Medical Foam Market Size, Share & Industry Analysis by Type (Flexible, Rigid, and Spray), By Material (Polyurethane, Polyethylene, Polystyrene, Silicone, and Others), By Structure (Open-Cell Foam and Closed-Cell Foam), By Application (Wound Care, Medical Packaging, Patient Support & Comfort, and Others), By End-User (Hospitals & Clinics, Medical Device Manufacturers, Homecare Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

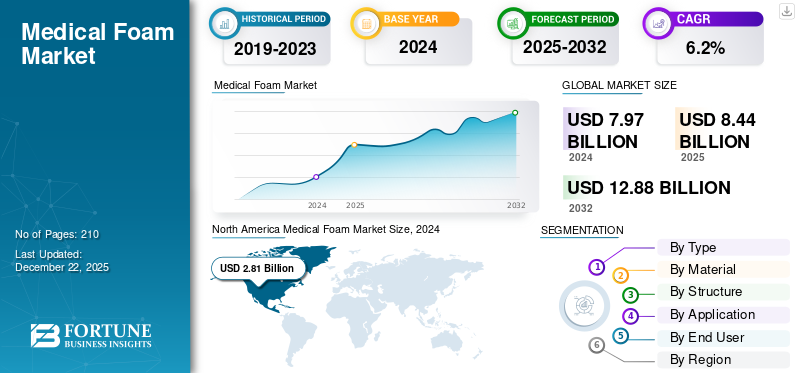

The global medical foam market size was valued at USD 8.44 billion in 2025. The market is projected to grow from USD 8.95 billion in 2026 to USD 14.61 billion by 2034, exhibiting a CAGR of 6.32% during the forecast period. North America dominated the medical foam market with a market share of 35.35% in 2025.

Medical foam is composed of specialized polymeric materials, such as polyurethane, polyethylene, polystyrene, and silicone, specifically designed for cushioning, fluid absorption, sealing, insulation, and gentle adhesion in healthcare applications. Moreover, the medical foam plays a critical role in products such as advanced wound dressings, surgical drapes, ostomy and orthopedic supports, catheters, device seals and gaskets, medical packaging, and patient positioning systems. The market growth is attributed to the rising incidence of chronic wounds linked to diabetes and aging populations, increasing focus on infection control, and rising adoption of minimally invasive and home-care treatments. Additionally, advancements in foam technologies are expected to have a positive impact on the market as they offer superior clinical performance and enhanced patient comfort.

The market is dominated by several major players, including Smith+Nephew, Mölnlycke Health Care, 3M Healthcare, and ConvaTec, at the forefront. A strong emphasis on new product introductions and a growing focus on implementing inorganic strategies are expected to influence the market shares of these companies.

MARKET DYNAMICS

MARKET DRIVERS

Rising Prevalence of Chronic Wounds and Procedure Volumes to Drive Market Growth

The surging prevalence of chronic wounds is expected to drive the global medical foam market growth. In addition, rising surgical volumes in orthopedics, cardiology, and general surgery are spurring the demand for foams used in cushioning, draping, sealing, and sterile packaging of instruments and implants. Moreover, infection-prevention initiatives continue to favor single-use components, while aging populations and the growing prevalence of diabetes sustain product demand associated with pressure injuries and venous ulcers. Continual technological advancements are leading to the introduction of products with superior capabilities, which can offer better patient outcomes.

- For instance, in September 2024, Solventum announced the launch of its new Place and V.A.C. dressing, especially designed for chronic wounds.

MARKET RESTRAINTS

Limited Standardization and Complex Validation Procedures to Hamper Market Growth

Compliance with stringent biocompatibility, particulate, and other standards significantly adds to the time and expense of the validation process for medical foams. Additionally, manufacturers must invest heavily in cleanroom-grade production environments, conduct sterilization compatibility assessments, and provide detailed regulatory documentation prior to approval. Furthermore, fluctuations in raw material prices for polyurethane, polyethylene, and silicone increase production costs and complicate long-term supplier contracts. These combined regulatory and financial challenges slow new product introductions, consolidate manufacturing power among a few large global suppliers and limit innovation.

