Monofilament Absorbable Sutures Market Size, Share & Industry Analysis, By Type (Natural and Synthetic), By Application (Gynecology, Orthopedics, Cardiology, General Surgery, and Others), By End-user (Hospitals & ASCs, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

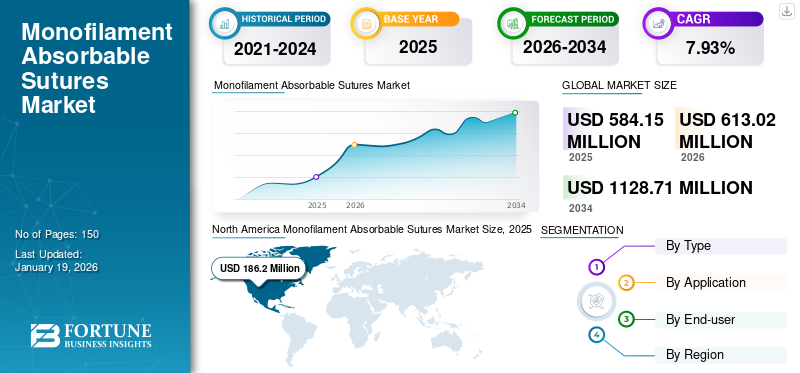

The global monofilament absorbable sutures market size was valued at USD 584.15 million in 2025 and is projected to grow from USD 613.02 million in 2026 to USD 1128.71 million by 2034, exhibiting a CAGR of 7.93% during the forecast period. North America dominated the monofilament absorbable sutures market with a market share of 12.02% in 2025.

Monofilament absorbable sutures are surgical threads made from a single strand of synthetic or natural material designed to be absorbed by the body over time. These types of sutures do not require removal by a doctor, making them ideal for internal wounds or surgical sites that are difficult to access after surgery.

The increase in surgical procedures worldwide drive the demand for resorbable sutures, which is anticipated to fuel the market growth.

- For example, as per the data provided by the American Joint Replacement Registry (AJRR) in November 2024, approximately 3.7 million arthroplasty procedures were performed across the Americas in 2023.

The market comprises key players such as Johnson & Johnson Services, Inc., Genesis Medtech, Medtronic, B. Braun SE, and DemeTECH Corporation are the major players involved in providing monofilament dissolvable sutures in the global market. These companies are increasingly implementing growth strategies such as new product launches, acquisitions, and expanding geographical reach to gain a significant market share.

MARKET DYNAMICS

Market Drivers:

Increasing Volume of Surgical Procedures to Increase Demand for Monofilament Absorbable Sutures

The rise in orthopedic surgeries, bypass operations, gynecological surgeries, and cosmetic procedures is increasing the usage of monofilament resorbable sutures to enable rapid wound closure, thereby driving market growth.

- For instance, as per the data provided by the Canadian Institute for Health Information (CIHI) in February 2024, the cesarean section accounted for 33.4% of all deliveries in Canada in 2023.

- Additionally, as per the data provided by the National Center for Biotechnology Information (NCBI) in August 2023, approximately 400,000 coronary artery bypass graft (CABG) surgeries have been performed every year across the world.

Moreover, the geriatric population is more susceptible to chronic diseases, leading to an increasing number of surgeries, such as angioplasty, joint replacements, and organ transplants. The rising number of surgeries generates a huge demand for monofilament dissolvable sutures to perform surgical procedures. These are some of the additional factors enhancing the market growth.

Market Restraints:

Growing Adoption of Various Alternatives to Restrict Market Growth

The increasing shift toward alternative wound closure methods hinders the adoption of monofilament absorbable sutures. Alternatives, such as surgical staplers, tissue adhesives, and hemostats, are largely preferred in certain surgical procedures due to advantages such as rapid application, reduced tissue trauma, and improved cosmetic outcomes.

Staplers are widely used in laparotomy and orthopedic surgeries for speed, while adhesives gain traction in dermatological and cosmetic procedures for minimizing scarring. These alternatives are restricting the adoption of monofilament sutures in the global market.

- For example, as per the data provided by the Suture Planet in February 2025, surgical staplers provide several benefits compared to sutures, including faster application, lower risk of infection, and reduced tissue damage.

Therefore, the growing shift of patients toward alternatives to surgical sutures, such as surgical staplers, adhesive tapes, and tissue sealants, is expected to restrict the market growth in the upcoming years.

