Minimally Invasive Surgery Devices Market Size, Share & Industry Analysis, By Type (Inflation Devices, Guiding Devices, Endoscopic Devices, Laparoscopic Devices, Robotic Assistive Surgery Devices, Navigation & Visualization Systems, and Others), By Application (Cardiology, Gastrointestinal, Orthopedic, Gynecological, Neurology, Dental, and Others), By End-user (Hospitals & ASCs, Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

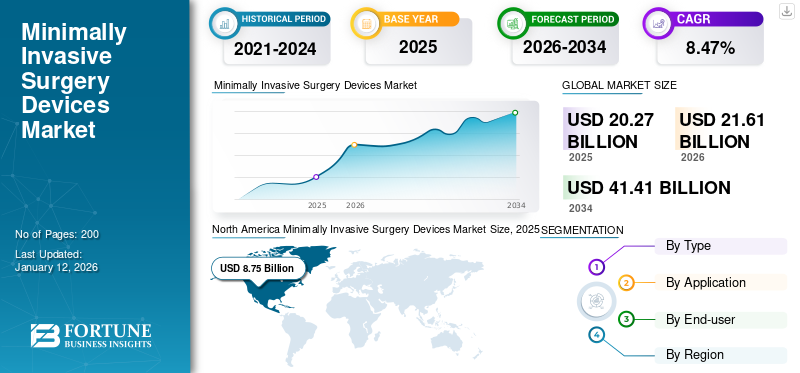

The global minimally invasive surgery devices market size was valued at USD 20.27 billion in 2025. The market is projected to grow from USD 21.61 billion in 2026 to USD 41.41 billion by 2034, exhibiting a CAGR of 8.47% during the forecast period. North America dominated the minimally invasive surgery devices market with a market share of 43.18% in 2025.

Minimally Invasive Surgery (MIS) devices are specialized tools designed to perform surgical procedures through small incisions or natural body openings, minimizing trauma to the patient. These devices include handheld instruments, guiding devices, inflation devices, and endoscopic devices. These devices collectively enable surgeons to perform complex operations with smaller incisions, leading to reduced pain, quicker recovery, less scarring, and a lower risk of infection compared to traditional open surgery.

The growth of the global minimally invasive surgery devices market is anticipated to be driven by the rising preference for minimally invasive procedures to avoid blood tests and reduce pain post-surgery. Additionally, the increasing prevalence of chronic conditions such as cardiovascular disorders, obesity, and neurological ailments necessitates surgical interventions, thereby driving demand for minimally invasive surgery solutions.

Some of the major players in the market are Medtronic, Johnson & Johnson Services, Inc., and Koninklijke Philips N.V. These players are focused on increasing investments, expanding geographic presence, and collaboration to develop and launch new products with other companies to gain a significant portion of the market.

Minimally Invasive Surgery Devices Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 20.27 billion

- 2026 Market Size: USD 21.61 billion

- 2034 Forecast Market Size: USD 41.41 billion

- CAGR: 8.47% from 2026–2034

Market Share:

- North America dominated the global minimally invasive surgery devices market with a 43.18% share in 2025, attributed to well-established healthcare infrastructure, high surgical volumes, and favorable reimbursement policies for minimally invasive procedures.

- Endoscopic Devices held the largest market share by type in 2024, driven by increasing adoption in endovascular surgeries, providing high-definition, magnified imaging with minimal tissue trauma.

Key Country Highlights:

- Japan: Rising elderly population and strong investments in robotics for surgical applications are accelerating the adoption of robotic-assisted minimally invasive procedures in hospitals and academic centers.

- United States: Dominance driven by a high volume of MIS procedures in orthopedic and cardiology applications, supported by extensive infrastructure, Medicare reimbursements, and the growing number of Medicare-certified ASCs (over 6,300 as of 2024).

- China: Rapid aging population (297 million aged 60+ in 2023) is driving demand for minimally invasive interventions, with growing investments in robotic surgery platforms and increased hospital capacity for MIS techniques.

- Europe (e.g., U.K., Germany): Increasing adoption of robotic-assisted surgeries, particularly in the U.K., with notable developments like the first pediatric robotic surgery performed using a next-gen device at Evelina London Children’s Hospital in early 2025.

