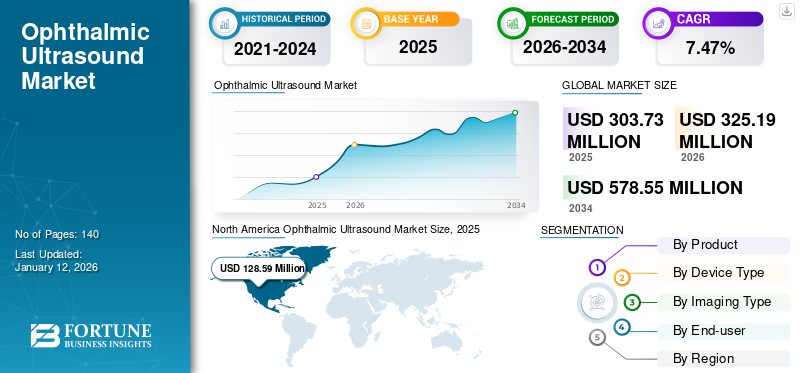

Ophthalmic Ultrasound Market Size, Share & Industry Analysis, By Product (Device and Accessories), By Device Type (Cart-based, Portable, and Hand-held), By Imaging Type (2D Imaging and 3D Imaging), By End-user (Hospitals, Ophthalmic Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global ophthalmic ultrasound market size was valued at USD 303.73 million in 2025. The market is projected to grow from USD 325.19 million in 2026 to USD 578.55 million by 2034, exhibiting a CAGR of 7.47% during the forecast period. North America dominated the ophthalmic ultrasound market with a market share of 42.34% in 2025.

Ophthalmic ultrasound devices are specialized imaging instruments used by ophthalmologists to visualize the internal structures of the eye. These devices utilize high-frequency sound waves to generate detailed images of ocular tissues, including the retina, vitreous humor, anterior segment, and orbit. The growth of the ophthalmic ultrasound market is fueled by the rising prevalence of eye disorders, technological advancements in devices, and the increasing launch of novel ultrasound instruments used in the diagnosis of eye-related diseases.

- For example, as per the data provided by Crystal Vision Ltd. in March 2025, an estimated 30.6% of adults across the world will be suffering from hyperopia by the end of 2025.

Moreover, the market consists of several small and mid-size companies such as Keeler, Micro Medical Devices (MMD), Inc., and HAI Laboratories, Inc., among others. Several market players are participating in medical conferences to create brand awareness among consumers.

- For instance, in February 2025, Micro Medical Devices (MMD), Inc. was present at Vision Expo East 2025 that took place in Florida, U.S. During the event, this company was present at booth PAN1861 to showcase its ocular ultrasound products and raise its awareness in the market.

Furthermore, the increasing adoption of facility expansion by market players to enhance their product offerings in the global market is one of the additional factors supplementing market growth.

Ophthalmic Ultrasound Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 303.73 million

- 2026 Market Size: USD 325.19 million

- 2034 Forecast Market Size: USD 578.55 million

- CAGR: 7.47% from 2026–2034

Market Share:

- North America dominated the global ophthalmic ultrasound market with a 42.34% share in 2025, driven by advanced healthcare infrastructure, rising prevalence of ocular diseases such as glaucoma, and increasing awareness of eye-related disorders.

- By product, the device segment is expected to retain the largest market share throughout the forecast period due to increasing product launches, especially portable and hand-held devices that improve accessibility and patient outcomes.

Key Country Highlights:

- Japan: Growth supported by strong presence of leading players like NIDEK CO., LTD. and rising product approvals such as the ArcScan Insight 100 gaining NMPA approval in China.

- United States: Market growth fueled by a high burden of eye diseases (e.g., 4.2 million people living with glaucoma in 2022 per CDC) and active participation of key companies (e.g., MMD Inc., Keeler) in national medical expos.

