Mixed Signal System-on-Chip (MxSoC) Market Size, Share & Industry Analysis, By Processor Type (Configurable Processors, ARM Processors, Soft Instructions Processors, Multi Core Processors, and Digital Signal Processors), By Product (Standard Cell Based Mixed Signal SoC & Embedded Mixed Signal SoC), By Fabrication Technology (Full-custom mixed-signal SoC & Semi-custom mixed-signal SoC), By End-User (OEMs, ODM, Semiconductor IDMs, & Others), By Application (Consumer Electronics, IT and Telecommunications, Automotive, Industrial & Automation, Medical, & Others), & Regional Forecast, 2025 – 2032

MIXED SIGNAL SYSTEM-ON-CHIP (MXSOC) MARKET SIZE AND FUTURE OUTLOOK

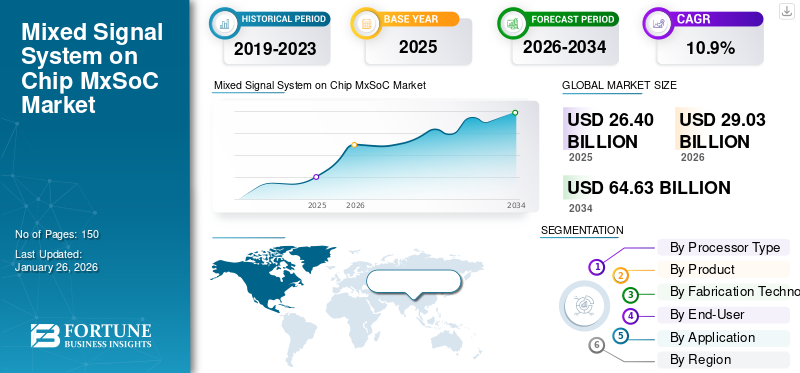

The global mixed signal system-on-chip (MxSoC) market size was valued at USD 24.10 billion in 2024. The market is projected to grow from USD 26.40 billion in 2025 to USD 54.33 billion by 2032, exhibiting a CAGR of 10.9% during the forecast period. Asia Pacific dominated the mixed signal system-on-chip (MxSoC) market with a market share of 34.94% in 2024.

A mixed-signal integrated circuit combines analog and digital elements onto a single semiconductor chip. Unlike traditional designs that focus solely on either analog or digital components, a mixed-signal integrated circuit leverages the strengths of both to achieve superior chip performance.

The market has experienced considerable expansion in recent years, driven by the rising need for high-performance integrated circuits across various sectors, including consumer electronics, automotive, and industrial applications. Advanced Mixed Signal SoCs integrate both analog and digital signals into a single chip, making them vital for applications that necessitate the processing of both analog signals (such as audio and video) and digital signals (such as computation and data transfer). The market growth can be linked to the growing miniaturization of electronic devices and the demand for affordable, energy-efficient solutions.

The major market players included in this industry are Texas Instruments Incorporated, Analog Devices, Inc., Qualcomm Incorporated, NXP Semiconductors N.V., Infineon Technologies AG, STMicroelectronics N.V., Renesas Electronics Corporation, Broadcom Inc., Intel Corporation, and Microchip Technology Inc.

IMPACT OF GENERATIVE AI

Design Efficiency and Creation of New Applications through Generative AI to Boost Market Growth

Generative AI is accelerating the mixed-signal SoC market by enabling faster chip design, verification, and analog/digital co-optimization, cutting time-to-market. It also drives new demand for high-speed, low-latency mixed-signal SoCs in AI datacenters (interconnects, power management). Additionally, AI-assisted EDA tools reduce complexity in analog block design, improving yield and lowering NRE costs. Overall, generative AI both boosts design efficiency and creates new application markets for MxSoCs.

IMPACT OF RECIPROCAL TARRIFFS

Reciprocal tariffs can raise costs across the Mixed-Signal SoC supply chain, as many players depend on cross-border wafer supply, foundries, and packaging hubs. Higher duties on semiconductor imports/exports may squeeze margins for fabless firms and wafer suppliers, slowing adoption in cost-sensitive consumer and IoT markets.

MARKET DYNAMICS

Market Drivers

Increasing Penetration of Smartphones to Aid Market Growth

The rising adoption of smartphones is projected to accelerate the mixed signal system-on-chip (MxSoC) market growth in the future. The appetite for smartphones is fueled by advancements including superior processors, sophisticated camera technologies, and improved connectivity, which heighten consumer interest and encourage upgrades. Furthermore, the increasing necessity for internet access and mobile data stimulates demand, particularly in developing regions, attributed by the presence of affordable and mid-range smartphones.

Market Restraints

Complexities in Design and Integration to Hinder Market Expansion

A key market restraint for the Mixed-Signal SoC industry is the design and manufacturing complexity of integrating analog and digital blocks on a single chip, which leads to higher development costs and longer verification cycles. Dependence on specialty process nodes (RF CMOS, SiGe, HV CMOS) also limits scalability compared to digital-only SoCs.

