Needle Coke Market Size, Share & Industry Analysis, By Type (Oil-Based and Coal-Based), By Application (Graphite Electrodes, Special Carbon/Graphite Material, Lithium-ion Battery, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

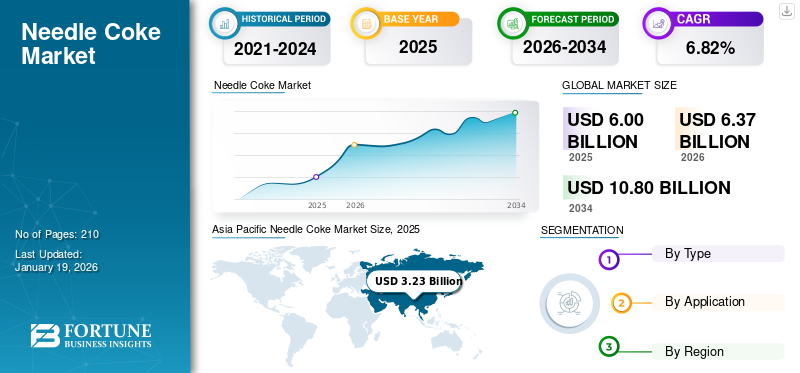

The global needle coke market size was valued at USD 6 billion in 2025. The market is projected to grow from USD 6.37 billion in 2026 and is projected to reach USD 10.8 billion by 2034, exhibiting a CAGR of 6.82% during the forecast period of 2026-2034. The Asia Pacific region is expected largest revenue share in the market, owing to the rapid industrialization, the growth of the electric vehicle (EV) industry, and increased steel production. Asia Pacific dominated the global market with a share of 53.83% in 2025.

Needle coke is an essential element in the steel recycling process, which is driving the market growth. This is mainly a heating element used in an electric arc furnace (EAF) for steel making. The versatile properties of steel make it the most dominant material used in various industries across the globe.

- In April 2025, the Government of India announced a target to achieve a production capacity of 300 billion tons by 2030, from 179 MT in 2024, to cater to the huge demand for end-use industries. Such development is expected to propel market expansion over the forecast period.

Asia Pacific, particularly China, dominated the market due to its substantial steel production and growing EV industry. North America and Latin America have also witnessed significant growth, supported by advancements in steel manufacturing technologies and the rising adoption of EVs. The market is poised for substantial expansion, supported by global industrialization, urbanization, and the transition toward cleaner energy solutions.

GrafTech International Ltd. is a prominent player in the market primarily due to its significant vertical integration and large-scale production capacity. The company operates through its major production facilities in Europe. The vertical integration provides GrafTech with competitive product quality and cost advantages, solidifying its leading position in the needle coke industry.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rapid Growth of Steel Industry to Foster Market Growth

The rising demand for graphite electrodes in the steel industry is a major driver for the needle coke market growth. As electric arc furnaces become more prevalent due to their energy efficiency and lower emissions, the need for high-quality coke increases. Additionally, the growing adoption of lithium-ion batteries in electric vehicles (EVs) has fueled the demand, as needle coke is a key anode material. Urbanization and infrastructure growth also boost steel consumption, indirectly supporting coke demand, especially in emerging economies with expanding industrial bases.

- In April 2025, Baldota Group announced investment plans for a steel plant in Karnataka, India. The plant is expected to have a production capacity of 10.5 billion tons/annum once fully operational. Such developments indicate the robust demand for steel and needle coke.

Infrastructure Development and Urbanization to Drive the Market Growth

Rapid urbanization and large-scale infrastructure development fuel product demand, especially in emerging markets such as India, China, and Southeast Asia. As construction and industrial projects grow, the need for steel increases, indirectly boosting the demand for coke used in graphite electrodes for EAF steelmaking. Government investments in smart cities, transportation, and housing create long-term market opportunities. This trend ensures a consistent pull for synthetic coke, driven by infrastructure-led economic growth and the evolving structural needs of developing nations.