- For instance, in January 2024, the FDA and ISO announced the launch of new biocompatibility testing regulations for medical devices. These new regulations are responsible for product validation, followed by the introduction of the product to the market.

MARKET OPPORTUNITIES

Shift to Homecare and Outpatient Surgery to Expand Market Growth Opportunities

Recently, there has been a shift in procedures from inpatient settings to ambulatory surgery centers and home-care environments. Clinicians and caregivers increasingly require dressings and device interfaces that are easy to apply, comfortable, and low-risk to remove. This transition is driving the demand for soft silicone and multilayer polyurethane (PU) foams that offer high moisture vapor transmission rates (MVTR), excellent conformability, and secure yet gentle adhesion, reducing skin trauma and minimizing the frequency of dressing changes. Additionally, the increasing prevalence of conditions such as chronic wounds is also expected to create a favorable environment for market growth.

- For instance, according to data published by the Agency for Healthcare Research and Quality in October 2025, an estimated 2.5 million people develop pressure ulcers in the U.S. per year.

MEDICAL FOAM MARKET TRENDS

Growing Preference for Lightweight Designs for Better Ergonomics is one of the Major Market Trends

Medical device and packaging manufacturers are increasingly adopting lightweight, thinner, and high-performance foam structures that deliver effective cushioning and absorption while minimizing material consumption. These optimized designs help reduce transportation weight, lower raw material expenses, and enhance flexibility and conformability, especially in wound dressings, orthopedic supports, and medical packaging applications. Furthermore, this shift aligns with healthcare providers’ emphasis on ergonomic, easy-to-apply, and patient-friendly materials, enabling improved usability and comfort.

- For instance, in October 2024, Avery Dennison Medical announced the launch of its SilFoam Lite, a lightweight foam specifically designed for the treatment of chronic wounds.

MARKET CHALLENGES

Consistent Quality at Scale and Regulatory Evidence Requirements to Offer Substantial Challenge

Maintaining consistent pore structure, adhesion strength, and absorption performance across production lots remains technically challenging, especially as lead times shorten and demand accelerates. Hospitals and payers are increasingly requiring robust clinical and economic validation to justify the use of premium medical foams, which adds to the costs of product trials and data generation. Additionally, ongoing price pressure from group purchasing organizations (GPOs) continues to constrain margins. It reduces available capital for research and development (R&D), making it difficult for manufacturers to sustain innovation while meeting cost and performance expectations.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Significant Comfort Provided by Flexible Foam Type to Accelerate Segment Growth

On the basis of segmentation by type, the market is classified into flexible, rigid, and spray.

To know how our report can help streamline your business, Speak to Analyst

The flexible segment held the highest global medical foam market share 59.40% in 2026. Certain factors, including its superior comfort, adaptability, and substantial adoption in healthcare settings, are driving segment growth. Moreover, flexible foams are also preferred in wound dressings, surgical pads, prosthetic liners, and patient cushions. In addition, continuous innovations in polyurethane and silicone compositions are also improving breathability and durability, helping flexible foams remain the preferred choice for modern medical and patient-care applications.

- For instance, in March 2025, Mölnlycke Health Care showcased a study in which Mepilex Border Flex demonstrated higher efficiency as a wound dressing.

The spray segment is expected to grow at a CAGR of 7.2% over the forecast period.

By Material

Superior Cost-Effectiveness and Biocompatibility of Polyurethane to Boost Segment Growth

In terms of material, the market is categorized into polyurethane (PU), polyethylene (PE), polystyrene (PS), silicone, and others.

The polyurethane (PU) segment captured the largest share of the market in 2025. In 2026, the segment dominates with a 53.31% share. Polyurethane (PU) foam offers several benefits, including high performance, cost efficiency, and biocompatibility. Moreover, the foam is designed with several variants, enabling it to widen its applications. Additionally, its compatibility with coatings and adhesives enables seamless integration into advanced dressings and diagnostic devices. Furthermore, the increasing number of product introductions is also projected to have a positive impact on segment growth.

- For instance, in March 2025, Rogers Corporation announced the launch of its new polyurethane foam, called PORON 40V0. The foam is fire-resistant and can be utilized for medical device packaging, wound closure, and biomedical comforts.

