Occupancy Sensor Market Size, Share & Industry Analysis, By Technology (Passive Infrared (PIR), Ultrasonic, Dual Technology (PIR + Ultrasonic), Microwave, Image Processing, and Others), By Connectivity (Wired and Wireless), By End-user (Commercial, Residential, Industrial, and Others), By Installation Type (Indoor and Outdoor), By Application (Lighting Control, HVAC Control, Security & Surveillance, Energy Management, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

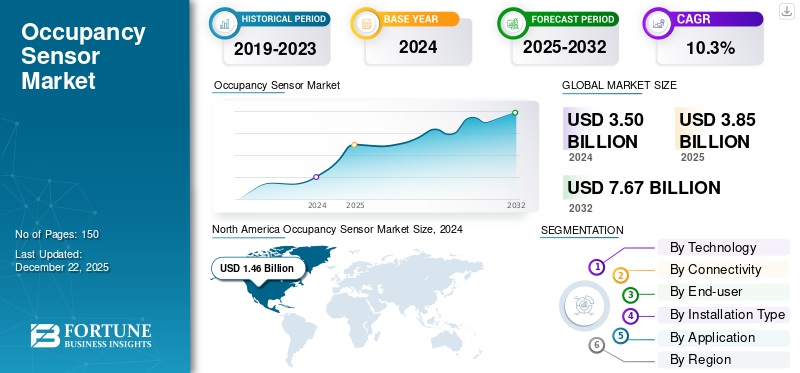

The global occupancy sensor market size was valued at USD 3.85 billion in 2025. The market is projected to grow from USD 4.25 billion in 2026 to USD 9.03 billion by 2034, exhibiting a CAGR of 9.90% during the forecast period. North America dominated the market with a share of 41.80% in 2025.

The occupancy sensor market refers to the industry focused on designing, producing, and distributing sensors that detect individuals' presence or absence within a specific area for lighting control, HVAC control, security & surveillance, and energy management. The market is driven by increasing demand for energy-efficient solutions, rising adoption of smart buildings, and supportive government regulations that promote energy conservation. The key players operating in the market are Schneider Electric, Legrand, Lutron Electronics, Honeywell International Inc., Johnson Controls, Signify, Eaton Corporation, Crestron Electronics, Leviton Manufacturing Co., Inc., and ABB.

The COVID-19 pandemic disrupted the market initially due to supply chain interruptions and decreased construction activities. However, it drove long-term demand by accelerating the adoption of smart building technologies focused on contactless and energy-efficient solutions. For instance,

- According to EY, 92% of companies sustained technology investments during COVID-19, despite typical cutbacks in uncertain times. This highlights the critical role of digital supply chains in managing disruption and demand volatility.

IMPACT OF RECIPROCAL TARIFFS

Reciprocal tariffs between major trading nations had a mixed impact on the market, owing to the increasing cost of raw materials and components imported from tariff-imposed countries. For instance,

- The imposition of U.S. tariffs on imported components is expected to increase production costs by an estimated 4% to 6%, significantly impacting the sensors and consumer electronics

These high costs have reduced manufacturers' profit margins and hindered price competitiveness in global markets. Therefore, companies have been forced to reconsider their supply chains and adopt local manufacturing options to mitigate tariff-related risks.

However, some regions have seen positive developments as local manufacturers gain a competitive edge due to reduced reliance on imports. This shift has encouraged domestic production and innovation investment, strengthening regional market positions. Thus, the continued trade tensions and policy uncertainty are the key challenges that could limit the expansion of the market.

OCCUPANCY SENSOR MARKET TRENDS

Integration of IoT and AI Technologies Drives Smart Occupancy Sensor Adoption

Integrating IoT connectivity and AI-driven intelligence into sensor platforms is fueling the market. IoT-enabled occupancy sensors allow real-time data collection and communication with centralized building management systems, leading to responsive and automated lighting, HVAC, and security control. For instance,

- According to the report published by IoT Analytics, the number of connected IoT devices reached 16.6 billion by the end of 2023. This represents a 15% increase compared to 2022, reflecting strong year-over-year growth in global IoT adoption.