MARKET RESTRAINTS

High Production Costs to Restrain Market Growth

Despite strong demand, the market faces restraints such as high production costs and environmental concerns. Manufacturing the product involves energy-intensive processes and releases significant greenhouse gases, which can lead to regulatory hurdles and increased compliance costs. Supply constraints due to limited petroleum-based feedstock further restrict the production capabilities. Varying raw material availability and price volatility also hamper the market stability. Moreover, geopolitical tensions affecting oil supply and refining operations can disrupt production, especially in regions heavily dependent on petroleum derivatives.

MARKET OPPORTUNITIES

Increasing Demand for Lithium-ion Batteries is Expected to Create Lucrative Opportunities

The transition toward renewable energy and electric mobility offers robust opportunities for needle coke manufacturers. The growing EV market requires lithium-ion batteries, where synthetic coke is essential for anode production. Increasing investment in clean energy storage solutions presents new avenues for coke usage. Moreover, advances in technology and R&D may reduce manufacturing costs and environmental impacts, propelling the demand for sustainable production. Emerging economies, especially in Asia Pacific and Africa, show rising infrastructure and steel demand, offering untapped market penetration and growth potential in the coming years.

- According to the International Energy Agency, EV battery demand is expected to grow four and a half times by 2030 and nine and twelve times in 2035, creating huge opportunities for lithium battery anode and coke manufacturers in the coming years.

MARKET CHALLENGES

Trade Restrictions and Geopolitical Instability Challenges Market Players

The limited number of producers and their reliance on specific feedstock create challenges in production and pricing. Environmental regulations targeting carbon emissions pose operational challenges, necessitating technological upgrades and increased investments. Additionally, competition from alternative materials and synthetic substitutes in battery and electrode applications could hamper the market share. Trade restrictions and geopolitical instability can further complicate global supply and distribution, particularly in export-dependent markets and regions facing raw material shortages.

GLOBAL NEEDLE COKE MARKET TRENDS

Growing Demand for Synthetic Graphite is an Emerging Market Trend

A key trend in the market is the shift toward synthetic needle coke, driven by its consistent quality and suitability for battery applications. The rise in electric vehicle sales boosts the demand for high-performance anode materials, making synthetic variants more attractive. Technological innovations in coke production and purification are improving efficiency and environmental compliance. Additionally, vertical integration strategies among manufacturers are emerging to secure raw material access and stabilize pricing. Regional shifts in production, especially toward Asia Pacific, are also influencing global trade flows and competitiveness.

IMPACT OF U.S. TARIFFS

U.S. tariffs, particularly those applied to goods and commodities produced in China, significantly impact the global market, including increased costs and disruptions to trade. China, a major consumer of coke, has responded with its retaliatory tariffs, leading to higher import costs and slowing down the output of anode materials. This has decreased U.S. petroleum coke shipments to China and potentially transformed global supply chains.

Moreover, in response to U.S. tariffs, China imposed tariffs on U.S. petroleum coke, including needle coke, which has increased import costs. This has led to a decrease in the U.S. coke shipments to China. Hence, the tariffs have disrupted the global supply chain, as China, a major consumer, is seeking alternative sources of supply. This can lead to uncertainty and volatility in the market, impacting other countries as well.

Hence, the imposition of U.S. tariffs has led to a sharp rise in prices for low-sulfur petcoke and coke in China and other markets. This price surge has been attributed to a slowdown in refining operations and increased demand from sectors including anode materials worldwide.

SEGMENTATION ANALYSIS

By Type

Oil-based Segment to Dominate Market Owing to High Demand in Electric Arc Furnaces

Based on the type, the market is segmented into oil-based and coal-based.

The oil-based segment is expected to dominate the market share 79.77% in 2026, driven by its distinct advantages in various applications. Oil-based segment, derived from petroleum feedstock, is preferred for producing ultra-high power (UHP) graphite electrodes used in electric arc furnaces (EAF) steelmaking due to its superior structural integrity and conductivity.

Furthermore, the coal-based segment, especially synthetic variants, is gaining traction in the lithium-ion battery industry for its high purity and consistency, making it ideal for anode production. Growing needs across the steel and EV sectors fuel parallel demand for both types. The demand for coal-based coke is expected to grow significantly, driven primarily by increasing demand from the steel and lithium-ion battery industries.

By Application

To know how our report can help streamline your business, Speak to Analyst

Rising Steel Production Contributes to Graphite Electrodes Segmental Growth

Based on the application, the market is categorized into graphite electrodes, special carbon/graphite material, lithium-ion battery, and others.

