Metal Matrix Composites Market Size, Share & Industry Analysis, By Product Type (Aluminum MMC, Copper MMC, Refractory MMC, and Others), By Reinforcement Material (Silicon Carbide, Aluminum Oxide, and Others), By End-Use (Automotive, Aerospace & Defense, Electronics, Energy, Manufacturing Industry, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

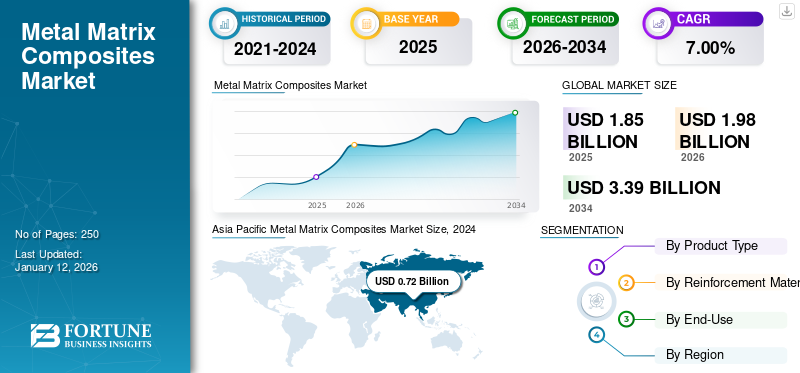

The global metal matrix composites market size was valued at USD 1.85 billion in 2025. The market is projected to grow from USD 1.98 billion in 2026 to USD 3.39 billion by 2034, exhibiting a CAGR of 7.00% during the forecast period. Asia Pacific dominated the metal matrix composites market with a market share of 42% in 2025.

Metal Matrix Composites (MMCs) are advanced materials consisting of a reinforced metal base with elements such as ceramics or fibers to enhance their properties. These materials play a vital role in modern engineering due to their excellent combination of high strength, rigidity, and low weight. Currently, these composites are highly used in automotive and aerospace industries due to their strength, wear resistance, and thermal conductivity. Additionally, these composites provide outstanding dimensional stability and thermal conductivity, which makes them ideal for use in electronics and thermal control systems. Increasing product demand from automotive, aerospace, and electronics industries will significantly drive the market growth. The companies leading the market include Materion Corporation, CPS Technologies, GKN Powder Metallurgy GmbH, DWA Aluminum Composites USA, Inc., and Coherent Corp.

Global Metal Matrix Composites Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 1.85 billion

- 2026 Market Size: USD 1.98 billion

- 2034 Forecast Market Size: USD 3.39 billion

- CAGR: 7.00% from 2026–2034

Market Share:

- Asia Pacific dominated the Metal Matrix Composites Market with a 42% share in 2025, driven by rapid industrial growth and rising demand in the automotive, aerospace, and electronics industries across China, India, Japan, and South Korea.

- By product type, Aluminum MMC is expected to retain the largest market share in 2025, supported by increasing demand from the automotive and aerospace industries due to its lightweight, corrosion resistance, and wear resistance.

Key Country Highlights:

- China: A leading contributor to regional demand due to massive production capacity and strong demand from the automotive and electronics industries.

- United States: Home to advanced aerospace and defense sectors, with increasing adoption of MMCs in turbine engines, military vehicles, and electric vehicles.

- India: Rapid industrialization and growing defense and automotive sectors are boosting MMC consumption, especially aluminum-based composites.

- Europe: Adoption is driven by advanced engineering capabilities and sustainability focus in countries like Germany, France, and the U.K., particularly across aerospace, automotive, and renewable energy sectors.

