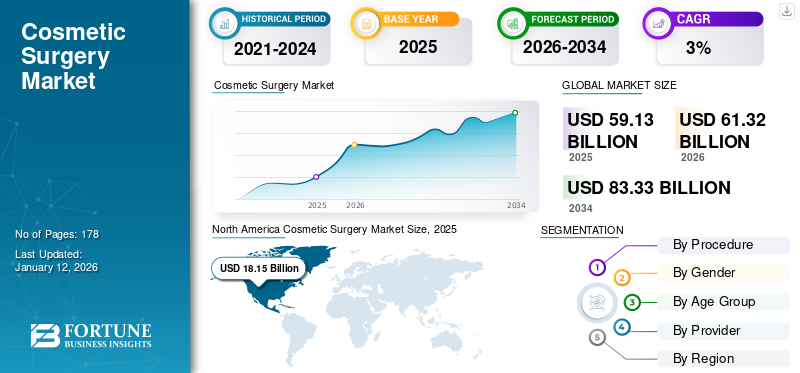

Cosmetic Surgery Market Size, Share & Industry Analysis, By Procedure (Surgical Procedures and Non-Surgical Procedures), By Gender (Female and Male), By Age Group (18 Years and Younger, 19 to 34 Years, 35 to 50 Years, 51 to 64 Years, and 65 Years & Above), By Provider (Hospitals & Specialty Clinics and Spas & Cosmetic Surgery Centers), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global cosmetic surgery market size was valued at USD 59.13 billion in 2025. The market is projected to grow from USD 61.32 billion in 2026 to USD 83.33 billion by 2034, exhibiting a CAGR of 3.50% during the forecast period. North America dominated the cosmetic surgery market with a market share of 30.70% in 2025.

The cosmetic surgery market has grown significantly due to rising disposable incomes, societal pressure for enhanced physical appearance, and advancements in medical technology. This market encompasses a broad range of aesthetic procedures, both surgical and non-surgical, aimed at improving or altering physical features. The market includes both invasive surgeries (such as liposuction and facelifts) and non-invasive treatments (such as botox and dermal fillers). This rapid expansion is also fueled by the increasing acceptance of cosmetic procedures across different demographics, especially with greater emphasis on appearance due to social media and the global beauty standard.

Additionally, the availability of innovative technologies and devices for treating skin conditions along with improving reimbursement policies for cosmetic procedures will increase the number of patients undergoing these surgeries. Furthermore, several people are preferring easy, pain-free methods for appearing youthful and healthy without complications. This factor is increasing the demand for non-surgical procedures.

Key players in the market are focusing on new product developments and receiving approvals to strengthen their market position. For example, in July 2022, the FDA approved AviClear, a non-invasive acne treatment, marking a major advancement in the cosmetic dermatology space. This approval highlights how innovation continues to shape the market, expanding the range of treatment options available to consumers.

Furthermore, growing demand for medical tourism, where people travel from other countries for various cosmetic procedures, and the emergence of new cosmetic clinics are expected to fuel the cosmetic surgery market during the forecast period. Brazil, Argentina, Costa Rica, Malaysia, Poland, the Philippines, Mexico, and Thailand are some of the popular destinations for these surgery tourism.

Bausch Health Companies Inc., Johnson & Johnson Services, Inc. (MENTOR), and AbbVie Inc. are some of the key players in the cosmetic surgery market through their extensive product lines and focus on innovation. Additionally, other key players such as Cutera, GALDERMA, and Merz Pharma are expanding their market presence through new product launches and strategic initiatives.

Global Cosmetic Surgery Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 59.13 billion

- 2026 Market Size: USD 61.32 billion

- 2034 Forecast Market Size: USD 83.33 billion

- CAGR: 3.50% from 2026–2034

Market Share:

- Region: Europe dominated the market with a 22.40% share in 2025. This leadership is driven by the high demand for surgical procedures such as breast augmentation, rhinoplasty, and eyelid surgery, and a growing preference for non-surgical procedures among the patient population.

