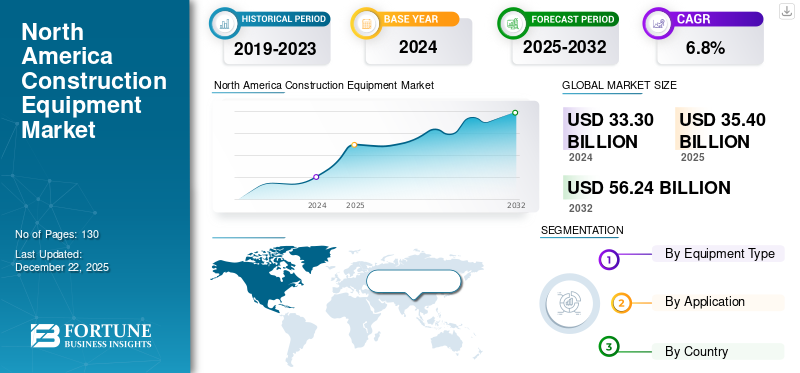

North America Construction Equipment Market Size, Share & Industry Analysis, By Equipment Type (Earthmoving Equipment, Material Handling Equipment & Cranes, Concrete Equipment, Road building equipment, Civil engineering equipment, Crushing and screening equipment, and Other Equipment), By Application (Residential, Commercial, and Industrial), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

The North America Construction Equipment market size was worth USD 33.30 billion in 2024 and is estimated to grow to USD 35.40 billion in 2025 and reach USD 56.24 billion by 2032. The market is projected to grow at a CAGR of 6.8% during the forecast period.

The North American market for construction equipment, including earthmoving and material handling equipment, is witnessing a strong growth owing to heavy infrastructure investments, planned megaprojects, manufacturing facility expansion, and the development of industrial parks. Diversification of economies and investment in transport infrastructure boosts the market growth of construction equipment.

- For instance, in February 2025, the Canadian government planned a high-speed rail network between Quebec City and Toronto with an investment of about USD 2.74 Billion.

Download Free sample to learn more about this report.

The new construction put in place in the U.S. in 2023 was valued at almost USD 2 trillion. In the coming years, the value of the construction equipment industry is expected to keep growing, reaching roughly USD 2.3 Trillion in 2028, indicating a positive impact on the North America Construction Equipment Market share.

North America Construction Equipment Market Trends

Investment in Long-Term Megaprojects in Energy, Semiconductor, and Battery Plants to Boost the Market

Several government-backed initiatives, energy infrastructure spending, and regulatory policies supporting the adoption of clean fuels are gaining traction across the countries. Investment in emerging sectors, including renewable energy, battery storage projects, allows significant demand for excavation, powerline equipment, trenching, and others. Such factors are influencing the North America construction equipment market growth across the region.

- For instance, Canada’s Quebec government has allocated more than USD 1 Billion for infrastructure upgrades and industrial modernization.

Download Free sample to learn more about this report.

Canada’s residential housing types accounted for about 17.16 Million Units of which a prominent share was held by single Housing units in 2024.

Key takeaways

- In the Construction Equipment type segmentation, Earthmoving Equipment accounted for about 52% of the North America Construction Equipment Market in 2024.

- In the by Application Segment, the Industrial sector is projected to grow at a CAGR of 7.3% in the forecast period.

- In the by country segmentation, the U.S. dominate the market for Construction Equipment in the region.

North America Construction Equipment Market Growth Factors

Growing Industrialization and Energy Transition Along with the Rental Market, to Drive the Market Growth

Several emerging sectors, including oil and gas, automotive, logistics, warehouses and other manufacturing plants, in the North American market are witnessing significant growth. Expansion plans for oil and gas, LNG terminals, grid expansion are driving the market growth. Infrastructure projects such as the Interoceanic Corridor (CII) are generating significant volume demand for earthmoving, roadbuilding, and manufacturing applications.

- For instance, according to the Canadian Association of Petroleum Producers (CAPP), Canada invested more than USD 25 Billion in Alberta’s Oil and Gas sectors in 2024.

