Medical Clothing Market Size, Share & Industry Analysis, By Product (Surgical Drapes, Scrubs & Gowns, Gloves, Facial Protection, Sterilization Wraps, Protective Apparel, and Others), By Usage (Disposable, and Reusable), By Type (For Patient, and For Healthcare Professional), By End-user (Hospitals, Outpatient Facilities, Physicians’ Offices, and Others), By Sales Channels (Business to Customer {Online and Retail Stores}, and Business to Business), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

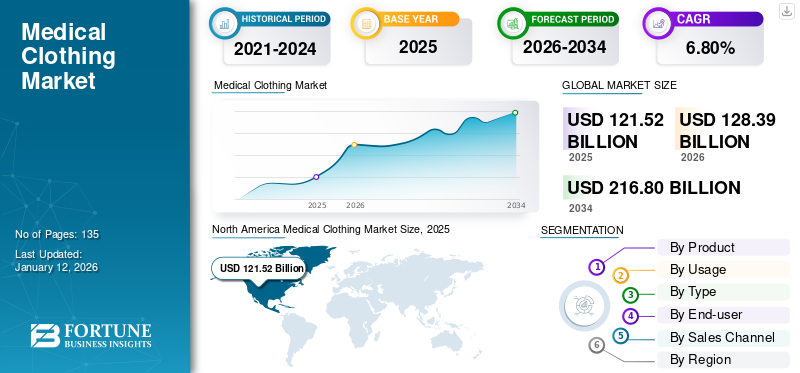

The global medical clothing market size was valued at USD 121.52 billion in 2025. The market is projected to grow from USD 128.39 billion in 2026 to USD 216.8 billion by 2034, exhibiting a CAGR of 6.80% during the forecast period. North america dominated the medical clothing market with a market share of 39.84% in 2025.

Medical clothing is an integral component for infection control in the healthcare industry. This clothing protects medical professionals from contaminants, infectious materials, and bodily fluids during routine surgical procedures and patient diagnostic interventions. Several medical and health hazards are a part of the work of medical professionals such as nurses, doctors, medical staff, and more. Medical apparel creates a barrier between the potentially infectious material and the healthcare workers, avoiding any damage or adverse effects on their health. The types of protective clothing used in the hospital and medical facilities include surgical gowns, scrubs, drapes, protective facemasks, aprons, boots, coveralls, eye gear, and caps.

Furthermore, factors such as stringent infection control regulations, advancements in fabric technology, and rising focus on healthcare worker safety have led to the demand for healthcare apparel across healthcare settings. Moreover, the growing number of healthcare professionals, the increasing number of inpatients and surgical volumes, and the rising number of market players are the key factors anticipated to propel the growth of the market.

- For instance, according to data published by the Australian Institute of Health and Welfare in 2022, about 735,500 patients were admitted for surgery from public hospital elective surgery waiting lists, an increase of 18.0% compared to 2021–22 in Australia.

Key players in the market include O&M Halyard Inc., ANSELL LTD, Medline Industries, Cardinal Health, and 3M. These players focus on expanding their geographic presence and product portfolio to capture a significant market share.

Market Dynamics

Market Drivers

Growing Number of Surgeries to Boost Usage of Surgical Medical Clothing, Propelling the Market Growth

The increase in the geriatric population has led to a rise in the prevalence of age-related disorders, including cataracts, glaucoma, cardiac arrhythmia, and arthritis, among other conditions. This, along with an increased emphasis on early diagnosis and treatment through initiatives undertaken by various national and regional healthcare agencies, has led to a surge in the number of admissions to inpatient and outpatient departments in healthcare settings globally. Thus, an increase in the number of surgical procedures across hospitals is expected to boost the demand for disposable and reusable products such as medical gowns and surgical drapes, among others.

- According to the German Heart Surgery Report 2022, published in June 2023, around 93,913 cardiac surgeries were performed in Germany, which indicated a rise of 1.2% from 2021.

Moreover, a surge in occupationally-acquired infections among healthcare professionals, such as needle stick injury and chronic infections of hepatitis and tuberculosis, among others, boosts the demand for infection prevention and control measures, such as use of healthcare protective equipment. Such measures across clinical settings are anticipated to augment global medical clothing market growth.

- According to a 2021, article published by the Occupational Safety and Health Administration (OSHA), the proper use of personal protective equipment (PPE) can prevent up to 35-37% of occupational injuries or diseases.