- China: Expansion supported by Keeler’s establishment of a localized manufacturing facility in Shanghai in February 2025 and increasing demand for high-quality diagnostic tools.

- Europe: Market expansion driven by rising number of ophthalmology clinics and diagnostic centers, such as the launch of the Optegra Eye Clinic in Hounslow, England, and strong government support for NHS cataract services.

MARKET DYNAMICS

Market Drivers

Growing Prevalence of Eye-related Disorders is Likely to Propel Market Growth

The increasing prevalence of eye-related disorders is a significant factor driving the ophthalmic ultrasound market growth. With growing individuals experiencing conditions such as glaucoma, diabetic retinopathy, age-related macular degeneration (AMD), and vitreous hemorrhages, the demand for advanced diagnostic tools such as ophthalmic ultrasound to facilitate early detection and effective management is increasing.

- For example, as per the data provided by Crystal Vision Ltd. in March 2025, an estimated 37.2% and 23.1% of the adult population in America and Europe, respectively, will be suffering from hyperopia by the end of 2025.

These conditions increase the demand for ocular ultrasound devices, thus driving the growth of the market.

Market Restraints

Higher Cost of Devices and Availability of Alternative Diagnostic Methods Impede Market Growth

The high cost of ophthalmic ultrasound devices is limiting their adoption in low and middle-income countries, thereby hindering market growth.

- For instance, the cost of ocular ultrasound devices ranges from USD 5,500 to USD 20,000.

In addition to high cost, the availability of alternative diagnostic methods such as optical coherence tomography (OCT) is impacting the growth of the market by providing clinicians with other effective, less invasive, or more advanced options. Thus, several market players are introducing advanced ocular diagnostic devices in the global market. This can lead to reduced reliance on traditional ultrasound techniques, thereby hindering market expansion.

- For example, in June 2024, NIDEK CO., LTD., a global manufacturer and distributor of ophthalmic, optometric, and lens edging equipment, announced the launch of the RS-1 Glaucoma Optical Coherence Tomography in the global market.

While ophthalmic ultrasound remains a valuable diagnostic tool, the proliferation of advanced imaging techniques, including OCT, fundus imaging, and MRI, is providing clinicians with effective alternatives. The availability of alternative products can also impede the adoption and growth of the market, particularly in conditions where these newer methods are sufficient or preferred.

Market Opportunities

Expansion of Healthcare Infrastructure and Growing Awareness About Eye Disorders to Provide Lucrative Growth Opportunities in Market

The ophthalmic ultrasound devices market has substantial growth opportunities driven by developing healthcare infrastructure, technological advancements, and increasing awareness about eye disorders and their early diagnosis. The opening of new ophthalmic hospitals and clinics directly drives the market by increasing demand for diagnostic imaging tools. These facilities need ultrasound equipment to diagnose and monitor various eye conditions.

- For example, in October 2024, the Sydney Eye Hospital unveiled the Gadigal Eye Clinic, a pioneering eye clinic within the South Eastern Sydney Local Health District (SESLHD).

- Similarly, in May 2021, the Vision Eye Institute (VEI) opened a new clinic on the New South Wales Central Coast.

Government bodies and several healthcare organizations of different nations are organizing a few campaigns to promote early diagnosis of eye diseases, ultimately boosting ultrasound device utilization and thereby enhancing market growth.

- For example, the L. V. Prasad Eye Institute (LVPEI) eye care network celebrated Glaucoma Awareness Week from March 8-16, 2025, to raise awareness about this silent but serious disease that can affect both adults and children. The week-long observance included social media campaigns, patient awareness sessions, and continuous medical education (CME) sessions.

Market Challenges

High Initial Investment Costs and Limited Accessibility of Ocular Ultrasound Devices are Major Market Challenges

Advanced ocular ultrasound devices often require significant upfront investment for purchase and ongoing maintenance. These costs can be prohibitive for many healthcare providers, especially in low-resource settings such as developing countries or small clinics. As a result, the adoption of cutting-edge ultrasound technology is limited, thus restricting market growth.

