PET-based Synthetic Paper Market Size, Share & Industry Analysis, By Product Type (Coated and Uncoated), By Application (Packaging, Printing & Publishing, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

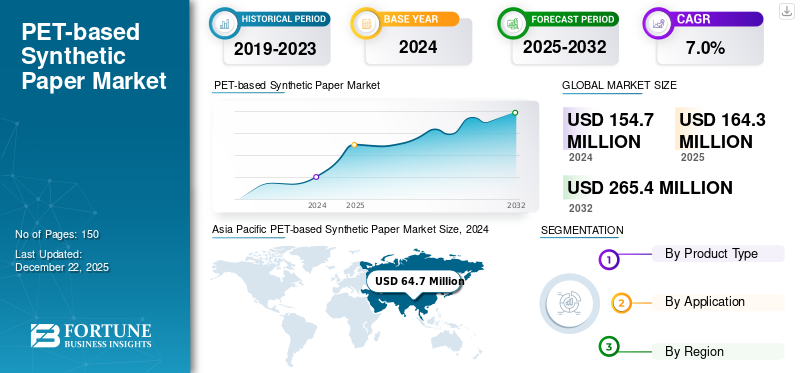

The global PET-based synthetic paper market size was valued at USD 164.3 million in 2025 and is projected to grow from USD 174.5 million in 2026 to USD 303.7 million by 2034, exhibiting a CAGR of 7.0% during the forecast period. Asia Pacific dominated the PET-based synthetic paper market with a market share of 42.00% in 2025.

The global PET-based synthetic paper market is witnessing significant growth opportunities driven by various applications such as packaging, advertising, and the publishing industry. PET synthetic paper is an advanced substrate manufactured from polyethylene terephthalate (PET) resin, designed to provide the physical appearance and functionality of traditional paper while offering superior performance characteristics. Unlike conventional pulp-based paper, PET synthetic paper is resistant to tearing, moisture, and chemicals, making it a durable alternative for high-performance applications. Additionally, increasing demand for attractive, durable packaging and promotional materials is driving the growth of the PET-based synthetic paper market.

The main players working in the market include TOYOBO CO., LTD., MDV GmbH, Agfa-Gevaert Group, Cosmo Films, and Mitsubishi Polyester Film GmbH.

PET-based Synthetic Paper MARKET TRENDS

Increasing Use of Synthetic Paper in High-End Printing Applications Boosts Market Development

The PET synthetic paper market is witnessing a trend toward the adoption of high-end printing and publishing applications. Unlike traditional paper, synthetic variants offer superior printability, tear resistance, and longevity, making them suitable for premium labels, maps, menus, and manuals. Printing companies are increasingly recognizing the value of synthetic paper in providing long-lasting and visually appealing products that can withstand rough handling and environmental exposure. The trend is particularly visible in outdoor advertising and luxury branding, where durability and aesthetics are important.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Sustainable and Recyclable Packaging Solutions is Fueling the Market Progress

One of the major drivers for the PET-based synthetic paper industry is the global shift toward sustainability in packaging. Consumers, governments, and corporations are increasingly rejecting non-recyclable materials in favor of eco-friendly alternatives. PET synthetic paper aligns well with this trend as it integrates seamlessly into existing PET recycling streams, unlike other plastic-based papers. Brands in food, cosmetics, and pharmaceuticals are adopting PET synthetic papers for labels and packaging to comply with recycling regulations while enhancing environmental responsibility.

MARKET RESTRAINTS

High Production Costs Compared to Conventional Paper to Restrict Market Growth

One of the major restraints limiting the adoption of PET synthetic paper is its higher production cost compared to conventional wood-based paper. The process of producing synthetic paper involves the use of petroleum-derived raw materials, advanced resin formulations, and specialized coating technologies, all of which add to manufacturing expenses. Additionally, the need for precision equipment to maintain consistent quality and surface finish further elevates costs. Unless large-scale technological advancements reduce costs, the price disparity will continue to be a significant barrier to wider adoption.