The graphite electrodes segment is estimated to hold a larger needle coke market share 75.33% in 2026, owing to the rapid growth in the steel manufacturing industry, especially electric arc furnace (EAF) production, increasing environmental regulations favoring EAF over blast furnaces, and rising infrastructure electrode in steelmaking. This boosts the coke consumption due to its superior electrical conductivity and strength.

- In December 2024, Mitsubishi Chemical Group announced plans to increase the production capacity of anode material for lithium-ion batteries used mainly in electric vehicles.

Furthermore, the lithium-ion battery segment is expected to grow significantly due to its critical role in producing high-performance anode materials. Its highly crystalline structure enhances battery capacity, longevity, and charging efficiency. As electric vehicles (EVs), portable electronics, and energy storage systems expand rapidly, synthetic coke is expected to become essential for meeting quality and performance standards in battery production.

NEEDLE COKE MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Asia Pacific Needle Coke Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

High Demand from End-User Industries Drives Market Growth in North America

The market in North America is driven by high demand from the graphite electrode industry, particularly in the U.S. The region benefits from well-established steel manufacturing and EV battery sectors. Technological advancements and environmental regulations encourage the production of high-quality synthetic coke. Additionally, the shale gas boom ensures the availability of raw materials. However, competition from Asian imports and fluctuating raw materials prices pose challenges for the market. The market is expected to remain stable with a moderate growth forecast.

U.S.

Increasing Steel Production to Propel Market Growth

The market in the U.S. is expected to grow significantly, owing to the increasing steel production using electric arc furnaces and the rising demand for lithium-ion batteries. This growth is further supported by the increasing adoption of electric vehicles, renewable energy storage systems, and advancements in battery technology requiring high-quality anode materials. The U.S. market is estimated to reach USD 0.73 billion by 2026.

- In April 2025, Lyten announced the production of battery-grade lithium-metal to expand its battery supply chain in the U.S., which creates an exclusively U.S.-manufactured anode supply chain.

Europe

Rising Demand for Lithium-ion Batteries to Boost Market Growth

In Europe, the market is supported by a strong emphasis on sustainability and clean energy. The region focuses on electric vehicles and green steel initiatives, boosting demand for needle coke in battery and electrode production. Stringent environmental regulations and high operational costs impact local manufacturing, leading to increased imports. Germany, France, and the U.K. lead in consumption despite slower economic recovery in some parts. Rising investments in renewable energy and steel recycling will drive long-term growth. The UK market is estimated to reach USD 0.24 billion by 2026, while the Germany market is estimated to reach USD 0.28 billion by 2026.

Asia Pacific

Robust Steel Production Drivers Market Growth

Asia Pacific dominates the market, with China and India as major contributors. Rapid industrialization, robust steel production, and the growing electric vehicle industry are key drivers. China leads in both consumption and production, with different government initiatives supporting EV and battery markets. Japan and South Korea also showcase a steady demand. However, environmental concerns and production capacity limitations may impact the supply. With increasing infrastructure projects and EV adoption, the region is poised for significant long-term growth. The Japan market is estimated to reach USD 0.22 billion by 2026, the and the India market is estimated to reach USD 0.31 billion by 2026.

- In October 2024, Rain Industries Ltd and Northern Graphite announced a joint agreement to develop advanced battery anode materials for lithium-ion batteries for electric vehicles. Hence, such developments by battery market players are expected to propel market demand over the forecast period.

China

Large-scale Electric Arc Furnace Steelmaking Propels Market Growth

China’s market is mainly driven by growing lithium-ion battery production and electric arc furnace steelmaking. The Country’s transition from traditional blast furnaces to EAFs, driven by environmental policies and the push for sustainable steel production, has significantly increased the demand for graphite electrodes manufactured using needle coke. Furthermore, China’s rapid expansion in the electric vehicle market and energy storage systems has amplified the need for high-quality anode materials in lithium-ion batteries. Hence, these factors propel the market growth in the coming years. China market is estimated to reach USD 2.6 billion by 2026.

Latin America

Growing Demand for Steel to Boost Market Growth

The demand for needle coke in Latin America is growing steadily, driven by rising steel production and demand for electric vehicles. Moreover, government infrastructure projects and industrialization further support graphite electrode and battery-related needs, with growing coke consumption over the forecast period.