- By Procedure: Surgical procedures held the largest market share in 2025. The segment's growth is fueled by the long-term results offered by procedures such as breast augmentation, liposuction, and rhinoplasty, which is driving key industry players to invest in research and development for advanced products.

Key Country Highlights:

- Japan: As a key country in the Asia Pacific market, Japan ranks third globally in the number of cosmetic procedures performed, driven by high demand for non-surgical options like hair removal and non-surgical fat reduction.

- United States: The market is propelled by a high number of procedures, with an average surgeon fee of approximately USD 4,617 for breast augmentation. The market is also characterized by a strong focus on innovation, with recent FDA approvals for novel non-invasive treatments.

- China: As part of the fastest-growing Asia Pacific region, the market is driven by increasing disposable incomes and a rising emphasis on physical appearance, which fuels the demand for both surgical and non-surgical cosmetic procedures.

- Europe: The market is advanced by a high volume of cosmetic procedures, particularly in countries like the U.K. and Germany. For example, in the U.K., there were a significant number of breast augmentation and implant removal procedures conducted, reflecting strong consumer demand.

Market Dynamics

MARKET DRIVERS

Increasing Demand for Cosmetic Procedures is Fueling Market Growth

The increasing prevalence of various skin disorders, resulting in an increasing patient pool, is driving the demand for cosmetic surgery. The high demand for cosmetic procedures has gradually changed as aesthetics has become an important aspect of daily life. The rise in population focusing on aesthetic features has generated promising prospects for the cosmetic procedure market. Additionally, the increasing inclination of women toward cosmetic procedures, including breast augmentation, liposuction, eyelid surgeries, and abdominoplasty, among others, is further increasing the demand for these procedures. Moreover, increasing societal pressure to maintain a healthy appearance, particularly among adults, along with their preference for easy, minimally-invasive, and less painful, among others, are a few of the additional factors aiding the increasing treatment procedures.

- For instance, according to the International Society of Aesthetic Plastic Surgery, it was reported that approximately 2.5 million people underwent botulinum toxin procedures in 2022.

These factors along with an increase in research & development investments and new product launches by key players, are further driving the cosmetic surgery market growth.

MARKET RESTRAINTS

High Cost Associated with Cosmetic Surgical Procedures to Limit Growth of the Market

The rising demand for cosmetic procedures globally has prompted major industry players to intensify their research and development efforts to introduce innovative products into the market. However, the increasing complexity and technological advancements of these products often lead to higher costs, making these procedures less affordable for many patients and service providers.

- For example, according to the Aesthetic Society 2022 report, the average surgeon fee for breast augmentation in the U.S. is approximately USD 4,617 per session, while abdominoplasty costs around USD 7,465. Additionally, the growing use of advanced devices for non-surgical cosmetic treatments is further driving up procedure costs for patients.

Side effects from facial fillers such as redness, skin pigmentation, bruising, crooked smiles, and inflammatory reactions also hinder market growth by deterring potential patient populations.

MARKET OPPORTUNITIES

Increase in the Investments and Collaborations to Offer Lucrative Opportunities for Market Players

The increasing investments in research and development by key players in the market are aimed at manufacturing technologically advanced devices that enhance efficiency and accessibility. This focus has led to a surge in product launches designed to address the unmet needs for effective solutions. Additionally, major companies are concentrating on expanding their medical aesthetics divisions to meet the rising demand for various surgical and non-surgical aesthetic procedures, including breast enhancement, skin resurfacing, and body contouring.

- For example, in June 2022, Bausch Health Companies Inc. launched a new segment called Solta Medical, specifically dedicated to medical aesthetics. This strategic move bolstered the company’s presence in the medical aesthetics sector, offering new opportunities in the market.

