Middle East Contact Center as a Service Market Size, Share & COVID-19 Impact Analysis, By Function (Interactive Voice Response (IVR), Multichannel, Automatic, Call Distribution/AI Call Routing, Computer Telephony Integration (CTI), Reporting and Analytics, Workforce Optimization, Customer Collaboration, and Others), By Enterprise Type (SMEs (Less than 50, and 50 to 250) and Large Enterprises (251 to 500, 501 to 1000, and More than 1000)), and Country Forecast, 2025-2032

Middle East Contact Center as a Service Market Size

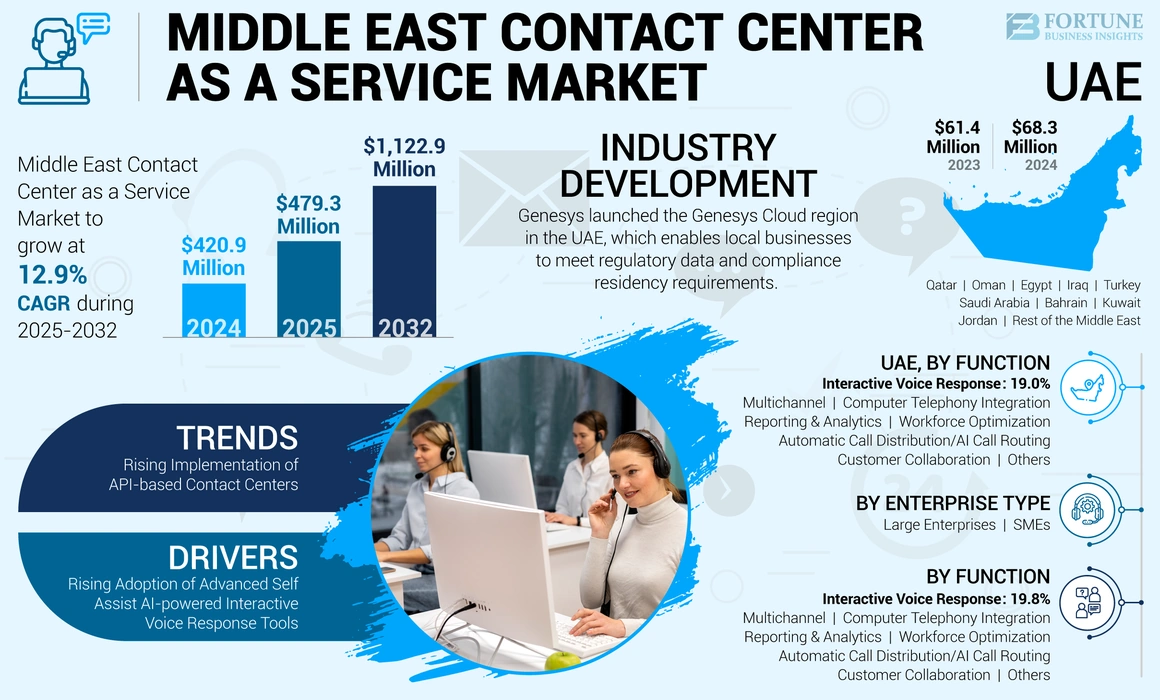

The Middle East contact center as a service market size was valued at USD 420.9 million in 2024. The market is projected to grow from USD 479.3 million in 2025 to USD 1,122.9 million by 2032, exhibiting a CAGR of 12.9% during the forecast period.

Contact Center as a Service (CCaaS) is a cloud-based model that leverages cloud computing infrastructure to host a suite of contact center applications and services, enabling seamless communication across various channels, including voice, email, chat, and social media. The Middle East market is witnessing a robust growth driven by the adoption of cloud-based communication solutions by incorporating advanced features, such as omnichannel support, artificial intelligence (AI)-enabled chatbots, and real-time analytics.

Key players are leveraging technologies, including voice recognition and natural language processing, to enhance customer interactions and foster scalability and flexibility in contact center operations. The region's enterprises are increasingly embracing CCaaS to optimize customer engagement, streamline workflows, and ensure compliance with industry standards, which is driving the Middle East contact center as a service market growth.

