North America Aerospace Fasteners Market Size, Share & Industry Analysis, By Material (Aluminum, Titanium, Stainless Steel, Superalloy, and Others), By Superalloy Material (A286, Inconel 718, Waspaloy, and Others), By Application (Airframe, Engine, Interior, and Others), and Regional Forecast, 2025-2031

KEY MARKET INSIGHTS

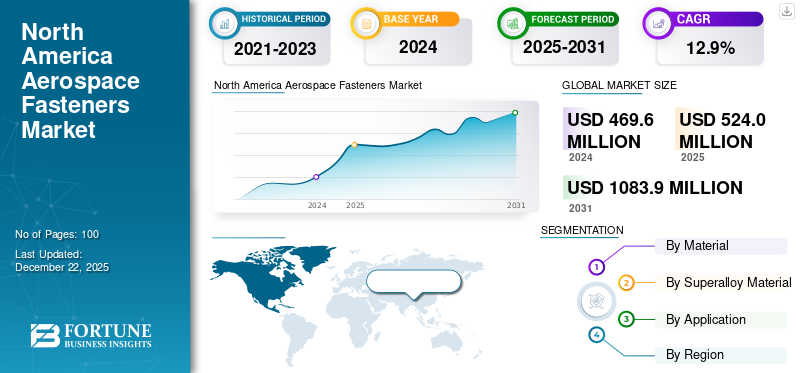

The North America aerospace fasteners market size was valued at USD 469.6 million in 2024. The market is projected to grow from USD 524.0 million in 2025 to USD 1083.9 million by 2031, exhibiting a CAGR of 12.9% during the forecast period.

North America maintains a commanding position in the aerospace fastener industry. A large number of fasteners are required for the manufacturing, maintenance, and repair of aircraft in the region's aerospace sector, which includes both the commercial and military industries. The increasing demand for specialized aerospace fasteners in North America is further supported by cutting-edge technology, an emphasis on lightweight materials, and a strong MRO (maintenance, repair, and overhaul) network.

North America serves as a hub for the development and deployment of advanced fastening solutions, which are critical for ensuring structural integrity, safety, and operational efficiency across a wide range of aerospace applications. The market further benefits from the ongoing advancements in materials science, manufacturing processes, and digital integration. Key players include Boring, Lockheed Martin, and Bombardier, who drive demand for high-quality fasteners (nuts, bolts) through their production and modernization initiatives.

Due primarily to disruptions in the aerospace sector and supply chains, the COVID-19 pandemic had a considerable impact on the aerospace fasteners market in North America. Although the initial effect was bad, with fewer planes being manufactured and delivered, the market is predicted to rebound once manufacturing and travel resume.

NORTH AMERICA AEROSPACE FASTENERS MARKET TRENDS

Growth in Aircraft Production and Maintenance Activities is a Latest Market Trend

Growth in aircraft production and maintenance is among the most prominent and impactful trends in the current aerospace industry. A combination of robust demand for new wide-body, narrow-body aircraft, the ongoing modernization of existing fleets, and regional leadership in both commercial and business aviation drives the demand in the industry. According to Aviation Week Network data, North America is expected to see substantial new aircraft deliveries in the coming decade, with over 5000 commercial aircraft between 2025 and 2034. This surge is further fueled by rising air passenger traffic.

With large manufacturing hubs in North America, major airplane makers such as Boeing and Airbus are boosting output to satisfy the rising demand for military and commercial aircraft. Furthermore, the demand for aerospace fasteners in North America is consistent as the worldwide fleet of commercial aircraft segment grows, necessitating more maintenance, repair, and overhaul (MRO) services.

MARKET DYNAMICS

MARKET DRIVERS

Increased Demand for Air Travel to Boost Market Expansion

The demand for air travel is rising prominently, which is a driver for the growth of the market. According to the International Air Transport Association (IATA), the aviation sector is expected to experience a substantial period of growth in the coming 20 years, with global passenger numbers estimated to expand to 8.2 billion by 2037. In October 2024, global air travel demand rose by 7.1% compared to the same month in 2023, as reported by the International Air Transport Association (IATA).

As air travel rises, there is an increase in the requirement for expansion of airline fleets to accommodate more passengers. Thus, different airlines are ordering novel aircraft at a growing rate. For instance, Airbus, a European-based aircraft producer, delivered 735 commercial aircraft in 2023, an 11% increase from 2022. In 2023, Boeing received a total of 1,314 net new orders (1,456 gross orders) prior to ASC 606 adjustments, marking a rise from the 774 net new orders (935 gross orders) recorded in 2022. In addition, the number of aircraft orders increased gradually in 2024, owing to an increase in air traffic globally. For instance, in December 2024, Pegasus Airlines, a low-cost airline based in Turkey, orders up to 200 Boeing 737-10 aircraft to modernize and expand its single-aisle fleet.