Market Restraints

Increase in Product Recalls and Product Regulatory Reforms May Limit Market Growth

Medical clothing is designed to protect healthcare professionals from infection exposure and spread; however, due to the defects in designs and materials, many products are becoming infection carriers. Manufacturers are focusing on branding and marketing and have limited supervision over the quality of the product. This is leading to compromised infection control and thereby limiting product adoption and market growth.

- In February 2023, 3M issued a Class 2 device voluntary recall for selected models and lots of steri-drape surgical drapes distributed between October 2021 and August 2022. The product was recalled owing to the difficulty in removing the liner on the adhesive component of affected drapes without damaging the product and rendering the product unusable.

- Cardinal Health issued a voluntary Class 2 device recall for two lots of Protexis surgical gloves distributed between August 2021 and February 2022. The recall was initiated due to shipping of affected products from the manufacturing plant to a Cardinal Health distribution centre without undergoing sterilization in August 2021.

- In January 2020, Cardinal Health recalled 9.1 million AAMI Level 3 surgical gowns from hospitals and surgical centres due to potential quality contamination.

Moreover, rise in introduction of strict regulatory policies and standard compliance by federal and government agencies toward medical clothing products is expected to hamper growth of new market entrants across the globe. Similarly, other issues faced by existing players, such as high manufacturing costs, extensive sterilization methods, and product biocompatibility errors, are anticipated to limit the market growth.

Market Opportunities

Rising Emphasis on Implementation of Infection Prevention Protocols and Guidelines Offers Lucrative Market Opportunities

The market is witnessing significant opportunities due to increasing emphasis on infection prevention and control, particularly in post-pandemic healthcare infrastructure reforms. As hospitals and clinics prioritize reducing healthcare-associated infections (HAIs), the demand for advanced antimicrobial and fluid-resistant hospital garments is rising. Further, companies are also focusing on launch of new products with enhanced capabilities, which are consequently estimated to offer a favorable environment for market growth during the forecast period.

- For instance, in November 2023, Cardinal Health announced the launch of its SmartGown EDGE breathable surgical gown with instrument pockets that enable convenient and safe instrument access in the operation theater.

Additionally, regulatory bodies are setting high standards for PPE and medical garments, encouraging hospitals to switch from reusable to disposable or high-performance reusable alternatives. Furthermore, emerging economies are expanding their healthcare infrastructure, resulting in a surge in demand for basic and advanced medical apparel. In addition, emerging countries are also focusing on strict implementation of infection prevention guidelines, thus offering substantial opportunity for the adoption of medical clothing.

- For instance, in May 2022, the Health Ministry of Fiji announced the introduction of Infection Prevention and Control guidelines to improve healthcare services, along with the prevention of infectious diseases.

Market Challenges

Environmental Burden of Disposable Medical Apparel Hampers the Market Growth

Though disposable medical clothing plays an important role in infection prevention, its growing adoption leads to significant environmental challenges. Hospitals and healthcare facilities generate large volumes of textile waste due to single-use gowns, drapes, and gloves. Most of these items are made from non-biodegradable synthetic materials, which contribute to plastic pollution.

Additionally, burning of medical textiles is a common disposal method observed around the world. This exercise creates substantial ecological concerns. Moreover, hospitals are under pressure to comply with both infection control and environmental regulations, often creating conflicting priorities. This dual mandate complicates procurement decisions and adds financial burden, especially in low-resource settings.

MEDICAL CLOTHING MARKET TRENDS

Rise in Deployment of Smart Medical Textiles By Market Players Globally is an Emerging Trend

Smart clothing, or e-textiles, incorporates advanced fibers and e-sensor electronics into a shirt, a bandage, or other clothing to perform specific patient care functions. These conductive or smart fibers are woven with standard medical-grade fabric and electronic elements, including microcontrollers, biomedical sensors, wearable antennas, and fiber optics. Smart medical textile captures, records and provides real-time data for vital health statistics such as heart rate, temperature, and respiratory rate.

The number of clinical trials and new product launches is increasing globally, owing to the demand for cost-effective and reliable garments to monitor health and aid in treatment among the population. Moreover, surge in chronic disease prevalence and economic burden of the healthcare system has augmented the demand for smart clothing across home and healthcare settings.