MARKET DYNAMICS

Market Drivers

Increasing Incidence of Chronic Conditions to Drive the Demand for Minimally Invasive Surgery Devices

In recent years, there has been a significant rise in the incidence of chronic diseases such as cardiovascular disorders, cancer, diabetes, and obesity. These conditions are more common among aged individuals.

- For instance, according to the data published by the British Heart Foundation in January 2025, around 620.0 million people worldwide are living with heart and circulatory diseases.

Many of these conditions require surgical intervention, and Minimally Invasive Surgery offers significant advantages over traditional open surgery. These benefits include reduced pain, shorter hospital stays, lower risk of infection, and faster recovery times. As a result, both patients and healthcare providers are increasingly opting for minimally invasive procedures to manage chronic illnesses more effectively.

- For instance, as of 2025, Bangkok Hospital mentioned that more than 4.0 million patients worldwide undergo arthroscopic knee surgery annually.

Market Restraints

High Cost of Minimally Invasive Surgery Devices and Accessibility Barriers May Hamper Market Growth

High initial investment and maintenance costs remain a significant restraint for the Minimally Invasive Surgery (MIS) devices market. The adoption of advanced MIS technologies, such as robotic surgical systems, sophisticated imaging equipment, and specialized instruments, requires substantial upfront capital.

- For instance, robotic systems such as the Da Vinci Surgical System can cost around USD 2.0 million initially, excluding additional expenses related to staff and surgeon training, ongoing maintenance, and surgical accessories. These costs impose a heavy financial burden on healthcare facilities, particularly smaller hospitals and clinics.

These high costs limit the accessibility of MIS devices to well-funded, large-scale medical hospitals and restrict their adoption in rural or resource-constrained settings. As a result, the widespread adoption of minimally invasive procedures is hampered, especially in regions with limited financial resources and healthcare infrastructure.

Market Opportunities

Rising Number of Ambulatory Surgical Centers (ASCs) to Amplify Product Demand

In recent years, the number of Ambulatory Surgery Centers (ASCs) has increased significantly, aiming to reduce the inpatient burden on hospitals for performing minimally invasive procedures, including arthroscopic surgeries and others.

- For instance, according to the data published by the Ambulatory Surgery Centers Association (ASCA) in September 2024, there were over 6,300 Medicare-certified ASCs in the U.S.

ASCs, which specialize in outpatient procedures, are increasingly adopting MIS technologies due to their alignment with cost-effective, patient-centric care.

Procedures such as total knee/hip replacements, cataract surgeries, and gastrointestinal interventions, which are traditionally performed in hospitals are shifting to ASCs. This trend is creating a sustained demand for MIS devices, including laparoscopes, robotic systems, and advanced imaging tools. Moreover, the cost advantages of ASCs and favorable reimbursement policies make them ideal for high-volume MIS procedures.

Market Challenges

Shortage of Skilled Professionals to Hinder Market Growth

The shortage of skilled professionals poses a significant challenge to the growth of the Minimally Invasive Surgery devices market. Performing MIS procedures requires specialized training and expertise; however, there is a persistent and growing global shortage of qualified surgeons and support staff.

- For instance, according to the American Association of Medical Colleges' 2024 report, the U.S. alone could face a shortage of 15,800 to 30,200 surgeons across all specialties by 2036.

This shortage is even more pronounced in rural and low-resource regions, where limited access to advanced surgical training and experienced personnel further restricts the adoption of MIS techniques. The lack of skilled professionals leads to delays in surgical care, suboptimal patient outcomes, and underutilization of advanced MIS devices, ultimately hindering market expansion.

MINIMALLY INVASIVE SURGERY DEVICES MARKET TRENDS

Technological Advancements in Minimally Invasive Surgery Devices to Support Industry Development

Technological advancements are significantly transforming the Minimally Invasive Surgery devices market, reshaping modern surgical standards. Advancements include the integration of robotic-assisted systems such as Intuitive Surgical's da Vinci and Medtronic's Hugo, which enhance surgical precision, dexterity, and visualization. This system enables complex procedures through smaller incisions and reduces patient recovery times.

