Air Conditioner Market Size, Share & Industry Analysis, By Type (Central, Split, Window, Portable, and Others), By Technology (Automatic and Manual), By Application (Residential and Commercial), By Distribution Channel (Online and Offline), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

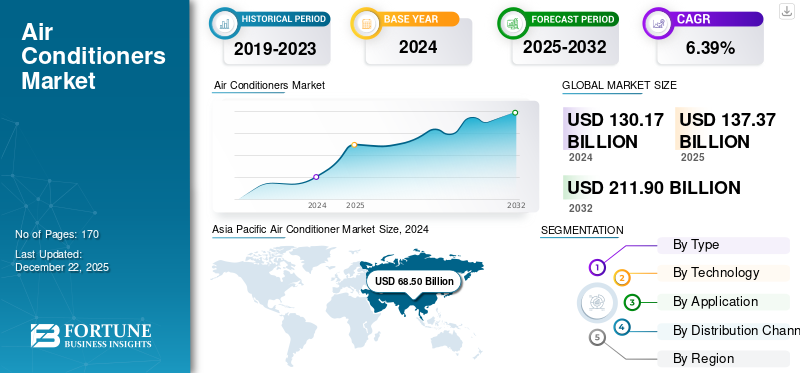

The global air conditioner market size was valued at USD 137.37 billion in 2025 and is projected to grow from USD 145.35 billion in 2026 to USD 245.61 billion by 2034, exhibiting a CAGR of 6.78% over the forecast period. Asia Pacific dominated the air conditioner market with a market share of 52.96% in 2025.

The market is evolving rapidly, shaped by escalating global temperatures and humidity levels, growing urbanization, and a shift toward technological sophistication. Demand is surging in emerging economies, especially across the Asia Pacific, where growing middle classes seek increased comfort in homes and workplaces. Consumers are embracing energy-efficient and smart air conditioning units to address both environmental concerns and utility cost savings. Regulatory pushes for greener appliances have accelerated product upgrades and replacements. In commercial sectors from offices to hospitality, the focus on health, productivity, and energy management further drives new installations and retrofits, ensuring strong market momentum over the coming years.

Key players operating in the market include Daikin Industries, Ltd., Mitsubishi Electric Corporation, Whirlpool Corporation, Carrier Global Corporation, Whirlpool Corporation, Hair Smart Home Co., Ltd., and Robert Bosch GmbH. Manufacturers are innovating with features such as IoT integration, enhanced air filtration, and inverter technologies, making modern systems not just about cooling but also about air quality and sustainability.

Market Dynamics

MARKET DRIVERS

Climate Change, Rising Temperatures, and Heatwaves to Boost Sales of ACs

Global warming and the increased frequency of heatwaves have made reliable cooling systems a necessity in more households and workplaces. In countries with severe or prolonged summers, such as India, China, the Gulf States, and North America, air conditioning systems shift from a luxury to a health and productivity necessity. Extended hot seasons and the urban heat island effect intensify year-round demand for air conditioners, which leads to higher sales in residential as well as commercial segments.

Urbanization and Expanding Middle Class to Drive Market Expansion

Rapid urbanization, especially in the Asia Pacific, Latin America, and parts of Africa, is a powerful driver of air conditioner market growth. As more people migrate from rural to urban areas, demand increases for modern housing, offices, shopping centers, and hotels that consider AC a basic infrastructure need. This is reinforced by expanding middle-class populations, whose rising disposable incomes make advanced cooling products increasingly accessible. The urban population’s aspiration for comfort, better air quality, and connected lifestyles pushes households and businesses to upgrade to energy-efficient and smart AC systems, through both new installations and frequent technology replacements. Moreover, developers and consumers both increasingly prioritize built-in and energy-efficient cooling in new buildings, augmenting product demand.