COVID-19 IMPACT

Surge in Remote Work and Demand for Digital Customer Engagement amid the Pandemic Boosted Market Growth

The COVID-19 pandemic significantly impacted the Middle East contact center as a service market, reshaping dynamics and strategies within the industry. With the necessity for remote work and increased demand for digital customer engagement, organizations in the Middle East accelerated their adoption of the cloud-based contact center as a service solution. This shift is underscored by a heightened emphasis on features, such as virtual call centers, omnichannel support, and Artificial Intelligence (AI)-driven automation.

Technical aspects, such as the deployment of secure and scalable cloud infrastructure, became paramount, enabling contact centers to maintain operational continuity while ensuring data privacy and compliance. The pandemic-induced disruptions highlighted the resilience of cloud-based contact center as a service, allowing businesses to quickly adapt to changing circumstances, manage surges in customer inquiries, and deploy remote agent solutions with minimal infrastructure overhaul. Additionally, the integration of advanced analytics and AI technologies within CCaaS platforms became crucial for extracting meaningful insights from the increased volume of customer interactions, aiding in personalized customer experiences and strategic decision-making.

Middle East Contact Center as a Service Market Trends

Rising Implementation of API-based Contact Centers to Fuel Market Growth

Organizations are strategically leveraging Application Programming Interfaces (APIs) to easily integrate contact center functionalities with diverse business applications, ensuring a unified and interconnected customer service ecosystem. For instance, leading e-commerce platforms in the Middle East are adopting API-based contact centers to synchronize customer data, order information, and support services to enhance customer experience.

API-based contact centers in the region offer a technologically advanced approach, facilitating the real-time exchange of information between various systems. This integration enables businesses to harness customer data effectively, improving agent efficiency and enabling personalized customer interactions. In practice, players in the region’s telecom industry are integrating APIs into their contact centers, allowing customers to seamlessly transition between self-service platforms and live-agent assistance for a more fluid and tailored customer journey.

For instance,

- In March 2022, Twilio introduced Flex Conversations, a new API for its cloud-based contact center platform, Flex. This single API integrates SMS, chat, and WhatsApp on the Flex platform, allowing users to deliver seamless experiences across these digital channels. Twilio Flex is described as a "truly unified, multichannel contact center platform," empowering companies to offer comprehensive customer journeys within a single user interface.

The strategic implementation of API-based contact centers is aligned with the region's emphasis on digital transformation and innovation. By enabling enhanced connectivity between contact center applications and business processes, organizations can unlock new possibilities in customer engagement. Thus, the above-mentioned factor is expected to expand the Middle East contact center as a service market share during the forecast period.

Download Free sample to learn more about this report.

Middle East Contact Center as a Service Market Growth Factors

Rising Adoption of Advanced Self Assist AI-powered Interactive Voice Response Tools to Drive Market Growth

The Middle East is witnessing a substantial surge in the adoption of advanced self-assist AI-powered interactive voice response (IVR) tools, acting as a significant catalyst for the growth of the Middle East’s market in the region. Organizations are increasingly leveraging Natural Language Processing (NLP) and machine learning algorithms within their IVR systems, facilitating more sophisticated and intuitive self-service interactions for customers. Prominent businesses in the region, including financial institutions, are deploying AI-powered IVR systems to enable customers to access account information and securely perform transactions using voice commands.

For instance,

- In November 2022, Gupshup, a conversational engagement company, acquired Knowlarity Communications, which specializes in cloud communications and AI-powered voice assistants. This acquisition enhances Gupshup's position in voice and video communications, expanding its Conversational Messaging suite. Knowlarity's expertise in the voice-based Conversational Engagement market aligns with Gupshup's strategy, targeting a substantial total addressable market of nearly USD 18 billion by 2024, transforming contact centers and smart voice systems.

