Multi-Walled Carbon Nanotubes Market Size, Share, & Industry Analysis, By Application (Electronics, Energy Storage, Composites, Biomedical, and Others), By End-Use Industry (Aerospace, Automotive, Consumer Electronics, Healthcare, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

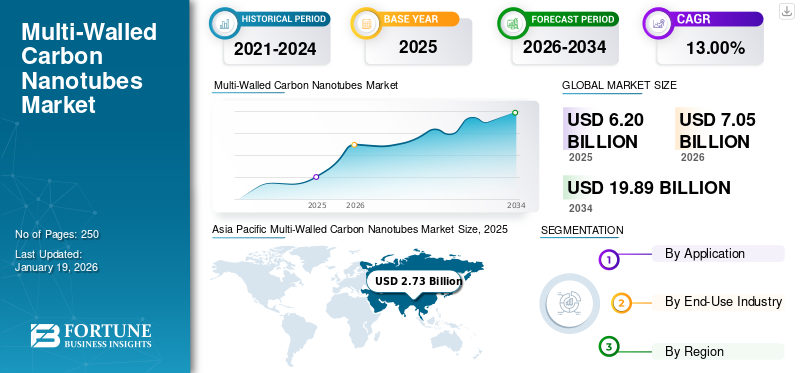

The global multi-walled carbon nanotubes market size was valued at USD 6.2 billion in 2025. The market is projected to grow from USD 7.05 billion in 2026 to USD 19.89 billion by 2034, exhibiting a CAGR of 13.00% during the forecast period. Asia Pacific dominated the multi-walled carbon nanotubes market with a market share of 44% in 2025.

Multi-walled carbon nanotubes (MWCNTs) are a type of carbon nanotube with multiple layers of graphene (rolled-up sheets of carbon) concentrically arranged, forming a tube-like structure Typically ranging from a few to tens of nanometers in diameter and several micrometers in length, MNCNTs exhibit exceptional mechanical, electrical, and thermal properties due to their sp2 carbon-bonding structure. Unlike single-walled carbon nanotubes, which consist of a single graphene layer, the MWCNTs have interlayer van der Waals forces that contribute to their structural stability and versatility. These nanotubes are synthesized through methods such as chemical vapor deposition (CVD), arc discharge, or laser ablation. It is used in applications such as reinforced composites, conductive films, energy storage devices, and biomedical due to their high strength, conductivity, and chemical resistance.

The market is a rapidly growing segment of the nanotechnology industry, driven by the product’s exceptional mechanical, electrical, and thermal properties. The market is expanding as industries seek advanced materials for applications such as conductive coatings, batteries, sensors, and reinforced polymers. Rising demand for lightweight materials in the automotive and aerospace sectors, increasing investment in renewable energy, and advancement in nanotechnology.

Arkema, Nanocyl SA, OCSiAl, Klean Industries Inc., and Cabot Corporation are the key players operating in the market.

Global Multi-Walled Carbon Nanotubes Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 6.20 billion

- 2026 Market Size: USD 7.05 billion

- 2034 Forecast Market Size: USD 19.89 billion

- CAGR: 13.00% from 2026–2034

Market Share:

- Asia Pacific dominated the multi-walled carbon nanotubes market with a 44% share in 2025, driven by rapid industrial growth, expanding electronics manufacturing, and strong demand for high-performance materials in China, Japan, and South Korea.

- By application, the electronics segment is expected to retain the largest market share in 2025, supported by rising demand for conductive films, sensors, flexible electronics, and advanced semiconductor materials.

Key Country Highlights:

- Japan: Market growth is supported by strong R&D investments in nanomaterials, expanding electronics manufacturing, and the adoption of high-performance composites in automotive and aerospace applications.

- United States: Demand is rising due to growing adoption of lightweight materials, strong aerospace and defense sector consumption, and increasing integration of MWCNTs in energy storage, sensors, and electronics.