Market Opportunities

Growing Demand for EVs and ADAS in Automotive to Create Lucrative Opportunities

As vehicles become more software-defined and sensor-heavy, they need SoCs that integrate analog (sensors, power management, RF) and digital (AI, control, connectivity) functions on a single chip. MxSoCs enable a smaller footprint, lower power, and faster data processing, making them critical for EV battery management, LiDAR/radar, and infotainment systems.

Mixed Signal System-on-Chip (MxSoC) Market Trends

Integration of Analog, RF, and Digital Blocks to Emerge as a Key Market Trend

A key trend in this market is the integration of analog, RF, and digital blocks to support edge AI and IoT devices. With billions of connected sensors and wearables requiring ultra-low power and real-time processing, demand is rising for compact SoCs that can handle sensing, signal conversion, and computation on a single chip, driving faster adoption across consumer and industrial applications.

SEGMENTATION ANALYSIS

By Processor Type

Demand for Integrated, Compact, and Energy Efficient Solutions by Configurable Processors

Based on processor type, the market is segmented into configurable processors, arm processors, soft instructions processors, multi core processors, and digital signal processors.

The configurable processors segment led the mixed signal system-on-chip (MxSoc) market share in 2024. The segment is expected to lead with a 31.5% share in 2025. This is due to increasing demand for integrated, compact, and energy-efficient solutions across diverse applications such as consumer electronics, automotive, and the Internet of Things (IoT).

The multi core processors segment will achieve the highest CAGR of 15.19% during the forecast period.

By Product

Increasing Popularity to Customize Analog and Digital Functions through Standard Cell Based Mixed Signal SoC

Based on product, the market is segmented into standard cell based mixed signal SoC and embedded mixed signal SoC.

By share, the standard cell based mixed signal SoC segment led the market in 2024. The segment is expected to lead with a 58.9% share in 2025. The segment is experiencing strong growth due to its flexibility in customizing analog and digital functions for specific applications. It is particularly favored in automotive (EV power management, ADAS), industrial automation, and IoT devices, where designers require optimized performance, lower power consumption, and faster time-to-market.

The embedded mixed signal SoC segment will achieve the highest compound annual growth rate (CAGR) of 13.21% during the forecast period.

By Fabrication Technology

Increasing Features and Ability to Enhance Operations Boosted Expansion of Full-Custom MxSoC

Based on fabrication technology, the market is segmented into full-custom mixed-signal SoC and semi-custom mixed-signal SoC.

By share, the full-custom mixed-signal SoC segment led the market in 2024. The segment is expected to lead with a 60.1% share in 2025. The segment is growing due to its ability to deliver highly optimized performance for specialized applications.

The semi-custom mixed-signal SoC segment will achieve the highest compound annual growth rate (CAGR) of 13.32% during the forecast period.

By End-User

Increasing Ready-to-Integrate SoC Solutions Fueled Expansion of the ODMs

Based on end-user, the market is segmented into OEMs, ODM, semiconductor IDMs, and others.

By share, the ODM segment led the market in 2024. The segment is expected to lead with a 35.6% share in 2025. Original Design Manufacturers (ODMs) are a leading segment as they design and supply customized SoCs for OEM clients without owning the final brand.

The others segment will achieve the highest compound annual growth rate (CAGR) of 15.09% during the forecast period.

By Application

Consumer Electronics Dominated Market Due to Proliferation of Smart Devices

Based on the application, the market is categorized into consumer electronics, IT and telecommunications, automotive, industrial & automation, medical, and others.

The consumer electronics segment was the major segment in 2024. In 2025, the segment is anticipated to dominate with a 28.7% share. The consumer electronics sector is expanding rapidly due to the proliferation of smartphones, wearables, smart home devices, and audio/video equipment. These devices require SoCs that integrate analog sensors, power management, and digital processing in compact, low-power designs.

The industrial & automation sector is growing at a CAGR of 14.07% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

MIXED SIGNAL SYSTEM-ON-CHIP (MXSOC) MARKET REGIONAL OUTLOOK

By region, the market is divided into North America, Europe, South America, the Middle East & Africa, and Asia Pacific.

ASIA PACIFIC

Asia Pacific held the dominant share in 2023, valued at USD 7.56 billion, and also took the leading share in 2024 with USD 8.42 billion. The dominance is driven by the region’s dominance in consumer electronics manufacturing, growing smartphone penetration, and strong adoption of IoT and industrial automation. The presence of leading foundries in Taiwan, South Korea, and China, along with government-backed semiconductor initiatives, further fuels growth. In 2025, the China market is estimated to reach USD 3.45 billion.

Download Free sample to learn more about this report.