- In February 2022, Unifonic introduced its Voice solutions in the UAE, highlighting the company's dedication to advancing the business messaging ecosystem in the region. The aim is to empower enterprises with enhanced system-initiated voice functions. Unifonic Voice solutions leverage automation to facilitate client-customer connections. This is achieved through turnkey voice experiences, seamlessly integrating with various mobile applications, online solutions, and business systems using a straightforward programmable Voice API. Already successful in Saudi Arabia, UAE organizations can access and benefit from this advanced technology.

The integration of AI-driven self-assist tools is driven by the region's commitment to enhancing customer experiences through intelligent automation. These tools, powered by advanced analytics, analyze historical customer data to predict user intents, allowing for personalized and context-aware interactions. A notable illustration is the deployment of AI-powered IVR in the telecommunications sector, where customers can efficiently resolve common queries, such as billing or service disruptions using the self-service options, thereby optimizing operational efficiency and improving customer satisfaction.

RESTRAINING FACTORS

Increasing Risk of Fraudulent Activities and Data Security Challenges to Impede Market Growth

The market in the region faces significant hindrances due to the increasing risk of fraudulent activities and persistent data security challenges. Notably, the financial sector in the Middle East encounters a rising threat landscape, with cybercriminals employing techniques, such as phishing and identity theft, to exploit vulnerabilities in contact center operations. For instance,

- In September 2023, According to Sum and Substance Ltd data, fraudulent activities contributed 0.8% in Israel and 1.4% in Qatar, respectively. This threat involves creating lifelike entities using genuine individuals’ documents, posing a distinct challenge for verification providers. In addition, Israel, Saudi Arabia, and Qatar experienced a notable increase in forced verification cases, representing 5%, 2.5%, and 11% of all fraud instances in 2023, respectively. Forced verification involves subjecting individuals to verify procedures against their will, potentially indicating illicit activities. This rise emphasizes the heightened necessity for advanced authentication and verification measures to counter evolving fraudulent strategies in contact centers.

The region is grappling with the evolving complexity of fraudulent activities, necessitating the deployment of sophisticated cybersecurity measures to safeguard sensitive customer information within the contact center as a service framework. The complicated landscape of fraudulent activities necessitates a complex cybersecurity strategy within CCaaS solutions in the Middle East. This strategy involves implementing advanced authentication protocols, encryption technologies, and real-time anomaly detection systems to fortify defences against unauthorized access and data breaches. Compliance with stringent regional data protection laws further compounds the challenge, urging businesses to navigate a complex legal landscape and ensure robust security measures within their contact center infrastructure.

Middle East Contact Center as a Service Market Segmentation Analysis

By Function Analysis

Need for Automating Customer Interactions to Surge Segment Growth for IVR

By function, the market is divided into interactive voice response (IVR), multichannel, automatic, call distribution/AI call routing, computer telephony integration (CTI), reporting and analytics, workforce optimization, customer collaboration, and others.

The interactive voice response (IVR) segment holds the highest market share due to its pivotal role in automating customer interactions through voice recognition, speech analytics, and natural language processing. The technical efficiency of IVR systems in routing calls, providing self-service options, and seamlessly integrating with backend systems enhances the operational productivity, reduces agent workload, and ensures a streamlined customer experience, making it a cornerstone technology in the contact center as a service ecosystem.

The workforce optimization segment exhibits the highest CAGR due to its integration of advanced technologies, such as speech analytics, quality monitoring, and performance management. The technical prowess of workforce optimization in enhancing agent productivity, optimizing resource utilization, and leveraging actionable insights from customer interactions aligns with the evolving demands for data-driven decision-making, contributing to its significant growth rate within the CCaaS ecosystem.

By Enterprise Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Focus on Scalability and Cost-effectiveness to Fuel SMEs Segment Growth

Based on enterprise type, the market is bifurcated into SMEs and large enterprises.

The SMEs segment exhibits the highest CAGR due to the scalability and cost-effectiveness offered by cloud-based CCaaS solutions. The technical advantages, such as rapid deployment, flexible subscription models, and on-demand resource allocation, cater to the dynamic needs of SMEs, empowering them with sophisticated contact center capabilities, including omnichannel support, real-time analytics, and Artificial Intelligence (AI)-driven automation, fostering their accelerated adoption within the CCaaS market.