- China: As a global leader in nanotechnology production, China drives high MWCNT consumption through extensive electronics manufacturing, EV battery production, and government-supported nanomaterial commercialization.

- Europe: Growth is driven by strict sustainability regulations, rising adoption of lightweight automotive materials, and increasing investments in next-generation battery technologies under EU clean-energy initiatives.

MARKET DYNAMICS

MULTI-WALLED CARBON NANOTUBES MARKET TRENDS

Increasing Demand for Composites & Lightweight Materials Drives the Market Growth

The global market is experiencing significant growth, driven by the increasing demand for advanced composites and lightweight materials across various industries. Multi-walled carbon nanotubes, known for their exceptional strength, electrical conductivity, and thermal properties, are integrated into composite materials to enhance performance while reducing weight. In the aerospace and automotive sectors, MWCNT-reinforced composites are used to manufacture lightweight yet durable components, improving fuel efficiency and reducing emissions. For instance, aircraft manufacturers incorporate MWCNT-based composites into structural parts, while automotive companies use them in body panels and battery casings for electric vehicles. Similarly, the sports industry leverages these materials to produce high-performance equipment such as tennis rackets, bicycles, and helmets, where the strength-to-weight ratio is critical.

MARKET DRIVERS

Expansion in Consumer Electronics Amid the Market Growth

Multi-walled carbon nanotubes are increasingly used in smartphones, tablets, laptops, and wearable devices to enhance performance and durability. For instance, their incorporation into flexible displays and touchscreens improves responsiveness and reduces weight, as seen in Samsung's foldable smartphones and Apple's advanced OLED screens. Additionally, MWCNTs are utilized in lithium-ion batteries to boost energy storage and charging speeds, a critical feature for electric vehicles (EVs) and portable electronics including Tesla's Powerwall and high-performance laptops. The growing demand for faster, lighter, and more efficient devices has spurred innovation, with companies including LG Chem and Nanocyl developing MWCNT-based composites for heat dissipation in processors and 5G infrastructure.

MARKET RESTRAINTS

Production Cost & Scalability May Hamper the Market Growth

The synthesis of multi-walled carbon nanotubes involves complex processes such as chemical vapor deposition (CVD), arc discharge, and laser ablation, all requiring expensive raw materials, specialized equipment, and high energy consumption. For instance, the purification and functionalization of MWCNTs to remove impurities and enhance compatibility with other materials further escalate costs, making them less competitive than conventional materials such as carbon fibers or graphene. Additionally, achieving consistent quality and uniformity in large-scale production remains a persistent challenge, as even minor deviations in temperature or catalyst composition can lead to defects, reducing performance and marketability.

MARKET OPPORTUNITIES

Rising Biomedical Integration to Create Lucrative Opportunities in the Market

In the biomedical sector, multi-walled carbon nanotubes are increasingly used in drug delivery systems, tissue engineering, biosensors, and medical imaging due to their high surface area, biocompatibility, and ability to penetrate cell membranes. For instance, functionalized MWCNTs serve as efficient carriers for targeted drug delivery, enhancing the precision and efficacy of treatments for diseases including cancer. Researchers are also exploring their use in regenerative medicine, where MWCNT-based scaffolds promote cell growth and tissue repair.

Additionally, their conductive properties make them ideal for biosensors that detect glucose levels, pathogens, or biomarkers with high sensitivity. The growing demand for advanced diagnostic tools and minimally invasive therapies further propels the multi-walled carbon nanotubes market growth. Companies such as Nanocyl, Arkema, and Cheap Tubes are investing in R&D to expand biomedical applications while regulatory bodies work to ensure safety standards.