This connectivity enhances operational efficiency, reduces energy wastage, and supports the development of smart buildings and smart cities.

AI-driven intelligence further strengthens the market by allowing sensors to learn occupancy patterns and optimize system performance based on predictive analytics. AI-enhanced sensors minimize false triggers and adapt to human behavior, improving user comfort and energy management. Therefore, the demand for such intelligent solutions drives the occupancy sensor market share.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Growing Emphasis on Energy Efficiency and Sustainability Fuels Market Expansion

Rising demand for energy efficiency and sustainability is propelling the occupancy sensor market growth. Governments and organizations are introducing stringent energy codes and offering incentives to promote the adoption of energy-saving technologies. For instance,

- Governments globally have introduced stringent regulations to promote energy efficiency, including the U.S. Energy Policy Act, the European Union’s Energy Performance of Buildings Directive (EPBD), and Japan’s Top Runner Program. These policies mandate the adoption of energy-saving technologies and standards across residential, commercial, and industrial sectors.

These regulatory measures are boosting the widespread use of these sensors, which optimize energy usage by controlling lighting and HVAC systems based on real-time occupancy.

Sustainability initiatives in the construction and real estate sectors further accelerate sensor adoption. Building owners and developers are integrating these sensors to achieve green building certifications such as LEED and BREEAM, which are increasingly valued in the market. This focus on environmental responsibility and cost efficiency is expected to drive the demand for smart energy-efficient sensor solutions.

Market Restraints

High Costs, Integration Challenges, and Privacy Concerns Restrain Market Growth

High costs associated with advanced occupancy sensor technologies restrain the market for small and medium-sized enterprises with limited budgets. The initial investment required for purchasing and installing these sensors can be substantial, slowing adoption rates across various sectors. Furthermore, the complexity involved in integrating these sensors with existing building management systems often results in increased deployment time and higher expenses. This factor limits scalability and complicates the implementation of large-scale smart building projects. Additionally, growing privacy concerns related to collecting and using occupancy data have raised user hesitation, restricting the market in sensitive commercial environments.

Market Opportunities

Smart Home and Building Automation Present Significant Growth Prospects for these Sensors

The rising adoption of smart home and smart building technologies is creating significant growth opportunities for the market. For instance,

- According to industry specialists, the smart home market revenue is projected at USD 174.0 billion in 2025 and is expected to grow at a 9.55% CAGR to USD 250.6 billion by 2029.

Increasing consumer demand for automation, energy management, and enhanced security drives the demand for occupancy sensors. This trend encourages manufacturers to innovate and develop wireless, AI-enabled sensors with improved functionality and ease of installation.

Moreover, expanding IoT infrastructure in residential and commercial buildings further supports market growth. Smart buildings rely heavily on these sensors to optimize lighting, HVAC, and security operations, enhancing the building's efficiency. Therefore, stakeholders are investing in research and development to benefit from this growing market need.

SEGMENTATION ANALYSIS

By Technology

Passive Infrared (PIR) Sensors Dominate Market Due to Cost-Effectiveness and Broad Applicability

Based on technology, the market is divided into passive infrared (PIR), ultrasonic, dual technology (PIR + ultrasonic), microwave, image processing, and others.

The passive infrared (PIR) segment holds the highest market share of 32.72% in 2026, due to its cost-effectiveness, reliability, and wide applicability in detecting motion through body heat. Its low power consumption and ease of installation make it a preferred choice across residential and commercial spaces.

The microwave technology segment is expected to grow at the highest CAGR in the coming years, owing to its superior sensitivity and ability to detect motion through obstacles, such as walls and partitions. Its suitability for high-precision applications in complex environments is driving increased adoption.