MARKET DYNAMICS

MARKET DRIVERS

Escalating Need for Durable and Lightweight Materials in Aerospace and Automotive Sectors to Drive Market Growth

The aerospace and automotive industries are key contributors to the rising demand for metal matrix composites, owing to their requirement for materials that offer both lightweight characteristics and exceptional mechanical strength. In aerospace industry, reducing the mass of components without sacrificing structural durability is vital for enhancing fuel efficiency, increasing payload capabilities, and improving overall performance. MMCs are perfectly suited for turbine blades, structural frames, and aircraft skins due to their high strength and resistance to extreme temperatures. Similarly, the automotive industry is turning to MMCs to meet strict emissions and fuel economy standards. These composites are widely used in high-stress areas such as engine parts, drive shafts, and brake systems, where traditional metals often underperform. Hence, increasing product demand from the aerospace and automotive industries is expected to drive metal matrix composites market growth.

MARKET RESTRAINTS

Limited Raw Materials and High Production Costs are Hindering Market Expansion

A significant factor limiting the broader use of MMCs is the high cost and limitations of raw materials. Unlike traditional metals, MMCs require advanced manufacturing techniques such as liquid metal infiltration, diffusion bonding, and powder metallurgy. These methods are not only labor-intensive but also demand precise control over variables such as temperature, pressure, and material composition, making them expensive. Moreover, the limited availability of raw aluminum and titanium restrict market growth as they are important factor in the manufacturing process.

MARKET OPPORTUNITIES

Advanced Manufacturing and Technological Innovation to Boost Market Growth

The combination of metal matrix composites with advanced production technologies such as additive manufacturing, automation, and Artificial Intelligence (AI)-driven design offers a major growth opportunity for the market. Traditionally, the production of metal matrix composites has been complex and expensive. However, the emergence of new manufacturing technologies is beginning to simplify these processes, reduce costs, and improve material consistency. Moreover, technological advancements such as robotics, biomedical implants, and marine engineering offer great opportunities for the metal matrix composites market. As industries continue to demand materials that perform reliably under extreme conditions while reducing weight and cost, the versatility and adaptability of MMCs position them as a key solution.

MARKET CHALLENGES

Complex Manufacturing Processes Challenges Market Development

The complicated production process of metal matrix composites is one of the major challenges of market growth. The manufacturing of MMCs is done by 4 methods including, solid-state method, semi solid-state method, liquid-state method, and vapor deposition. In solid-state method, two or more solid materials are sandwiched together using thermal and/or mechanical energy. In semi solid-state method, a powder blend is heated to form a semi-solid state, and then pressure is applied to produce composites. In liquid-state method, electroplating and electroforming processes are used, and in the vapor deposition method, physical vapor deposition is used. All these methods of manufacturing are lengthy and complex which increases the cost of the product, hence acts as a challenge to the market.

TRADE PROTECTIONISM

The global market is motivated by trade policies and protectionist measures. For instance, the U.K. steel industry has called for protectionist measures to address an impending surge of imported steel due to a global glut from China. This could impact the availability and pricing of raw materials for metal matrix composites production.

METAL MATRIX COMPOSITES MARKET TRENDS:

Growing Use of Electric & Hybrid Vehicles to Boost Market Growth

The automotive sector is increasingly utilizing MMCs in electric and hybrid vehicles to improve energy efficiency and extend battery life. Components such as brake rotors, pistons, and drive shafts benefit from the lightweight and wear-resistant properties of MMCs. As global electric vehicle market grows, manufacturers are exploring advanced materials to optimize performance and reduce energy consumption. This trend is particularly strong in Asia Pacific, where governments are incentivizing electric vehicles, and insisting on the purchase and local manufacturing of advanced automotive components.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product Type

Aluminum MMC is Leading due to Increasing Demand from Automotive and Aerospace Industries

Based on product type, the market is classified into aluminum MMC, copper MMC, refractory MMC, and others.

Aluminum MMC is the most widely adopted product type because of its exceptional blend of lightweight properties, mechanical strength, and corrosion resistance. These composites are typically reinforced with ceramics such as silicon carbide, alumina, or boron carbide to improve their wear resistance, thermal conductivity, and overall rigidity. The aluminum MMC offers stiffness and excellent wear resistance, making it highly suitable for automotive and aerospace applications, where reducing component mass without sacrificing durability is critical.