MARKET CHALLENGES

Trade Barriers & Export Restrictions May Hamper the Market Growth

Tariffs imposed by the U.S. on Chinese-made multi-walled carbon nanotubes under Section 301 trade policies have raised prices for American manufacturers, reducing competitiveness and slowing adoption in industries such as aerospace and electronics. Similarly, export controls on high-purity carbon nanotubes by Japan, citing national security concerns, have restricted the availability of advanced MWCNTs for global buyers in semiconductor and battery applications. The European Union's stringent regulatory requirements and anti-dumping duties on imports from certain countries have created bottlenecks, forcing companies to seek costlier alternatives or delay projects. Additionally, geopolitical tensions, such as those between China and Western nations, have led to export bans on critical raw materials including graphite, a key precursor for MWCNT production, further straining supply. India's recent import licensing requirements for carbon nanotubes, aimed at promoting domestic production, have inadvertently slowed industrial adoption due to bureaucratic delays and limited local expertise. These barriers fragment the market, discourage innovation, and increase lead times, ultimately stifling the potential of MWCNTs in emerging applications including conductive polymers and energy storage.

Download Free sample to learn more about this report.

Trade Protectionism and Geopolitical Impact

Trade protection measures, such as tariffs, import quotas, and subsidies, significantly impact the global multi-walled carbon nanotubes market by altering supply chains and production costs. For instance, tariffs on raw materials or finished MWCNTs can raise prices, disadvantaging exporters while protecting domestic industries. Countries such as China and the U.S., which are key players in nanotechnology, may impose trade barriers to safeguard local manufacturers, leading to market fragmentation. Subsidies, on the other hand, can boost domestic production but may trigger trade disputes if deemed unfair by competitors. Such protectionist policies can stifle innovation by reducing competition and limiting access to global markets, ultimately slowing industry growth.

Geopolitical tensions further complicate the market by disrupting supply chains and influencing trade alliances. For example, U.S.-China trade wars or sanctions on Russia can restrict the flow of critical materials, increasing costs and delaying production. Additionally, geopolitical rivalries may drive countries to prioritize self-sufficiency, leading to increased R&D investments in local production. However, this could also result in duplicated efforts and inefficiencies. Regional conflicts or export controls on advanced materials may force companies to diversify suppliers, reshaping global trade dynamics. Overall, geopolitical instability introduces uncertainty, deterring long-term investments in the market.

Segmentation Analysis

By Application

Electronics Segment to Dominate Due to Increasing Demand for Consumer Electronics

Based on application, the market is segmented into electronics, energy storage, composites, biomedical, and others.

The electronics segment held the largest multi-walled carbon nanotubes market share in 2024. The segment's growth is driven by increasing demand across electronics and energy storage applications. MWCNTs are widely used in conductive films, transistors, sensors, and flexible displays in the electronics sector due to their high electrical conductivity, mechanical strength, and thermal stability. The growth of wearable devices, IoT, and 5G technology accelerates adoption, while advancements in printed and flexible electronics further propel market expansion.

The energy storage segment is set to witness significant growth during the forecast period due to the rapid growth of electric vehicles (EVs), renewable energy storage systems, and portable electronics, which are major drivers, alongside increasing R&D in next-generation battery technologies. Government policies promoting clean energy and EVs further boost demand.

By End-Use Industry

Aerospace Segment Holds the Most Significant Share Owing to Extensive Product Adoption

Based on the end-use industry, the market is segmented into aerospace, automotive, consumer electronics, healthcare, and others.

The aerospace segment held the most significant global market share in 2024. The growth of the segment is driven by the increasing use of composite materials for aircraft structures, coatings, and thermal management systems, offering superior mechanical properties and corrosion resistance. The growing emphasis on next-generation aircraft with advanced performance characteristics and stringent regulatory standards for sustainability further accelerates adoption.

The automotive segment is expected to grow significantly during the forecast period due to the shift toward electric vehicles (EVs) and the demand for lightweight materials to improve battery efficiency and vehicle range. Multi-walled carbon nanotubes enhance the conductivity and durability of lithium-ion batteries, making them essential for EV battery electrodes and thermal interface materials. Furthermore, their integration into polymer composites for structural components reduces vehicle weight while maintaining safety standards.