- For instance, Medtronic submitted its Hugo RAS system to the FDA for a urologic indication, marking a significant step in its pursuit of broader market access.

Moreover, Artificial Intelligence (AI) is increasingly being embedded in surgical devices, powering smart instruments with autonomous navigation, adaptive control, and real-time feedback, further improving surgical accuracy and patient safety.

Innovations in endoscopic and laparoscopic equipment, such as high-definition cameras, 3D imaging, robotics, and miniaturized instruments, are expanding the scope and effectiveness of minimally invasive surgeries.

Single-Port Laparoscopic Surgery to Fuel Market Progress

Advances in single-port laparoscopic surgery and natural orifice transluminal endoscopic surgery have revolutionized minimally invasive surgeries by improving recovery times and reducing scarring. These procedures further seek specialized minimally invasive surgical instruments, which are expected to surge in popularity in the near future.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic negatively impacted market growth in 2020 attributed to the decrease in surgical volume and visits to surgeons. This led to decreased demand for minimally invasive surgery devices.

- For instance, according to the article published by the National Center for Biotechnology Information (NCBI) in October 2021, the popularity and usage of minimally invasive surgery significantly declined during the pandemic.

However, the market recovered to pre-pandemic levels in 2021 and 2022 due to the relaxation of lockdown restrictions and increased surgical interventions in healthcare settings. Furthermore, the rising cardiovascular and other complications are expected to fuel the demand for MIS procedures, driving market growth in the coming years.

SEGMENTATION ANALYSIS

By Type

Increasing Number of Endovascular Surgeries to Spur Endoscopic Devices Segment Growth

Based on type, the market is classified as inflation devices, guiding devices, endoscopic devices, laparoscopic devices, robotic assistive surgery devices, navigation & visualization systems, and others.

The endoscopic devices segment dominated the market in 2024 fueled by an increase in the number of endovascular surgeries. Endoscopic devices provide high-definition, magnified images that allow surgeons to perform delicate procedures with minimal tissue damage, leading to faster recovery and less postoperative pain.

The inflation devices segment accounted for second-largest share in 2024. The growth of the segment is attributable to its crucial role in laparoscopic and endoscopic surgeries to create and maintain a working space inside the body, typically by insufflating gas (e.g., CO2) into the abdominal cavity.

The guiding devices accounted for the third-largest share of the global market in 2024. The segment’s growth is expected to be driven by the growing demand for guiding devices as they offer enhanced precision and control during complex procedures, which reduces complications and improves recovery times.

The laparoscopic devices segment is anticipated to expand at a substantial CAGR during the forecast period. The growth can be attributed to the benefits associated with the use of laparoscopic devices such as reduced scarring, shorter hospital stays, and lower infection risks compared to open surgeries.

The robotic assistive surgery devices segment is anticipated to expand at a fastest CAGR during the forecast period. The growth can be attributed to increasing strategic collaborations and demonstrations of Robotic-Assisted Surgery (RAS) devices by prominent players and universities for minimally invasive surgeries.

- For instance, in November 2024, Virtual Incision, the manufacturer of MIRA Surgical System (MIRA), a Robotic-Assisted Surgery (RAS) device, and Sovato Health, a comprehensive solution designed to enable remote surgery, announced the successful completion of a preclinical demonstration of nearly 40,000 miles combined distance.

The navigation & visualization systems accounted for a considerable market share in 2024. Advanced navigation and visualization systems, including 3D imaging, Augmented Reality (AR), and real-time imaging, significantly improve surgical accuracy by providing detailed intraoperative guidance. These technologies reduce errors, enhance decision-making, and enable complex procedures to be performed minimally invasively, thereby improving patient outcomes and reducing complications. Such benefits are expected to increase the adoption, which is expected to drive segment growth in the coming years.

The others segment, including electrosurgical devices and auxiliary devices, is expected to grow at a stagnant rate due to their increasing popularity in minimally invasive surgeries in healthcare settings for cutting, coagulation, and hemostasis.

By Application

Growing Incidence of Fractures and Sports Injuries to Fuel Growth of Orthopedic Segment

Based on application, the market is classified into cardiology, gastrointestinal, orthopedic, gynecological, neurology, dental, and others.

