Methylamine Market Size, Share & Industry Analysis, By Form (Gas and Liquid), By End-Use Industry (Pharmaceuticals, Agricultural Chemicals, Solvents, Plastics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

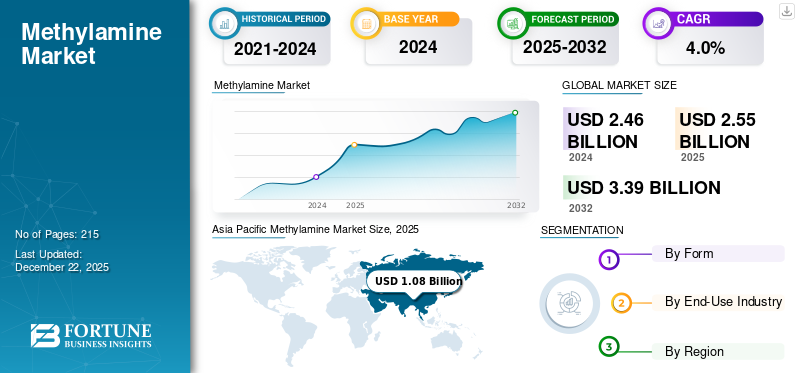

The global methylamine market size was valued at USD 2.51 billion in 2025 and is projected to grow from USD 2.61 billion in 2026 to USD 3.62 billion by 2034, exhibiting a CAGR of 4.0% during the forecast period. Asia Pacific dominated the methylamine market with a market share of 43% in 2025.

The global market is experiencing steady growth driven by its extensive application across various industrial sectors. It is a colorless gas or liquid with a strong ammonia-like odor and is primarily utilized as a building block in manufacturing pharmaceuticals, agrochemicals, and rubber chemicals. Its versatility as a key intermediate in synthesizing herbicides, insecticides, and pharmaceutical products underscores its importance in these markets. The pharmaceutical industry is a significant consumer of chemicals, used in the manufacture of active pharmaceutical ingredients, and it is also used in the agrochemical sector to produce pesticides and fungicides. Rising demand from the agriculture, chemical, and pharmaceutical industries will significantly drive the market growth.

The main players operating in the market include Mitsubishi Gas Chemical Company, Inc., BASF SE, Eastman Chemical Company, Sigma Aldrich, and Balaji Amines.

METHYLAMINE MARKET TRENDS

Increased Focus on Sustainable Production Methods Drives Market Growth

Sustainability is becoming a key trend in the market as manufacturers strive to reduce environmental impact and comply with stricter regulations. Companies are adopting green chemistry principles by developing cleaner synthesis routes that minimize waste and energy consumption. Using renewable raw materials and implementing catalytic processes helps improve efficiency and reduce carbon footprint. This shift toward sustainable manufacturing enhances brand reputation and aligns with growing consumer and regulatory demand for eco-friendly products.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rising Pharmaceutical Industry to Boost Market Development

The expanding pharmaceutical industry is a major driver of product consumption globally. It acts as a vital intermediate in synthesizing active pharmaceutical ingredients used in antibiotics, antihistamines, and respiratory drugs. With the increasing dominance of chronic diseases and rising healthcare awareness, demand for high-quality medications is accelerating. This progress is particularly remarkable in emerging markets, where improving healthcare infrastructure and increasing disposable incomes fuel pharmaceutical production. Additionally, the development of new drug formulations and personalized medicine requires reliable chemical intermediates, including methylamine. Hence, growing health awareness is expected to drive the methylamine market growth.

MARKET RESTRAINTS

Increasingly Strict Environmental Regulations are Limiting Market Growth

The market faces challenges due to increasingly stringent environmental regulations across key markets. Governments are imposing tighter controls on emissions, waste discharge, and chemical handling to minimize environmental and health risks. Compliance with these rules often requires significant investment in pollution control technologies and cleaner production processes, which can increase operational costs for manufacturers. In regions with stricter environmental norms, some manufacturers face challenges in maintaining competitive pricing while meeting compliance standards.