The large enterprises segment holds a comparatively lesser share than SMEs due to factors, such as existing investments in on-premises solutions, complex integration requirements, and the need for customized, enterprise-grade features. The technical intricacies of migrating from legacy systems, ensuring seamless integration with diverse enterprise applications, and addressing stringent security and compliance standards contributes to a slower adoption rate among large enterprises within the rapidly evolving CCaaS landscape.

COUNTRY INSIGHTS

The report studies the market across the countries, such as Saudi Arabia, Bahrain, UAE, Kuwait, Qatar, Oman, Egypt, Iraq, Turkey, and Jordan.

UAE dominates this market as it is known for its vibrant business environment and commitment to innovation and has emerged as a dynamic player in the global Business Process Outsourcing (BPO) and contact center industry. The country’s strategic location, multilingual talent pool, and robust digital infrastructure makes the UAE a compelling destination for businesses seeking outsourcing solutions. Owing to its cultural diversity, the UAE boasts a workforce fluent in English, Arabic, and a variety of other languages, positioning it as a hub for global customer service.

To know how our report can help streamline your business, Speak to Analyst

The market in Egypt is estimated to grow with the highest CAGR during the forecast period. Egypt has become a major hub for the labor market with a growing focus on the IT services and outsourcing industries. Egypt has constantly located itself to become a major hub of business and technology services to organizations situated in Europe, North America, and Middle East & Africa. As a result, egypthas developed to become one of the leading business process outsourcing (BPO) and contact center destination in the global marketplace. According to the Offshore BPO Confidence Index, Egypt ranked in 3rd place in the global BPO industry in 2023. This shows the growth of Egypt in the BPO industry, which may be of interest to many multinational companies that operate in this promising industry and want to invest in Egypt.

Egypt has constantly located itself to become a major hub of business and technology services to organizations situated in Europe, North America, and the Middle East & Africa. As a result, the country has developed to become one of the leading business process outsourcing (BPO) and contact center destination in the global marketplace.

The market is witnessing growth in Saudi Arabia due to factors including digital transformation among industries and technological advancements. The Saudi Vision 2030 aims to transform the ICT hub in Saudi Arabia, supported by advanced digital infrastructure, modern technologies, and diverse investments.

Bahrain’s market for contact center as a service is estimated to grow significantly in the coming years as the country's GDP is recording growth from non-oil sectors. Sectors, including telecom, tourism, and BFSI, among others, are contributing to the country’s GDP as various initiatives have been taken to support the country’s GDP.

Iraq's business scenario has been undergoing major transformations, driven by increasing internet penetration, a young population, and increasing consumer expectations. In such a dynamic setting, providing excellent customer service has become an essential factor in gaining a competitive edge. Contact centers can be vital in meeting these demands efficiently and effectively.

Jordan is gaining popularity as a thriving ITO/BPO hub, and it is an attractive destination for businesses that are seeking to outsource their IT and business processes. According to a Royal Court statement, from 2018 to 2021, the BPO and contact center sector attracted foreign investment and provided around 8,000 jobs. This factor is expected to fuel the market during the forecasted period.

Turkey, a dynamic and rapidly developing country, is becoming an attraction for foreign investments in the contact center and BPO industry. The Turkish BPO and contact center industry is marked by its commitment to quality assurance and data security. Adhering to internationally recognized standards such as ISO and Six Sigma and following strict data privacy regulations, Turkish BPO companies have built a reputation for trustworthiness and reliability.

The market growth in Qatar is propelling. Qatar has a strong development plan specifically in the ICT sector and is open to working with U.S. companies to obtain safe, top-quality, and secure products and services. Major ICT players are investing in the country; for instance, in June 2023, Google invested around USD 19 billion and launched its Cloud Region in Qatar with a vision to contribute to Qatar's economic activity over the next seven years and create job opportunities.

