Omega-3 fatty acids Market Size, Share & Industry Analysis, By Source (Algae Oil, Fish Oil, Krill Oil, Concentrates, Plant & Seed Oil, and Others), Type (ALA, EPA, DHA, and EPA-DHA), Concentration (Standard, High Concentrate, and Ultra-high Grade) and Application (Dietary Supplements, Functional/Fortified Food, Infant Formulae, Pharmaceuticals, and Animal Feed & Pet Foods), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

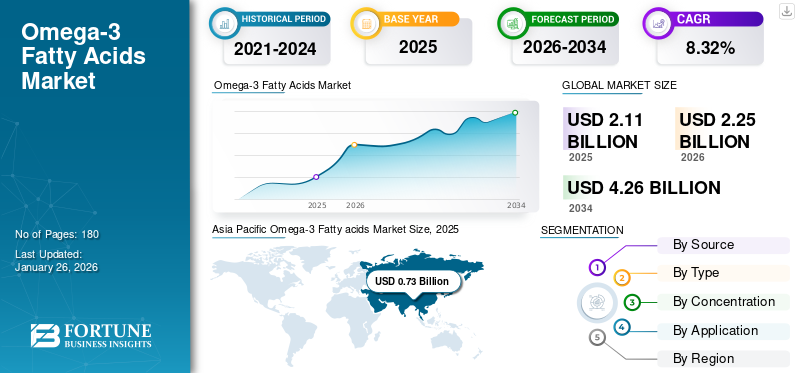

The global omega-3 fatty acids market size was valued at USD 2.11 billion in 2025 and is projected to grow from USD 2.25 billion in 2026 to USD 4.26 billion by 2034, registering a CAGR of 8.32% over the forecast period. Asia Pacific dominated the omega-3 fatty acids market with a market share of 34.43% in 2025.

Omega-3 fatty acids are a group of essential polyunsaturated fats which are essential for human health. Some of the different types of acids include EPA, DHA and others. Several manufacturers are focused on exploring novel functional ingredients and developing innovative methods for their delivery to capitalize on this emerging trend. Functional/fortified foods are the budding category that involves incorporating active omega-3 ingredients for the improvement of overall health.

Companies such as Evonik, BASF SE, and Royal DSM N.V. are some of the well-known players operating to meet the market growth. The increasing awareness regarding the health benefits of polyunsaturated fatty acids (PUFA) and the technological advancements to improve their bioavailability are the key factors driving the growth of the global omega-3 fatty acid market demand.

MARKET DYNAMICS

MARKET DRIVERS

Rising Awareness of Health Benefits of Polyunsaturated Fatty Acids (PUFA) Will Aid Market Growth

The recent recognition of the positive health effects of PUFAs has created a huge demand for Omega-3 fatty acids. The product is used in various applications such as dietary supplements, functional foods, and pharmaceuticals. Several recent clinical studies suggest that the consumption of PUFAs primarily supports chronic diseases such as cardiovascular problems and supports other functions in the body. The growing awareness regarding the omega fatty acids benefits and the importance of essential fatty acids is fueling the demand for long-chain PUFAs. In the past few years, omega fatty acids have gained remarkable popularity as they cannot be produced by the body and have to be administered externally with omega-3 rich diets or dietary supplements.

The most significant source of polyunsaturated fatty acid is fish oil. The recent evolution in market trends, such as the rising popularity of plant-based, clean-labeled ingredients, has contributed to exploring novel sources to extract PUFAs. Algae oil and flax seeds are important sources of omega-3fatty acids that are perfect for consumers following vegetarian diets. The emerging methods and studies that prove the health claims of PUFAs are expected to aid the growth of the market in the years to come.

MARKET RESTRAINTS

Organoleptic Properties and other Process-related Challenges to Impede Market Growth

Fish and Krill are the most significant marine sources of the product. The extraction process of omega-3 from marine sources has evolved in the last few years. There are a few process-related challenges faced by producers that hamper the growth of the market. Omega-3 products sourced from marine sources have a fishy odor and taste, which results in an unpleasant sensory experience. Functional foods containing these fatty acids may lose their flavor balance.

Furthermore, high temperatures in the processing may also affect the quality of the product. The extraction and purification processes of omega-3 fatty acids from marine sources produce a large amount of waste, and the contamination in the extracted product can limit its purity. The challenges faced in the process of producing high-quality, extremely purified products are impeding the growth of the market.

MARKET OPPORTUNITIES

Surging demand in Infant Nutrition Create Opportunity For Market Expansion

Increased demand for plant based raw materials acts as a key factor supporting its increased use in major ingredients such as vegan supplements, infant formula, and fortified foods. Manufacturers can also develop improved purification technologies and odor-free formulations to develop new products for the market. Manufacturers also have the opportunity to develop product lines specifically for the infant nutrition market. As mandatory DHA inclusion guidelines are adopted by several countries in Europe, China, and South America there is opportunity for growth in this segment.

