Non-alcoholic Spirits Market Size, Share & Industry Analysis, By Product Type (Whiskey, Rum, Gin and Aperitif, Vodka, and Others), By Category (Conventional and Artisanal), By Type (Original and Flavored), By Price (Value, Premium, and Super Premium), By Distribution Channel (On-Trade and Off-Trade {Supermarket/Hypermarket, Convenience Stores, Liquor Stores, Online Retail, and Others}), and Regional Forecast, 2026-2034

Non-Alcoholic Spirits Market Size and Future Outlook

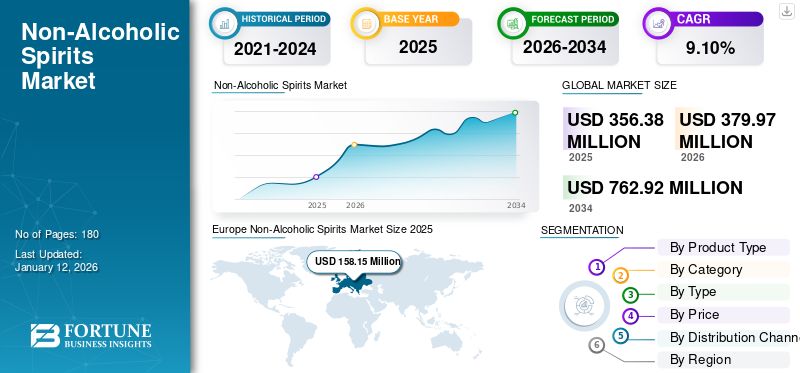

The global non-alcoholic spirits market size was valued at USD 356.38 million in 2025 and is projected to grow from USD 379.97 million in 2026 to USD 762.92 million by 2034, exhibiting a CAGR of 9.10% over the forecast period 2026-2034. Europe dominated the non-alcoholic spirits market with a market share of 44.38% in 2025.

Non-alcoholic spirits are distilled spirits which do not contain alcohol. Several steps are included in manufacturing these products, including distillation, infusion of aromatics & botanicals, and removal of alcohol through partial osmosis. These products include non-alcoholic rum, non-alcoholic gin, and whiskey. They are perceived to be healthier than their alcoholic versions due to their ability to reduce the risk of illness, which is otherwise caused by alcohol. Hence, the growth rates of these products are expected to remain high. Limited sugar in these drinks also makes them suitable for weight-conscious consumers. Some prominent manufacturers of non-alcoholic spirits include V9 Beverages, Diageo, Seedlip, and others.

Global Non-Alcoholic Spirits Market Overview

Market Size

- 2025 Value: USD 356.38 million

- 2026 Value: USD 379.97 million

- 2034 Forecast Value: USD 762.92 million, with a CAGR of 9.10% from 2026–2034

Market Share

- Regional Leader: Europe held the highest market share at 44.38% in 2025, driven by rising health consciousness and growing demand for premium alcohol alternatives in countries like France and the U.K.

- Fastest-Growing Region: Asia Pacific is expected to grow rapidly, fueled by increasing disposable incomes, shifting demographics, and rising popularity of craft and imported non-alcoholic beverages in China, India, and Japan.

- Top Product Segment: Gin and aperitif led the product category in 2024 due to their popularity among experimental consumers and mixologists in on-trade settings.

Industry Trends

- Premiumization & Craft Appeal: Rising demand for small-batch, artisanal non-alcoholic spirits with botanical and exotic flavors.

- Luxury & Lifestyle Positioning: Non-alcoholic spirits are increasingly marketed as luxury beverages with collectible packaging and strong brand heritage.

- Flavor Innovation: Launches of tropical, spiced, and fruit-forward variants tailored for younger, taste-exploring consumers.

- On-Trade Dominance: Bars and restaurants remain the key distribution channels, driving discovery and trial of new products.

- Online Retail Expansion: Growth in e-commerce and DTC platforms boosted availability during and post-COVID-19.

Driving Factors

- Health Consciousness & Wellness Trends: Consumers are reducing alcohol intake and seeking healthier alternatives to traditional spirits.

- Government Support & Campaigns: Initiatives in Europe and Asia encouraging responsible drinking and alcohol-free alternatives.

- Product Innovation & Branding: Frequent launches of flavored, premium, and event-themed non-alcoholic spirits are enhancing consumer appeal.