MARKET OPPORTUNITIES

Rising Demand for Sustainable Packaging Solutions Brings New Opportunities

One of the most promising opportunities for the PET-based synthetic paper industry lies in the rapid growth of sustainable packaging. With global consumer preferences shifting toward eco-friendly alternatives, industries such as food & beverage, cosmetics, and e-commerce are actively seeking recyclable and durable packaging materials. PET synthetic paper, with its tear resistance, moisture protection, and recyclability, is well-positioned to meet these needs. It offers a more durable and environmentally conscious substitute for conventional packaging papers, particularly in applications such as labels, shopping bags, and wrapping solutions.

- According to the U.K. government, the Extended Producer Responsibility scheme, starting in October 2025, will require producers to pay for packaging waste. This is expected to drive over USD 13.5 billion in recycling investments and encourage the use of recyclable materials such as PET-based synthetic paper.

MARKET CHALLENGE

Limited Recycling Infrastructure in Emerging Economies Challenges the Market Growth

Although PET-based synthetic paper is recyclable, its effective recycling is often limited by inadequate waste management infrastructure, especially in developing economies. Recycling systems in many regions are not fully equipped to process synthetic paper alongside traditional plastics, leading to challenges in segregation and processing, thereby hindering PET-based synthetic paper market growth. This limits the potential for large-scale circular economy practices and restricts adoption in markets where recycling compliance is difficult. Without robust collection and processing systems, the environmental advantages of PET synthetic paper cannot be fully realized, posing a restraint on its global growth, especially across Asia Pacific, Latin America, and parts of Africa.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product Type

Coated Segment Leads the Market, Driven by its Ability to Enhance Smoothness

Based on product type, the market is classified into coated and uncoated.

The coated segment holds the largest PET-based synthetic paper market share. Its coating layer improves smoothness and brightness, ensuring sharper image reproduction and vibrant colors, making it ideal for premium packaging, marketing materials, and high-quality labels. Industries such as cosmetics, pharmaceuticals, and luxury goods rely heavily on coated grades due to their ability to support sophisticated graphics and branding requirements. The added surface treatment also provides resistance to smudging, scratching, and environmental exposure, thereby extending the lifespan of printed content.

Uncoated PET synthetic paper offers the inherent durability and resistance of PET resin without additional surface treatments, making it a cost-effective option for functional applications. It retains essential properties such as chemical tolerance, water resistance, and tear resistance while providing a matte finish that suits basic printing and packaging needs. This type of synthetic paper is widely adopted in labels, tags, manuals, and maps, where longevity and strength are more critical than high-end graphic presentation.

By Application

Packaging Segment Dominates Due to Its Durability and Moisture Resistance

Based on application, the market is classified into packaging, printing & publishing, and others.

The packaging segment holds the largest PET-based synthetic paper market share, driven by its superior durability and adaptability across diverse industries. Its tear resistance, water resistance, and ability to withstand extreme conditions make it a reliable material for food, pharmaceuticals, and cosmetics packaging. PET synthetic paper enhances brand visibility by supporting vibrant graphics, glossy finishes, and detailed printing. Moreover, its hygienic and chemical-resistant properties ensure product safety, meeting stringent industry regulations.

Printing & publishing represent another key application area for PET synthetic paper, leveraging its unique combination of durability and high-quality print performance. Unlike traditional pulp-based paper, PET synthetic variants provide tear-resistance and weatherproof qualities, making them highly suitable for maps, manuals, outdoor signage, and frequently handled documents. Its smooth surface allows exceptional ink adhesion and sharp image reproduction, which is particularly valuable for publishing high-end magazines and brochures.

PET-based Synthetic Paper Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific PET-based Synthetic Paper Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the PET-based synthetic paper market with a valuation of USD 69 million in 2025, fueled by expanding packaging, retail, and publishing industries. Countries such as China, Japan, India, and South Korea dominate demand, with rapid urbanization and rising disposable incomes driving consumption of packaged goods. In China and India, the booming e-commerce and food delivery sectors rely on durable packaging and labeling solutions, boosting the use of synthetic papers. Japan has established a mature market, utilizing PET synthetic paper extensively in high-end publishing, electronics labeling, and premium packaging.