MARKET CHALLENGES

Regulatory Constraints and Safety Concerns are Potential Challenging Factors of the Market

Despite advancements in surgical techniques, safety risks remain a concern. There have been numerous incidents of botched surgeries and complications resulting from poorly conducted procedures. Ethical issues related to body image and societal beauty standards further challenge market development. Additionally, stringent regulations and regional specific regulations can pose a threat to entry for new products, technologies, and procedures. For instance, regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) play crucial roles in ensuring that products meet established safety standards. However, the approval process can be lengthy and costly, often requiring extensive clinical testing to demonstrate both safety and efficacy before a product can be marketed. For example, the US FDA approval timeline for cosmetic treatments can extend over several years due to the rigorous requirements involved.

COSMETIC SURGERY MARKET TRENDS

Increasing Demand for Cosmetic Procedures among Male Population to Propel Market Growth

In recent years, there has been an increasing trend of male cosmetic surgery. Procedures such as liposuction, rhinoplasty, and hair transplants are becoming popular among men. This growth is driven by age-related concerns as men are adopting these solutions to maintain their youthful look. Moreover, the increasing demand for non-surgical procedures, such as dermal fillers and botulinum toxin, among the male population is raising the number of treatments performed and contributing to market growth.

- According to the International Society of Aesthetic Plastic Surgery (ISAPS), in 2022, globally, around 2 million cosmetic surgeries were performed on men.

Additionally, non-invasive cosmetic treatments have observed significant growth due to their affordability, reduced recovery time, and lower complication rates. Procedures such as botox, dermal fillers, and laser treatments have become more popular than traditional surgeries. These factors result in a higher demand for cosmetic procedures among the male population.

Download Free sample to learn more about this report.

Impact of COVID-19 on Market

The COVID-19 pandemic led to a significant decline in demand for various cosmetic procedures globally, primarily due to the suspension of elective procedures in 2020. Due to the slowdown of elective surgical procedures in 2020, the total number of cosmetic surgeries performed decreased compared to the previous year.

- In 2020, the total number of plastic surgery procedures worldwide decreased by 1.8%, with surgical procedures experiencing an even steeper decline of 10.9% compared to 2019 levels as healthcare systems prioritized urgent care and limited elective services.

This factor adversely affected sales of related products as many key industry players reported lower sales figures. However, with the easing of lockdown restrictions, there has been a marked increase in interest in home care-based procedures. Additionally, the focus on introducing advanced products to cater to changing consumer preferences is expected to drive market growth in the near future.

SEGMENTATION ANALYSIS

By Procedure

Increasing Number of Breast Augmentation Procedures Boosted Surgical Procedures Segment Growth

Based on procedure, the market is divided into surgical procedures and non-surgical procedures.

The surgical procedure segment is further classified into breast augmentation, liposuction, eyelid surgery, abdominoplasty, rhinoplasty, and others. The non-surgical procedure segment is further sub-divided into botulinum toxin, hyaluronic acid, hair removal, non-surgical fat reduction, photo rejuvenation, and others.

The surgical procedures segment dominated the market share by 79.01% in 2025. The increase in demand for surgical procedures, such as breast augmentation, rhinoplasty, liposuction, and others, is due to the long-term results they offer. This increasing demand results in key industry players to focus on research and development activities to introduce advanced products in the market, fueling the growth of the segment.

- According to the data published by the Aesthetic Society in 2022, around 1.9 million surgical procedures were performed in 2022 compared to 2021. Amongst 1.9 million procedures, 0.4 million liposuction procedures were performed. Such a higher number of surgical procedures is boosting segment growth.

The non-surgical procedure segment is expected to register the highest compound annual growth rate (CAGR) during the forecast period. The growing popularity of non-surgical procedures, such as dermal fillers, botulinum toxin, hyaluronic acid, and others across the world, may fuel the segment’s growth during the forecast period. These procedures are favored for safer, less painful, and easy recovery, further boosting demand. Additionally, an increasing number of product launches are expected to fuel segment growth.