MARKET RESTRAINTS

High Installation and Maintenance Costs to Hamper Market Growth

High installation and maintenance cost of AC systems, especially in developing economies, significantly restricts market growth. These costs include the initial purchase price, professional installation fees, ongoing servicing, and the expense of spare parts or repairs. For many price-sensitive consumers and small businesses, particularly in emerging markets, these high upfront and recurring costs can be a substantial barrier to adoption. The challenge is further amplified by escalating energy prices, which increase the total cost of ownership over time. Consequently, despite growing demand for comfort and cooling solutions, the high cost factors restrain large-scale penetration of modern AC systems among lower and middle-income segments, slowing overall market expansion.

MARKET OPPORTUNITIES

Rising Demand for Energy-Efficient and Smart ACs to Offer Potential Growth Opportunities

A major growth opportunity in the AC market lies in the increasing consumer and regulatory focus on energy-efficient air conditioning systems. With rising electricity costs and heightened environmental awareness, buyers, especially in rapidly urbanizing regions such as the Asia Pacific, are prioritizing energy-saving inverter technology, IoT-enabled smart ACs, and environmentally friendly refrigerants. Governments are actively promoting energy-efficient appliances through stricter regulations, incentives, and star-rating systems, stimulating market adoption. This push drives manufacturers to innovate and expand product portfolios tailored to eco-conscious consumers seeking cost savings and sustainability. This integration of smart features, such as remote controls and AI-based climate management, also appeals to tech-savvy customers. As a result, this trend not only encourages replacement and upgrade cycles but also opens new growth opportunities in untapped semi-urban and smaller city markets, fueling long-term expansion globally.

AIR CONDITIONER MARKET TRENDS

Growing Demand for Sustainability and Green Building Solutions

Sustainability and green building solutions are considered to be the key trends that are driving the growth of the AC market globally. As sustainability becomes a vital consideration for consumers, specifically in light of rising electricity costs and environmental concerns, there is an increased demand for energy-efficient AC systems. Modern ACs equipped with advanced technology, such as inverter technology, are able to adjust their compressor speed and cooling power based on the room’s temperature, significantly reducing energy consumption. For instance, according to the Ministry of New and Renewable Energy, in 2024, India has recorded 1.28 crore registrations and 1.4 million applications for green building construction, highlighting the scheme's potential to lower the carbon footprint of residential buildings significantly.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Flexibility and Sleek Design Features of Split AC Systems to Fuel Segment Expansion

By type, the market is divided into central, split, window, portable, and others.

The split AC segment is expected to hold the majority of the market share of 53.65% in 2026. Their dominance is supported by the flexibility offered by them to be installed in various configurations, allowing for targeted cooling in specific rooms or zones. This flexibility is beneficial for homes with large or irregular layouts. Besides, the indoor units of split systems have a sleek design that can blend with home decor, in contrast to bulky window units. Many split systems come with advanced filtration options that help reduce allergens and improve indoor air quality, which is essential for health and comfort, further supplementing segmental growth.

The portable AC segment is projected to record the fastest CAGR over the assessment years. These compact cooling devices are designed to cool a single room or small space. Unlike traditional ducted or split systems, these AC systems do not require permanent installation. They are usually mounted on wheels, making them easy to move from one room to another. Moreover, these AC units are useful for short-term cooling. They are a great option for temporary housing, or emergency cooling sources in particularly hot areas, which in turn is likely to drive their growth over the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Technology

Easy Operability and Affordability of Manual AC Units to Drive Segmental Growth

By technology, the market is segmented into automatic and manual.

The manual segment captured the largest air conditioner market share of 73.08% in 2026. Manual units have a longer lifespan compared to advanced units, owing to their simpler technology, particularly when well-maintained. They are less prone to issues related to digital components, making them more reliable over the long term. Besides, the price sensitivity of many consumers, especially in developing economies of the Asia Pacific, makes manual devices a more attractive option. These units provide an affordable cooling solution compared to higher-end inverter or smart AC models, contributing to their growth.

