Natural Health Medicines Market Size, Share & Industry Analysis, By Product (Omega Fatty Acids, Natural Extracts, Vitamins & Minerals, Probiotics, and Others), By Form (Tablets, Chewable, Liquid, and Others), By Function (Gut Health & Digestive Support, Brain Health & Cognitive Support, Immune Health, Healthy Ageing, Women's Health, Energy & Performance, Prenatal & Postnatal Health, and Others), By Distribution Channel (Direct Selling, Pharmacies, Grocery Stores, and E-commerce), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

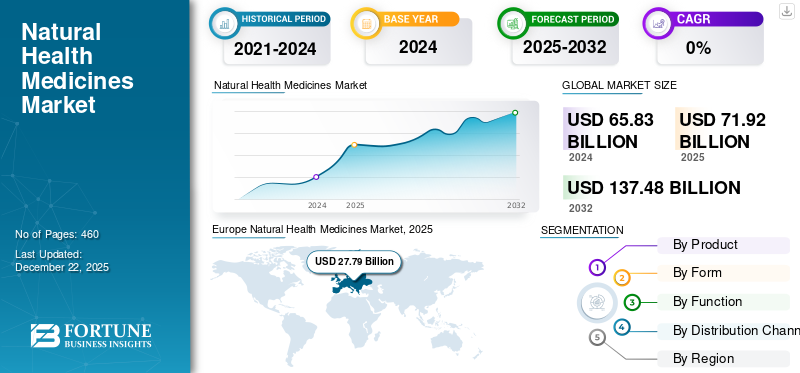

The global natural health medicines market size was valued at USD 71.92 billion in 2025. The market is projected to grow from USD 78.65 billion in 2026 to USD 137.49 billion by 2034, exhibiting a CAGR of 7.23% during the forecast period. Europe dominated the natural health medicines market with a market share of 38.64% in 2025.

The demand for natural health medicines is rising globally due to the inclination of consumers toward more natural products for health & wellness purposes.

Natural health medicines, often referred to as herbal medicines, are substances obtained from natural sources, such as plants or animals, used to treat or prevent illness. They encompass a wide range of herbs aiming to support the body's natural healing abilities. Major players operating in the industry include Amway Corp., General Nutrition Centers, Inc., Herbalife Nutrition Ltd, Nordic Naturals, and Wild Nutrition Ltd. These players are competing with each other to gain a major market share.

Impact of COVID-19

The COVID-19 pandemic accelerated a shift toward preventive healthcare practices. Consumers became more proactive about maintaining their health, leading to increased demand for natural supplements perceived as beneficial for overall wellness. According to a research paper published by the U.S. National Library of Medicine (NLM), in March 2020, the demand for multivitamin supplements surged, with sales increasing by 51.2%. During this period, total sales of vitamins and supplements reached nearly 120 million units, reflecting a significant spike driven by heightened health concerns amid the COVID-19 pandemic.

Moreover, during the pandemic, consumers sought natural supplements to boost their immune systems in order to prevent or mitigate the severity of COVID-19 infections. Supplements such as vitamin C, vitamin D, multivitamins, probiotics, and zinc were particularly popular for their perceived immune-boosting properties. Additionally, the onset of the pandemic led to panic buying and stockpiling behaviors. Consumers purchased natural supplements in bulk, fearing shortages or increased prices in the future. Also, the pandemic forced people to stay at home, leading to increased online activity. This shift enhanced the visibility and accessibility of supplements through various direct and indirect e-retailing platforms, further boosting sales.

Global Natural Health Medicines Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 71.92 billion

- 2026 Market Size: USD 78.65 billion

- 2034 Forecast Market Size: USD 137.49 billion

- CAGR: 9.70% from 2026–2034

Market Share:

- Europe dominated the natural health medicines market with a 38.64% share in 2025, driven by long-standing consumer preference for alternative treatments, a robust preventive healthcare sector, and high imports of plant-based ingredients.

- By product, the vitamins & minerals segment led the market in 2025, supported by widespread adoption and awareness of essential micronutrients for immunity, development, and disease prevention.

Key Country Highlights:

- United States: Aging population and increasing demand for natural remedies are boosting the market for safe and effective alternatives to conventional medicines.

- Germany, France, Italy (Europe): Europe remains a key hub for the use and production of natural supplements, supported by a health-conscious population and import of plant-based ingredients.

- China, India, Japan (Asia Pacific): Rich history and government support for traditional medicine and plant-based healthcare are driving market expansion.

- Brazil, Argentina (South America): Increasing chronic disease prevalence and rising health awareness are pushing demand for natural alternatives.