The silicone segment is expected to grow at a CAGR of 7.0% over the forecast period.

By Structure

Extensive Antimicrobial Properties of Open-Cell Foams to Drive Segment Growth

In terms of structure, the market is categorized into open-cell foam and closed-cell foam.

The open-cell foam segment captured the largest market share in 2025. In 2026, the segment dominates with a 63.52% share. The segment is expected to experience considerable demand in the healthcare sector due to its soft texture, breathability, and superior fluid-handling capabilities. Moreover, its porous, interconnected structure allows air and moisture to pass through easily, making it perfect for wound dressings, patient cushions, and orthopedic supports. Furthermore, its adaptability with coatings, antimicrobial agents, and films enhances its functionality in modern medical products.

- For instance, in June 2022, Medline introduced Optifoam Gentle EX foam for better dressing and prevention of pressure injuries.

The closed-cell foam segment is expected to grow at a CAGR of 5.6% over the forecast period.

By Application

Significant Prevalence of Trauma and Chronic Wounds to Accelerate Wound Care Segment Growth

In terms of application, the market is categorized into wound care, medical packaging, patient support & comfort, and others.

The wound care segment captured the largest market share in 2025. In 2026, the segment dominates with a 46.15% share. The wound care segment commands the largest share of the market, as flexible polyurethane and silicone foams have become integral to advanced wound management. These foams offer superior fluid absorption, pressure relief, and breathability. Additionally, hospitals and clinics prefer foam-based dressings as they reduce the frequency of dressing changes, minimize the risk of infection, and promote faster healing. Moreover, the substantial prevalence of chronic wounds is also estimated to offer a lucrative opportunity for segment growth.

The medical packaging segment is expected to grow at a CAGR of 6.3% over the forecast period.

By End User

Availability of Advanced Infrastructure in Hospitals & Clinics to Boost Segment Growth

Based on end-user, the market is segmented into hospitals & clinics, medical device manufacturers, homecare settings, and others.

In 2024, the global market was dominated by the hospitals and clinics segment in terms of end-user. Hospitals and clinics account for the largest share of the market due to their high patient inflow and constant demand for wound dressings, surgical pads, and cushioning materials. In addition, these facilities are capable of handling a wide range of surgical procedures where foams are used for protection and infection control.

In addition, the homecare settings segment is projected to grow at a CAGR of 7.2% during the study period.

Medical Foam Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Medical Foam Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in 2025, valuing at USD 2.98 billion, and also maintained the leading share in 2026, with USD 3.17 billion. The growth of the North America medical foam market is attributed to substantial surgical procedures, developed healthcare infrastructure, and technological advancements. In 2026, the U.S. market is estimated to have reached USD 2.93 billion. The growth of the U.S. market is attributed to the rising prevalence of chronic and surgical wounds as well as the increasing adoption of advanced wound care products.

- For instance, in 2022, an estimated 280,000 bariatric surgeries were performed in the U.S., representing a 41% increase compared to 2021.

Europe

Europe is projected to witness notable growth in the years to come. During the forecast period, the European region is projected to record a growth rate of 5.2% and reach a valuation of USD 2.23 billion by 2025. This is primarily due to substantial research & development investments, rising adoption of antimicrobial dressings, and the rapid expansion of medical packaging. Owing to these factors, countries including the U.K., Germany, and France are anticipated to record the valuation of USD 0.42 billion, USD 0.59 billion, and USD 0.35 billion respectively in 2026.

Asia Pacific

After Europe, the market in Asia Pacific is estimated to reach USD 2.29 billion in 2025. The regional market is expected to exhibit the fastest CAGR during the forecast period. In the region, India and China are estimated to reach USD 0.35 billion and USD 0.67 billion, respectively in 2026.

Latin America and the Middle East & Africa

Over the forecast period, the Latin America and Middle East & Africa regions are expected to witness moderate growth in this market space. The Latin America market, in 2025, is set to have touched a valuation of USD 0.56 billion. The consolidation of healthcare infrastructure, coupled with extensive investments in superior healthcare facilities, is further estimated to drive regional growth during the forecast period. In the Middle East & Africa, the GCC market is set to have reached a value of USD 0.22 billion by 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Strong Emphasis on New Product Development with Enhanced Capabilities to Maintain their Market Position

The global market exhibits a semi-concentrated structure, with numerous small- to mid-sized companies actively operating worldwide. These players are actively involved in product innovation, strategic partnerships, and geographical expansion.