The automatic segment is anticipated to record the fastest CAGR over the forecast period. Primary factors contributing to the growth of the segment include optimized energy usage, sensor-controlled temperature and humidity levels, and advanced filtration systems that improve indoor air quality by removing pollutants and allergens. Besides, some models offer connectivity features, allowing users to control settings via smartphone apps or voice commands. Tech-savvy consumers are willing to spend more for such additional features, augmenting the product demand.

By Application

Rapid Urbanization and Rising Spending Power of Consumers Fueled Residential Segment Growth

Based on application, the market is segmented into residential, institutional, and commercial.

The residential segment accounted for the highest market share of 54.73% in 2026. The residential sector primarily uses AC for comfort, health benefits, and improved indoor air quality. Increasing demand for air conditioning systems is driven by improved health as it filters out allergens, pollutants, and airborne pathogens. Rapid urbanization results in more densely populated areas where heat retention is common. New housing projects cater to this growing population, necessitating effective cooling systems to maintain livable indoor conditions. Thus, increased housing density amplifies the need for efficient AC systems to combat urban heat islands, driving segmental growth. Moreover, the growing purchasing power of consumers leads to higher product sales.

The commercial segment is expected to grow at the fastest rate over the assessment years. The businesses and workplaces extensively utilize air conditioning systems for a variety of reasons, including team member comfort, operational efficiency, and increased productivity. Moreover, many businesses rely on electronic equipment that generates heat, where high temperatures can lead to equipment malfunction or damage. Therefore, AC systems help regulate both temperature and humidity, protecting valuable assets and extending their lifespan. In retail environments, a comfortable atmosphere encourages customers to spend more time in stores, directly impacting sales. Businesses recognize that investing in effective cooling solutions can lead to improved customer satisfaction, which is likely to boost product demand in commercial settings.

By Distribution Channel

Traditional Shopping Experience and Extensive Offline Distribution Networks Boosted Growth of Segment

Based on the distribution channel, the market is segmented into online and offline.

The offline segment accounted for the largest share of the market share of 71.64% in 2026. Many consumers prefer to see and experience AC units in person before making a purchase. Offline retailers allow consumers to inspect the product's quality, design, and features, which is particularly important for high-value items such as AC. Furthermore, in many Asian countries, shopping in physical stores remains a culturally ingrained practice. Consumers may prefer the traditional shopping experience over online purchases, particularly for significant investments such as AC systems. Also, many established brands have extensive offline distribution networks that include showrooms and authorized dealers to reach a broader customer base, which reinforces segmental growth.

The online segment is projected to expand at the fastest CAGR over the forecast period (2025-2032). Online platforms often feature a wider selection of brands and models compared to physical stores. This variety allows consumers to compare different products easily and choose according to their preferences and budgets. Additionally, online channels offer the convenience of shopping at any time, allowing consumers to explore options and make purchases without the constraints of store hours. Also, many e-commerce platforms provide home delivery services, eliminating the need for consumers to transport bulky items such as ACs themselves.

AIR CONDITIONER MARKET REGIONAL OUTLOOK

By region, the market is divided into North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

North America

The market in North America stood in second position in the global market. Increasing average temperatures and more frequent heatwaves due to climate change significantly elevate the necessity for air conditioning. As hotter weather becomes more common even in traditionally milder regions, residents and businesses increasingly rely on cooling systems for comfort and health.

The U.S. contributed to the major share of the North American market. The growth of urban centers and rising population density across all the U.S. states creates a higher demand for cooling solutions in residential, commercial, and industrial buildings. Urban growth leads to more high-rise buildings and dense housing complexes where AC is essential for livable indoor environments. The U.S. market is projected to reach USD 36.61 billion by 2026.