- South Africa: Growth is fueled by rising awareness and reliance on affordable, plant-based healthcare, especially in rural areas.

Natural Health Medicines Market Trends

Heightened Consumption of Herbal Dietary Supplements to Promote Market Growth

The use of alternative antibiotic medicines, such as herbal products, has increased over the last decade. Herbal products are gaining popularity among patients as well as healthcare professionals. According to WHO, almost 10-50% of the population in developed countries use herbal products regularly in some form. The major reason for using herbal products is they offer better immunity than synthetic drugs. In developing countries such as China, Japan, India, Vietnam, South Africa, and Bangladesh, herbal medicines are sometimes the only affordable and available treatment option. Consumers primarily opt for these medicines for cough, cold, gastrointestinal sickness, and painful conditions such as joint pain, rheumatic diseases, and stiffness. This ongoing trend of consuming herbal supplements is expected to offer growth opportunities for the market.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Rising Health Awareness among Younger Consumers to Drive Market Growth

Younger consumers are increasingly prioritizing preventive healthcare, emphasizing overall well-being rather than reactive treatment for illnesses. This shift has led to a surge in demand for natural supplements that address specific health concerns such as immunity, mental health, and fitness, further contributing to the global natural health medicines market growth.

Furthermore, younger generations are adopting healthier lifestyles that align with sustainability and environmental consciousness. This has fueled demand for plant-based, vegan, and organic supplements, which are perceived as cleaner and more ethical choices. The trend of ‘clean living’ has also driven innovation in supplement formulations, such as gummies, powders, and personalized nutrition solutions tailored to individual needs, which propels the demand for natural health supplements.

Shifting Consumer Focus from Synthetic to Natural Supplements to Fuel Product Adoption

Recently, consumers in developed countries are increasingly concerned about the potential side effects of synthetic supplements, such as chemical additives and artificial ingredients. Therefore, natural supplements derived from plant-based or organic sources are perceived as safer and healthier alternatives. Besides, the rising prevalence of chronic diseases, including obesity, diabetes, and cardiovascular issues, in developed countries has encouraged individuals to adopt preventive healthcare practices, with natural supplements playing a key role in maintaining overall well-being and further fostering market growth.

Therefore, in developing nations, growing awareness of preventive healthcare has led to increased demand for natural supplements. Consumers are becoming more proactive, particularly in urban areas where access to information about wellness is expanding through digital platforms, driving product adoption within developing nations.

Market Restraints

High Costs of Natural Ingredients to Restrict Market Growth

Fluctuations in raw material prices directly affect the production costs of natural supplements, influencing the final price of the products. For instance, magnesium is a key ingredient in many natural supplements, such as magnesium glycinate and magnesium oxide. Therefore, any increase in magnesium prices directly raises the raw material costs for natural supplement manufacturers. This leads to higher production costs, which are often passed on to consumers, leading to increased prices of natural supplements, hence restricting its market growth.

Moreover, the high cost of natural supplements limits their accessibility to a broader consumer base, particularly in price-sensitive markets such as Brazil, South Africa, and India, among others. This restricts the market to a niche segment rather than achieving widespread adoption. Besides, high prices may lead to skepticism among consumers, particularly in rural and semi-urban areas where there is a lack of information about natural supplements. This skepticism discourages major investments in these regions, hindering its market growth.

Market Opportunities

Innovation in Product Formulation to Propel Market Growth

The shift toward preventive healthcare has spurred demand for supplements that promote overall well-being rather than treating illnesses. This has led to innovative formulations in natural supplements to create unique blends targeting niche demographics or specific health concerns. Also, increasing innovations in extraction and processing technologies improve the effectiveness and bioavailability of natural ingredients, making supplements more effective.

Furthermore, supplement manufacturers are creating specialized formulations that address specific health concerns such as heart health, cognitive function, and joint health. They are also integrating sustainability into product development by sourcing local ingredients, using eco-friendly packaging, and promoting organic certifications. Besides, consumers are increasingly preferring clean-label supplements, which are basically free from synthetic additives and allergens. This demand drives innovation in plant-based and minimally processed formulations for natural supplements, fueling its market growth in the near term.

In March 2025, Wiley's Finest, a global provider of science-driven supplements, launched ‘Relax Focus’ supplements featuring GABA and L-Theanine. This product is basically suitable for managing stress, promoting relaxation, and improving focus.

Segmentation Analysis

By Product

Vitamins & Minerals Segment Dominates Due to Widespread Adoption, Awareness, and Product Penetration

On the basis of product, the market is segmented into omega fatty acids, natural extracts, vitamins & minerals, probiotics, and others.