MARKET OPPORTUNITIES

Expanding Agrochemical Sector Offers Promising Opportunity for Market

The global demand for food and sustainable agriculture continues to rise, creating significant opportunities for producers. As farmers adopt advanced crop protection products to improve yields and decrease losses due to pests and diseases, the need for methylamine-based agrochemicals increases. Developing countries are modernizing their agricultural practices, using more herbicides, pesticides, and fungicides formulated with product derivatives. Additionally, the focus on environmentally friendly and bio-based agrochemicals also promotes innovation in product applications. With increasing government support for agricultural modernization and food security initiatives, the agrochemical industry is positioned for robust growth.

- As per the India Brand Equity Foundation (IBEF), India’s organic products in the Indian market are growing and are anticipated to rise with a CAGR of 25.2% between 2022-27, and also Indian agricultural sector is expected to increase to USD 24 billion by 2025 showcasing a major opportunity for the market as they are used for agriculture chemicals.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Unavailability Pose a Major Challenge to Market

The market is vulnerable to supply chain disruptions affecting the availability and cost of key raw materials such as methanol and ammonia. Factors such as geopolitical tensions, natural disasters, and transportation blocks can interrupt the steady supply of these essential inputs. Interruptions increase production costs and risk delayed deliveries to end-use industries, potentially disrupting pharmaceutical and agrochemical manufacturing schedules. Manufacturers with limited sourcing options or heavy reliance on imports face higher operational risks.

TRADE PROTECTIONISM

Trade protectionism has become a major issue impacting the global market. For example, in Europe, compliance with REACH regulations poses administrative and financial challenges to non-EU suppliers, and a product’s classification as a hazardous substance triggers the export. However, local producers in India and China are safeguarded through import duties to encourage domestic production. Moreover, geopolitical tensions and trade wars can disrupt the smooth flow of materials and goods, leading to volatility in the market.

Segmentation Analysis

By Form

Gas Segment Led Market Due to Its Ease of Handling in Controlled Environments

Based on form, the market is classified into gas and liquid.

The gas segment accounted for the largest share of the market. Methylamine in gaseous form is widely used in industrial applications due to its ease of handling in controlled environments and compatibility with various chemical processes. It is particularly valued in large-scale manufacturing setups where it can be efficiently transferred through pipelines and integrated into automated systems. The gaseous form is commonly utilized in the production of pharmaceuticals, pesticides, and solvents. Due to its high reactivity, the gas phase enables precise chemical synthesis, especially in manufacturing active pharmaceutical ingredients and crop protection products.

Liquid methylamine is preferred in many applications for its ease of storage and mixing into chemical processes that require solution-based inputs. It is widely used to synthesize resins, dyes, surfactants, and other specialty chemicals. In pharmaceutical and agrochemical industries, liquid form is a key raw material for producing intermediates under controlled conditions. Its solubility in water and various organic solvents enhances its versatility across multiple chemical reactions. It also reduces the risk of gas leaks and is easier to handle in facilities with limited infrastructure for gaseous chemicals.

By End-Use Industry

Increasing Need for Medicines & Drugs Boosts Product Adoption in Pharmaceuticals Industry

Based on the end-use industry, the market is classified into agricultural chemicals, pharmaceuticals, solvents, plastics, and others.

The pharmaceutical segment is the largest end-use industry in the market. Methylamine is widely utilized as a key building block for the synthesis of various active pharmaceutical ingredients and intermediates. Its role in producing drugs, such as antihistamines, analgesics, and antibiotics, makes it essential to pharmaceutical manufacturing. With global healthcare spending on the rise and increased R&D in drug development, the demand for pharmaceutical-grade products is growing rapidly. Additionally, expanding pharmaceutical production in emerging economies has further accelerated the need for reliable chemical intermediates.

The methyl-based amine plays a crucial role in the agricultural chemicals industry as a foundational intermediate in producing pesticides, herbicides, and fungicides. With global agricultural practices shifting toward higher efficiency and yield, the demand for methylamine-based agrochemicals continues to rise. Its application ensures improved pest control and supports sustainable farming practices by reducing crop losses. Additionally, rising concerns over food security and the need for agricultural growth further boost the adoption of advanced agrochemicals.

Methylamine is frequently used in making industrial and specialty solvents due to its solubility and chemical reactivity. It serves as a major chemical in producing many solvent compounds, which are widely applied in coatings, adhesives, dyes, and cleaning agents. The flexibility of the chemical in forming stable compounds with high solvency power makes it a favored component in solvent manufacturing. Electronics, textiles, and automotive industries rely on these solvents for precision cleaning and processing.

