalence of cancer. The presence of key companies with advanced strategies, clinical studies, and regulatory approvals to expand their presence in the global market.

- In November 2023, Telix Pharmaceuticals Limited announced that its first patient had been dosed in its Phase III ProstACT GLOBAL study of TLX591 (177Lu-rosopatamab tetraxetan), to evaluate TLX591 in adult patients with PSMA-positive metastatic castrate-resistant prostate cancer (mCRPC).

Rest of the World

The rest of the world is anticipated to be the fourth-largest market with a value of USD 0.28 billion in 2025. This growth is attributed to the increasing emphasis on nuclear medicine and radiopharmaceutical development to conquer the growing number of cancer cases.

- For instance, as per the data provided by Salehiya in 2024, Saudi Arabia has a state-of-the-art research center dedicated to radiopharmaceutical manufacturing and radioisotope research. In addition, the government is developing a new pharmacy strategy to support the goals of Saudi Vision 2030, which include nuclear medicines. Such advancements aimed to propel the growth of the region during 2025-2032.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Bayer AG and Novartis AG Accounted for Highest Market Share Owing to their Diversified and Robust Product Portfolio

Market players, such as Bayer AG and Novartis AG, dominated the global market in 2024, owing to the presence of products such as Xofigo, Lutathera, and Pluvicto in their product portfolios. These players are focused on adopting strategies such as new product developments, mergers and acquisitions, and partnerships to increase their market share. Additionally, Lantheus, Telix Pharmaceuticals Limited, Clarity Pharmaceuticals, RADIOPHARM THERANOSTICS LIMITED, and others are some of the prominent players in the market. These emerging players are increasingly getting engaged in R&D initiatives for the launches of innovative radiation therapeutics.

- For instance, in January 2024, Lantheus announced its strategic agreements with Perspective Therapeutics, Inc. Under these agreements, Lantheus obtains an option to exclusively license Perspective’s Pb212-VMT-⍺-NET, a clinical-stage alpha therapy developed for the treatment of neuroendocrine tumors.

LIST OF KEY RADIOTHERANOSTICS COMPANIES PROFILED

- Bayer AG (Germany)

- Novartis AG (Switzerland)

- Lantheus (U.S.)

- Jubilant Pharmova Limited (India)

- Clarity Pharmaceuticals (Australia)

- Telix Pharmaceuticals Limited (Australia)

- Ariceum Therapeutics (Germany)

- Radiopharm Theranostics Limited (Australia)

KEY INDUSTRY DEVELOPMENTS

- October 2024: Sanofi partnered with Orano Med, a leader in targeted alpha therapies for oncology, to leverage their combined expertise in combating rare cancers and to expedite the advancement of next-generation radioligand therapies.

- June 2024: Lantheus acquired Life Molecular Imaging’s global rights to 177Lu-DOTA-RM2 and 68Ga-DOTA-RM2, a clinical-stage radiotherapeutic and radio diagnostic pair to address unmet medical needs in prostate and breast cancer treatment.

- January 2024: Ariceum Therapeutics announced the submission of an application to the UK's MHRA to initiate a Phase 1 trial of 123I-ATT001 in patients suffering from recurrent glioblastoma.

- July 2023: Telix Pharmaceuticals Limited announced that the first patient had been dosed in a Phase I trial evaluating its investigational targeted radiation therapy, TLX250, in combination with Merck KGaA, peposertib (M3814) in patients with solid tumors.

- December 2022: Novartis AG announced that the European Commission (EC) approved Pluvicto (lutetium (177Lu) vipivotide tetraxetan) in combination with Androgen Deprivation Therapy (ADT) as a targeted radioligand therapy to treat Metastatic Castration-Resistant Prostate Cancer (mCRPC).

REPORT COVERAGE

The global radiotheranostics market research report emphasizes providing an industry overview and examining the market dynamics. The report includes a market analysis of the drivers, restraints, opportunities, challenges, and trends influencing the market. The report also highlights pipeline analysis and key developments within the industry, as well as discusses the launch of new products by major players in the market. Furthermore, the report explores the impact of the COVID-19 pandemic on the industry and provides an overview of the market situation during this period.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 27.90% from 2026-2034 |

|

Segmentation |

By Radioisotope

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 4.75 billion in 2025 and is projected to reach USD 44.26 billion by 2034.

In 2026, the North America market stood at USD 3.74 billion.

The market is expected to exhibit a CAGR of 27.90% during the forecast period (2026-2034).

Based on radioisotopes segment, the Lutetium-177 segment leads the market.

North America dominated the radiotheranostics market with a market share of 60.80% in 2025.

The contributing factors, such as the rising prevalence of cancer robust therapeutic radiopharmaceutical pipelines, drive market growth.

The key trend in this market is the utilization of artificial intelligence and machine learning for radiotheranostics development.

Bayer AG and Novartis AG are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us