- For instance, in January 2023, GALDERMA launched FACE, a solution that stimulates the results of injectable treatments by providing advanced wrinkles detection among the patient population.

To know how our report can help streamline your business, Speak to Analyst

By Gender

Growing Emphasis on Aesthetic Appearance Augmented the Demand for Cosmetic Treatments among Females

On the basis of gender, the market is segmented into female and male.

The female segment captured the largest cosmetic surgery market share in 2025. The segmental dominance is due to the large number of females undergoing cosmetic procedures for various applications such as breast augmentation and breast reduction. Increasing availability of technologically advanced products and growing acceptance of aesthetic procedures among females are expected to further fuel segment growth during the forecast period. The segment is expected to hold 85.53% of the market share in 2026.

- According to the data published by the International Society of Aesthetic Plastic Surgery (ISAPS) 2022, it was reported that around 20,991 breast augmentation and 4,193 breast implant removal procedures were conducted in the U.K.

The male segment is expected to grow at a moderate CAGR of 2.9% during the forecast period. The increasing adoption of cosmetic surgery by men to improve their aesthetic appearance to have a youthful look is boosting segment growth. The rising number of males undergoing procedures, such as gynecomastia and eyelid surgery, among others, across the world, will fuel the segment’s expansion during 2025-2032.

- According to the data published by the International Society of Aesthetic Plastic Surgery (ISAPS) 2021, the number of Gynecomastia procedures performed in Germany increased from 11,118 in 2021 to 11,798 in 2022. This growth in gynecomastia and other procedures among men is expected to fuel segment growth.

By Age Group

Demand for Cosmetic Treatments to Rise among 35-50 Years Age Group

Based on age group, the market is segmented into 18 years and younger, 19 to 34 years, 35 to 50 years, 51 to 64 years, and 65 years & above.

The 35 to 50 years’ segment is poised to hold 40.3% share of the market in 2025 and is expected to witness significant growth during the forecast period. This is due to a major surge in the adoption of non-surgical procedures such as botulinum toxin among people in this age group. Furthermore, the growing awareness regarding anti-aging and body contouring treatments among women in this age group will further fuel segment growth.

- For instance, according to a 2023 article published by San Antonio Cosmetic Surgery, approximately 48% of the population injectable neurotoxins within this age group.

The 19 to 34 years’ segment held the second-largest share of the market in 2022. The segment is expected to exhibit a CAGR of 4.1% during forecast period. This is attributed to the growing demand for cosmetic treatments among this age group such as breast augmentation and rhinoplasty. Moreover, the growing focus of key players on launching and receiving approvals from regulatory bodies for products to enhance beauty is expected to fuel segmental growth.

- For instance, in February 2023, GALDERMA launched Alastin Skincare Resurface Skin Polish, a product with dual action exfoliators with an aim to increase its product offerings.

By Provider

Hospitals & Specialty Clinics Segment Dominated Due to Higher Outpatient Admission

Based on provider, the market is classified into hospitals & specialty clinics and spas & cosmetic surgery centers.

The hospitals & specialty clinics segment captured the largest market share in 2024. The segment is expected to acquire 30.71% of the market share in 2026. The increasing number of inpatient and outpatient admissions in hospitals and specialty clinics, along with the growing demand for minimally invasive procedures, are the factors expected to drive segment growth significantly.

- According to the data published by the International Society of Aesthetic Plastic Surgery in 2022, approximately 47.4% of cosmetic procedures are carried out in hospitals and 31.1% in specialty clinics worldwide.

The spas & cosmetic surgery centers segment is expected to grow with a CAGR of 3.2% positively in the upcoming years due to the robust growth of medical tourism and the emergence of new medical spas & cosmetic surgery centers.

- According to the article published by the American MedSpa Association, there were 8,841 medical spas in 2022 compared to 7,430 in 2021. This increasing number of spas and a gradual increase in the number of procedures performed in cosmetic centers can further grow the segment in the near future.

