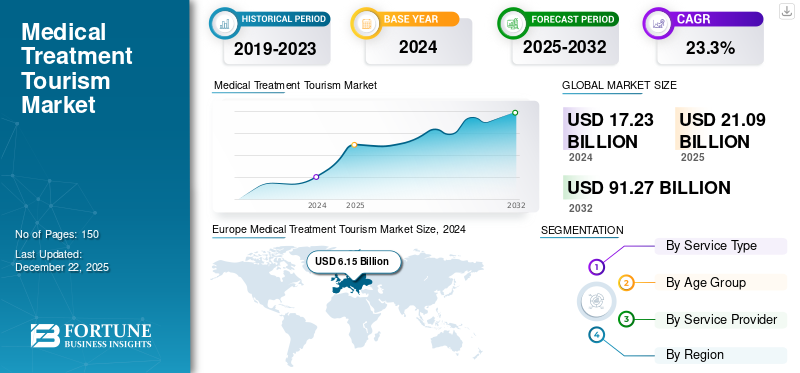

Medical Treatment Tourism Market Size, Share & Industry Analysis, By Service Type (Cardiac Procedures, Oncology Procedures, Orthopedic & Spine Procedures, Dental Procedures, and Others), By Age Group (Pediatric and Adult), By Service Provider (Public and Private), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global medical treatment tourism market size was valued at USD 21.09 billion in 2025. The market is projected to grow from USD 25.87 billion in 2026 to USD 140.88 billion by 2034, exhibiting a CAGR of 23.60% during the forecast period. Europe dominated the medical treatment tourism market with a market share of 54.08% in 2025.

Medical treatment tourism is the practice of traveling to another country, often for cost savings, to undergo medical treatments. This form of medical tourism is driven by the desire to access affordable medical surgeries, including dental procedures, cardiac procedures, and many others.

The growth of the global medical treatment tourism market is driven by expanding healthcare infrastructure and the availability of cost-effective treatments in developing nations. For example, in May 2025, SPARSH Group of Hospitals' new 300-bed quaternary care facility opened in Bangalore, India. This facility provides specialized services in orthopedics, neurosciences, cardiac sciences, oncology, organ transplants, and women's & children's health. It is incorporated with advanced technologies such as robotic-assisted surgeries, AI-based diagnostics, 3D printing, and real-time analytics.

The market consists of several key players such as Apollo Hospitals Enterprise Ltd., Fortis Healthcare, Bumrungrad International Hospital, and The Johns Hopkins Hospital. These market players are focusing on enhancing their footprints in the global market by expanding healthcare infrastructure and providing a wide range of medical treatments for domestic and international patients.

MARKET DYNAMICS

Market Drivers

High Burden of Chronic Diseases and Expanding Healthcare Infrastructure in Emerging Countries Augment Market Growth

The chronic diseases, such as cancer, cardiovascular conditions, and orthopedic diseases, are rising globally, especially in developed countries with aging populations. However, the high cost of treatment and long waiting times for medical treatment in the patient's home nation are shifting their focus to seek timely and affordable care abroad. For example, patients with cancer, cardiac conditions, or other medical conditions from North America and Europe often visit emerging countries such as Malaysia, Turkey, and India to receive high-quality and cost-effective treatments with shorter wait times.

- For example, according to data provided by Japan Life Support in May 2025, around 1.5 million patients visited Turkey in 2023 for medical treatments, due to lower treatment costs in Turkey than in Europe and the U.S. The same source reported that more than 40.0% of medical travelers came from Europe (mainly Germany, the U.K., and the Netherlands) for medical treatment in Turkey in 2023.

Moreover, the expanding healthcare infrastructure in emerging countries due to the adoption of advanced medical technologies and international accreditations such as Joint Commission International (JCI) is attracting more patients for medical treatment, thereby driving the medical treatment tourism market growth. Additionally, the opening of new healthcare facilities that help to provide treatment for international patients, as part of a healthcare facility strategy, is enhancing market growth. For example, in September 2024, RivExcel and American Hospital Dubai announced the opening of three new medical tourism offices in Lagos, Nigeria.

Thus, the growing healthcare infrastructure and the lower cost of treatments with high-quality medical services in these emerging countries attract more international patients seeking medical treatments, thereby driving market growth.