To know how our report can help streamline your business, Speak to Analyst

NORTH AMERICA & EUROPE

During the forecast period, the North America region is projected to record a growth rate of 9.97%, which is the highest among all the regions, and reach a valuation of USD 8.76 billion in 2025. This is mainly due to the rising demand for advanced consumer electronics and automotive applications, particularly EVs and ADAS systems. Backed by these factors, countries including the U.S. are expected to record the valuation of USD 6.44 billion, and Canada to record USD 1.62 billion in 2025. After Asia Pacific, the market in Europe is estimated to reach USD 5.38 billion in 2025 and secure the position of the third-largest region in the market.

SOUTH AMERICA & MIDDLE EAST & AFRICA

Over the forecast period, South America and the Middle East & Africa regions would witness a moderate growth in this market. The South American market in 2025 is set to record USD 0.98 billion in its valuation. The market in this region is supported by the expansion of telecom infrastructure, rising adoption of smartphones, and increasing digitization across Brazil and Argentina. In the Middle East & Africa, GCC is set to attain the value of USD 0.80 billion in 2025, driven by smart city projects, rising demand for connected devices, and investments in automotive and industrial automation sectors, particularly in the Gulf region.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Notable Players to Implement Strategic Strategies to Expand Business Reach

Key players present in this market are offering mixed signal system-on-chip (MxSoC), enabling devices to process both real-world analog signals (from sensors, audio, etc.) and perform complex digital computations. They concentrate on holding contracts with small and local businesses to grow their business. Moreover, such mergers & acquisitions, partnerships, and investments will create a surge in demand for this industry.

List of Key Mixed Signal System-on-Chip (MxSoC) Companies Studied (including but not limited to):

- NXP Semiconductors N.V. (Netherlands)

- Infineon Technologies AG (Germany)

- STMicroelectronics N.V. (Switzerland)

- Renesas Electronics Corporation (Japan)

- Broadcom Inc. (U.S.)

- Intel Corporation (U.S.)

- Microchip Technology Inc. (U.S.)

- Maxim Integrated Products, Inc. (U.S.)

- Silicon Laboratories Inc. (U.S.)

- MediaTek Inc. (Taiwan)

- ON Semiconductor Corporation (onsemi) (U.S.)

- Marvell Technology, Inc. (U.S.)

- Skyworks Solutions, Inc. (U.S.)

- Qorvo, Inc. (U.S.)

- Semtech Corporation (U.S.)

- ROHM Co., Ltd. (Japan)

- Dialog Semiconductor Plc (U.K.)

…and more.

KEY INDUSTRY DEVELOPMENTS:

- October 2025: MaxLinear’s single-chip Sierra Radio SoC was selected by Pegatron 5G for a next-generation 5G Open RAN macro radio unit — a sign that integrated mixed-signal radio SoCs are being adopted for O-RAN infrastructure.

- October 2025: Point2 Technology announced collaborations and demos around ultra-low-power, low-latency mixed-signal SoCs for high-speed interconnects (AI/datacenter interconnect context), indicating the growth of mixed-signal SoCs outside classic analog/RF markets.

- May 2025: Qorvo has revealed the growth of its QPG6200 lineup with the addition of three new Matter systems-on-chips (SoCs).

- February 2025: Tower Semiconductor is running global technical events and reported steady demand for analog/mixed-signal chips used in automotive. Foundry capacity and specialty nodes remain strategically important.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The mixed-signal soc market offers strong investment opportunities, driven by demand for integrated analog + digital functionality in automotive (EV/ADAS), telecom (5G/6G), and AI datacenter interconnects. Specialty foundries and wafer suppliers benefit from high-voltage, RF, and sensor-compatible processes. Strategic opportunities lie in funding startups with RF/AI mixed-signal IP and partnering with foundries to capture long lifecycle, high-margin applications.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/types, and the leading end-use of the product. Besides, it offers insights into the mixed signal system-on-chip (MxSoC) market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

| ATTRIBUTE | DETAILS |

| Study Period | 2019-2032 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2032 |

| Historical Period | 2019-2023 |

| Growth Rate | CAGR of 10.9% from 2025 to 2032 |

| Unit | Value (USD Billion) |

|

Segmentation |

By Processor Type

By Product

By Fabrication Technology

By End-User

By Application

By Region

|

Frequently Asked Questions

The market is projected to reach a valuation of USD 54.33 billion by 2032.

In 2024, the market was valued at USD 24.10 billion.

The market is projected to record a CAGR of 10.9% during the forecast period.

By End-User, the ODM segment led the market in 2024.

Increasing penetration of smartphones to aid market growth.

Texas Instruments Incorporated, Analog Devices, Inc., Qualcomm Incorporated, NXP Semiconductors N.V., Infineon Technologies AG, STMicroelectronics N.V., Renesas Electronics Corporation, Broadcom Inc., Intel Corporation, and Microchip Technology Inc. are the top players in the Mixed Signal System-on-Chip (MxSoC) market.

Asia Pacific held the highest market share in 2024.

By application, the industrial & automation segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us