The orthopedic segment dominated the market in 2024. The increasing number of fractures and other orthopedic injuries is driving the demand for arthroscopic surgeries as they cause less blood loss and shorten recovery time. Moreover, the adoption of arthroscopic surgeries for joint replacement and spinal procedures is also expected to propel the use of minimally invasive surgery devices, thereby expected to drive the segment’s growth.

The cardiology segment held the second-largest share of the market in 2024. The growing incidence of cardiovascular diseases is expected to boost surgical demand, including minimally invasive surgeries such as heart valve repair, in several countries, fueling the segment’s growth in the forthcoming years.

The gastrointestinal segment held a substantial market share in 2024. There has been an increasing use of laparoscopes and robotic systems to treat digestive disorders in recent years. These devices reduce tissue trauma, recovery time, and scarring compared to traditional open surgery.

The gynecological segment is expected to grow at the fastest CAGR in coming years. The increasing patient visits to gynecology clinics, driven by rising complications such as ovarian cysts and fibroids worldwide, are expected to fuel the demand for effective solutions, such as minimally invasive surgeries.

The neurology segment is expected to grow significantly in the forthcoming years due to the increasing cases of brain cancer and other conditions. This drives demand for minimally invasive procedures, propelling the segment’s growth.

- For instance, according to the data published by the American Cancer Society, Inc. in January 2025, nearly 24,820 malignant tumors of the brain or spinal cord were diagnosed.

The dental segment is projected to grow considerably in the coming years. Minimally invasive dental surgery focuses on preserving as much natural tooth structure as possible, utilizing techniques such as resin infiltration and adhesive dentistry to repair and restore teeth with minimal intervention. This approach prioritizes prevention and early intervention, often avoiding extensive procedures such as drilling and filling. Such a scenario is expected to fuel the segment’s growth in the forthcoming years.

By End-User

Strategic Launch of Robotic Surgery Institutes Encourage Hospitals & ASCs Segment Growth

Based on end-user, the market is segmented into hospitals & ASCs, clinics, and others.

The hospitals & ASCs segment dominated the market in 2024, attributed to the high preference for performing minimally invasive surgeries in these settings due to significant resources and reimbursement for these procedures. Moreover, the strategic launch of robotic surgery institutes for minimally invasive surgery is expected to fuel segment growth.

- For instance, in January 2025, Prashanth Hospitals launched the Institute of Robotic Surgery and a surgical robotic system for minimally invasive surgeries.

The clinics segment held the second-largest share in 2024. The increasing patient volume to specialty clinics for specific conditions such as dental, ophthalmic, and gynecological is expected to increase the minimally invasive surgeries performed in these settings.

The others segment, including academic clinics and military hospitals, is increasingly performing minimally invasive surgeries for training and accidental purposes, which is expected to increase the adoption of minimally invasive surgery devices.

MINIMALLY INVASIVE SURGERY DEVICES MARKET REGIONAL OUTLOOK

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Minimally Invasive Surgery Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market in 2025. The market in North America stood at USD 8.75 billion in 2025. The region’s well-established healthcare infrastructure favors the adoption of minimally invasive procedures, which is expected to drive minimally invasive surgery devices market growth.

In the U.S., reimbursement policies for minimally invasive surgeries, such as arthroscopic and laparoscopic surgeries, are expected to increase surgical volume in hospital outpatient departments, ASCs, and other healthcare settings. The United States market is expected to reach USD 8.81 billion by 2026.

- For instance, as of 2025, for knee arthroscopy with meniscus repair (CPT code 29882), the average patient payment in hospital outpatient departments is around USD 784, indicating Medicare's share is substantial but variable depending on the setting.

Europe

The market in Europe held a substantial share in 2024. The increasing use of robot surgery devices, particularly in the U.K., is expected to enhance the landscape for minimally invasive surgery in the region. The United Kingdom market is expected to reach USD 0.65 billion by 2026, while the Germany market is expected to reach USD 1.35 billion by 2026.

- For instance, according to the data published by the NHS Foundation Trust in January 2025, a seven-year-old boy has become the first child in the U.K. to undergo surgery using a pioneering new robot-assisted device at Evelina London Children’s Hospital.