The market in Oman is expected to witness growth as the government of the country is actively following a development plan that focuses on diversification, industrialization, and privatization, with the aim of reducing the country’s reliance on the oil sector’s contribution to GDP and creating more job opportunities for the increasing number of the young population entering the workforce.

Kuwait’s market is estimated to witness substantial growth in coming years as the contact centre and BPO providers are investing in Kuwait to enhance their presence. Many contact center solution providers and BPO companies are partnering with Kuwaiti firms with the aim of providing proven management skills and technical expertise in managing a contact center and delivering a seamless customer experience.

Key Industry Players

Key Players Launch New Products to Strengthen Market Position

Major players in the market are actively creating advanced solutions to cater to customer demands. They also focus on enhancing their existing product portfolio to deliver flexible solutions with unique attributes. Furthermore, these organizations proactively pursue collaboration, acquisitions, and partnerships to bolster their product offerings.

List of Top Middle East Contact Center as a Service Companies:

- Genesys (U.S.)

- NICE (Israel)

- Cisco System, Inc. (U.S.)

- Twilio Inc. (U.S.)

- Avaya LLC (U.S.)

- Vonage (U.S.)

- Orange Business (France)

- Silah Gulf (Bahrain)

- Bevatel (Saudi Arabia)

- Kalaam Telecom (Bahrain)

KEY INDUSTRY DEVELOPMENTS:

- In October 2023, Genesys, a provider of AI-powered cloud solutions, launched its Genesys Cloud region in the UAE. This launch enables local businesses to meet regulatory compliance and data residency requirements by keeping sensitive customer data within the region while transitioning contact centers to the cloud. Leveraging the AWS Middle East (UAE) Region, Genesys aims to empower GCC businesses with the latest AI and digital innovations from Genesys Cloud, facilitating faster, smarter, and more personalized experiences while prioritizing security, compliance, and service-level requirements.

- In October 2023, Qtel and Cisco partnered by signing a memorandum of understanding (MOU). This collaboration aims to introduce new services for business customers and consumers in Qatar, leveraging the combined skills, capabilities, and solutions of both companies. The MOU aligns Cisco's Smart Connected Communities vision with Qatar Telecom's expertise in telecommunications. This agreement facilitates the sharing of knowledge and expertise between Qtel and Cisco in the development of comprehensive network and communication solutions.

- In April 2023, Redington, a technology solution provider in the Middle East and Africa, partnered with Genesys. This partnership enables Redington to provide the Genesys Cloud CX™ Platform, built on Amazon Web Services (AWS), to their customers across the region. The AWS SCA partnership with Redington strengthens this alliance, and Genesys empowers regional businesses to experience the personalized cloud seamlessly.

- In October 2022, NICE announced that IGT Solutions, a next-gen CX company, leveraged NICE CXone's leading cloud platform for seamless customer interactions in the Travel and Hi-Tech industries. With over 20 years of experience, IGT has been providing integrated business process management, technology, and digital services across diverse sectors.

- In February 2022, NICE and Etisalat Digital partnered to initiate the use of the CXone platform in the UAE. This partnership streamlined the path to the cloud for Etisalat customers, offering seamless digital self-service and agent-assisted experiences. Through CXone, Etisalat Digital is well-positioned to guide organizations in transforming their business through effective customer communication.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 12.9% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Function, Enterprise Type, and Country |

|

Segmentation |

By Function

By Enterprise Type

By Country

|

Frequently Asked Questions

The market is projected to reach USD 1,122.9 million by 2032.

In 2024, the market was valued at USD 420.9 million.

The market is projected to grow at a CAGR of 12.9% during the forecast period.

The SMEs are expected to have the highest CAGR in the market.

Rising adoption of advanced self-assist AI-powered interactive voice response tools to drive the market growth.

Geneys, NICE, Cisco Systems, Inc., Twilio Inc., Avaya LLc, Vonage, Orange Business, Silah Gulf, Bevatel, and Kalaam Telecom are the top players in the market.

UAE is expected to hold the highest market share.

By function, workforce optimization is expected to grow with a highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us