Moreover, the limited healthcare infrastructure in low-income areas further complicates the market penetration of ocular ultrasound devices. The uneven distribution of these devices, predominantly found in urban centers, results in rural communities being inadequately served. Additionally, there is often a shortage of specialized ophthalmic ultrasound equipment and eye health professionals to operate it. This lack of infrastructure and expertise hampers the deployment of advanced diagnostic tools, thereby constraining market expansion in these areas.

Such circumstances pose challenges to the market's growth.

- For example, as per the data provided by Elsevier B.V. in December 2021, the 46 countries comprising sub-Saharan Africa (SSA) host approximately 12.0% of the world's population while accounting for 10.0% of the global burden of visual impairment. Despite this, SSA is underserved in ophthalmic care, with just 2.5 ophthalmologists per million inhabitants out of over 230,000 ophthalmologists globally in 2020.

OPHTHALMIC ULTRASOUND MARKET TRENDS

Increasing Adoption of Technologically Advanced Ultrasound Devices by Healthcare Facilities is a Significant Market Trend

Several prominent market players are focusing on the development of sophisticated devices and systems that provide efficient diagnosis of eye disorders. Along with this, the rising adoption of these state-of-the-art devices by healthcare facilities is considered a significant trend that is enhancing market growth throughout the forecast period.

- For instance, in February 2022, Barraquer Ophthalmology Centre acquired the new ABSolu ultrasound scanner to obtain more exhaustive results regarding eye structure. This technology increases the depth of the field by 70.0%, which allows the ophthalmic center to obtain images with outstanding resolution, allowing the visualization of the entire eye with an exceptional level of detail.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product

Rising Product Launches are Predicted to Contribute to Device Segment Dominance

Based on the product, the market is divided into device and accessories.

The device segment is expected to account for the major proportion of the ophthalmic ultrasound market share throughout the forecast period. The growth of the segment will be largely attributable to the growing launch of portable ultrasound devices in the global market.

- For example, in May 2024, Quantel Medical SAS announced the launch of Pocket III, a hand-held ultrasound pachymeter in the global market. This product launch expanded the company’s ocular ultrasound portfolio.

On the other hand, the accessories segment is expected to grow at a considerable CAGR from 2025-2032. The increasing prevalence of ophthalmic diseases, advancements in technologies, and the rising use of eye ultrasound devices during ocular surgical procedures are some of the major factors expected to drive segmental growth during the forecast period.

By Device Type

Portable Segment to Lead Due to Its Rising Demand and Higher Availability

Based on device type, the market is divided into cart-based, portable, and hand-held.

The portable segment is anticipated to grow at a dominant CAGR throughout the forecast period. The growth of the segment is mainly attributed to the fact that portable ophthalmic devices are involved in providing accessible, efficient, and cost-effective solutions for eye care. These devices enhance diagnostic capabilities, enable early detection, and improve patient outcomes, while offering the convenience of portability.

- For example, the 4Sight with A-Scan probe, a portable ultrasound system developed by Keeler, provides high-quality imaging in a compact form factor, making advanced diagnostics feasible even in resource-limited settings.

On the other hand, the cart-based segment is expected to grow at a considerable CAGR from 2025-2032. The increasing hospitalizations for the diagnosis and treatment of ocular diseases are enhancing segmental growth.

Furthermore, the hand-held segment is expected to grow moderately during the forecast period, owing to the rising availability of hand-held ophthalmic ultrasound probes and systems. For example, Accutome’s PachPen and PachPen Vet hand-held pachymeters feature a superior ergonomic design that fits comfortably in any hand. The PachPen hand-held pachymeter is also equipped with Accutome’s Digital Signal Analysis, which will eliminate non-perpendicular measurements on the cornea.