In addition, the commercial aircraft industry is expected to witness a robust recovery growth trajectory in the coming years. For instance, Boeing's 2024 Commercial Market Outlook projects a demand for nearly 44,000 new commercial aircraft over the next 20 years.

This increase in aircraft production directly corresponds with a higher demand for aerospace fasteners, which are vital components in aircraft assembly and maintenance. Therefore, the rise in air traffic and air travel acts as a prominent driver for the growth of the market. As airlines expand their fleets with new aircraft, the need for reliable and advanced fasteners will continue to fuel the growth of the North America aerospace fasteners industry.

MARKET RESTRAINTS

Fluctuating Raw Material Prices Are Anticipated to Hamper Market Growth

The prices of key raw materials used in aerospace fasteners, such as titanium, aluminum, and alloy steel, can be highly volatile. The prices of these primary materials keep fluctuating due to various factors such as global supply chain issues, geopolitical tensions, and changes in demand. This volatility can lead to unpredictable production costs for manufacturers, making it difficult to maintain stable pricing for customers. For instance, the pricing data for aluminum from 2016 to 2024 shows significant fluctuations, with prices per ton recorded as follows: USD 1,467.3 in 2016, USD 2,075.6 in 2018, USD 1,722.9 in 2020, USD 2,816.1 in 2022, and a projected USD 2,282.1 in 2024.

Therefore, high production costs and fluctuating raw material prices are significant restraints on the North America aerospace fasteners market growth.

MARKET OPPORTUNITIES

Innovation in Fastener Design for Composite Aircraft Structure is Latest Market Opportunity

As aircraft manufacturers strive to improve performance, efficiency, and safety, the demand for advanced fastening solutions that can accommodate new materials, complex geometries, and evolving engineering requirements is rising.

The development of innovative fasteners is closely linked to advancements in manufacturing technologies and digital integration. Additive manufacturing, or 3D printing, is enabling the production of custom fasteners with intricate designs. These techniques allow for the creation of fasteners for specific structural needs.

Manufacturers such as Howmet Aerospace developed Flite-Tite fasteners, which address the unique challenges posed by lightning strikes on carbon fiber reinforced aircraft. Flite-Tite fasteners are engineered to hold composite airframe sections tightly and securely. The Flite-Tite fastening system incorporates a titanium or steel sleeve that prevents gaps between the composite airframe sections, allowing electrical currents to discharge safely.

The company also manufactures Asp Fasteners with innovative design and functionality, particularly in the context of fastening various materials, including composites. Its design is particularly beneficial for materials sensitive to clamp-up or installation force conditions, reducing the risk of damage during installation. Moreover, the Composi-Lok fasteners by Monogram Aerospace are specifically designed for use in composite laminates while also being compatible with metal structures, providing superior joint integrity.

Download Free sample to learn more about this report.

Segmentation Analysis

By Material

Increased Production of Commercial Aircraft Propelled Aluminum Material Demand

On the basis of material, the market has been divided into aluminum, stainless steel, superalloy, and titanium.

The aluminum segment accounted for a dominating North America aerospace fasteners market share in 2024. The dominance is attributable to the increased production of commercial aircraft. Aluminum fasteners are used in the majority of aircraft as they reduce corrosion, avoid magnetism, are low-cost, and provide aesthetic quality. Aluminum fasteners are mainly used in commercial aviation, military aircraft, and general aviation. These fasteners are mainly purchased by Tier 1 suppliers of Airbus and Boeing. Aluminum fasteners are more commonly used in the manufacturing of Boeing 787, Airbus A310, Boeing 777, and other aircraft.

The titanium segment is likely to grow with the highest CAGR in North America aerospace fasteners market. The growth of the segment is attributed to the growing demand for advanced engines and the rising commercial fleet expansion.

By Superalloy Material

A286 Segment Represented Largest Market Share Due to Its High Strength

Based on superalloy material, the market is divided into A286, Inconel 718, Waspaloy, and others.

The A286 segment dominated the market share in 2024. A286 offers excellent strength and corrosion resistance, making it suitable for critical structural and engine applications in aerospace. A286 is an iron-based superalloy specifically used to deliver mechanical strength and superior resistance to corrosion. A286 maintains its strength at elevated temperatures up to approximately 1300°F, which is crucial in environments near jet engines and exhaust systems.