Market Restraints

Post-operative Complications and Inadequate Follow-up Care to Restrict Market Growth

The patients visit several countries for medical procedures and often return home shortly after the surgery. This limits the patient's access to proper follow-up care from the surgeon, from whom they have received the surgical treatment. This lack of continuity in medical care can become problematic, particularly for patients who experience post-surgical complications, including infections, bleeding, or issues with the surgical site. Additionally, the long-distance travelling of patients after surgery increases the risk of complications such as Deep Vein Thrombosis (DVT), infection, and delayed healing. In such complications, patient may struggle to find local medical support and return to their original destination from where they received medical treatment. This leads to additional cost and inconvenience for patients, negatively affecting the overall experience.

- For example, the majority of the U.K. Patients are travelling abroad for obesity surgery, due to long waiting times. However, upon their return, many face severe health complications due to inadequate post-operative care.

Furthermore, the lack of standardized post-operative protocols in several countries raises safety concerns. Various surgical procedures require several days of recovery. When post-operative care is unavailable or not aligned with international healthcare standards, the patients may be exposed to medical risks. Due to all these factors, many patients are avoiding medical treatments from international countries, hindering market growth.

Market Opportunities

Increasing Government Initiatives Toward Promotion of Medical Tourism to Create Opportunities for Market Growth

Government authorities across several countries are increasingly focusing on organizing campaigns and participating in medical events to promote medical tourism in their countries. Additionally, the increasing strategic alliances between government authorities are crucial in enhancing national medical tourism agendas, thereby contributing to market growth globally.

- For example, in May 2023, Dubai Health Authority (DHA) participated in the 30th edition of the Arabian Travel Market, which took place at the Dubai World Trade Center, with 34,000 participants representing more than 150 countries. The authority's presence in this global event was part of the authority's continuous plans and efforts to enhance Dubai's position and competitiveness as a leading destination for health tourism.

- In September 2022, the Ministry of Economy and Dubai Health Authority (DHA) signed a memorandum of understanding (MoU) to promote the exchange of expertise to drive medical tourism flows to UAE and cement the country's position as a favored medical tourism destination.

Market Challenges

Ethical Concerns and Insurance Limitations are Key Medical Treatment Challenges

Over the past few years, medical tourism has experienced challenges, such as ethical concerns and limited insurance coverage. Some of the preferred countries providing medical tourism have come under scrutiny for unethical practices, such as unregulated organ transplants or exploitation of donors. For example, nations such as Pakistan and Egypt have been criticized for illegal kidney transplants, which led to ethical and reputational issues for the global medical treatment tourism industry.

Hospitals that follow unethical medical practices can lose international accreditations (such as JCI) or be flagged by international organizations such as the World Health Organization (WHO). This can significantly hinder their ability to attract global patients and secure partnerships with medical insurance providers. For example, in 2007, China faced international criticism for the use of organs from executed prisoners. Despite subsequent reforms, this ethical controversy negatively impacted the country's medical tourism for several years.

In addition, the standard health insurance policies do not cover medical procedures performed abroad, creating financial risks for patients.

- For example, a patient living in the U.S. and traveling to Turkey for dental surgery has to pay entirely out of pocket, as the insurance provider does not recognize treatment from international medical facilities.

These ethical and financial barriers continue to pose challenges for the medical treatment tourism market's growth.

Download Free sample to learn more about this report.

Medical Treatment Tourism MARKET TRENDS

Increasing Patients' Preference for Affordable Medical Treatments in Developing Nations Boosts Market Progress

Over the past decade, medical tourism for various surgical procedures has grown exponentially across the globe. This surge in demand for medical treatments in developing nations is higher due to the minimum waiting time and low-cost treatment. Countries such as Turkey, Mexico, South Korea, Thailand, and others have become prime locations for international patients to receive medical care, as they provide medical treatment at lower prices.

Along with this, developing countries are heavily investing in advancing their medical infrastructure, with state-of-the-art medical equipment making them more attractive to foreign patients. For example, according to Avicenna International Hospital, the cost of heart bypass surgery in Turkey ranges from USD 7,000 to USD 15,000, with a 1-2 week waiting time. On the other hand, the cost of heart bypass surgery in the U.S. is more than USD 70,000, with a waiting time of 3-6 months.

As a result, more patients are seeking medical care in developing countries, where they can receive high-quality care at affordable prices, boosting market growth.

Adoption of Advanced Robotic Systems for Complex Surgeries

The increasing adoption of robotic surgeries is a key trend driving the medical tourism market. Robotic-assisted surgery (RAS) offers numerous benefits such as increased precision, minimally invasive procedures, faster recovery times, and reduced complications, making it a preferable option for international patients. This, in turn, is enhancing the growth of the medical tourism industry, particularly in regions with advanced robotic surgery facilities.