By Imaging Type

Rising Adoption of Ocular Ultrasound Devices with 3D Imaging Technology to Fuel Segment Growth

Based on imaging type, the market is divided into 2D imaging and 3D imaging.

The 3D imaging segment is expected to grow at the highest CAGR during the forecast period. This is mainly attributed to the fact that 3D imaging enhances visualization capabilities, improves diagnostic accuracy, aids in surgical planning, and supports early detection of ocular diseases. These advantages lead to increased adoption of ocular ultrasound devices with 3D imaging, thereby fueling segmental growth. For example, Companies such as Sonomed Esca and Optos introduced 3D ultrasound systems that integrate seamlessly into routine ophthalmic examinations.

The 2D imaging segment is projected to experience considerable growth from 2025 to 2032. The rising incidence of ophthalmic disorders, coupled with the increasing adoption of eye ultrasound devices in ocular surgical interventions, are key factors anticipated to propel the segment's expansion during the forecast period.

By End-user

Inauguration of New Ophthalmic Clinics Offering Diagnostic Services for Eye Diseases to Foster Segment Growth

Based on the end-user, the market is divided into hospitals, ophthalmic clinics, and others.

The ophthalmic clinics segment is expected to grow at the highest CAGR during the forecast period. The growth of the segment is primarily attributed to the opening of new clinics providing diagnostic services for eye diseases.

- For example, in March 2024, the Optegra Eye Clinic was launched in Colchester, England, to provide diagnosis and treatment for patients suffering from ophthalmic diseases.

The hospitals segment is expected to grow at the second-largest CAGR during the forecast period. The growth of the segment is due to the rising prevalence of ocular diseases and strategic collaborations among hospitals providing advanced ocular diagnosis and treatment.

- For example, in April 2025, Maxivision and Malabar Eye Hospitals entered into a strategic collaboration to Revolutionize Eye Care in North Kerala, India.

- For instance, as per the data provided by the National Center for Biotechnology Information (NCBI) in February 2023, the global prevalence of diabetic retinopathy was 103 million in 2020 and is expected to reach 161 million by the end of 2045.

The others segment is expected to grow stagnantly throughout the forecast period, owing to increasing diagnoses of ocular diseases at outpatient imaging centers. Additionally, an increasing utilization of ocular ultrasound devices at research institutes is driving segmental growth.

OPHTHALMIC ULTRASOUND MARKET REGIONAL OUTLOOK

In terms of region, the global market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Ophthalmic Ultrasound Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market with a 42.34% share in 2025. The region generated revenues of USD 128.59 million in 2025. The dominance of this region is largely attributed to the presence of advanced healthcare infrastructure and the growing awareness about eye-related disorders across the region. In addition, the high burden of ocular diseases aids market growth in the U.S.

- For example, as per the data provided by the Centers for Disease Control and Prevention (CDC) in October 2024, around 4.2 million people of all ages were living with glaucoma, including 1.5 million people with vision-affecting glaucoma in the U.S. in 2022.

Europe

Europe accounted for the second-largest share of the market in 2024. The expansion of ophthalmology clinics, hospitals, and diagnostic centers facilitates increased utilization of ophthalmic ultrasound devices across the region, thereby enhancing market growth.

- For example, in August 2024, Optegra Eye Clinic was launched in Hounslow, England, to provide NHS cataract surgery for patients.

Asia Pacific

Asia Pacific held a moderate market share in 2024 and is expected to grow at the highest CAGR throughout the forecast period. The growing focus of industry players on receiving regulatory approvals for new product launches is one of the main factors driving market growth in this region.

- For example, in May 2024, ArcScan announced that its device, ArcScan Insight 100, received National Medical Products Administration (NMPA) approval in China.

Latin America and Middle East & Africa

The markets in Latin America and the Middle East & Africa are expected to grow at a considerable CAGR during the forecast period. The growing awareness about eye health and early diagnosis of eye disorders is driving market growth in these regions.