By Connectivity

Wired Segment Leads Market Owing to Reliability and Integration with Building Systems

Based on connectivity, the market is divided into wired and wireless.

Wired sensors dominate the market share of 62.71% in 2026, due to their stable performance, minimal interference, and suitability for large, integrated building systems. Their reliability and consistent power supply make them ideal for commercial and industrial applications.

Wireless sensors are expected to witness the highest CAGR during the forecast period due to ease of installation, flexibility in retrofitting existing infrastructure, and growing adoption in smart homes and offices. The increasing use of IoT and battery-powered solutions further supports this trend.

By End-user

Commercial Sector Commands Market, Driven by Energy Efficiency and Compliance Needs

Based on end-user, the market is divided into commercial, residential, industrial, and others.

The commercial segment leads the market share of 41.03% in 2026, as businesses prioritize energy efficiency, building automation, and operational cost reduction in offices, retail spaces, and institutions. Regulations and green certification requirements further support commercial adoption.

The residential segment is expected to grow at the highest CAGR over the forecast period due to rising awareness of energy conservation, smart home adoption, and demand for enhanced home comfort and security features. The increasing availability of affordable and user-friendly sensor solutions also contributes to this growth.

To know how our report can help streamline your business, Speak to Analyst

By Installation Type

Indoor Segment Dominates with Strong Demand in Offices, Homes, and Institutional Buildings

Based on installation type, the market is divided into indoor and outdoor.

Indoor installations dominate the market as they are primarily used in offices, homes, and commercial buildings to efficiently manage lighting, HVAC, and security systems. Controlled indoor environments also support better sensor performance and longevity.

Outdoor installations are expected to witness the highest CAGR over the forecast period due to the growing demand for perimeter security, parking management, and exterior lighting control in residential and commercial settings. Advancements in weather-resistant and long-range detection technologies are enabling broader outdoor applications.

By Application

Security & Surveillance Leads Market with Widespread Use in Monitoring and Intrusion Detection

Based on application, the market is divided into lighting control, HVAC control, security & surveillance, energy management, and others.

The security & surveillance segment holds the highest share in the market due to its critical role in motion detection and unauthorized access monitoring across various environments. These sensors are widely used in alarm systems, CCTV integration, and smart security solutions.

The lighting control segment is expected to grow at the highest CAGR over the projected period as energy regulations and sustainability goals drive the adoption of automated lighting systems. Occupancy sensors offer significant energy savings by ensuring lights operate only when needed, especially in commercial and public buildings.

OCCUPANCY SENSOR MARKET REGIONAL OUTLOOK

By region, the market is divided into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America Occupancy Sensor Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.61 billion in 2025 and USD 1.78 billion in 2026, due to the early adoption of smart building technologies and strong regulatory support for energy efficiency. The region benefits from high investment in commercial infrastructure, widespread sustainability awareness, and advanced IoT integration across sectors. Additionally, the presence of major players in the U.S. and ongoing technological innovation further strengthens its market leadership. The U.S. market is projected to reach USD 1.04 billion by 2026.

Asia Pacific

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is expected to grow at the highest CAGR in the market, driven by rapid urbanization, growing construction activities, and rising demand for smart home solutions. Governments in the region are investing in smart city projects and energy-efficient technologies to address urban challenges. The expanding middle-class population and increased awareness of energy conservation are also accelerating sensor adoption. The Japan market is projected to reach USD 0.23 billion by 2026, the China market is projected to reach USD 0.28 billion by 2026, and the India market is projected to reach USD 0.18 billion by 2026.

Europe

Europe holds the second-largest share in the market, owing to stringent environmental regulations and the widespread implementation of energy efficiency directives such as the Energy Performance of Buildings Directive (EPBD). Countries across the region are actively promoting green building certifications and smart automation technologies. Furthermore, increased renovation activities in commercial and residential sectors contribute to sustained demand for these sensors. The UK market is projected to reach USD 0.26 billion by 2026, and the Germany market is projected to reach USD 0.22 billion by 2026.