North America

North America is a prominent market for PET synthetic paper, driven by strong demand across the packaging, labeling, and publishing sectors. The U.S. leads regional consumption, supported by the large presence of consumer goods, food & beverage, and pharmaceutical companies that require high-quality packaging solutions. Canada is witnessing rising demand, particularly in food packaging and logistics labeling, as e-commerce expansion requires stronger and more reliable materials.

Europe

Europe represents an innovation-driven market for PET synthetic paper, due to its strong emphasis on sustainability, recycling, and environmentally friendly packaging. The European Union’s strict regulations on single-use plastics and non-recyclable packaging materials have accelerated the adoption of synthetic papers that can be recycled within PET streams. Countries such as Germany, France, and the U.K. are major consumers, particularly in food, cosmetics, and pharmaceutical packaging, where branding and compliance with safety standards are critical.

Latin America

Latin America’s market is expanding steadily, primarily driven by the expanding packaging and printing industries. Brazil and Mexico are the largest contributors, with food & beverage packaging and retail labeling accounting for the majority of consumption. The region’s rising middle-class population has created strong demand for consumer goods, cosmetics, and pharmaceuticals, all of which require reliable and durable packaging materials.

Middle East & Africa

In the Middle East & Africa, the market is witnessing steady growth, driven by growing demand in packaging, advertising, and industrial labeling applications. In the Middle East, countries such as the UAE and Saudi Arabia are leading adopters, supported by expanding retail, luxury goods, and food industries. Premium packaging and branding play a significant role in these economies, making synthetic paper highly suitable for labels and promotional materials.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies are Emphasizing Sustainability to Strengthen Their Market Presence

The PET-based synthetic paper market is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key market players include TOYOBO CO., LTD., MDV GmbH, Agfa-Gevaert Group, Cosmo Films, and Mitsubishi Polyester Film GmbH. These companies compete based on product innovation, cost efficiency, and regional dominance. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY PET-BASED SYNTHETIC PAPER COMPANIES PROFILED

- TOYOBO CO., LTD. (Japan)

- Bleher Folientechnik GmbH (Germany)

- MDV GmbH (Germany)

- Agfa-Gevaert Group (Belgium)

- Cosmo Films (India)

- Aluminium Féron GmbH & Co. KG (Germany)

- Mitsubishi Polyester Film GmbH (Germany)

- Polyplex (India)s

- Sihl GmbH (Germany)

- RELYCO (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2021: Cosmo Films introduced a 100% opaque synthetic paper, showcasing its strength and durability as a high-performance printing substrate. The new offering expanded the company's portfolio of specialty films, reinforcing its innovation in the packaging and printing materials space.

- February 2024: Mitsubishi Polyester Film GmbH began the construction of the HOSTAPHAN PET film line in Wiesbaden, Germany, with an investment of approximately USD 128.0 million, completed in Q1 2025. The highly automated facility (27,000 ton capacity) would feature energy-efficient heat recovery, PCR input for circular economy gains, and robotic roll packaging.

REPORT COVERAGE

The global market analysis provides information on market size and forecast by all segments. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information about the key regions, key industry growth, new product launches, details on partnerships, mergers & acquisitions, and a number of manufacturers in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.0% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1164.3 million in 2025 and is projected to reach USD 303.7 million by 2034.

In 2025, the market value stood at USD 69 million.

The market is expected to exhibit a CAGR of 7.0% during the forecast period of 2026-2034.

The coated segment leads the market by product type.

The expansion of the packaging industry is a key factor driving market growth.

TOYOBO CO., LTD., MDV GmbH, Agfa-Gevaert Group, Cosmo Films, and Mitsubishi Polyester Film GmbH are some of the leading players in the market.

Asia Pacific dominates the market.

The growing demand for sustainable packaging in consumer goods, food & beverage is likely to drive the adoption of the product in the forthcoming years.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us