The vitamins & minerals segment dominated the market and held a major share in 2025. Vitamins & minerals are recognized as essential micronutrients for humans, which are required to perform a range of everyday functions. However, these nutrients are needed in small quantities. They are still necessary for normal development, growth, and an enhanced immune system. A few examples of vitamins & minerals include Vitamins B, A, C, and D, iron, calcium, and potassium, among others. Apart from improving the immune system and body development, vitamins can strengthen cognitive function and minimize the risk of heart disease and stroke. Moreover, minerals such as magnesium, calcium, and phosphorus assist in keeping bones healthy and strong. Thus, such benefits of vitamins & minerals propel the segment’s growth globally. The vitamins & minerals segment is also expected to dominate the market share by 51.60% in 2026.

Natural extracts emerged as the fastest-growing segment in 2025 and are anticipated to grow at the same pace in the forecast period. Predominantly, plant extracts are utilized in medicine formulations due to their potential benefits, which include offering relief with negligible side effects compared to synthetic medicines, targeting specific ailment concerns, and others. Ginseng, ginkgo biloba, curcumin, and others are some of the common botanical extracts available across the global market. Moreover, these extracts show therapeutic applications in numerous areas, which include cardiovascular health, neurological disorders, and digestive ailments. Natural extracts segment is anticipated to exhibit CAGR of 11.02% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Form

Chewable Category Dominated Market Due to its Widespread Popularity and Ease of Consumption

Depending on form, the global market is segmented into tablets, chewable, liquid, and others.

Amongst all forms, the chewable segment led the market in 2025 and generated the maximum share of 37.89%. Chewable emerged as a convenient form of medicine, and they are designed to be processed by chewing, which stimulates the release of active ingredients. As a dosage form, chewables have benefits with respect to production, portability, long-term stability, and dosing accuracy. Compared to other tablets and liquids, one of the major benefits of chewables is their easy administration without swallowing difficulties, and they can be easily consumed without water. Moreover, these chewables are available in various shapes and have pleasant taste, which escalates consumer acceptance, and are ideal for disabled and bedridden individuals.

Tablets have secured a second position in the global market and are projected to soar at a higher pace in the coming years. In comparison to other forms, tablets are the most popular and common form of medicines, which are safe and economical for consumers, especially due to lower manufacturing costs. Moreover, these tablets are easy to swallow and have accurate doses, which are required for targeted ailments. Additionally, compared to capsules, tablets have prolonged shelf life and resistance to temperature and moisture, and can be manufactured utilizing numerous techniques such as dry granulation, wet granulations, and others, which aid in optimizing the tablet’s properties. Thus, the advantages of tablets bolster their consumption rate across the globe.

By Function

Energy & Performance Segment Dominated Market Due to Widespread Adoption among All the Age Groups

Based on function, the market is categorized into gut health & digestive support, brain health & cognitive support, immune health, healthy ageing, women’s health, energy & performance, prenatal & postnatal health, and others.

The energy & performance function leads the global market and held the largest share in 2025. Compared to other functions, majority of natural health medicines are known to improve performance and boost the energy levels of consumers. Several plant extracts, vitamins, and minerals are capable of enhancing mental and physical performance and promoting alertness. These nutrients, which are major bioactive compounds, help the human body cope with stress and increase metabolism when used for producing natural health medicines. Thus, the factors mentioned above facilitate the segment’s growth across the world. The energy & performance function is projected to lead the market share by 20.06% in 2026.

Brain health & cognitive support function is expected to be the fastest-growing segment at a high CAGR of 12% during the forecast period, and predicted to bolster at a higher pace in the near term. In today’s era, the global population is actively seeking natural medicines that can augment cognitive function, and this rise in demand is majorly observed across younger demographics. Moreover, the need for cognitive medicines has drastically increased due to remote work since the pandemic, which has triggered the demand for products that promote focus and concentration. Thus, such increased awareness of improved brain health drives the segment’s growth.

By Distribution Channel

Grocery Stores Segment Dominated Market Due to Presence of Wide Range of Health Medicines in Modern Grocery Stores

Based on distribution channel, the market is distributed into direct selling, pharmacies, grocery stores, and e-commerce.

Grocery stores have secured the foremost position and dominated the global natural health medicines market share. This segment is expected to secure 35.63% of market share in 2026. Grocery stores are recognized as the go-to option by consumers due to their widespread presence, easy accessibility, and affordability. These stores offer a vast range of local and international brands of natural health medicines, as compared to small health food stores, which fulfill diversified consumer preferences. Moreover, with respect to prices, grocery stores provide discount coupons to their consumers and offer the option of bulk purchasing natural medicines at lower prices, thus making it a suitable choice for budget-conscious consumers. Therefore, such benefits of grocery stores fuel its growth across the global market.