Market Opportunities:

Expanding Healthcare Infrastructure in Developing Nations is Generating Lucrative Opportunities

Expanding healthcare infrastructure, particularly in developing countries, creates growth opportunities for the monofilament absorbable sutures market due to the increasing number of surgical procedures and demand for advanced wound closure solutions. As a result, several healthcare facilities are incorporating advanced medical technologies.

- For example, in July 2024, Al Qassimi Hospital in Sharjah, a healthcare facility of Emirates Health Services (EHS), announced the acquisition of the latest cardiac catheterization simulator from "HeartRoid". The simulator features three advanced simulation models designed for treating different heart diseases.

Moreover, the opening of new medical facilities in developing nations is enhancing the market growth. This expansion increases the volume of surgical procedures, creating a greater demand for sutures.

- For example, in June 2025, Inamdar Multispecialty Hospital launched a new Dental & Face Surgery Clinic, equipped for 24/7 emergency care in Pune, India.

Market Challenges:

Post-surgical Complications is a Major Obstacle Affecting Market Growth

Post-surgical complications associated with monofilament absorbable sutures, such as infection, wound dehiscence (reopening), scarring, suture-associated hypersensitivity reactions, and tissue reactions such as granuloma formation, are significant challenges hindering the market growth. These complications can lead to increased patient morbidity, higher healthcare costs, and a reluctance to adopt these sutures in certain surgical procedures.

Such complications influence the healthcare professional to opt for alternative solutions such as non-absorbable sutures. This shift toward alternative solutions due to post-surgical complications is hampering market growth over the forecast period.

Stringent Regulatory Scenarios are Major Challenges for Market’s Expansion

Regulatory authorities, such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA), mandate extensive testing and documentation to ensure the safety and efficacy of medical devices, including sutures. These regulatory complexities pose significant challenges to the monofilament absorbable sutures market growth by increasing development costs and delaying product launches, particularly for smaller manufacturers with limited resources.

These stringent and often unpredictable approval processes and differing regulations across various countries and regions create barriers to market access.

MONOFILAMENT ABSORBABLE SUTURES MARKET TRENDS

Rising Adoption of Knotless Absorbable Sutures is Emerging as a Major Market Trend

The growing preference for knotless absorbable sutures, especially those made from monofilament materials, is emerging as a significant trend in the market. These sutures are being rapidly adopted in minimally invasive procedures, such as cardiovascular, orthopedic, and laparoscopic surgeries, where maintaining consistent tension and minimizing tissue trauma are essential.

Surgeons worldwide are widely adopting absorbable monofilament knotless sutures due to their ability to lower the risk of surgical site infections (SSI), eliminate the need for suture removal, and offer reliable wound closure without the complications of knot-tying. The clinical evidence further supports this trend.

- For example, according to data provided by the British Journal of Surgery in October 2022, a comparative study was conducted by using absorbable knotless barbed sutures and conventional resorbable sutures to perform open hernia repairs. The study results demonstrated a marked reduction in surgical site infections (SSI) using absorbable knotless barbed sutures compared to conventional sutures.

Additionally, the continuous advancements in suture technology, such as synthetic bioengineered and antimicrobial-coated resorbable sutures, are the key trends supporting market growth.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Government Recommendation Regarding Usage of Synthetic Sutures in Surgeries is Responsible for Segment’s Dominance

Based on type, the market is segmented into natural and synthetic.

The synthetic segment is expected to dominate the market during the forecast period. The increasing government recommendations regarding the usage of synthetic antibacterial sutures for surgical procedures are enhancing the segmental growth. Moreover, the increasing market players' focus on introducing innovative synthetic monofilament absorbable sutures in the global market is an additional factor driving segmental growth.

- For example, in June 2021, Ethicon, a division of Johnson & Johnson Services, Inc., announced that the National Institute for Health and Care Excellence (NICE) issued new medical technologies guidance (MTG59). This guidance recommended the usage of Plus Antibacterial Sutures in surgical procedures across the U.K.

The natural segment is projected to grow at a considerable CAGR during the forecast period. The segment's growth is mainly attributed to the fact that natural resorbable sutures are made from biological materials that break down and are absorbed by the body over time. Due to the greater absorbability of natural sutures, they are widely utilized in ophthalmic, gynecological, and plastic surgeries. Furthermore, the natural sutures are less expensive than synthetic options, making them accessible, especially in resource-limited settings.

By Application

Rise in Number of Orthopedic Surgeries Supports the Segment's Leadership Position

Based on application, the market is segmented into gynecology, orthopedics, cardiology, general surgery, and others.