- Improved Cold Chain & Retail Infrastructure: Especially in developing regions, enabling better distribution and shelf-life.

- Growing Millennial & Gen Z Demand: Younger consumers are driving demand due to their preference for mindful consumption and social drinking without alcohol.

MARKET DYNAMICS

Market Drivers

New Product Launches in Non-Alcoholic Spirits Category to Support Market Growth

Beverage manufacturing companies are redefining their product offerings to focus on experimental experiences and engagement with consumers to provide a memorable experience. Spirits manufacturing companies are packaging their products in collectible bottles and focusing on their brand heritage to curate their products for an evolving consumer segment. As consumers are shifting toward healthier alternatives of alcoholic drinks and are open to experimenting with the taste and flavor of zero-alcohol beverages, traditional alcoholic brands are also investing in expanding their product offerings in this category. Hence, the growth of the global non-alcoholic spirits market is expected to remain high.

For instance, in September 2024, non-alcoholic spirits brand, Seedlip, launched the non-alcoholic distillery lab Sylva, which will manufacture premium dark spirits with no/low alcohol content that consumers can pre-book.

Increased Demand for Non-Alcoholic Drinks Among Health-Conscious Consumers to Escalate Market Growth

One of the key factors contributing to the market's growth is the strategic positioning of these drinks as a healthy alternative to alcoholic beverages. The presence of alcohol in beverages is linked to several health issues, which include liver disease, brain, and heart ailments. Consumption of alcohol-free spirits helps reduce calorie consumption and the chances of contracting these ailments. It also helps consumers enjoy drinks that are similar in taste to alcohol-based ones. Hence, with the increase in health consciousness among consumers, the demand for such products is also expected to increase.

Market Restraint

Complex Manufacturing Process and High Production Cost to Limit Market Growth

Compared to alcohol products, zero-alcohol spirits are expensive, which makes them the least favorable option among cost-conscious consumers. The high production cost of these products is one of the major factors that adds to the price of the final product. A significant proportion of low-alcohol spirits are manufactured from standard spirits through dealcoholisation, increasing the overall production cost. As the manufacturing process is complex, advanced machinery and skilled labor are required to conduct the manufacturing, which adds to the overall cost of the product. Hence, cost-conscious consumers may prefer to purchase other cheaper alternatives available in the market.

Market Opportunity

Favorable Government Initiatives and Improvement in Cold Chain Infrastructure to Create Opportunities For Market Expansion

Government initiatives that support the growth of the non-alcoholic spirits market are expected to help domestic market players expand their production capacity and even export their products to international markets. For instance, the government of India intends to expand the export of its alcoholic and non-alcoholic spirits to the international markets as a part of its “Make In India” campaign. Moreover, improvements in the cold chain infrastructure, especially in developing countries, act as one of the key factors expected to support the growth of the market in the untapped region.

Market Challenge

Complex Regulatory Approvals to Create Challenges for Market Growth

Complex regulatory frameworks in different countries pose a significant challenge for manufacturers with respect to the production, packaging, marketing, and distribution of non-alcoholic spirits in different countries. Apart from this, producing spirits by maintaining the sensory characteristics of alcoholic spirits without alcohol is a major challenge for manufacturers. Low consumer awareness also plays a crucial role in the limited sales of these drinks.

Non-Alcoholic Spirits Market Trends

Growing Demand for Luxury Drinks is a Major Factor Supporting Market’s Growth

The increased demand for premium drinks among consumers is a major factor positively influencing the market’s growth. The popularity of local craft brands is growing in the market, and consumers are opting for niche luxury products produced in small batches. As the popularity of such artisanal batches increases, the non-alcoholic spirits market growth is expected to gain traction.

- For instance, in 2023, ECHIGOYAKUSO Corporation, one of the most prominent manufacturers of craft gin in Japan, launched a botanical ingredient-based craft non-alcoholic gin named NON ALCOHOLIC YASO GIN in the country.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic had a negative impact on the market’s growth as many major foodservice establishments and public houses, such as pubs were closed during this period. Government restrictions on public gatherings forced several such establishments to close or minimize their operations, resulting in reduced product sales through these channels. However, online sales of these beverages increased during this period. The expansion of online retail channels during this time was one of the major factors that helped boost the sales of non-alcoholic drinks through online platforms.