Middle East & Africa

Rising Investments in Industrial Infrastructure and Increasing Steel Production are Expected to Drive Market Growth

The Middle East & Africa market is experiencing significant growth, driven by rising investments in industrial infrastructure and increasing steel production, particularly in Saudi Arabia and South Africa. The market is also being influenced by the global trend toward renewable energy and electric vehicle (EV) adoption, which are driving the demand for lithium-ion batteries, where needle coke is used in the anode.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Increasing Focus on Expansion of Production by Key Players is Fueling Market Growth

The key players operating in the global needle coke market include GrafTech International Ltd., Graphite India Ltd., Mitsubishi Chemical Corporation, JXTG Holdings, Phillips 66, Sumitomo Corporation, Indian Oil Corporation, Shaanxi Coal and Chemical Industry Group. In September 2020, IndianOil announced the installation of the Grassroot Needle Coker Unit at Paradip Refinery in India using IndianOil R&D's in-house technology. This unit will have a capacity of 56 KTPA by utilizing Graphite Electrodes. Market players are adopting various expansion strategies, such as partnerships, collaborations, and regional expansion, to increase market share in the global market in the coming years.

List of Key Needle Coke Companies Profiled

- GrafTech International Ltd (U.S.)

- Graphite India Ltd (India)

- Mitsubishi Chemical Corporation (Japan)

- JXTG Holdings (Japan)

- Sumitomo Corporation (Japan)

- Indian Oil Corporation (India)

- Sojitz Ject Corporation (Japan)

- Posco Chemical Company (South Korea)

- China National Petroleum Corporation (China)

- Phillips 66 (U.S.)

- Bao-steel Group (China)

- Sinopec Shanghai Petrochemical Company Limited (China)

KEY INDUSTRY DEVELOPMENTS

- In January 2025, TACC Ltd collaborated with Ceylon Graphene Technologies (CGT) to set up a graphene manufacturing unit in India. Moreover, both companies will advance graphene technology and applications.

- In May 2023, Chevron Lummus Global LLC announced a contract with TAQAT Development Company to develop a 75,000 TPA needle coke/synthetic graphite complex in Saudi Arabia. The Chevron Lummus Global LLC will provide licensing, pilot plant testing, basic design, and operations support.

- In July 2022, Zhongyi Future New Energy Technology Co., Ltd. announced an agreement to build a needle coke carbon material project with an investment of USD 1.49 billion. The project is expected to generate sales of USD 1.93 billion after completion.

- In December 2022, Gazprom Neft announced the production of needle coke at the Omsk Refinery in 2024. The production facility reduced the import dependence of Russia from the aerospace to the steel industry.

- In November 2020, Fanda Carbon entered into a strategic partnership with Sinopec Oil Refining Co., Ltd. to establish large-scale cooperation in the supply and R&D of needle coke products.

Investment Analysis and Opportunities

- In July 2023, Anovion announced plans to develop a manufacturing facility to produce synthetic graphite made of needle coke through an investment of USD 800 billion. The development is partially funded by a U.S. Department of Energy grant, and the plant is located in Georgia, U.S.

- In November 2021, LB Group announced plans to construct a lithium-ion battery anode material manufacturing facility with a capacity of 200,000 mt/year. The project is expected to cater to the increasing demand for lithium-ion batteries, leading to market growth of needle coke as a raw material for graphite electrodes.

REPORT COVERAGE

The global needle coke market report delivers a detailed insight into the market. It focuses on key aspects, such as leading companies in the market. Besides, the report offers regional insights and global market trends & technology, and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.82% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 6 billion in 2025.

The market is likely to grow at a CAGR of 6.82% over the forecast period (2026-2034).

The graphite electrodes segment is expected to lead the market over the forecast period.

The market size of Asia Pacific stood at USD 3.23 billion in 2025.

The rapid growth of the steel industry and infrastructure development, and urbanization to foster market expansion.

Some of the top players in the market are GrafTech International Ltd., Graphite India Ltd., Mitsubishi Chemical Corporation, JXTG Holdings, and Phillips 66.

The global market size is expected to reach USD 10.8 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us