Copper MMC is a specialized class of advanced materials that combine the electrical and thermal conductivity of copper with enhanced mechanical properties of reinforcing materials such as graphite, carbon nanotubes, or ceramic particles such as silicon carbide and alumina. These composites are engineered to address the limitations of pure copper, particularly its relatively low strength and wear resistance. By mixing reinforcements, copper MMCs achieve improved hardness, wear resistance, and thermal stability while holding copper’s superior conductivity.

The refractory MMC segment is expected to grow at a significant rate during the forecast period. Refractory MMC are developed using high-melting-point metals such as tungsten, titanium, niobium, and molybdenum, which are reinforced with ceramics or fibers to deliver superior strength and thermal resistance. These composites are specially designed to perform in extreme environments, offering excellent stability at high temperatures, resistance to oxidation, and exceptional durability. Their unique properties make them invaluable in critical sectors such as aerospace, defense, and nuclear energy.

By Reinforcement Material

Growing Use of Silicon Carbide to Fuel Metal Matrix Composites Demand from Automotive and Aerospace Industries

Based on reinforcement material, the market is classified into silicon carbide, aluminum oxide, and others.

Silicon carbide holds highest share of the market. It is one of the most widely used reinforcement materials in metal matrix composites, valued for its excellent hardness, thermal conductivity, and wear resistance. When incorporated into the metal matrix, especially aluminum, silicon carbide enhances stiffness, reduces weight, and significantly improves the composite’s ability to withstand high temperatures and abrasive conditions. Its low density combined with high modulus of elasticity makes it ideal for applications in the aerospace and automotive industries, where material performance under thermal and mechanical stress is crucial.

Aluminum oxide segment is anticipated to grow substantially in the near future. Aluminum oxide is a widely used ceramic reinforcement in metal matrix composites for its excellent thermal stability, chemical inertness, and hardness. When added to metals such as aluminum or magnesium, alumina enhances wear resistance, tensile strength, and oxidation resistance. However, achieving uniform distribution and strong interfacial bonding between alumina particles and the metal matrix can affect performance. Ongoing research focuses on surface treatments and advanced processing methods to overcome these issues.

By End-Use

Automotive Segment to Dominate Owing to Rising Demand for Lightweight & Fuel-Efficient Vehicles

Based on end-use, the market is distributed into automotive, aerospace & defense, electronics, energy, manufacturing industry, and others.

Automotive is the largest end-use segment, driven by the need for fuel-efficient, high-performance, and lightweight vehicles. Metal matrix composites, especially aluminum-based composites, are extensively used in manufacturing engine blocks, pistons, drive shafts, and brake rotors. Additionally, as the demand for battery-electric vehicles rises, MMCs play a vital role in thermal management and structural support systems in EV architecture.

In the aerospace & defense end-use, metal matrix composites are valued for their excellent strength-to-weight ratio, high-temperature resistance, and durability. Decreasing the mass of aircraft components is essential to improving fuel efficiency, payload capacity, and overall performance. Moreover, in defense industry, metal matrix composites are used for high-performance applications that demand superior strength and durability. These composites are used in a wide range of defense equipment, including lightweight armor, missile components, gun barrels, and structural parts in military vehicles. Increasing product adoption in aircraft components and defense equipment will significantly drive the segment growth.

In the electronics industry, metal matrix composites are essential for thermal management and structural reliability in compact, high-performance devices. Additionally, these composites are used in casings for laptops, smartphones, and communication equipment due to their light weight and electromagnetic shielding properties. The rapid growth of 5G networks and data centers has also fast-tracked the need for reliable materials that can manage heat without compromising performance. This is anticipated to surge product demand in electronics industry.

Metal Matrix Composites Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific

Asia Pacific Metal Matrix Composites Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 0.77 billion in 2025 and USD 0.82 billion in 2026, primarily due to rapid industrial growth and rising demand in the automotive, aerospace, and electronics industries. China, India, Japan, and South Korea are witnessing strong economic expansion, driving the need for high-performance and lightweight materials. The region benefits from cost-effective manufacturing capabilities, plentiful raw materials, and a well-established supply chain.