- In 2022, Prevayl Limited launched SmartWear, the first sportswear enhanced with clinical-grade ECG. The clothing combines premium sportswear with biometric technology to help the population achieve their optimum health at any fitness level.

Similarly, the rise in use of electronics and medical technology and increase in emphasis of key players on production of advanced clothing across clinical applications such as physiological monitoring among pregnant women and diagnosis of infectious diseases, among others, is contributing to the global market growth.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product

Growing Awareness about Infection Spread to Augment Surgical Drapes, Scrubs & Gowns Segment Growth

Based on product, the market segments are surgical drapes, scrubs & gowns, gloves, facial protection, sterilization wraps, protective apparel, and others.

The surgical drapes, scrubs & gowns segment dominated the global market with a share of 40.12% in 2026. The demand for these products is growing due to an increase in awareness about spread of infections, rising patient pool, growth in hygiene awareness, and technological innovations in medical products. In addition, the increasing launch of sustainable, reusable products by industry players further augmented the segment growth.

- In August 2022, Medu Protection, with an initial investment of USD 4.0 million, began trials in Mexican hospitals to develop a line of sustainable, virus-resistant reusable products, including surgical gowns, head coverings and full-body suits.

On the other hand, the facial protection segment is expected to see a balanced rise during the forecast timeframe. This is attributed to the increasing prevalence of infectious diseases, growing concerns about safety and hygiene, and stringent mandates about the usage of face masks worldwide, owing to the rise in concern about COVID-19 infection.

- For instance, in January 2023, the World Health Organization (WHO) updated its guidelines on facemask usage in community settings, COVID-19 treatments, and clinical management. The update recommended its use irrespective of the local epidemiological situation, given the previous spread of the COVID-19 pandemic globally.

To know how our report can help streamline your business, Speak to Analyst

By Type

Stringent Infection Prevention Policies and Mandates to Boost For Healthcare Professional Segment Growth

On the basis of type, the market is segmented into for patients and for healthcare professionals.

The For healthcare professionals segment held a largest medical clothing market with a share of 81.09% in 2026, due to its extensive demand across a wide range of clinical settings. Unlike patient apparel, which is typically limited to the duration of a hospital stay or outpatient visit, medical clothing for professionals is required daily and across all operational shifts. Moreover, healthcare workers, including doctors, nurses, technicians, and support staff, must be equipped with hospital garments such as scrubs, coats, gowns, and PPE. In addition, government regulations to follow infection prevention protocols are also estimated to have a positive impact on the segment growth during the forecast period.

The for patient segment holds a comparatively smaller share in the market, primarily due to its short-term use. Patient garments are typically used during hospitalization, surgical recovery, or diagnostic procedures, after which they are either disposed of or laundered for reuse. Unlike healthcare professionals who require multiple sets of clothing on a daily basis, the patient population does not demand high volume or frequency.

By Usage

Huge Benefits Offered by Disposable Products to Impel the Segment Growth

On the basis of usage, the market is segmented into disposable and reusable.

Disposable segment held the largest share in the global market with a share of 68.47% in 2026. This was attributed to an increase in the adoption of medical disposables across healthcare organizations owing to high potential advantages such as lower costs associated with maintenance, repair, replacement, and minimum infection risks, among others. Moreover, the surge in adoption of disposable products across healthcare settings in developed countries and high ongoing costs of reusable products for disinfecting supplies, machine maintenance, and labor are expected to propel segment growth during the forecast timeframe.

- According to data published by Plastic Surge Industries in December 2022, 90.0% of the surgeries in the U.S. use disposable gowns and surgical drapes, as compared to reusable ones.

On the other hand, the reusable segment held a substantial share in the global market in 2024. The growth was owing to increasing focus of healthcare centres on the regulation of medical waste, introduction of environmentally friendly medical products, and emphasis on long-term cost savings from medical products. Moreover, the shortage of medical disposables supply across the globe further propelled the growth of the reusable segment.

By End-user

Growing Number of Surgical Procedures at Hospitals to Spur the Segment Growth

By end-user, the market is segmented into hospitals, outpatient facilities, physicians’ offices, and others.

The hospitals segment held the leading position in the global market.This dominance was attributed to factors such as growing number of surgical procedures, rise in patient pool, and presence of well-equipped infrastructure at hospitals. In addition, increasing investment in healthcare infrastructure by emerging countries is anticipated to propel the segment’s growth during the forecast period.