SEGMENTATION ANALYSIS

By Product Type

Gin and Aperitif Hold Highest Market Share Owing to Their Huge Popularity Among Experimental Consumers and Mixologists

By product type, the market is segmented into whiskey, rum, gins and aperitif, vodka, and others.

Gin and aperitif segments accounted for the largest market with a share of 42.74% in 2026 and are expected to grow steadily. These drinks are popular among young experimental consumers and mixologists in restaurants and bars. Several companies, including domestic and international brands, are launching alcohol-free gin in their market to attract consumers who want to enjoy alcoholic-free variants of such products.

Whiskey is another prominent product type that is popular among consumers. Rising consumer preference for premium-quality, specially developed products manufactured through craft distilleries positively influences the segment’s growth. The products' scents and innovative flavors are also factors that make them favorable among consumers.

Rum segment held a significiant share by 8% in the market in 2024. Rum is another major category of products that is popular among consumers. As more consumers are shifting to alcohol-free drinks, innovative product alternatives are being launched in the market to target such consumer segments. Innovative flavor profiles, such as spiced flavor, botanical flavor, and others have been launched in the market, contributing to this segment’s growth.

The popularity of non-alcoholic vodka is also growing among consumers, and there is a huge opportunity for the manufacturers to expand their product offerings in this category. Other products, such as non-alcoholic mezcal, tequila, and other agave spirits are also available in the market and growing popular among consumers.

To know how our report can help streamline your business, Speak to Analyst

By Type

Flavored Products Account for Largest Market Share Due to Their Good Taste Profile

By type, the market is segmented into original and flavored.

The flavored segment accounts for the highest market contributing 73.64% globally in 2026 and is projected to grow at a high CAGR of 8.57% during the forecast period. Non-alcoholic drinks are healthier, and including flavors in them helps improve their taste as they mimic the flavor profile of alcoholic beverages in a similar category.

Original/unflavored products is likely to account for 27% of the market share in 2025 and it’s another major segment that will grow steadily during the forecast period. It provides a clean taste to the consumers who prefer to enjoy the beverages in their original taste. Moreover, such products usually contain less sugar than flavored products hence the original/unflavored products segment dominates the market.

By Category

Conventional Products Account for Largest Market Share Due to Their Wider Availability

By category, the market is segmented into conventional and artisanal products.

The conventional products segment accounted for the largest market share in 2025 owing to their wider availability and lower price compared to artisanal products. Several multinational companies, such as Diageo, Seedlip, and others are expanding their product range in the zero-alcohol spirits segment. The conventional segment is projected to capture 60.27% of the market share in 2026.

The artisanal products segment is expected to record the fastest CAGR of 6.56% during the forecast period owing to the growing popularity of high-quality artisanal products among consumers who want to experiment with their taste. These products are comparatively expensive and are produced in small batches.

By Price

Premium Products Account for Largest Market Share as Their High Quality is Favored By Health-Conscious Consumers

Based on price, the market is segmented into value, premium, and super premium.

The premium segment dominated the segment accounting for 47.24% market share in 2026 and is also expected to record a comparatively higher CAGR of 8.69% than other categories. The increase in consumer health consciousness and the consequent shift of consumers toward such high-quality, premium ingredient-based products are among the major factors supporting this segment's growth.

The value segment is likely to capture 35% of the market share in 2025 and is another prominent segment of non-alcoholic spirits globally. Cost-conscious consumers are also investing in products that are health-conscious, and the launch of products in this category helps cater to this consumer base.

The super premium product segment is projected to grow at the highest rate during the forecast period. These products include artisanal products manufactured in small batches with high-quality ingredients that are favored by consumers who intend to experiment with unique tastes and flavors in beverages.

By Distribution Channel

On-Trade Channel Has Highest Market Share Due to Wider Product Sales Through Restaurants and Other Channels

Based on distribution channel, the market is segmented into on-trade and off-trade channels.

The on-trade distribution channel segment will account for the largest market share of 70% in 2025 and exhibit a strong CAGR of 8.72% during the forecast period as this platform records higher sales of non-alcoholic spirits as compared to other channels. Apart from restaurants, pubs, and other foodservice channels, experimental drinking venues are becoming increasingly popular and directed towards meeting the diverse requirements of consumers.