The Inconel 718 segment is projected to grow significantly during the forecast period. Inconel 718 is a nickel-chromium-based superalloy. It has lightweight characteristics relative to its strength and temperature resistance. Due to such characteristics, it offers improved payload capacity and extended range in aircraft.

By Application

Fleet Modernization Programs for Aging Aircraft Fueled Segmental Growth for Airframes

Based on application, the market is segmented into airframe, engine, interior, and others.

The airframe segment dominated the global market in 2024. To guarantee safety, compliance, and operational efficiency, older fleets require more maintenance, repair, and overhaul (MRO) operations. Due to structural inspections, repairs, and upgrades that rely heavily on high-quality fasteners to maintain the airframe's integrity, there is a great demand for these services among MRO providers.

The engine segment is anticipated to grow significantly during the study period. Engines function in extreme temperatures and pressures, and fasteners made of superalloys are essential for longevity and safety. Enhancements in superalloy formulations and coatings increase resistance to heat, oxidation, and wear, which helps to ensure engine dependability.

COMPETITIVE LANDSCAPE

Key Industry Players

Focus on Innovation and Technology in Aerospace Fasteners by Leading Firms Has Led to Their Prevailing Presence in Market

The competitive landscape of North America aerospace fasteners market is shaped by established industry leaders in the region. Key players in the market include Howmet Aerospace Inc. (U.S.), B&B Specialties Inc. (U.S.), and The Boeing Company. (U.S.), HC Merchandisers, Inc. (HC Pacific) (U.S.), LISI Aerospace (France), MS Aerospace (U.S.), and others. These companies invest heavily in research and development to produce fasteners that are lightweight, durable, and compatible with new materials such as composites and advanced alloys. Moreover, companies such as Boeing and Lockheed Martin generate consistent demand for high-quality fasteners for both commercial and military aircraft.

LIST OF KEY NORTH AMERICA AEROSPACE FASTENER COMPANIES PROFILED

- Howmet Aerospace Inc. (U.S.)

- B&B Specialties Inc. (U.S.)

- The Boeing Company. (U.S.)

- HC Merchandisers, Inc. (HC Pacific) (U.S.)

- LISI Aerospace (France)

- MS Aerospace (U.S.)

- National Aerospace Fasteners Corporation (Taiwan)

- Stanley Black & Decker, Inc. (U.S.)

- Wurth Group (Germany)

- TriMas Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2025: New supplies of specialized nuts and bolts that connect Boeing's best-selling commercial aircraft have been obtained by the firm. Due to the February fire, Boeing had been short on particular fasteners used to secure the landing gear on its 737 MAX jets.

- July 2024: Howmet Aerospace Inc. announced an expansion of its operations in Morristown, Tennessee, creating 50 new jobs and investing USD 27.9 million in the facility. This announcement was made in conjunction with the Farnborough International Airshow taking place in the U.K.

- May 2024: IperionX Limited and Vegas Fastener Manufacturing established a joint venture to manufacture titanium alloy fasteners and precision components, offering titanium fasteners and components to the U.S. Army Ground Vehicle Systems Center (GVSC).

- September 2023: 3D Systems, a top U.S. provider of additive manufacturing solutions, said it has secured a USD 10.8 million deal from the U.S. Air Force for a Large-format Metal 3D Printer Advanced Technology Demonstrator. The agreement supports the creation of large-scale additive manufacturing print capabilities relevant to hypersonics.

- February 2023: TriMas revealed that it has finalized an agreement to purchase the operational net assets of Weldmac Manufacturing Company (“Weldmac”), a prominent designer and producer of high-performance, intricate metal fabricated components and assemblies for the aerospace, defense, and space launch sectors.

REPORT COVERAGE

The North America aerospace fasteners market analysis provides market size and forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market growth over the forecast period. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2031 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2031 |

|

Historical Period |

2021-2023 |

|

Growth Rate |

CAGR of 12.9% from 2025-2031 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Material

|

|

By Superalloy Material

|

|

|

By Application

|

Frequently Asked Questions

Fortune Business Insights says that the market value stood at USD 469.6 million in 2024 and is projected to reach USD 1083.9 million by 2031.

In 2025, the market value stood at USD 524.0 million.

The market is expected to exhibit a CAGR of 12.9% during the forecast period.

Increased demand for air travel is expected to boost market expansion.

Howmet Aerospace Inc. (U.S.), B&B Specialties Inc. (U.S.), The Boeing Company. (U.S.), HC Merchandisers, Inc. (HC Pacific) (U.S.), LISI Aerospace (France), and MS Aerospace (U.S.) are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us