Asia Pacific

Asia Pacific is expected to witness the highest CAGR during the forecast period. The growth is attributed to the increasing aging population in the region, which may increase the susceptibility to various conditions, driving the demand for minimally invasive surgery devices. The Japan market is expected to reach USD 1.38 billion by 2026, the China market is expected to reach USD 1.79 billion by 2026, and the India market is expected to reach USD 0.37 billion by 2026.

- For instance, according to the data published by the State Council of the People’s Republic of China in October 2024, China's population aged 60 and above reached around 297.0 million in 2023.

Latin America

The Latin American market is expected to grow at a significant CAGR during the forecast period, driven by the increasing launches of surgical robotic systems in key countries, which may enhance the landscape of minimally invasive surgery.

- For instance, in May 2022, CMR Surgical Ltd. launched the Versius Surgical Robotic System in Brazil to perform surgeries across gynecology, urology, and others.

Middle East & Africa

The Middle East & Africa is anticipated to witness stagnant growth during the forecast period. The growth is mainly attributable to the increasing awareness of the region’s population and government about the benefits of minimally invasive surgery. This, in turn, increases the demand for laparoscopic surgeons and related surgical devices in the region.

- For instance, in May 2023, according to the data published by the World Laparoscopy Training Institute Dubai, the demand for highly skilled laparoscopic surgeons is increasing significantly due to the high adoption of laparoscopic surgery.

COMPETITIVE LANDSCAPE

Key Industry Players

Execution of Strategic Initiatives and Introduction of New Products to Drive Revenue Growth for Key Market Players

The market is consolidated, with major players such as Medtronic, Johnson & Johnson Services, Inc., and Koninklijke Philips N.V. holding a significant portion of the global minimally invasive surgery devices market share in 2024.

Their dominance is attributed to extensive global reach and a wide range of advanced product offerings. These companies are continuously introducing new solutions for various surgeries, such as urological, and orthopedic.

Moreover, other prominent companies such as Boston Scientific Corporation, Olympus Corporation, Stryker, and B. Braun SE, are actively involved in strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to increase their market share and enhance competitiveness.

LIST OF KEY MINIMALLY INVASIVE SURGERY DEVICES COMPANIES PROFILED:

- Medtronic (Ireland)

- Johnson & Johnson Services, Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Boston Scientific Corporation (U.S.)

- Olympus Corporation (Japan)

- Stryker (U.S.)

- B. Braun SE (Germany)

- Steris (U.S.)

- Intuitive Surgical (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Medtronic expanded the URO clinical trial, the largest of its kind for robotic-assisted urologic surgery, and demonstrated excellent safety and effectiveness.

- March 2024: Intuitive Surgical received FDA 510(k) clearance for da Vinci 5, the company’s next-generation multiport robotic system, to offer a smooth experience in minimally invasive surgery.

- December 2023: Stryker received a grant for its patent for a minimally invasive surgical probe featuring a bulbous, smooth tip and an integrated neuro-monitoring element to detect electrical activity.

- September 2023: Stryker introduced the next-generation 1788 minimally invasive surgical camera platform to offer more vibrant images with balanced lighting across multiple specialties.

- April 2023: Boston Scientific Corporation acquired Apollo Endosurgery to expand in Endoluminal Surgery (ELS) and enter the bariatrics field.

REPORT COVERAGE

The global minimally invasive surgery devices market analysis provides market size and forecast by type, application, and end-user segment. It covers market dynamics and emerging market trends. It offers insights into the prevalence of key conditions, the number of surgeries, new product launches, and key industry developments. The report provides an in-depth analysis of the competitive landscape, including insights into market share distribution and detailed profiles of leading companies.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.47% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 20.27 billion in 2025 and is projected to reach USD 41.41 billion by 2034.

In 2025, the market value stood at USD 8.75 billion.

The market is expected to exhibit a CAGR of 8.47% during the forecast period of 2026-2034.

By end-user, the hospitals & ASCs segment led the market.

The key factors driving the market are the increasing prevalence of chronic conditions and technological advancements in surgery devices.

Medtronic, Johnson & Johnson Services, Inc., and Koninklijke Philips N.V. are the top players in the market.

North America dominated the market in 2024 by holding the largest share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us