SEGMENTATION ANALYSIS

By Service Type

Dental Procedures Segment Led Due to Rise in Number of Patients

Based on service type, the market is categorized into cardiac procedures, oncology procedures, orthopedic & spine procedures, dental procedures, and others.

The dental procedures segment dominated the market in 2024 and is projected to grow at the second-largest CAGR throughout the forecast period. The rise in the number of patients seeking dental treatment in emerging countries due to affordability is one of the main factors driving the segment’s growth.

- For example, as per the data provided by Fine Up in September 2024, around 400,000 health tourists visited Turkey in 2023 specifically for dental treatments.

The cardiac procedures segment accounted for a moderate market share in 2024 and is anticipated to grow at the third-largest CAGR from 2025 to 2032. The rising number of people suffering from chronic diseases and traveling to international countries to receive appropriate medical treatment is one of the important factors driving the segment's growth.

The orthopedic & spine procedures segment accounted for the second-largest market share in 2024 and is projected to grow at the highest CAGR from 2025 to 2032. The growth of the segment is mainly attributed to the growing aging population and the rising number of people suffering from joint disorders worldwide. For example, as per the data provided by Arthritis Australia in February 2025, an estimated 5.39 million Australians will be living with arthritis by the end of 2040.

The oncology procedures segment is anticipated to grow stagnantly during the forecast period due to the high burden of cancer.

By Age Group

Adult Segment to Display Highest CAGR Due to the High Prevalence of Chronic Diseases

Based on age group, the market is categorized into pediatric and adult.

The adult segment is anticipated to grow at the highest CAGR during the forecast period. The growth of this segment is mainly attributed to the large number of adults suffering from several chronic diseases that require timely treatment.

- For example, as per the data provided by the National Council on Aging, Inc. in May 2024, 94.9% percent of adults age 60 and older have at least one condition, while 78.7% of the adult population can have two or more chronic conditions.

The pediatric segment is expected to grow considerably during the forecast period. The rising demand for specialized pediatric care for conditions such as congenital heart disease, endoscopic sinus surgery, and pediatric hand reconstruction, which are prompting many families to travel abroad for medical treatments, is an important factor driving the segment's growth.

By Service Provider

Private Segment Dominated Due to Its Growing Efforts to Increase Facilities

Based on the service provider, the market is categorized into public and private.

The private segment dominated, accounting for the major global medical treatment tourism market share in 2024. This segment is anticipated to grow at the highest CAGR during the forecast period. The growing efforts of private hospitals and clinics to increase the number of facilities and expand the service offerings for various treatments are some of the important factors leading to the segment's growth.

- For example, in February 2025, Johns Hopkins Aramco Healthcare (JHAH), a collaboration between Saudi Aramco and Johns Hopkins Medicine, opened an Oncology Center of Excellence in Saudi Arabia. This new oncology center would support Saudi Arabia's ambitions to become a regional medical tourism destination.

The public segment is expected to grow considerably during the forecast period due to rising government initiatives related to expanding healthcare infrastructure. Additionally, the increasing strategic alliances between public healthcare providers and insurance providers to ensure smooth hospital admissions and attract international patients are some of the additional factors contributing to the segment's growth.

MEDICAL TREATMENT TOURISM MARKET REGIONAL OUTLOOK

In terms of region, the global market can be divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe

Europe Medical Treatment Tourism Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the global market in 2024, reaching a market size of USD 6.15 billion and accounting for 35.7% of the market share. This growth is due to the high number of people visiting European countries for medical treatments due to the presence of high-quality and technologically advanced healthcare infrastructure. Additionally, opening new medical facilities providing treatment to international patients is another factor supplementing market growth in European countries.

- For example, in August 2023, Institut Curie, one of the major research centers of France, strengthened its position in western Paris by opening its new hospital in Saint-Cloud. This hospital has highly skilled teams of medical professionals who are involved in providing cancer treatment by using ultra-modern cellular therapy platforms.

North America

North America accounted for the second-largest share of the market in 2024. The growth in this region is mainly attributed to the presence of advanced healthcare infrastructure and a high concentration of licensed practitioners.

Additionally, the increasing focus of government authorities on the launch of medical travel events in the U.S. to enhance the medical travel ecosystem is one of the important factors driving market growth in the U.S.

- For example, in October 2022, the Korea Tourism Organization, Global Healthcare Resources, and the Medical Tourism Association partnered to launch a private medical travel event for the American marketplace. This exclusive and private B2B event brought together American insurance companies, employers, insurance agents and consultants, and travel agents engaged in medical tourism.