Middle East and Africa and South America

Middle East & Africa and South America are expected to grow more slowly due to limited technological infrastructure and slower adoption of building automation systems. Economic challenges and lower awareness of energy-saving technologies have hindered rapid market expansion in these regions. However, gradual improvements in urban development and smart infrastructure projects may support future growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Launch New Products to Strengthen Market Positioning

Players launch new product portfolios to enhance their market positioning by leveraging technological advancements, addressing diverse consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. Such strategic product launches help companies maintain and grow their market share in a rapidly evolving end-user market.

Long List of Occupancy Sensor Companies Studied (including but not limited to)

- Schneider Electric (France)

- Legrand (France)

- Lutron Electronics (U.S.)

- Honeywell International Inc. (U.S.)

- Johnson Controls (U.S.)

- Signify (Netherlands)

- Eaton Corporation (Ireland)

- Crestron Electronics (U.S.)

- Leviton Manufacturing Co., Inc. (U.S.)

- ABB (Switzerland)

- Panasonic Corporation (Japan)

- Hager Group (Germany)

- Steinel GmbH (Germany)

- Delos Living LLC (U.S.)

- InnoSenT GmbH (Germany)

- And more...

KEY INDUSTRY DEVELOPMENTS

- June 2025: SensorSwitch launched the TLS Twist-to-Lock Sensor, an occupancy sensor with daylight dimming for industrial applications. The sensor is available as a field-installable option or integrated within Lithonia Lighting REBL Round and Compact Pro High Bay luminaires.

- April 2025: Occuspace introduced Micro, a sensor designed to measure space utilization in flex spaces, phone booths, meeting rooms, and other shared work areas. This sensor complements the Macro sensor, enabling comprehensive occupancy monitoring across 100% of building spaces.

- March 2025: VergeSense introduced Infinity, an AI-driven occupancy sensor designed to enhance workspace optimization through real-time spatial insights. The sensor features a ten-year battery life and a significantly reduced carbon footprint, advancing sustainability and maintenance efficiency.

- March 2025: Johnson Controls introduced the NSW8000 Series Wireless Network Sensor for Metasys building automation systems and FX series controllers. This multisensor enables real-time relative humidity, temperature, and occupancy monitoring, with optional CO2 sensing to enhance air quality management.

- January 2025: Logitech introduced Logitech Spot, a versatile sensor designed to simplify deployment and optimize workplace management. The device automates meeting room reservations and monitors environmental conditions to improve employee well-being and reduce energy consumption.

REPORT COVERAGE

The market report focuses on key aspects such as leading companies, technology, connectivity, end-user, installation type, and application. Besides, the report offers insights into the market trend analysis and highlights vital end-user developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years. The market segmentation is mentioned below:

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Unit |

Value (USD Billion) |

|

|

Growth Rate |

CAGR of 9.90% from 2026 to 2034 |

|

|

Segmentation |

By Technology

By Connectivity

By End-user

By Installation Type

By Application

By Region

|

|

|

Companies Profiled in the Report |

· Schneider Electric (France) · Legrand (France) · Lutron Electronics (U.S.) · Honeywell International Inc. (U.S.) · Johnson Controls (U.S.) · Signify (Netherlands) · Eaton Corporation (Ireland) · Crestron Electronics (U.S.) · Leviton Manufacturing Co., Inc. (U.S.) · ABB (Switzerland) |

|

Frequently Asked Questions

The market is expected to reach USD 9.03 billion by 2034.

In 2025, the market size stood at USD 3.85 billion.

The market is projected to grow at a CAGR of 9.90% during the forecast period.

By end-user, the commercial segment is leading the market.

Growing emphasis on energy efficiency and sustainability fuels market expansion.

Schneider Electric, Legrand, Lutron Electronics, and Honeywell International Inc. are the top players in the market.

North America dominated the market with a share of 41.80% in 2025.

Asia Pacific is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us