The off-trade channel is one of the leading segments that is expected to grow the fastest during the forecast period. Supermarkets and hypermarkets, which are a part of this channel, account for the largest market share due to the wide availability and sales of non-alcoholic drinks through these distribution channels. In the offline stores, specifically the liquor and specialty stores, the shop owners are expanding their inventory of non-alcoholic beverages, and the demand for similar spirits is also increasing. The evolving consumption patterns of consumers are crucial in prompting retailers to provide more shelf space for such products. There is a huge potential for growth through the evolving retail channels, specifically the online channels. Hence, this channel is projected to grow the fastest during the forecast period.

Non-Alcoholic Spirits Market Regional Outlook

Geographically, the global non-alcoholic spirits market report covers analysis across North America, Europe, Asia Pacific, South America, the Middle East, and Africa.

Europe

Europe Non-Alcoholic Spirits Market Size 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Europe is the leading market of zero-alcohol spirits, valued at USD 158.15 million in 2025 in the global non-alcohol spirits market. There is a growing public awareness about the harm caused by the consumption of alcohol, and the European Commission is also funding several projects that help increase this awareness among consumers. Alcohol-free beverages are a suitable alternative for consumers who want to enjoy the flavor of spirits without the presence of alcohol in them.

France is the leading consumer and accounts for the major portion of the global non-alcoholic spirits market share. There are a significant number of startups in the country involved in producing a wide range of zero-alcohol products, including spirits. The country has an extensive number of well-established companies that are extending their product offerings in this segment due to the growing number of consumers who are abstaining from alcohol. The market in France is estimated to hit USD 41.69 million in 2025, while the U.K. market likely to value for USD 22.96 million and Germany anticipated to hit USD 26.22 million in 2026.

North America

North America's market is expected to be the second-largest regional market, accounting for USD 121.11 million in 2026 and exhibiting a strong CAGR of 8.90% during the forecast period and the U.S. accounts for the highest share in the region, followed by Canada and Mexico. Mindful consumption of beverages among young consumers due to increased awareness about the ill effects of alcohol consumption is one of the major factors influencing the product’s growth in the region.

In the U.S., the attitude of consumers toward drinking is becoming unfavorable, and several people are opting for alcohol-free alternatives. As per a report published by the RAC on Motoring 2024, in the U.S., around 28% of consumers aged 17-24 who were driving and surveyed for the study consumed non-alcoholic drinks. Similarly 35% of the consumers aged 65 years and above consumed non-alcoholic drinks. Thus, major alcoholic beverage manufacturers, such as Diageo and Pernod Richard are launching non-alcoholic products for these consumers in the country. The U.S market is likely to reach USD 74.99 million in 2026.

- For instance, in October 2024, Caleño, a non-alcoholic spirits brand, extended its Colombia-inspired non-alcoholic ‘rum’ range by launching new products. The two new flavors launched in the market include White Coconut ‘Rum’ and Mango and Passion Fruit ‘Rum.’

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

In Asia Pacific, China, India, and Japan are expected to register strong growth. The Asia Pacific region will likely value for USD 60.88 million in 2026, as the third-largest market. Increase in disposable income in the region, positive demographic changes in India & Southeast Asian countries, growth in retail sector, and rising popularity of craft spirits & imported brands are some of the major factors that will positively influence the market’s growth in the region. Several domestic companies that earlier operated in this category in the value-based segments are also expanding their product portfolio and offering high-quality premium products to the aspirational consumer base. The market in China is estimated to hit USD 21.86 million in 2026, while the Japan market will likely value for USD 10.96 million and India is anticipated to hit USD 7.19 million in 2026.

South America

The non-alcoholic spirits market of South America is still evolving and expected to grow rapidly in the coming years with a market size of USD 19.20 million in 2026. Healthy and moderate drinking trends among young consumers, especially Gen Z consumers, are shaping and popularizing zero-alcohol drinks in Brazil, Argentina, Chile, and other South American nations. Moreover, they have a low-calorie content, so weight-conscious individuals also favor them.