North America Construction Equipment Market Restraints

Regulatory Compliance Pressures and Supply Chain Disruptions to Limit the Market Growth

Considerable reliance on components and machines, including excavators and hydraulics, from international markets to limit the market growth for construction equipment. Moreover, uncertain political scenarios and disrupted sourcing strategies due to tariffs might limit the market growth.

Segmentation Analysis

By Equipment Type

Based on equipment type, the market is divided into Earthmoving Equipment, Material Handling Equipment & Cranes, Concrete Equipment, Road building equipment, Civil engineering equipment, Crushing and screening equipment, and Other Equipment.

Growing mega projects, urbanization, infrastructure development, and mining activities are expected to drive the unit sales of excavators, dozers, loaders, and others. Increasing investment in public infrastructure development is further supported by government initiatives and investments to boost the earthmoving equipment segment. Owing to several such reasons, Earthmoving equipment accounted for the largest market share in the North American region.

Material Handling Equipment and Cranes are expected to witness the highest growth rate due to the rapid expansion of fulfillment centres, warehouses, logistic parks, and production plant expansion. Capital expenditure in semiconductor manufacturing plants, EV batteries, and energy infrastructure is expected to accelerate the segment growth for material handling equipment and cranes.

By Application

Based on the Application, the market is bifurcated into Residential, Commercial, and Industrial.

The residential sector is expected to dominate the market. Rising investment in housing development projects and supportive government programs are driving the demand for compact and medium-sized construction equipment. Growing demand for rental machinery in the residential construction sector across the U.S. and Canada is expected to bolster the market growth of construction equipment in the residential sector.

- According to the Census Bureau, the U.S. recorded about 1.41 million new housing developments in 2023.

- Canada launched 100,000+ new homes under its Housing Accelerator Fund across several cities, including Toronto and Vancouver.

By Country

Based on Country, the market is segmented into U.S. and Canada.

In the U.S. market, significant investments in infrastructure, construction spending, growing commercial and residential activity, along with increasing rental market concentration are expected to boost the market revenue share. Growing logistics and capital expenditure in the manufacturing sector are also expected to boost the U.S. market. Several key players in the market are expanding their presence through collaboration and acquisition strategies.

- For instance, United Rentals acquired H&E Equipment Services with an investment of about USD 4.8 Billion to expand its fleet and footprint.

List of Key Companies in the North America Construction Equipment Market

Caterpillar Inc., Deere & Company, and Komatsu are few key players in the market generating considerable revenue across the region. Wide array of product offerings, diversified industry applications, and new product offerings to benefit the construction equipment market in North America. Investment in tech-integrated and clean energy machines to meet sustainability targets, also fuels the market demand in the region.

LIST OF KEY COMPANIES PROFILED

- Caterpillar Inc. (U.S.)

- Deere & Company (U.S.)

- Komatsu (Japan)

- Volvo Construction Equipment (Sweden)

- Doosan Bobcat (South Korea)

- CNH Industrial (U.S.)

- Hyster-Yale Materials Handling, Inc. (U.S.)

- Toyota Material Handling (U.S.)

- Manitowoc Company, Inc. (U.S.)

- Terex Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Volvo Construction Equipment has planned manufacturing of crawler excavator and wheel loaders in Pennsylvania, U.S. The total investment account for about USD 261 Million to produce mid-to-large sized excavators.

- June 2024: Doosan Bobcat has planned an investment of about USD 300 Million in a new production facility. The new compact loader facility development is expected to begin in 2026.

REPORT COVERAGE

The North America Construction Equipment market report provides a detailed analysis of the market. It focuses on market dynamics and key industry developments, such as mergers and acquisitions. Additionally, it includes information about the growth in earthmoving equipment, concrete and material handling equipment, and applications. Besides this, the report also offers insights into the latest industry trends and the impact of various factors on the demand for construction equipment.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.8% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type

|

|

By Application

|

|

|

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market was worth USD 33.30 billion in 2024.

The market is expected to exhibit a CAGR of 6.8% during the forecast period of 2025-2032.

By Equipment type, the Earthmoving Equipment segment is set to lead the market.

Caterpillar Inc., Deere & Company, Volvo Construction Equipment are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us