Methylamine Market Regional Outlook

By region, the market is categorized into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Methylamine Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the market with a share of 43% in 2025, fueled by rapid industrialization, growing population, and expanding end-use sectors. Countries such as China, India, and Japan are major contributors due to their extensive agrochemical, pharmaceutical, and plastic manufacturing industries. Lower production costs, easy access to raw materials, and supportive government policies encourage domestic and foreign investment in chemical manufacturing. The expanding agricultural sector and increasing pesticide use further support regional market growth.

North America

North America holds a significant methylamine market share due to its robust pharmaceutical and agrochemical industries. The U.S., in particular, has high consumption levels driven by advanced drug manufacturing, pesticide production, and strict product quality standards. Sustainability initiatives and shifts toward green chemistry also influence production and product development strategies. While market growth is relatively mature, steady demand from healthcare and agriculture sectors continues to sustain regional expansion.

Europe

Europe is a key industry for methyl-based amine, with strict regulations shaping production and application trends. Countries such as Germany, France, and Netherlands are home to advanced chemical and pharmaceutical industries, driving demand for high-purity methyl-based amine in drug synthesis and specialty chemicals. Europe is also witnessing a gradual shift towards bio-based intermediates, influencing the nature of chemical feedstock procurement.

Latin America

Latin America shows emerging potential for product consumption. Industrial development, infrastructure expansion, and growing demand for agricultural efficiency drive interest in chemical inputs. With proper support, the region could emerge as a vital future demand center for the market.

Middle East & Africa

Growing use of the product in agriculture, a burgeoning pharmaceutical industry, and more and more applications in industrial and water treatment are all fueled by rising investments in infrastructure and sustainability initiatives, which drive the product demand in the Middle East & Africa. As a result, consumption steadily increases across a variety of industries.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in Their Dominating Positions in Market

The market is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key global companies include Sigma Aldrich, Mitsubishi Gas Chemical Company, Inc., BASF SE, Eastman Chemical Company, and Balaji Amines, among others. These companies compete based on product innovation, cost efficiency, and regional dominance. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY METHYLAMINE COMPANIES PROFILED

- Mitsubishi Gas Chemical Company, Inc. (Japan)

- BASF(Germany)

- Eastman Chemical Company (U.S)

- Balaji Amines (India)

- Sigma Aldrich (Germany)

- Hefei TNJ Chemical Industry Co., Ltd. (China)

- Otto Chemie Pvt. Ltd. (India)

- Alkyl Amines Chemicals Limited (India)

- Chemanol (Saudi Arabia)

- Arclin (U.S.)

KEY INDUSTRY DEVELOPMENTS

- September 2024: BASF announced that it has inaugurated a new world-scale production plant for alkyl ethanolamines at its Antwerp Verbund site. This new investment will help the company to expand its production capacity for alkyl ethanolamines, including dimethyl ethanolamine (DMEOA) and methyl diethanolamine (MDEOA), by nearly 30 percent to over 140,000 tons per year.

- December 2023: BASF completed its capacity expansion for key specialty amines in the U.S. The expansion will help the company to produce more of its key polyetheramines and amine catalysts marketed under the Baxxodur and LupragenTM brands.

- February 2022: Eastman Chemical Company completed the expansion of its tertiary amine capacity, primarily DIMLA 1214, at both its Ghent, Belgium, and Pace, Florida, manufacturing sites. The expansion will help it meet the customer demand.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Estimated Year |

2026 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.0% from 2026-2034 |

|

Unit |

Value (USD Billion) Volume (Kilotons) |

|

Segmentation |

By Form

|

|

By End-Use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 2.61 billion in 2026 and is projected to reach USD 3.62 billion by 2034.

In 2025, the market value in Asia Pacific stood at USD 1.08 billion.

The market is expected to exhibit a CAGR of 4.0% during the forecast period of 2026-2034.

By form, the gas form led the market.

The rising pharmaceutical industry to boost market expansion.

Sigma Aldrich, Mitsubishi Gas Chemical Company, Inc., BASF SE, Eastman Chemical Company, and Balaji Amines are some of the leading players in the market.

Asia Pacific holds the largest share of the market.

The increase of healthcare infrastructure and the rising agriculture sector in various countries such as China, India, and the U.S. is one of the major factors that are expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us