Cosmetic Surgery Market Regional Outlook

On the basis of region, the global market has been classified into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Cosmetic Surgery Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for a market value of USD 18.83 billion in 2026, and in 2025, the market value stood at USD 18.15 billion. The dominance of this region can be attributed to the increasing adoption of surgical and non-surgical cosmetic procedures among patients in North America Additionally, increasing demand for minimally invasive and safer procedures and the adoption of the latest advanced aesthetic devices in the market is further encouraging key players to launch innovative products in the region.

- For instance, in June 2023, Cynosure launched the CynoGlow revitalizing treatment plan, combining PicoSure Pro and Potenza for skin revitalization, with an aim to increase its product offerings.

The U.S. dominated the market in North America in 2024. The U.S. market size is expected to be USD 17.47 billion in 2026. The increasing disposable income per capita along with growing beauty related concerns among the patient population is driving more people to undergo various surgical and non-surgical cosmetic procedures. This, along with increasing investments among the major players to provide comprehensive treatment solutions among the patient population is expected to fuel the growth of the market in this country.

Europe

Europe held the second position in the global market, with the growing demand for surgical procedures such as breast augmentation, rhinoplasty, and eyelid surgery. The region is anticipated to account for the second-highest market size of USD 13.24 billion in 2025, exhibiting the second-fastest growing CAGR of 4.1% during the forecast period. According to the data published by the International Society of Aesthetic Plastic Surgery (ISAPS) 2022, the total cosmetic procedures performed in the U.K. increased from 621,600 in 2020 to 208,296 in 2021. Additionally, the growing preference toward non-surgical procedures in the U.K., Germany, and France among the patient population is contributing to the growth of the market. The market value in U.K. is expected to be USD 0.90 billion in 2026.

On the other hand, Germany is projecting to hit USD 3.19 billion in 2026, and France is likely to hold USD 1.64 billion in 2025

Asia Pacific

The growth of the market in this region is attributed to the growing demand for non-surgical cosmetic procedures such as hair removal and non-surgical fat reduction procedures. Asia Pacific is expected to hit USD 8.70 billion in 2026, as the fourth-largest market. For instance, according to 2022 data published by ISAPS, Japan captured the third position in the number of cosmetic procedures performed across the world. The market in China is expected to hit USD 1.70 billion in 2026, whereas India is likely to reach USD 1.49 billion and Japan is projected to hit USD 2.28 billion in 2026.

Latin America

Latin America is expected to be the third-largest market with a value of USD 12.94 billion in 2025 and to register the highest CAGR during the forecast period. The growing demand for medical tourism, the acceptance of innovative techniques in various aesthetic clinics, and providing patients with cosmetic procedures at an affordable price are major factors fueling market growth in this region.

- For example, in June 2022, the Silicone Center clinic in Brazil announced that it is offering variant sizes of silicon prosthesis implants at affordable pricing for breast augmentation procedures to meet customers’ demands.

- Additionally, according to the data published by the International Society of Aesthetic Plastic Surgery (ISAPS) in 2022, around 2.0 million surgical cosmetic procedures were performed in Brazil, and 0.9 million were performed in Mexico. Such a higher number of procedures drives market growth in the region.

Middle East & Africa

The growth in the region can be attributed to the preferential shift toward non-surgical procedures such as Botox and chemical peel, among others, along with the increasing focus of manufacturers on providing advanced products, which is expected to support the growth of the market in this country.

- According to the data published by the International Society of Aesthetic Plastic Surgery (ISAPS) in 2022, the total number of non-surgical procedures performed was around 0.6 million in 2021 in Turkey.

List of Key Companies in Cosmetic Surgery Market

Key Players to Introduce New Products to Strengthen their Market Position

Bausch Health Companies Inc., Johnson & Johnson Services, Inc. (MENTOR), and AbbVie Inc. are dominating players in the cosmetic surgery industry due to the presence of a wide product portfolio and their focus on the introduction of new advanced products in the market.