The orthopedics segment dominated the market in 2024. This dominance was mainly attributed to the high burden of orthopedic disorders and the rising number of orthopedic surgeries, such as hip and knee replacements.

- For example, as per the data provided by Curvo Labs, Inc. in September 2024, around 737,503 hip replacement procedures were performed in the U.S. in 2021, which increased to 765,558 in 2022.

The gynecology segment accounted for a substantial monofilament absorbable sutures market share in 2024. The growth of this segment is mainly attributed to the increase in the number of births by cesarean section.

- For instance, according to data published by the GOV.U.K., in May 2024, deliveries by caesarean section increased from 34.7% in 2022 to 37.8% in 2023 in the U.K.

The general surgery segment held a moderate market share in 2024, owing to the growing demand for monofilament absorbable sutures primarily for deep tissue closure and in areas where long-term support is minimal. They are most commonly used in abdominal surgeries as they provide the necessary support during the early stages of healing and disappear as the tissue strengthens.

The cardiology segment accounted for the second-largest market share in 2024. The growth of this segment was attributed to the increasing usage of resorbable sutures in cardiac surgeries, specifically for purse strings during cardiopulmonary bypass.

- For example, as per the data provided by the Mass General Brigham Incorporated in November 2024, over 900,000 cardiac surgeries, including coronary bypass surgeries, are performed in the U.S. every year.

The others segment is anticipated to grow at a considerable CAGR during the forecast period, owing to the increasing use of monofilament sutures in cosmetic surgeries.

By End-user

Adequate Reimbursement Policies Provided by Hospitals & ASCs Responsible for their Dominance

Based on end-user, the market is segmented into hospitals & ASCs, specialty clinics, and others.

The hospitals & ASCs segment is projected to dominate the market throughout the forecast period. The dominance of this segment is mainly due to the rise in the number of patients suffering from chronic diseases seeking medical treatments in hospitals. Also, the adequate reimbursement policies awarded by hospitals in developed countries with diverse treatment options are an additional factor supplementing segmental growth.

- For example, according to the Ambulatory Surgical Center Services Status Report published by the MedPAC in March 2024, Medicare-certified ASCs rose by 0.2 percent from 6,075 in 2021 to 6,088 in 2022.

The specialty clinics segment held the second-largest share in 2024. This growth was mainly attributed to the increasing preference for surgical interventions in specialty clinics due to comprehensive, specialized treatment availability and shorter waiting times. Also, the opening of new specialty clinics worldwide to provide patients with specialized care for particular conditions further supplements the segment’s growth.

- For example, in September 2024, Rehasport opened its fifth orthopedic center in Wrocław, Poland.

The others segment is anticipated to grow considerably throughout the forecast period, owing to increasing utilization of monofilament absorbable sutures at military hospitals, academic clinics, and nursing homes.

MONOFILAMENT ABSORBABLE SUTURES MARKET REGIONAL OUTLOOK

In terms of regions, the global market can be divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Monofilament Absorbable Sutures Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 186.2 million in 2025 and USD 192.89 million in 2026. North America dominated the global market in 2024 with a market size of USD 180.8 million and a 32.3% market share. The high prevalence of chronic conditions and established healthcare infrastructure across North America are important factors expected to fuel the regional market growth.

In the U.S., the significant reimbursement for various surgeries in hospitals and ambulatory surgical centers (ASCs) is increasing the surgical volume across the country, which may involve resorbable sutures.

- For instance, in November 2023, the Centers for Medicare & Medicaid Services (CMS) released its 2024 final payment rule for ASCs and hospital outpatient departments (HOPD). They finalized the addition of 37 surgical procedures to the ASC-CPL.

Europe

Europe accounted for the third-largest share of the market in 2024 and is anticipated to grow at the second-largest CAGR during the forecast period. The market growth across European countries is largely attributable to the high burden of surgeries, including cardiac surgeries, orthopedic surgeries, general surgeries, and others, which is expected to increase the adoption of monofilament absorbable sutures.

- For instance, according to the National Adult Cardiac Surgery Audit (NACSA) 2023 report, published in January 2023, around 24,807 cardiac operations were performed in the U.K. from April 2021 to March 2022.

Asia Pacific

The market in the Asia Pacific region is expected to grow at the highest CAGR during the forecast period. The increasing focus of market players on new product launches is driving market growth in this region.

- For instance, in August 2023, Healthium Medtech Limited announced the launch of TRUMAS, a range of dissolvable monofilament sutures designed to address challenges faced during suturing in minimal-access surgeries in the Indian market.

Moreover, this region's rising aging population, improving healthcare access, and medical tourism further support market growth.

