Plant Growth Regulators Market Size, Share & Industry Analysis, By Type (Cytokinins, Auxins, Gibberellins, Ethylene, and Others), Crop Type (Cereals, Oilseeds & Pulses, Fruits & Vegetables, Turf & Ornamentals, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

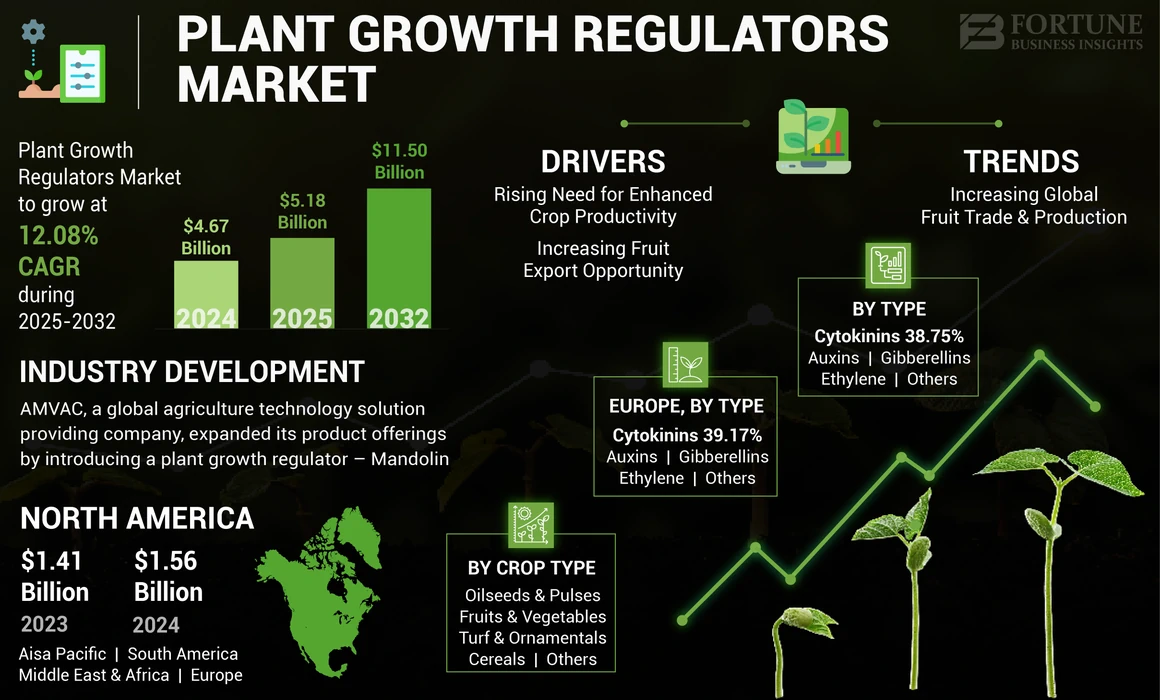

The global plant growth regulators market size was valued at USD 4.67 billion in 2024. The market is projected to grow from USD 5.18 billion in 2025 to USD 11.50 billion by 2032 at a CAGR of 12.08% during the 2025-2032 forecast period. Europe dominated the plant growth regulators market with a market share of 33.4% in 2024.

Moreover, the U.S. plant growth regulators market is projected to reach USD 1.00 billion by 2032, supported by increased agricultural productivity needs.

Various studies/statistics suggest that the PGR for trees, shrubs, groundcovers, and hedges reduce pruning and trimming labor by approximately 50%. Unlike plant hormones that are produced by plants, plant growth regulators are artificially synthesized by humans to aid the growth and development of plants. The market size is expected to increase significantly in the coming years, given the rising demand for high-quality food grains. According to the Indian Council for Agricultural Research (ICAR), the consumption of food grains in India would reach 345 million tonnes by 2030. Asian PGR companies have made considerable efforts to acquire other companies to achieve regional expansion and increase their brand reputation.

Farmers of all sizes have been experiencing the impact of the COVID-19 crisis, from social distancing requirements to travel restrictions and market closures. From a consumption standpoint, smallholder farmers across developing countries are among those at greater risk of an economic impact caused by the COVID-19 pandemic, as even the slightest price fluctuations in product price can have significant consequences impacts on their businesses.