E-commerce is anticipated to be the second leading segment with a high CAGR of 11.05% in the natural health medicines market during the forecast period. This channel is rapidly growing, primarily because of the wider customer reach and competitive pricing compared to other segments. The convenience of shopping for natural health medicines from the workplace or home and the ease of returning/exchanging natural medicine are the pivotal factors supporting the segment’s growth. Also, compared to other channels, e-commerce offers a faster buying process, and price and product comparison entices consumers' attention. Moreover, the easy payment options and vast availability of products as per targeted needs further stimulate the usage and sales of natural health medicines via online channels.

Natural Health Medicines Market Regional Outlook

By region, the market is studied across North America, Europe, Asia Pacific, and South America.

North America

Europe Natural Health Medicines Market, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is the third-largest region in the global market, anticipated to hit USD 17.00 billion in 2026. The U.S. market is also projected to hit USD 14.17 billion in 2026. In North America, the wellness market has witnessed strong innovation. It has become crowded in the last few years, especially in areas such as vitamins, extracts, and personalized nutrition. Most Americans value and seek items that can fulfill needs across various wellness dimensions (mindfulness, digestive health, and appearance). As a result, this evolving wellness industry augments the use of naturally sourced health medicines across the region. Essential oils, extracted from plants, hold importance in traditional Chinese medicines and Ayurveda, providing numerous potential advantages such as improved immune health and pain relief. These oils (lavender oil, bergamot oil) possess anti-inflammatory and anti-microbial properties, which play a substantial role in reducing inflammation and are a main factor in immune response. Thus, such usage of essential oils strengthens the growth of the natural health medicines market.

In the U.S., the graying of the population has given rise to a large burden of acute health-related ailments. Consumers of today’s era seek natural remedies that promote their overall well-being and assist in mitigating health challenges across the nation. As individuals are fully aware of the detrimental effects of conventional medicines, they tend to opt for complementary or alternative health-promoting products due to their safety and efficacy. Thus, the growing older population strengthens the usage of natural health medicines amongst U.S. consumers.

Europe

Europe emerged as the leading region with a value of USD 30.18 billion in 2026 across the natural health medicines market and has a dynamic history of the utilization of natural supplements since the ancient period. Still today, this region serves as a key hotspot for the usage and production of naturally-extracted health medicines. The surging consumer preferences for alternative treatment and the well-built preventative healthcare industry are pivotal factors that make Europe a captivating market for health products. The U.K. market is projected to hit USD 3.6 billion in 2026. The Germany’s market is likely to hold USD 5.57 billion in 2026, and France will anticipate to hit USD 4.54 billion in 2025.

Europe is one of the prominent producers of natural ingredients for creating health products. For numerous years, European's interest in natural products has been rising due to the improved adoption of healthier lifestyles. Thus, to meet the increasing demand of consumers, the region is focusing on importing large volumes of naturally sourced ingredients. As a result, such imports of plant-sourced ingredients strengthen their usage in the production of natural health medicines.

Asia Pacific

Asia Pacific is anticipated to be the second fastest-growing region in the global natural health medicines market size of USD 27.37 billion in 2026, with the second-largest CAGR of 10.49% during the forecast period, as plant-based supplements hold high importance in daily lives of Asian consumers. They are utilized for a vast range of health ailments and are often the only or primary source of healthcare. As a result, such use of natural products in the preventative healthcare industry propels the market’s potential.

In Asia, natural medicines play a substantial role in supporting consumers' overall well-being and health. The naturally-extracted supplements have been prevalent since ancient times and were used to address nutrient deficiencies. However, in the 19th century, the invention of conventional medicines influenced Asians to turn to such products to cure their ailments. However, the rising side effects of regular supplements pose a stress on Asian’s physical and mental health. As a result, various government bodies are actively working to enhance the importance of natural medicines across the region. For instance, in 2024, the Chinese government committed USD 5 million (2024-2028) to support the World Health Organization’s Traditional, Complementary, and Integrative Medicine Programme. The China market is projected to hit USD 10.59 billion in 2026. The Japan’s market is likely to hold USD 6.16 billion in 2026, and South Korea will anticipate to hit USD 3.02 billion in 2025.