- For instance, in November 2023, Rainbow Hospital launched 4 new facilities in India with 270 beds in 2023.

- The International Society of Aesthetic Plastic Surgery (ISAPS) published a global report in 2022. The report stated that the total number of procedures performed by plastic surgeons in 2022 saw an increase of 11.2%, with more than 18.8 million non-surgical procedures and 14.9 million surgical procedures performed globally.

On the other hand, the outpatient facilities segment is anticipated to showcase the fastest growth rate during the forecast period. The rapid growth of the segment is attributed to the growing preference of medical professionals to conduct private practices, further contributing to the increasing number of specialty clinics and subsequently driving the demand for medical and nursing scrubs.

- For instance, according to a report published by the Association of American Medical Colleges 2022, sports medicine saw an increase in the number of practicing physicians from 2,252 to 3,208, i.e., a growth of 42.5% from 2016 to 2021.

By Sales Channel

Growing Number of Institutional Purchase for Cost Efficiency to Boost the Segment Growth

By sales channels, the market is segmented into business to business and business to customer.

The B2B (business-to-business) sales channel dominated the market accounting for 70.87% market share in 2026. The large-scale procurement by healthcare institutions such as clinics, diagnostic labs, hospitals, surgical centers, and long-term care facilities is primarily responsible for the largest share of the segment. These establishments follow standardized procurement cycles, often purchasing in bulk through tenders, contracts, or long-term supply agreements. The need for a continuous and regulated supply of scrubs, gowns, protective wear, and uniforms for medical staff ensures consistent demand.

On the other hand, the B2C (business-to-consumer) channel holds a smaller share in the market, as it largely caters to individual healthcare professionals, students, or caregivers purchasing attire for personal use. While this segment has witnessed growth with the rise of e-commerce and direct-to-consumer brands, its scale remains limited compared to institutional procurement. Individual buyers typically purchase fewer units, and the frequency of repurchase is lower.

MEDICAL CLOTHING MARKET REGIONAL OUTLOOK

Regionally, the market is classified into North America, Asia Pacific, Europe, Middle East & Africa, and Latin America.

North America

North America Medical Clothing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market by generating revenue of USD 121.52 billion in 2025. The primary factors responsible for the leading position are developed hospital infrastructure, growing incidence of several acute and chronic diseases, and presence of major players involved in product manufacturing. Moreover, high emphasis of market players on the expansion of product distribution channels further propels the regional growth.

The growth of the U.S. market is attributed to stringent regulations, availability of products, and focus on containing healthcare-associated infections. In addition, introduction of technologically advanced products is also likely to have a positive impact on the market growth. The U.S. market is valued at USD 46.57 billion by 2026.

- In November 2023, Figs Inc., a healthcare apparel company, launched its first permanent retail store in the U.S. The store being branded a ‘Community Hub’ boosted demand for the product portfolio along with e-commerce sales in the country.

- In July 2021, PROTECH USA announced the introduction of a new production work plant that expanded and enhanced its capacity to produce EZDoff medical gowns for healthcare and other critical industries.

Asia Pacific

On the other hand, the Asia Pacific is anticipated to exhibit the highest CAGR during 2024-2032, owing to improving healthcare infrastructure and increasing awareness about safety and hygiene among healthcare professionals in the region. Furthermore, factors such as the increasing focus on manufacturing medical clothing by prominent players and emerging countries such as India and China are anticipated to provide substantial growth opportunities for medical clothing manufacturers.The Japan market is valued at USD 7.85 billion by 2026, the China market is valued at USD 10.35 billion by 2026, and the India market is valued at USD 8.07 billion by 2026.

- In December 2021, DONY VIETNAM COMPANY LIMITED launched the Dony protective coverall designed to provide all-around protection to healthcare workers. The garments offer head-to-toe protection with ease and comfort with a premium antibacterial cloth mask.

Europe

Europe accounted for a significant market share in 2024. The stable position of Europe in the global market was due to growth in product innovation, leading to a rise in new product launches in medical disposables. Similarly, increasing awareness of new initiatives for the introduction of sustainable products across healthcare organizations for economic benefits boosted the market growth. The UK market is valued at USD 3.44 billion by 2026, while the Germany market is valued at USD 7.6 billion by 2026.