- For example, the April Brown Campaign was held in April 2024 in São Paulo, Brazil, to create awareness about eye diseases and the importance of eye health. Such initiatives enhance market growth.

The rising burden of ocular diseases such as glaucoma, vitreous hemorrhage, diabetic retinopathy, retinoblastoma, and others contributes largely to the region's demand for ocular ultrasound devices for the diagnosis of these diseases.

COMPETITIVE LANDSCAPE

Key Industry Players

Growing Focus of Market Players on Facility Expansion Enhances Their Product Offerings

The global market consists of key companies such as Keeler, Micro Medical Devices (MMD), Inc., and HAI Laboratories, Inc., among others, offering a wide range of ocular ultrasound diagnostic products. The growing focus of companies on facility expansion is one of the major reasons for companies' significant share in the global market.

- For instance, in February 2025, Keeler launched a state-of-the-art manufacturing facility in China, driving localized production of ophthalmic equipment in Shanghai, China. The launch of this new facility marks a major milestone in the expansion of Keeler’s global footprint, allowing the company to better serve the growing demand for high-quality ophthalmic devices in China and the surrounding regions.

Moreover, other market players include Lumibird Medical, NIDEK CO., LTD., Sonomed Escalon, and several small-scale companies across the globe. These companies are focusing on strategic partnerships and acquisitions to expand their geographic presence in the global market.

List of Key Ophthalmic Ultrasound Companies Profiled

- Keeler (U.K.)

- HAI Laboratories, Inc. (U.S.)

- Micro Medical Devices (MMD), Inc. (U.S.)

- Lumibird Medical (France)

- NIDEK CO., LTD. (Japan)

- Sonomed Escalon (U.S.)

- DGH Technology, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Micro Medical Devices (MMD), Inc. was present at American Society of Cataract and Refractive Surgery (ASCRS) event held in Los Angeles, California, U.S. During the event the company was present at booth 2622 to showcase their ophthalmic diagnostic products.

- February 2025 - Frost Optical, a provider of ophthalmic equipment and service solutions, announced a partnership with Keeler, a manufacturer of ophthalmic diagnostic instruments. As a result of this partnership, Frost Optical became an authorized dealer of Keeler’s high-quality product range, offering customers access to cutting-edge diagnostic and examination tools designed to enhance clinical efficiency and patient care.

- February 2023 - NIDEK CO., LTD., the manufacturer and distributor of ophthalmic, optometric, and lens edging equipment, announced a partnership with HOYA Vision Care to expand their portfolio of state-of-the-art optical instruments and products used in patient care and eye examination.

- July 2022: NIDEK TECHNOLOGIES S.R.L., a subsidiary of NIDEK CO., LTD. acquired 90.0% of the shares of NIDEK MEDICAL S.R.L., a sales and service company of ophthalmic devices.

- March 2019 - Lumibird Medical received the U.S. Food and Drug Administration (FDA) approval for the new A/B/S/UBM ultrasound platform ABSolu. With this approval, the company started providing this product in the U.S. market.

REPORT COVERAGE

The global ophthalmic ultrasound market research analysis report provides a detailed competitive landscape and market insights. It focuses on key aspects such as competitive landscape, product, end-user, and region. In addition to the global market size, it covers regional analysis of different market segments, profiles of key market players, and market dynamics. Moreover, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year 2025 |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.47% from 2026-2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Product

|

|

By Device Type

|

|

|

By Imaging Type

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 325.19 million in 2026 and is projected to reach USD 578.55 million by 2034.

In 2025, the market value stood at USD 128.59 million.

The market will exhibit steady growth at a CAGR of 7.47% during the forecast period (2026-2034).

By product, the device segment is expected to lead the market during the forecast period.

Growing prevalence of eye-related disorders is the key driving factor of the market.

Keeler, HAI Laboratories, Inc., Micro Medical Devices (MMD), Inc., and Lumibird Medical are the major players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us