Numerous internationally reputed companies have been successful in minimizing the COVID-19 impact on their operations. For instance, Corteva., a U.S.-based chemical, agricultural, and seed company, focused on monitoring and tracking the status of its raw material provider/suppliers, logistics movements, production facilities in 2020 to ensure that COVID-19 did not disrupt its crop-protection supply chain. The company has remained relatively unaffected by the COVID-19 crisis, given the strength of its distribution channel.

Global Plant Growth Regulators Market Overview

Market Size:

- 2024 Value: USD 4.67 billion

- 2025 Value: USD 5.18 billion

- 2032 Forecast Value: USD 11.50 billion, with a CAGR of 12.08% from 2025-2032

Market Share:

- Europe led the plant growth regulators market with a 33.4% share in 2024 and remains dominant, supported by high adoption in cereals and fruit crops.

- By crop type, the cereals segment is projected to hold a 36% share in 2025.

Key Country Highlights:

- The plant growth regulators market in Japan is expected to reach USD 253.48 million by 2025.

- The U.S. market is projected to reach USD 1.00 billion by 2032.

- India is forecast to witness a strong CAGR of 12.70%, while Europe is anticipated to grow at a CAGR of 9.44% during the forecast period.

Plant Growth Regulators Market Trends

Increasing Global Fruit Trade & Production is a Prominent Trend

Internationally reputed PGR companies are expected to target major fruit-producing and consuming countries such as Australia and Japan to achieve more substantial profit margins. In this respect, the growth of the Australian avocado industry is likely to boost the demand for PGRs throughout the forecast period.

According to the Eurostat’s report on summer related fruits, the EU countries harvested nearly 8.6 million tons of summer fruits including watermelon, muskmelon, strawberries, peaches, and nectarines in 2022. Spain is one of the leading producers of summer related fruits, producing nearly half of the EU’s watermelons and 32% of muskmelons. Historical global fruit production and trade trends suggest that the use of PGRs in fruit production is likely to be considerable in the foreseeable future.

Download Free sample to learn more about this report.

Plant Growth Regulators Market Growth Factors

Rising Need for Enhanced Crop Productivity Backed by Government Support

The increasing need for enhancing crop productivity coupled with rising consumption worldwide is favoring the plant growth regulators market growth. The increasing food safety and security concern has further augmented the production of cereals worldwide. China, India, the U.S., Russia, Brazil, Argentina, Indonesia, and France are the major cereal-producing countries in the world. According to the Department of Agriculture and Farmers Welfare, the food grain production in India stood at 330.05 MT in 2022-23, growing by 14 MT from 2021-22.

Increasing population, changing consumer lifestyles are causing major demand for all types of crops, most notably cereals worldwide. In Asian countries such as India and China, the rising cereal production is attributable to considerable improvements in crop production practices and the increasing availability of high-productive varieties of cereals.

Increasing Fruit Export Opportunity is Favoring Market Expansion

The increasing global fruit trade & production is favoring market growth, given the rising popularity and need for the use of PGRs in fruit plants. The U.S. is one of the world’s largest exporters of fruits. According to the U.S. Department of Agriculture National Agricultural Statistics Services (USDA/NASS), citrus fruit production in the U.S. reached 4.9 million tons in 2022-23, which was about 12% down from 2021-22 due to bad weather and low rainfall. The PGRs help overcome the damages caused by abiotic stress, thus assisting the growers in improving their crop yield.

The vast production base in India offers lucrative opportunities for the export of fruits over the forecast period. According to the Agricultural and Processed Food Products Export Development Authority (APEDA), a Government of India ministry, India exported fruits worth USD 668.75 million during the 2019-20 period. The U.K., Sri Lanka, UAE, Nepal, Malaysia, Qatar, and Oman are the major export markets for Indian fruits.

RESTRAINING FACTORS

Rising Prevalence of Substitute Products Paired with Long Approval Period for New PGRs

The rising prevalence and popularity of PGR substitutes such as fertilizers continue to hamper the demand for PGRs worldwide. According to the FAO, world fertilizer consumption has increased from 101.77 kgs to 136.82 kgs per hectare of arable land. Despite the increasing consumption of PGRs worldwide, a sizable number of farmers across countries, most notably in Asian markets, continue to follow or practice conventional agriculture techniques/systems and rely on the usage of conventional agricultural products such as fertilizers, as against focusing on new solutions for crop protection/regulation.