Europe

Europe generated significant revenue in the AC market and is projected to grow steadily over the forecast years. Strict European Union regulations such as the Ecodesign Directive and Energy Labelling Regulation promote energy-efficient, inverter-based air conditioning systems that reduce power consumption by up to 40%. Governments offer incentives and subsidies for eco-friendly and solar-powered AC systems, aligning with Europe’s sustainability goals. These policies push manufacturers in the region toward innovation in green technologies and encourage consumers to select energy-efficient models, leading to market growth in the European region. The UK market is projected to reach USD 2.45 billion by 2026, while the Germany market is projected to reach USD 3.64 billion by 2026.

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 72.75 billion in 2025 and USD 77.45 billion in 2026. The Asia Pacific accounted for the largest market share globally and is expected to record the fastest CAGR during the forecast period of 2025-2032. The growth of the region is likely to be driven by its increasing indoor air quality awareness, growth in residential and commercial construction, rising disposable income and lifestyle changes, expanding urbanization, and population growth. Increasing spending power of consumers, particularly among the middle-class segments, fuels adoption as air conditioning shifts from luxury to a necessity. Moreover, innovations in smart cooling solutions with IoT integration, remote controls, energy-saving inverter technology, and higher Seasonal Energy Efficiency Ratio (SEER) ratings attract consumers focused on reducing energy consumption and utility costs. Furthermore, growing emphasis on reducing carbon emissions and adopting eco-friendly products encourages manufacturers to choose greener air conditioning options. Government programs and rebates support this trend. The Japan market is projected to reach USD 9.51 billion by 2026, the China market is projected to reach USD 50.47 billion by 2026, and the India market is projected to reach USD 5.21 billion by 2026.

Asia Pacific Air Conditioner Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

South America and the Middle East & Africa

South America and the Middle East & Africa region are projected to witness stable growth in the coming years. Hot and humid climates in many parts of South America create a strong need for AC, especially in urban areas where heat islands exacerbate temperature. Furthermore, policies such as Brazil’s National Energy Efficiency Plan encourage the use of energy-efficient and eco-friendly refrigerants, promoting the adoption of inverter and smart cooling devices that reduce carbon emissions. Moreover, growth in retail, hospitality, manufacturing, and data centers demands large-scale, precise cooling devices such as VRF and centralized HAVC systems, further strengthening market growth.

Competitive Landscape

KEY INDUSTRY PLAYERS

Strong Focus on Product Innovation and Strengthening Distribution Network to Increase Market Share

The global AC market is highly competitive, with major global players including Daikin, LG, Samsung, Panasonic, Haier, Gree, Midea, and other regional giants striving for market share. These players implement aggressive innovation and localization. Companies are intensifying their focus on energy efficiency, green technologies, and smart features such as IoT-enabled controls to meet stricter regulations and evolving consumer demands. Strategic moves include heavy R&D investment in eco-friendly refrigerants, AI-driven climate management, and variable refrigerant flow (VRF) systems that target both residential and commercial users. Brands are also expanding manufacturing capacity, especially in high-growth regions such as the Asia Pacific, while deepening distribution networks into Tier 2 and 3 cities and promoting digital and e-commerce channels. In addition, players are customizing products to local needs and fortifying after-sales service with robust marketing campaigns to build brand equity and drive loyalty in a price-sensitive, environmentally conscious market.

LIST OF KEY AIR CONDITIONER COMPANIES PROFILED

- Daikin Industries, Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- Carrier Global Corporation (U.S.)

- Whirlpool Corporation (U.S.)

- Hair Smart Home Co., Ltd. (China)

- Panasonic Corporation (Japan)

- Robert Bosch GmbH (Germany)

- Samsung Electronics Co., Ltd (South Korea)

- Midea Group Co., Ltd (China)

- Voltas Limited (India)

Key Industry Developments

- March 2025: Sharp Corporation, a Japanese conglomerate, announced its re-entry into the Indian AC market through its wholly-owned subsidiary Sharp Business Systems. The company launched Reiryou, Seiryo & Plasma Chill Series, which are engineered to handle India’s extreme weather conditions.