Asia Pacific

The market in the Asia Pacific region is anticipated to grow at the highest CAGR throughout the forecast period. The increasing government initiatives to promote medical treatment tourism in Asia Pacific countries are among the main factors driving market growth in this region.

- For instance, as per the data provided by the MedCampus in February 2025, the Ministry of Health & Family Welfare (MoHFW), a government authority of India, initiated the "Heal in India" program to promote India as a global hub for medical tourism. This initiative aimed to attract patients from the Middle East & African countries to provide cardiac surgeries, organ transplants, and dental treatments.

Latin America and Middle East & Africa:

The Latin America and the Middle East & Africa regions held a considerable market share in 2024 and are projected to grow at a stagnant CAGR from 2025 to 2032. Increasing government initiatives to promote medical tourism and opening medical tourism representative offices are important factors driving market growth in these regions.

- For instance, in August 2024, American Hospital Dubai opened its first Emirati medical tourism office outside UAE, located in Lagos, Nigeria. This move aims to provide Nigerian patients with improved access to world-class medical services across various healthcare facilities in UAE.

COMPETITIVE LANDSCAPE

Key Industry Players

Growing Focus of Market Players on Receiving Accreditations from Respective Healthcare Authorities to Attract More International Patients

The market consists of key players such as Apollo Hospitals Enterprise Ltd., Fortis Healthcare, Bumrungrad International Hospital, and The Johns Hopkins Hospital, providing extensive medical treatments. The growing focus of key players on maintaining care quality and services with international accreditations is one of the important factors fostering the growth of the market. In March 2024, Bumrungrad International Hospital received its second GHA accreditation with "Excellence," which helped the company establish its position in medical tourism.

Moreover, companies such as ASAN MEDICAL CENTER, Gleneagles Hospitals, Vejthani Hospital, and MELIVA are entering into strategic collaborations and acquisitions to expand their service offerings in the global market.

List of Key Medical Treatment Tourism Companies Profiled

- Apollo Hospitals Enterprise Ltd. (India)

- Fortis Healthcare (India)

- Bumrungrad International Hospital (Thailand)

- Charité (Germany)

- Sheba Medical Center (Israel)

- The Johns Hopkins Hospital (U.S.)

- ASAN MEDICAL CENTER (South Korea)

- Gleneagles Hospitals (India)

- Vejthani Hospital (Thailand)

- Ranka Hospital (India)

- MELIVA (Lithuania)

KEY INDUSTRY DEVELOPMENTS

- May 2025 - The Embassy of the Republic of Korea in Kuwait inaugurated the first-ever Korea Health & Beauty Festa, held from 15th to 17th May 2025. The landmark event spotlighted Korea's growing global reputation in advanced healthcare, cosmetic medicine, and wellness tourism, offering Kuwaiti audiences an immersive experience of the country's thriving health and beauty sectors.

- August 2024 - Bangkok Chain Hospital Public Company Limited opened a new "Kasetsart Saree Radiotherapy Specialist Clinic," a comprehensive cancer treatment center to enhance patient care and outcomes.

- July 2024 - The Medical City (TMC), a premier healthcare brand, and the Department of Tourism (DOT) have officially entered into a historic partnership aimed at positioning the Philippines as a top destination for health and wellness.

- January 2024 - Ferns N Petals launched a medical tourism venture named MediJourney, which will provide a comprehensive range of healthcare services across over 30 treatment segments, including cardiology and oncology. This initiative aims to streamline medical travel processes and enhance patient care.

- October 2022 - Aster Medcity launched a houseboat experience for treating medical tourists on board. The new initiative of the hospital came on the occasion of this 12 months's World Tourism Day.

REPORT COVERAGE

The global medical treatment tourism market report provides a detailed competitive landscape and market insights. In addition to the global medical treatment tourism market size, it covers regional analysis of different market segments, profiles of key market players, and market dynamics. Moreover, the market report encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 23.60% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation

|

By Service Type

|

|

By Age Group

|

|

|

By Service Provider

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 21.09 billion in 2025 and is projected to reach USD 140.88 billion by 2034.

In 2025, the market value in Europe stood at USD 7.54 billion.

The market will exhibit steady growth at a CAGR of 23.60% during the forecast period (2026-2034).

By service type, the dental procedures segment led the market.

The high burden of chronic diseases and expanding healthcare infrastructure in emerging countries are some of the important factors driving market growth.

Apollo Hospitals Enterprise Ltd., Fortis Healthcare, Bumrungrad International Hospital, and The Johns Hopkins Hospital are the major players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us