- In January 2022, Mentor Worldwide LLC, a Johnson and Johnson Services Inc., launched a new MENTOR MemoryGel BOOST Breast Implant, expanding its market presence.

Other companies, such as Cutera, GALDERMA, Merz Pharma, and Cynosure, have a prominent presence in the global market. Their growth is driven by regulatory approvals, new product launches, and strategic initiatives to strengthen market presence. Additionally, strategic executions, including acquisitions and collaborations among major players, are expected to propel the growth of these companies.

- In June 2023, Cutera received approval for AviClear as a long-term treatment for mild to severe acne among the patients.

- Similarly, in April 2023, Allergan Aesthetics partnered with the American Society of Plastic Surgeons (ASPS), The Aesthetic Society, and the American Hernia Society (AHS) with an aim to increase its brand presence globally.

LIST OF KEY COMPANIES PROFILED

- Bausch Health Companies Inc. (Canada)

- Johnson & Johnson Services, Inc. (MENTOR) (U.S.)

- AbbVie Inc. (U.S.)

- Cutera (U.S.)

- Merz Pharma (Germany)

- GALDERMA (Switzerland)

- Sientra, Inc. (U.S.)

- Cynosure (U.S.)

- Apyx Medical (U.S.)

- Evolus, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2023 – GALDERMA received FDA approval for Restylane Eyelight for under eyes with the aim of increasing its brand presence in the market.

- August 2023 – TELA Bio, Inc. launched the OviTex PRS Long-Term Resorbable product in the U.S. market. This product can be used for plastic and reconstructive surgeries.

- March 2023 – Establishment Labs Holdings Inc. announced that it entered into agreements with four partners in Europe and a second chain of partners in Japan to launch Mia Femtech, which is used to increase breast shape in a 15-minute procedure.

- July 2022 – BIOPLUS CO., LTD. announced that its two types of hyaluronic acid fillers received a special import license from China. The products included DeneB and Skin Plus HYAL Implant.

- July 2022 – LightStim launched Elipsa, the first device to offer dual treatment options for treating acne and wrinkles using LED-based technology. Users can use this device at home.

- June 2022 – Cynosure launched the PicoSure Pro Device, which has an advanced lens focus array made of platinum, which would reduce wrinkles, acne scars, and pores by increasing the content of collagen and elastin.

- May 2022 – Apyx Medical announced that it had received the 510(k) clearance from the U.S. FDA for using its Renuvion Dermal Handpiece for specific dermal resurfacing procedures.

- February 2021 – GALDERMA received the U.S. FDA approval for Restylane Defyne for the augmentation and correction of mild to moderate chin retrusion.

- February 2021 – Merz Pharma announced the launch of BELOTERO BALANCE + Lidocaine in the U.S. The BELOTERO BALANCE is a Hyaluronic Acid (HA) filler for etched-in lines & the advantages of lidocaine formulation claim to provide a perfect finish to filler patients.

REPORT COVERAGE

The research report provides a detailed global cosmetic surgery market revenue analysis. In addition to revenue analysis, it focuses on key aspects such as leading companies, procedures, key gender types, and providers. Besides this, it offers insights into the latest market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market’s growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.50% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Procedure

|

|

By Gender

|

|

|

By Age Group

|

|

|

By Provider

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 59.13 billion in 2025 and is projected to reach USD 83.33 billion by 2034.

The market will exhibit a CAGR of 3.8% during the forecast period of 2026-2034.

The surgical procedures segment is expected to be the leading segment in the market during the forecast period.

The growing prevalence of dermatology conditions among individuals, coupled with increasing demand for cosmetic procedure is a key factor driving market growth.

Bausch Health Companies Inc., AbbVie Inc., and Johnson & Johnson Services, Inc. (MENTOR) are the top players in the market.

North America is expected to hold the largest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us