Latin America and Middle East & Africa

The market in Latin America and the Middle East & Africa are anticipated to grow at a stagnant CAGR during the forecast period. The market growth in these regions is primarily attributed to the rise in the number of cardiac surgeries, orthopedic surgeries, and ophthalmic surgeries, among others, resulting in an increasing usage of monofilament absorbable sutures. Furthermore, the improvement in hospital infrastructure in these regions is supplementing market growth.

COMPETITIVE LANDSCAPE

Key Industry Players:

Increasing Market Players Focus on Participating in Medical Conferences to Create Brand Awareness Among Consumers

The market consists of key players, such as B. Braun SE, Medtronic, DemeTECH Corporation, ORION SUTURES INDIA PVT. LTD., and Johnson & Johnson Services, Inc., among others, are providing absorbable sutures across the globe. The increasing focus of these key players on participating in medical conferences to create product awareness among healthcare providers is one of the important factors contributing to their significant position.

- For example, in October 2024, ORION SUTURES INDIA PVT. announced its presence at Africa Health 2024, a medical conference held in South Africa. During the event the company was present at stall no. H2.E17 to create awareness about its dissolvable stitches among consumers.

The other companies operating in the market are Dynek Pty Ltd., Genesis Medtech, Dolphin Sutures, and Suture Planet. The growing focus of these key players on strategic acquisitions and collaborations to expand their footprints in the global market is one of the important factors contributing to their considerable position.

List of Key Monofilament Absorbable Sutures CompaniesProfiled:

- Johnson & Johnson Services, Inc. (U.S.)

- Medtronic (Ireland)

- Braun SE (Germany)

- DemeTECH Corporation (U.S.)

- Genesis Medtech (Singapore)

- Dolphin Sutures (India)

- Lotus Surgicals Pvt Ltd (India)

- Suture Planet (India)

- Medico (China)

- Teleflex Incorporated. (U.S.)

- Healthium Medtech Limited (India)

- ORION SUTURES INDIA PVT. LTD. (India)

- Unisur Lifecare (India)

KEY INDUSTRY DEVELOPMENTS:

- November 2024 - ORION SUTURES INDIA PVT., a surgical suture manufacturing company, announced its presence at the MEDICA 2024 conference in Düsseldorf, Germany. During the event, the company was present at booth no. B66-1 to create awareness about its resorbable sutures among consumers.

- October 2024 - Corza Medical, a global medical technology company, announced the launch of its innovative new line of Onatec ophthalmic microsurgical sutures at the American Academy of Ophthalmology (AAO) conference 2024 in Chicago, U.S., from 18th to 21st October 2024.

- November 2023 - Peters Surgical announced its new distribution partnership with Vertice Healthcare to expand its sutures offering in the South African market.

- September 2023 - Genesis MedTech secured approval from China's National Medical Products Administration (NMPA) for the market launch of its resorbable sutures with antibacterial protection.

- November 2022 - Ur24Technology Inc., a privately held medical device company, announced that it had formed a strategic partnership with DemeTECH Corporation to enhance surgical product production and a global distribution network.

- June 2021 - Genesis Medtech acquired Horcon, a China-based suture company, to expand its surgical device portfolio.

REPORT COVERAGE

The global monofilament absorbable sutures market research report provides a detailed competitive landscape and market insights. In addition to the market size, it covers regional analysis of different market segments, profiles of key market players, and market dynamics. Moreover, the market report encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.93% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type, Application, End-user, and Region |

|

By Type |

· Natural · Synthetic |

|

By Application |

· Gynecology · Orthopedics · Cardiology · General Surgery · Others |

|

By End-user |

· Hospitals & ASCs · Specialty Clinics · Others |

|

By Region |

· North America (By Type, by Application, by End-user, and by Country) o U.S. o Canada · Europe (By Type, by Application, by End-user, and by Country/Sub-Region) o Germany o U.K. o France o Italy o Spain o Scandinavia o Rest of Europe · Asia Pacific (By Type, by Application, by End-user, and by Country/Sub-Region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Type, by Application, by End-user, and by Country/Sub-Region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Type, by Application, by End-user, and by Country/Sub-Region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 613.02 million in 2026 and is projected to reach USD 1128.71 million by 2034.

In 2025, the market value stood at USD 186.2 million.

The market will exhibit steady growth at a CAGR of 7.93% during the forecast period.

By type, the synthetic segment leads the market.

The growing aging population and the rising number of surgical procedures worldwide are some of the important factors driving market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us