North America

The growth of the market in North America is driven by the U.S. advanced aerospace and defense sectors. The region is home to leading aircraft manufacturers, space exploration companies, and military contractors that heavily rely on high-strength, lightweight materials. MMCs are extensively used in turbine engines, heat shields, and structural components to improve performance under extreme conditions. Additionally, the automotive industry in the U.S. is increasingly incorporating MMCs to meet fuel efficiency standards and reduce emissions.

Europe

In Europe, the market is driven by the region’s focus on sustainable development and advanced engineering. The U.K., Germany, and France are at the forefront of metal matrix composites adoption, particularly in automotive, aerospace, and renewable energy sectors. The region places strong importance on reducing carbon emissions and increasing fuel efficiency, prompting widespread use of lightweight composite materials.

Rest of the World (RoW)

In regions such as Latin America, and the Middle East & Africa, the MMC market is growing moderately due to increasing automotive, aerospace, and defense industries. Investments in modernizing infrastructure and energy projects, especially in oil-rich Middle Eastern countries, are major demand drivers. Additionally, Africa is beginning to explore MMCs in mining and energy-related machinery. As awareness and technological adoption grows, the countries in the RoW are expected to contribute more significantly to the global MMC market in the coming years.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in their Dominating Position

The market is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key global companies include Materion Corporation, CPS Technologies, GKN Powder Metallurgy GmbH, DWA Aluminum Composites USA, Inc., Coherent Corp., and Denka Company Limited. These companies compete based on product innovation, cost efficiency, and regional dominance, with a growing focus on lightweight and strong solutions for industrial uses. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, growing competition in the industry.

LIST OF KEY METAL MATRIX COMPOSITES COMPANIES PROFILED

- Materion Corporation (U.S.)

- CPS Technologies (U.S.)

- GKN Powder Metallurgy GmbH (Germany)

- SANTIER. (U.S.)

- Sumitomo Electric Industries, Ltd. (Japan)

- CYMAT Technologies Ltd. (Canada)

- DWA Aluminum Composites USA, Inc. (U.S.)

- Coherent Corp. (U.S.)

- Denka Company Limited. (Japan)

- Plansee (Austria)

- Loukus Technologies (U.S.)

- ADMA Products, Inc. (U.S.)

- CeramTec GmbH (Germany)

- Ferrotec Corporation (Japan)

- TISICS Ltd. (U.K.)

KEY INDUSTRY DEVELOPMENTS

- January 2024: Materion Beryllium & Composites announced completion of its operations for proprietary investment cast AlBeCast® aluminum beryllium products. This state-of-the-art casting capability will help the company to serve technically demanding customers in the aerospace, defense and precision industrial equipment industries.

- July 2022: II‐VI Incorporated has completed the acquisition of Coherent, Inc. “Coherent is an innovator with a portfolio of the most advanced technologies with manufacturer of metal matrix composites; after the acquisition, the II-VI name was changed into Coherent Corp.

REPORT COVERAGE

The global market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the metal matrix composites in key regions/countries, key industry developments, new product launches, details on partnerships, and mergers & acquisitions in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.00% from 2026-2034 |

|

Unit |

Value (USD Billion) Volume (Kiloton) |

|

Segmentation |

By Product Type

|

|

By Reinforcement Material

|

|

|

By End-Use

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.98 billion in 2026 and is projected to reach USD 3.39 billion by 2034.

In 2025, the market value stood at USD 0.77 billion.

The market is expected to exhibit a CAGR of 7.00% during the forecast period of 2026-2034.

The aluminum MMC led the market by product type.

The rapid growth of automotive industry is expected to drive the market.

Materion Corporation, CPS Technologies, GKN Powder Metallurgy GmbH, DWA Aluminum Composites USA, Inc., Coherent Corp., and Denka Company Limited are some of the leading players in the market.

Asia Pacific dominated the market in 2025.

Increasing investment in defense industry, rapid growth of electric vehicles, and rising electronic sector are some of the factors that are expected to favor product adoption.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us