OMEGA-3 FATTY ACIDS MARKET TRENDS

Expansion of Preventive & Cognitive Health Applications is Key Trend Impacting Market

Omega-3 (EPA/DHA) is increasingly positioned in the supplements market as a key ingredient that supports brain, heart, and eye health, beyond basic nutrition. Moreover, there is growing evidence that links Omega-3 intake to mental wellness and cognitive performance, driving its inclusion in the manufacturing of premium products for the consumers. Moreover, several food manufacturers are integrating Omega-3 into dairy, bakery, beverages, and infant formula products. They are adopting different production technologies which include the use of microencapsulation and emulsification to improve taste, stability, and shelf life of the products.

Download Free sample to learn more about this report.

Segmentation Analysis

By Source

Concentrates accounts for the largest market share owing to Higher EPA and DHA content

The market is divided by source into algae oil, fish oil, krill oil, concentrates, plant & seed oil,

and others.

The Concentrates segment led the market by source, accounting for 34.79% of the global market share in 2026. Concentrates contain 30-70% combined EPA and DHA, which provides 2–3× the active Omega-3 content in comparison to conventional oil. Hence these can be easily included in nutraceutical and pharmaceutical formulations.

The plant & seed oil segment is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.76% over the forecast period. Growing concern related to sustainability practices and overexploitation of traditional marine sources is expected to support this segments’ growth.

By Type

DHA is popular due to Scientifically proven Benefits of such Products

Based on type, the market is segmented into ALA, EPA, DHA, and EPA-DHA.

The DHA segment dominated by type, holding 34.96% of the market share in 2026. DHA is scientifically proven to provide neurological benefits and is widely used in infant nutrition products and cognitive health supplement products. DHA is legally required to be added in all infant formulas that are sold in the EU and in many Asian and South American markets supporting the segment’s growth.

EPA is another major type that is expected to grow by 7.97% during the forecast period. EPA is used in prescription drugs and is also approved by the U.S. FDA, EMA, and Japan’s PMDA. Such drugs help to treat hypertriglyceridemia, inflammation, and cardiovascular risk among high-risk patients.

By Concentration

High Concentrate is popular owing to Superior Purity and Higher Potency

Based on concentration, the market is segmented into standard, high concentrate, and ultra-high/pharmaceutical grade.

High Concentrate segment captured 42.00% of the global market share in 2026. High-concentrate oils contain EPA and DHA which is more effective than the omega-3 content of standard fish oil. Therefore, it delivers therapeutic dosages to the consumers in smaller capsules, making it suitable for pharma-grade and premium supplement formulations with improved functions. It is projected to grow steadily in the future.

Standard concentration is popularly used in packaged food products and is expected to grow by 7.35% during the forecast period. This type is less refined and cheaper to produce than high-concentrate or pharmaceutical-grade oils. Moreover, it is derived directly from crude or minimally refined fish oil, making it suitable for mass-market supplements, fortified foods, and animal feed applications.

By Application

To know how our report can help streamline your business, Speak to Analyst

Dietary supplements accounts for higher market share owing to rising preventive health awareness among consumers

The market is segregated by application into dietary supplements, functional/fortified food, infant formulae, pharmaceuticals, and animal feed and pet foods.

The Dietary Supplements application segment accounted for 57.37% of the market share in 2026. Omega-3 supplements (EPA and DHA) support improved heart and cardiovascular health, enhanced brain and cognitive function, joint, eye, and immune health. Hence, consumers consume Omega-3 supplements as a part of preventive healthcare regimes. Moreover, omega-3 has received official endorsements from regulatory agencies such as the FDA, EFSA, AHA, and WHO, strengthening the trust of consumers and medical practitioners.

Infant Formula sales are expected to grow 7.48% during the forecast period. DHA and EPA have been recognized as vital nutrients in babies' early life nutrition. Therefore, several countries have adopted regulations mandating the inclusion of such ingredients in most infant formula formulations.

Omega-3 Fatty Acids Market Regional Outlook

By region, the market is categorized into Europe, North America, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Omega-3 Fatty acids Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for USD 0.73 billion in 2025 and secure the position of the largest region in the market. Asia Pacific has immense potential for omega fatty acids, and it is expected to witness growth rates higher than the global average. The market's growth is attributed to the rising awareness of the health benefits and increasing discretionary incomes that enable consumers to spend on healthcare products that promote wellbeing. The demand for dietary supplements is increasing rapidly in highly populated countries of the region, such as China and India. The increasing popularity of functional food and beverages in the region contributes to the growth of omega-3 fatty acid-fortified foods. The Japan market reaching USD 0.27 billion by 2026, the China market reaching USD 0.32 billion by 2026, and the India market reaching USD 0.06 billion by 2026.

North America

North America held the second largest share in 2023, valued at USD 0.53 billion, and also took the leading share in 2024, with USD 0.56 billion. The robust growth of the market in North America is attributed to the rising awareness about the positive health effects of polyunsaturated fatty acids. The increasing prevalence of lifestyle-related health conditions, the increasing number of aging population, hectic lifestyle, and stress factors will create a huge demand for dietary supplements and functional foods in this region. The U.S. market reaching USD 0.53 billion by 2026. U.S. consumers are increasingly including nutritional supplements as part of its preventive health routines. Therefore, omega-3s (EPA, DHA, and ALA) are widely recognized for cardiovascular, brain, joint, and eye health benefits in the region and are used for manufacturing functional food and supplements.