South America

South America is recognized as the fourth-largest market, expecting a value of USD 3.77 billion in 2025 as a land of opportunity for various emerging markets, with natural supplements gaining huge popularity. Factors contributing to the strong growth include a rising middle-class population with indispensable incomes, a surging aging population, and diverse health-conscious consumers. However, compared to other regions, South America's natural health medicines market is still developing and is predicted to grow rapidly in the future years.

For a few years, the rate of chronic health prevalence has been increasing across the region, with obesity, gut ailments, and cardiovascular challenges being a few of the other common ailments at their peak. This spike in health conditions pushes South American consumers to switch toward natural medicines for targeted health solutions. Moreover, the intake of naturally-extracted supplements rose during the COVID-19 pandemic, when consumers realized the importance of safe extracts and shifted away from conventional medicines. Thus, such a rise in health ailments enhances the chances of using plant-sourced medicines.

Competitive Landscape

Key Market Players

New Product Launch is a Major Strategy Adopted by Players to Strengthen their Market Presence

The global natural health medicines market, which includes dietary and herbal supplements, is characterized by a dynamic and competitive landscape. This market is driven by consumer demand for natural health products, preventive healthcare, and wellness solutions.

The industry is highly fragmented, with both global conglomerates and specialized regional players competing across various product categories and distribution channels. Key players engage in mergers and acquisitions to expand product portfolios and gain access to new markets, while partnerships with healthcare providers and research institutions are common.

List of Key Natural Health Medicines Companies Studied

- Abbott Laboratories (U.S.)

- Amway Corp. (U.S.)

- Bayer AG (Germany)

- General Nutrition Centers, Inc. (U.S.)

- Glanbia Plc (Ireland)

- Herbalife Nutrition Ltd (U.S.)

- Nestle S.A. (Switzerland)

- Nordic Naturals (U.S.)

- Suntory Holdings Limited (Japan)

- Wild Nutrition Ltd (U.K.)

Key Industry Developments

- February 2025 – SFI Health EMEA, a regional subsidiary of the global natural healthcare company SFI Health, announced the upcoming availability of ‘Equazen’ products in Portugal. This move marks a significant step in SFI Health EMEA's European expansion strategy. These products feature a unique blend of essential fatty acids (Omega-3 and Omega-6), backed by several clinical studies that demonstrate their effectiveness in enhancing learning, concentration, and healthy brain development.

- December 2024 – SuanNutra, a global manufacturer of nutraceutical ingredients, launched an innovative digital platform called ‘SuanBlend,’ designed to support dietary supplement formulators in creating novel products. This platform offers clients flexibility and control during the formulation process. Besides, SuanBlend allows dietary supplement companies to experiment with customizable ingredient blends that target various health categories, such as cognition, beauty from within, and gut health.

- December 2024 – Wild Nutrition, a brand specializing in women's nutritional health, launched its first-ever TV advertising campaign on Boxing Day in 2024. This campaign marks a significant milestone in the brand's growth strategy, focusing on its unique Food-Grown ingredients that support women through various life stages. It is part of a broader strategy to drive long-term growth, highlighting Wild Nutrition's commitment to providing premium supplements that align with its Food-Grown philosophy.

- October 2024 – Nutrabay, a D2C sports nutrition and wellness brand in India, entered the ayurvedic supplements market with the product launch of ‘Shilajit.’ This strategic move is part of Nutrabay's broader strategy to diversify its product portfolio and capitalize on the growing demand for natural and holistic wellness solutions in India.

- August 2023 – Herbalife, an American producer of dietary supplements, launched Herbalife V, a comprehensive plant-based supplement line designed to cater to the growing demand for plant-based products. This new line includes a variety of products, such as plant-based protein shakes, a greens booster, and supplements for immune and digestive health. These products are formulated with organic fruits, vegetables, superfood powders, and green tea, which makes it easy to add nutrients to consumers’ daily routines.

Report Coverage

The natural health medicine report analyzes the market in-depth and highlights crucial aspects such as prominent pharmaceutical companies and supplement companies, competitive landscape, product, form, function, and distribution channel. Besides this, it provides insights into the natural health medicines market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.23% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

By Form

By Function

By Distribution Channel

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was at USD 71.92 billion in 2025 and is anticipated to record a valuation of USD 137.49 billion by 2034.

The global market will exhibit a CAGR of 7.23% during the forecast period 2026-2034.

By product, the vitamins & minerals segment is estimated to dominate the market during the forecast period of 2026-2034.

The growing awareness about health and rising adoption of natural ingredients is likely to drive the demand in the market.

Amway Corp., General Nutrition Centers, Inc., and Herbalife Nutrition Ltd are some of the leading players globally.

Europe dominated the global market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us