- For instance, in 2020, the NHS initiated a pilot project to introduce reusable type IIR-certified face masks in the U.K., with an aim to promote the use of reusable products in the healthcare industry.

Latin America and Middle East & Africa

Latin America and the Middle East & Africa are likely to experience slow growth in this market during the forecast period due to fewer number of hospitals present across countries and low healthcare expenditure by governments, leading to slow development of healthcare infrastructure.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players are Moving toward Aggressive Pricing Strategies to Gain a Competitive Strength

The global market is fragmented, with several players. Some of the prominent companies operating in the market have shifted to strategies such as product differentiation, aggressive pricing, and product upgrades to gain competitive strength. Besides these, several companies are creating distribution partnerships aimed at reaching wider audiences, thereby expanding their regional and global footprint. The market is also shifting toward high-value-added products for medical use. Moreover, technological advancement in the healthcare sector is due to the rising number of surgeries, which, in turn, also increases the use of surgical clothing.

- In August 2022, Molnlycke invested USD 54.4 million in a new plant in Kulim, Malaysia, to expand its production capacity to meet the demand for the supply of high-quality, sustainable surgical gloves.

Due to the exponential increase in the number of infections globally, stocks of protective equipment, which includes medical clothing, are fluctuating. This is aggravated by the supply bottlenecks. Several textile and clothing manufacturers, such as Eterna Mode Holding GmbH, Zara, Rösch Fashion GmbH & Co. KG, and Trigema Inh. W. Grupp e.K. and others have converted and manufactured protective masks and protective medical clothing in their production facilities.

LIST OF KEY MEDICAL CLOTHING COMPANIES PROFILED

- O&M Halyard Inc. (U.S.)

- ANSELL LTD. (Australia)

- Medline Industries (U.S.)

- Cardinal Health (U.S.)

- Barco Uniforms (U.S)

- Superior Uniform Groups (U.S)

- Semperit AG Holding (Austria)

- American Nitrile (U.S)

- 3M Company (U.S)

- Mölnlycke Health Care (Sweden)

KEY INDUSTRY DEVELOPMENTS

- May 2025– Healthmark announced the introduction of SafeGuard Dry. This is a new sterilization wrap incorporated with wet pack management functionality.

- October 2024 – The collaboration of Unigloves (U.K.) Limited and KluraLabs announced the launch of new antimicrobial nitrile gloves. The glove offers superior protection against bacteria and cross-contamination.

- November 2023 – Cardinal Health announced the launch of SmartGown EDGE Breathable surgical gown with assist instrument pockets in the U.S. The new surgical gown provides surgical teams with safe and convenient instrument access in the operating room.

- May 2023 – Ahlstrom announced the launch of its new Reliance Fusion sterilization wrap with next-generation technology. The new wraps are introduced for surgical equipment trays in hospitals.

- February 2023 – Fabletics launched a new 12-piece line of activewear scrubs for men and women. In addition, the company donated scrub sets to 25,000 medical professionals across the U.S. as part of the launch.

- May 2022 – Honeywell International Inc. announced the launch of two new NIOSH-certified respiratory offerings to help meet the needs of healthcare workers. The latest products expand the company’s personal protective equipment (PPE) portfolio for healthcare professionals, incorporating the company’s decades of expertise in producing respiratory protection solutions.

- December 2021- 3M announced that it has ramped up its N95 mask production owing to the increasing demand for N95 masks. The company expanded its production capabilities, which led to increased production to a rate of 2.5 billion N95 respirators.

REPORT COVERAGE

The report provides a detailed analysis of the global market and focuses on key aspects such as leading key players, product types, and leading applications of the products. The analysis offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years. It further highlights some of the growth-stimulating factors and restraints, helping the reader to gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.8% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product

|

|

By Usage

|

|

|

By Type

|

|

|

By End-user

|

|

|

By Sales Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 121.52 billion in 2025 and is projected to reach USD 216.8 billion by 2034.

Growing at a CAGR of 6.8%, the market is expected to exhibit steady growth during the forecast period.

By product, the surgical drapes, scrubs & gowns segment led the market in 2024.

North America dominated the market in 2025.

North America accounted for USD 121.52 billion in 2025.

The rising prevalence of chronic diseases, increasing surgical procedures, growing awareness about infection control, and product launches.

Cardinal Health, Inc., Halyard Health, Medline Industries, Inc., and Ansell Healthcare LLC are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us