- April 2024: Mitsubishi Heavy Industries Thermal Systems, Ltd (MHI Thermal Systems), a part of Mitsubishi Heavy Industries (MHI) Group, commenced mass production of its KXZ3 series of commercial multi-split ACs for its global markets. This recently added lineup adopts the R32 refrigerant, available in three: 22.4, 28.0, and 33.5kW. The series was launched in the European market, followed by launches in Australia, New Zealand, and Turkey.

- March 2024: Blue Star Ltd (India) unveiled a new inclusive range of room air conditioners, including a “best-in-class affordable’ and a “flagship premium range” for the summer season. Overall, the launch includes 100 models across the spectrum, including inverter, fixed speed, and window ACs across different price points to cater to the needs of all consumer segments.

- March 2023: LG Electronics, an India-based consumer durable & air conditioner company, announced the launch of its new 2023 range of DUALCOOL Inverter air conditioners under its AI+, health and hygiene portfolio. These newly launched range of ACs feature Plasmaster Inoizer++, AI +, Hot & cold, and LG ThinQ (Wi-Fi ACs) that can be operated with voice command, making them touch-free.

- February 2023: Godrej Appliances, the flagship company of the Godrej Group, business unit of Godrej & Boyce, launched India’s first leak-proof split AC with the Anti-Leak technology and has also filed a patent for it.

- September 2023: Johnson Controls-Hitachi Air Conditioning launched the Hitachi air365 Hybrid dual fuel system. This new system combines a heat pump and furnace to provide economical, efficient home comfort while reducing carbon emissions.

REPORT COVERAGE

The air conditioner market report provides a detailed analysis of the market and focuses on key aspects, such as competitive landscape, services, and leading product types. Besides this, it offers market insights and highlights key industry developments. In addition to the aforementioned factors, the air conditioner market analysis encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.78% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Central · Split · Window · Portable · Others |

|

By Technology · Automatic · Manual |

|

|

By Application · Residential · Institutional · Commercial |

|

|

By Distribution Channel · Online · Offline |

|

|

By Region · North America (By Type, Technology, Application, Distribution Channel, and Country) § U.S. (By Type) § Canada (By Type) § Mexico (By Type) · Europe (By Type, Technology, Application, Distribution Channel, and Country) § U.K. (By Type) § Germany (By Type) § France (By Type) § Italy (By Type) § Spain (By Type) § Rest of Europe (By Type) · Asia Pacific (By Type, Technology, Application, Distribution Channel, and Country) § China (By Type) § India (By Type) § Japan (By Type) § Australia (By Type) § Rest of Asia Pacific (By Type) · South America (By Type, Technology, Application, Distribution Channel, and Country) § Brazil (By Type) § Argentina (By Type) § Rest of South America (By Type) · Middle East and Africa (By Type, Technology, Application, Distribution Channel, and Country) § South Africa (By Type) § UAE (By Type) · Rest of the Middle East & Africa (By Type) |

Frequently Asked Questions

According to Fortune Business Insights, the global market size is USD 145.35 billion in 2026 and is projected to reach USD 245.61 billion by 2034.

In 2025, the global market value stood at USD 137.37 billion.

Recording a CAGR of 6.78% the market will exhibit a steady growth rate during the forecast period (2026-2034).

By type, the central air conditioner segment dominates the market.

Rapid urbanization and growing middle-class segments, coupled with the rising spending power of consumers, are the factors driving the market’s growth.

Daikin Industries, Ltd., Mitsubishi Electric Corporation, Whirlpool Corporation, Carrier Global Corporation, Whirlpool Corporation, Hair Smart Home Co., Ltd., and Robert Bosch GmbH are a few significant players in the global market.

Asia Pacific held the highest market share in 2026.

Rising demand for air conditioning systems due to the growing need for energy-efficient cooling solutions and escalating global warming conditions is likely to encourage the adoption of the product.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us