Smith Nephew Plc, Mölnlycke Health Care, 3M Healthcare, and ConvaTec are some of the dominating players in the market. A comprehensive range of medical foam technologies, continual innovation, and extensive focus on research & development are a few key strategies of these companies that bolster their dominance.

Apart from these, other pivotal players in the market include Coloplast, Avery Dennison Medical, Zotefoams plc, Rogers Corporation, Sekisui Chemical Co., Ltd., and others. These companies are deploying numerous strategic steps, such as partnerships with healthcare providers to consolidate their market presence.

LIST OF KEY MEDICAL FOAM COMPANIES PROFILED

- Smith & Nephew plc (U.K.)

- Mölnlycke Health Care AB (Sweden)

- 3M Company (U.S.)

- ConvaTec Group Plc (U.K.)

- Coloplast A/S (Denmark)

- Avery Dennison Medical LLC (U.S.)

- Zotefoams plc (U.K.)

- Rogers Corporation (U.S.)

- Sekisui Chemical Co., Ltd. (Japan)

- Recticel NV/SA (Belgium)

KEY INDUSTRY DEVELOPMENTS

- April 2024: Smith Nephew Plc announced the launch of a new product, ALLEVYN LIFE Dressing. The product study represented extensive output for all types of wounds.

- June 2023: Carpenter Co., announced the acquisition of Recticel N.V. to consolidate its position in the foam market.

- January 2023: Convatec announced the launch of its new product under the ConvaFoam brand. The new foam is specifically designed for chronic wounds.

- February 2021: Zotefoams plc. announced the commissioning of a new production facility in Poland.

- October 2019: 3M announced the acquisition of Acelity, Inc., with the aim of consolidating its presence in the wound care market.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.32% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, Material, Structure, Application, End User, and Region |

|

By Type |

· Flexible · Rigid · Spray |

|

By Material |

· Polyurethane (PU) · Polyethylene (PE) · Polystyrene (PS) · Silicone · Others |

|

By Structure |

· Open-Cell Foam · Closed-Cell Foam |

|

By Application |

· Wound Care · Medical Packaging · Patient Support & Comfort · Others |

|

By End User |

· Hospitals & Clinics · Medical Device Manufacturers · Homecare Settings · Others |

|

By Geography |

· North America (By Type, Material, Structure, Application, End User, and Country) o U.S. § By Type o Canada § By Type · Europe (By Type, Material, Structure, Application, End User, and Country/Sub-region) o Germany § By Type o U.K. § By Type o France § By Type o Spain § By Type o Italy § By Type o Scandinavia § By Type o Rest of Europe § By Type · Asia Pacific (By Type, Material, Structure, Application, End User, and Country/Sub-region) o China § By Type o Japan § By Type o India § By Type o Australia § By Type o Southeast Asia § By Type o Rest of Asia Pacific § By Type · Latin America (By Type, Material, Structure, Application, End User, and Country/Sub-region) o Brazil § By Type o Mexico § By Type o Rest of Latin America § By Product Type · Middle East and Africa (By Type, Material, Structure, Application, End User, and Country/Sub-region) o GCC § By Type o Saudi Arabia § By Type o Rest of Middle East and Africa § By Type |

Frequently Asked Questions

The global medical foam market size is projected to grow from $8.95 billion in 2026 to $14.61 billion by 2034, at a CAGR of 6.32% during the forecast period

In 2025, the market value stood at USD 2.98 billion.

The market is expected to exhibit a CAGR of 6.32% during the forecast period of 2026-2034.

The flexible segment led the market by type in 2025.

The key factors driving the market are the increasing prevalence of chronic wounds and technological advancements in foam.

Smith Nephew Plc, Mölnlycke Health Care, 3M Healthcare, and ConvaTec are some of the prominent players in the market.

North America dominated the market in 2025.

The increasing demand for foam-based dressings, coupled with the substantial prevalence of surgical wounds, is expected to drive market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us