Multi-Walled Carbon Nanotubes Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Multi-Walled Carbon Nanotubes Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest market share in 2025, generating market revenue worth USD 2.73 billion. The market growth is driven by rapid industrialization and expanding electronics and automotive sectors. China, Japan, and South Korea are major contributors, with China leading production and consumption due to government support for nanotechnology. Increasing EV adoption and demand for high-performance batteries propel market growth. India and Southeast Asia are emerging markets driven by infrastructure development and rising electronics manufacturing.

North America

North America is expected to grow significantly over the forecast period, driven by strong R&D activities, advanced technological adoption, and significant investments in aerospace, electronics, and energy storage. The U.S. dominates due to the presence of key manufacturers and increasing demand for lightweight, high-strength materials in the automotive and defense sectors. Government initiatives promoting nanotechnology and sustainable materials further boost growth.

Europe

Europe is projected to be the second-largest market, driven by stringent environmental regulations favoring advanced materials. Germany, France, and U.K. lead in automotive, aerospace, and renewable energy applications. The EU's focus on reducing carbon emissions drives product demand from battery technologies and lightweight composites.

Latin America

The Latin American market is expected to grow moderately. The automotive and construction industries are primary drivers, with MWCNTs used in coatings, composites, and energy storage. Limited R&D infrastructure and high production costs hinder rapid expansion, but increasing foreign investments and government initiatives in nanotechnology present future opportunities.

Middle East & Africa

The Middle East & Africa region is witnessing steady growth due to growing investments in construction, oil & gas, and energy sectors. The UAE and Saudi Arabia are leading due to infrastructure projects and the demand for advanced materials. South Africa shows potential in mining and automotive applications.

COMPETITIVE LANDSCAPE

Key Industry Players

Capacity Expansion to be the Key Strategy of Leading Companies

The global market share is concentrated and competitive, with major market players, including Arkema, Nanocyl SA, OCSiAl, Klean Industries Inc., and Cabot Corporation, striving to maintain their positions in the market. Market players are adopting strategies such as product diversification, sustainable practices, and strategic alliances to maintain their competitive edge and cater to evolving market demands. Particularly key players are investing in expanding their manufacturing capacities in high-growth regions such as India and China.

LIST OF KEY MULTI-WALLED CARBON NANOTUBES COMPANIES PROFILED

- Arkema (France)

- Nanocyl SA (Belgium)

- OCSiAl (Luxembourg)

- Nanoshell LLC (U.S.)

- Sanyo Corporation of America Co., Ltd. (U.S.)

- LG Chem (South Korea)

- Dycotec Materials Ltd (U.K)

- Klean Industries Inc. (Canada)

- Cabot Corporation (U.S.)

- Bergen Carbon Solutions AS (Norway)

KEY INDUSTRY

- January 2025: Nanocyl participated in NanoTech 2025 at the Tokyo Big Sight in Tokyo, Japan. Nanocyl will be stationed at Booth 4P-22, showcasing its cutting-edge multi-walled carbon nanotubes solutions and advanced materials designed to support cost efficiency, energy savings, and productivity gains across diverse industries.

- September 2020: Arkema was a member of the Korea Association of Carbon-Nano Industry, among 52 other companies. The association represented the carbon-nano industry to advance policies aimed at ecosystem vitalization for the carbon-nano industry and securing global competitiveness.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) & Volume (Kiloton) |

|

Growth Rate |

CAGR of 13.00% during 2026-2034 |

|

Segmentation |

By Application

|

|

By End-Use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 6.2 billion in 2025 and is projected to reach USD 19.89 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 2.73 billion.

The market is expected to exhibit a CAGR of 13.00% during the forecast period.

The aerospace segment led the market by end-use industry.

The surging product demand from the electronics industry will drive market growth.

Arkema, Nanocyl SA, OCSiAl, Klean Industries Inc., and Cabot Corporation are the key players in the market.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us