Middle East & Africa

The Middle East & Africa markets are largely untapped and present a huge opportunity for growth for non-alcoholic spirit manufacturers. There are several Middle Eastern countries where public consumption of alcohol is banned or the availability of such products is heavily regulated by the government. Thus, in the Middle Eastern and African countries, namely South Africa, Ethiopia, and others, non-alcoholic spirits are a suitable alternative for consumers who want to enjoy spirits' flavor without alcohol in them. The UAE market is projected at USD 2.22 million in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

New Product Launches and Investment in Innovation to Support Market Growth

The global market is fragmented, with several multinational companies, and regional & domestic players competing to expand their market presence. New product launches and investment in innovation are some of the major strategic initiatives the companies are using to compete with each other. The quality of zero-alcohol spirits that domestic brands in respective countries manufacture is also increasing rapidly, prompting several consumers to sample these products. The rising competition between domestic and international brands creates a suitable market scenario for innovation and competitive pricing of products for different consumer segments. Manufacturers are also launching seasonal or event-themed products to create memorable experiences for the consumer and increase brand loyalty. For instance, Indian brand Sober launched the Pink edition of SOBER NON-ALCOHOLIC GIN in 2020 to raise breast cancer awareness among consumers.

Major Players in the Non-Alcoholic Spirits Market

To know how our report can help streamline your business, Speak to Analyst

Diageo plc, Lyre’s, BARE Zero Proof Spirits Inc., Everleaf, and V9 Beverages Pvt. Ltd. are some of the largest players in the market. The global market is fragmented, with the top 5 players accounting for around 30% of the global non-alcoholic spirits market share.

List of Key Non-Alcoholic Spirits Companies Profiled:

- Diageo plc (U.K.)

- Lyre’s (U.K.)

- Everleaf (U.K.)

- V9 Beverages Pvt. Ltd. (India)

- Spiritless Inc. (U.S.)

- Wilderton (U.S.)

- THE FREE SPIRITS COMPANY (U.S.)

- SOBRII (Canada)

- Seadrift Distillery Non-Alcoholic Spirits (Australia)

- BARE Zero Proof Spirits Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2024: Non-alcoholic ‘spirits’ brand Caleño introduced new market rum flavors specifically targeting younger consumers. The new product range includes White Coconut, Mango, and Passion Fruit Rum.

- September 2024: JuneShine, a U.S.-based company, expanded its range of non-alcoholic products and included non-alcoholic Kombucha products in the market.

- September 2021: Diageo plc acquired U.S.-based company Ritual Zero Proof, one of the leading manufacturers of non-alcoholic spirits. The acquisition was expected to help the company sustainably grow in the zero-alcohol category.

- February 2021: Tanqueray introduced its non-alcoholic product variant of Classic gin Tanqueray 0.0% in the U.K. market. The product is available across supermarkets and is made of juniper, coriander, angelica, and licorice.

- September 2020: Lyre's Non-Alcoholic Spirit Co one of the prominent manufacturers of non-alcoholic spirits, named non-alcoholic spirits, obtained funding of USD 11.5 million. The funding helped the company position itself as one of the leading global players in the non-alcoholic beverage market.

Investment Analysis and Opportunities

The market report provides comprehensive investment analysis and opportunities to provide investors and business leaders with actionable insights. The global market overview report highlights the various opportunities that have the potential for investments, including new product launches, technological advancements, mergers & acquisitions, and geographic expansions.

REPORT COVERAGE

The report analyzes the market in-depth and highlights crucial aspects such as global market trends, prominent companies, and distribution channels. Besides this, the market analysis also provides insights into some of the most significant industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.10% from 2026 to 2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Product Type

|

|

By Category

|

|

|

By Type

|

|

|

By Price

|

|

|

By Distribution Channel

|

|

|

By Region North America (by Product Type, by Category, by Type, by Price, By Distribution Channel and by country)

Europe (by Product Type, by Category, by Type, by Price, By Distribution Channel and by country)

Asia Pacific (by Product Type, by Category, by Type, by Price, By Distribution Channel and by country)

South America (by Product Type, by Category, by Type, by Price, By Distribution Channel and by country)

Middle East and Africa (by Product Type, by Category, by Type, by Price, By Distribution Channel and by country)

|

Frequently Asked Questions

Fortune Business Insights says the global market was valued at USD 379.97 million in 2026 and is anticipated to reach USD 762.92 million by 2034.

At a CAGR of 9.10%, the global market will exhibit steady growth over the forecast period.

By product type, gin and aperitif dominates the market.

Increased demand for non-alcoholic drinks among health-conscious consumers will drive the market growth.

Diageo plc, Lyre’s, BARE Zero Proof Spirits Inc., Everleaf, and V9 Beverages Pvt. Ltd. are the leading companies.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us