Europe

After North America, the market in Europe is estimated to reach USD 0.55 billion in 2025 and secure the position of the third-largest region in the market. European consumers are highly health-conscious and proactive about preventive nutrition. Awareness of heart, brain, joint, and eye health benefits of Omega-3 supports the growing usage of such ingredients in different products. Aging populations in countries such as Germany, Italy, France, and other European markets are some of the major consumers of Omega-3 supplements for cardiovascular and cognitive support. During the forecast period, the European region is projected to record a growth rate of 7.18%. The UK market reaching USD 0.20 billion by 2026 and the Germany market reaching USD 0.16 billion by 2026.

South America and Middle East & Africa

Over the forecast period, South America and the Middle East & Africa regions would witness a moderate growth in this market. The South America market in 2025 is set to record USD 0.14 billion as its valuation. Expansion in refining and encapsulation facilities for domestic nutraceutical production in South American countries such as Brazil supports cheaper availability of such products in the market. In the Middle East & Africa, South Africa is set to grow at a CAGR of 7.00% during the forecast period. Several middle eastern infant nutrition companies use omega-3 in their baby nutrition formulas.

COMPETITIVE LANDSCAPE

Key Industry Players

Increasing R&D Activities to Aid Market Growth

The global market structure is moderately consolidated due to players such as Evonik, BASF SE, Royal DSM N.V., and Lonza & Epax. These major players are working toward further consolidation by acquiring small players in the industry. Partnerships, agreements, and investment in research & development are some of the key strategies adopted by these players to strengthen their market position.

The new entry of small and niche players in the market further escalates the competition and adds stimulus to the omega-3 fatty acids market growth. The exploration of novel sources for omega-3 by key players significantly contributes to the growth of the market.

LIST OF KEY OMEGA-3 FATTY ACIDS COMPANIES PROFILED

- Royal DSM N.V. (Netherlands)

- Evonik (Germany)

- BASF SE (Germany)

- Lonza (Switzerland)

- Epax (Norway)

- Croda International, Plc (U.K.)

- Cargill, Inc. (U.S.)

- Golden Omega (Chile)

- Corbion (Netherlands)

- Polaris (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Natac, an Omega-3 fatty acid launched Omega-3 Star a product which is manufactured using high-quality fish oil. This product is specially designed for application in the food, nutraceutical, and pet nutrition industries.

- October 2023: dsm-firmenich, one of the leading manufacturers of health, nutrition and beauty, announced the launch of life’s OMEGA O3020 in the North America market. It is the first and only single-source algal omega-3 with the same eicosapentaenoic acid (EPA) to docosahexaenoic acid (DHA) ratio that is naturally found in standard fish oil, but with higher efficacy.

- October 2022: Nature’s Bounty, a leader in manufacturing vitamin and nutritional supplements introduced a new Plant-Based Omega-3 dietary supplement in the market. This product is composed of 1,000 mg of vegetarian algae oil that supports heart, joint, and skin health.

- July 2021: Neptune Wellness Solutions Inc., a diversified and fully integrated health and wellness organization focused on plant-based, sustainable, and purpose-driven lifestyle brands, introduced a new Forest Remedies' plant-based Multi Omega 3-6-9 gummies and soft gels with Ahiflower as a major ingredient. This new product can help consumers to fulfill the nutrient requirement of the human body.

- February 2021: India-based start-up OZiva announced the launch of new vegan Omega-3 multivitamins to fulfill the increasing demand for plant-based dietary supplements.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.32% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Source, Type, Ingredients, Application, Concentration, and Region |

|

By Source |

· Algae Oil · Fish Oil · Krill Oil · Concentrates · Plant & Seed Oil · Others |

|

By Type |

· ALA · EPA · DHA · EPA-DHA |

|

By Concentration |

· Standard · High Concentrate · Ultra-high Grade |

|

By Application |

· Dietary Supplements · Functional/Fortified Food · Infant Formulae · Pharmaceuticals · Animal Feed & Pet Foods |

|

By Region |

North America (By Source, Type, Ingredients, Application, Concentration, and Country)

Europe (By Source, Type, Ingredients, Application, Concentration and Country)

Asia Pacific (By Source, Type, Ingredients, Application, Concentration and Country)

South America (By Source, Type, Ingredients, Application, Concentration and Country)

Middle East and Africa (By Source, Type, Ingredients, Application, Concentration and Country)

· Rest of the Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 2.11 billion in 2025 and is projected to grow from USD 2.25 billion in 2026 to USD 4.26 billion by 2034

In 2025, the market value stood at USD 0.73 billion.

The market is expected to exhibit a CAGR of 8.32% during the forecast period.

By source, the concentrates segment led the global market in 2024.

Rising awareness of health benefits of polyunsaturated fatty acids (PUFA) fuels market growth.

Evonik, BASF SE, and Royal DSM N.V. are a few of the key players in the market.

Asia Pacific held the largest market share in 2024.

Expansion of preventive & cognitive health applications is key trend impacting the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us