Plant Growth Regulators Market Segmentation Analysis

By Type Analysis

Cytokinins to Hold Major Share Backed by Increasing Empirical Evidence Indicating its Role in Enhancing Crop Resistance

Based on type, the market is classified into cytokinins (CKs), auxins, gibberellins, ethylene, and others. While auxins, CKs, and gibberellins are the most commonly used PGRs worldwide, ethylene and abscisic acid (ABA) are the major plant growth inhibitors worldwide The cytokinins segment held a dominant share of the market in 2023. The use of cytokinins is known to positively impact many facets of plant development and growth, including shoot & root growth, cell division & differentiation, senescence, apical dominance, response to abiotic & biotic stressors, and fruit & seed development.

The rising demand for CKs for ornamental plants is likely to encourage numerous CK manufacturers worldwide to exploit the business opportunities within the ornamental plants space. The cytokinins segment is projected to generate USD 2.01 billion in revenue by 2025.

To know how our report can help streamline your business, Speak to Analyst

By Crop Type Analysis

Key Players Focus to Develop Novel Product for Cereal Crops to Propel the Product Demand from the Segment

Based on crop type, the market is categorized into cereals, oilseeds & pulses, fruits & vegetables, turf & ornamentals, and others, infant nutrition, beverages, and others. Plant growth regulators are popular products when it comes to cereal production. While these products are more widely used in European countries, the registration of new plant growth regulators and increasing research within the cereals segment across other international markets such as Western Canada are indicative of the rising application of these regulators on cereals worldwide. The manufacturers are likely to target the Canada wheat market in the coming years, given the rising domestic demand for wheat-based products. The increasing cereal production worldwide also highlights the rising popularity of plant growth regulators in agriculture.The cereals segment is expected to hold a 36% share in 2025.

REGIONAL INSIGHTS

Europe Plant Growth Regulators Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The U.S. led the North America PGRs market in 2023. Numerous manufacturers share the U.S. plant growth regulator market space. Fine Americas Inc. is one of the leading companies in North America. This company operates through various distributors spread across North America, including Winfield Solutions, LLC, American Clay Works, Helena Chemical Co, Crop Production Services, Gar Tootelian, Inc, Leffingwell Ag, CPS, Ag Rx, Brehob & Son, and N.M. Bartlett Inc. The North American market is driven by increasing consumption of produce crops, most notably in the U.S. Corn, cotton, fruit, tree nuts, soybean & oil crops, wheat, and pulses are the major produce crops in the U.S. Canada is also witnessing a significant demand for all PGRs as it is one of the world’s top exporters of agricultural products. The agriculture sector in Western Canada has been diversifying over the years, not only in terms of what is grown but how farmers grow it. Two major categories of PGRs are commercially available in Western Canada, ethylene-releasing agents and gibberellin inhibitors.

France emerged as the largest market in Europe in 2024 with 21.7% market share. The country is likely to retain its pole position throughout the forecast period. The U.K. is expected to emerge as a major market over the forecast period. The use of PGRs is a common practice in the U.K. The Government of Alberta attributes the high demand for PGRs in the U.K. to a longer growing season wetter climate where lodging can lead to average yield losses up to 25% (every 3 to 4 years). Europe is anticipated to grow at a CAGR of 9.44% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is predicted to exhibit significant growth opportunities for the market on account of the rising disposable income and improving the standard of living in the region. China is the most prominent market for plant growth regulators in Asia Pacific. The rapidly expanding population in the country is creating a need for high productivity in agriculture, thereby boosting the product demand.

- The plant growth regulators market in Japan is expected to reach USD 253.48 million by 2025.

- India is projected to witness a strong CAGR of 12.70% during the forecast period.

Despite its considerable growth, the India PGRs market faces multiple bottlenecks. A highly fragmented domestic agrochemical market, intensifying competition between unorganized & organized PGR players, and overdependence on standard (generic) agrochemicals continue to add to the challenge. Tata Chemicals Ltd., Dharmaj Crop Guard Limited, Peptech Biosciences Ltd., Varsha Bioscience and Technology India Pvt Ltd., Star Bio Science, and Volkschem Crop Science Pvt. Ltd. are the major prominent domestic PGR manufacturers.

KEY INDUSTRY PLAYERS

Syngenta AG, Bayer AG, and Corteva, Inc. to Hold Prominent Positions in Global Market

In terms of the competitive landscape, Syngenta AG, Bayer AG and Corteva, Inc. hold a major share in the total global market. The consolidation has led only four or five companies to hold the major amount of global market share. The growing awareness regarding the benefits of the application of plant growth regulators for quality yield will increase their adoption in the future. The major players are expected to focus on new product launches to stay competitive in the forthcoming years.

In recent years, mergers between major crop protection companies indicate the increasing consolidation in the global industry. The mega-mergers between Dow and DuPont to form Corteva, Monsanto and Bayer AG, Syngenta and ChemChina, & FMC corporation is expected to bring high consolidation in the market in forthcoming years. Recent years have witnessed various developments. For instance, In March 2021, Bayer AG announced that its annual investment of 2 billion euros in crop science R&D is nearly double the spending of the company’s next closest competitors.

List of Top Plant Growth Regulators Companies:

- BASF SE (Mannheim, Germany)

- Bayer AG (Leverkusen, Germany)

- Corteva, Inc. (Delaware, U.S.)

- Syngenta AG (Basel, Switzerland)

- Nufarm Ltd. (Melbourne, Australia)

- Sumitomo Chemical Co. Ltd. (Ehime, Japan)

- UPL Limited (Mumbai, India)

- FMC Corporation (Pennsylvania, U.S.)

- Tata Chemicals Ltd. (Mumbai, India)

- Sichuan Guoguang Agrochemical Co., Ltd (Sichuan, China)

KEY INDUSTRY DEVELOPMENTS:

- August 2023: AMVAC, a global agriculture technology solution providing company, expanded its product offerings by introducing a plant growth regulator – Mandolin, specially formulated for citrus fruits.

- March 2023: Sumitomo Chemical India Ltd., a subsidiary company of Sumitomo Chemicals, launched a new plant growth regulator - Promalin® at Shimla, Himachal Pradesh. The product is available in 1 liter and 500 ml pack sizes across two states of North India - Himachal Pradesh and Jammu & Kashmir.

- June 2022: Valent Canada Inc., an agriculture company, extended its partnership with Nufarm Agriculture Inc., an Australian company, to expand its distribution channel across Canada.

- July 2021: Sumitomo Chemicals, one of the leading agriculture companies, received registration approval for its Accede Plant Growth Regulator. The product was developed to reduce labor cost in cultivation and improve the quality of peaches and apples.

- April 2021: Corteva, Inc. and Symborg, an expert in microbiological technologies, announced an agreement around a microbe-based nitrogen fixation product in the U.S., Canada, Brazil and Argentina. The Corteva product, to be branded as Utrisha N nutrient efficiency optimizer, works in natural field conditions, adapting to the plants’ growth needs and helping to maximize crop yield potential sustainably.

REPORT COVERAGE

The market research report includes qualitative and quantitative insights into the industry. It also offers a detailed of the market size and growth rate for all possible segments. Various key insights and market intelligence presented in the report are an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, SWOT analysis, the regulatory scenario in critical countries, and key plant growth regulator industry trends.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 12.08% from 2025 to 2032 |

|

Segmentation |

By Type

By Crop Type

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 4.67 billion in 2024 and is projected to reach USD 11.50 billion by 2032.

Registering a CAGR of 12.08%, the market will exhibit promising growth over the forecast period of 2025-2032

Based on type, the cytokinins segment is expected to lead during the forecast period.

The rising need for enhanced crop productivity worldwide is the key factor driving the market growth.

BASF SE, Bayer AG, Corteva, Inc., Syngenta AG, Nufarm Ltd., and Sumitomo Chemical Co., Ltd. are a few of the leading key players in the market.

Europe dominated the market in terms of share in 2023.

Based on crop type, the cereals segment holds a major share in the global market.

Digitalizing the supply and value chain is the key market trend.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us