Polyacrylamide Market Size, Share & Industry Analysis, By Type (Anionic, Cationic, Non-Ionic, and Amphoteric), By End-Use Industry (Water Treatment, Oil & Gas, Pulp & Paper, Mining, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

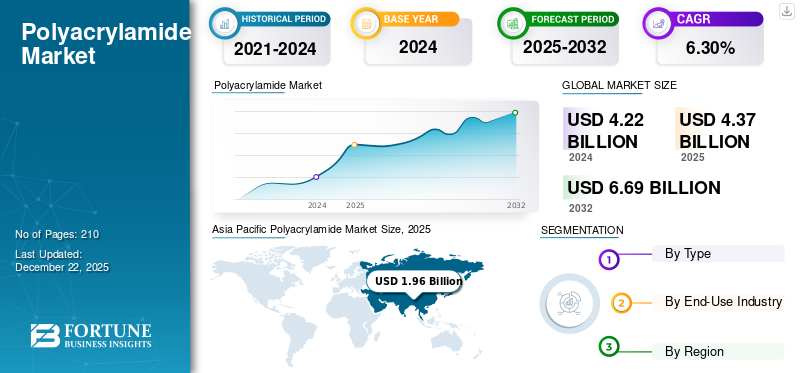

The global polyacrylamide market size was valued at USD 4.37 billion in 2025. The market is projected to grow from USD 4.63 billion in 2026 to USD 7.56 billion by 2034 at a CAGR of 6.30% during the forecast period. Asia Pacific dominated the polyacrylamide market with a market share of 45% in 2025.

Polyacrylamide (PAM) is a versatile, water-soluble synthetic polymer known for its flocculating and thickening capabilities. It is produced in various forms, including anionic, cationic, nonionic, and amphoteric, allowing it to serve various industrial applications. It is highly used in water and wastewater treatment, aiding solid-liquid separation. It also plays a key role in enhanced oil recovery by improving fluid movement in oil reservoirs.

In addition, PAM is used in mining for sludge treatment, pulp and paper for retention and drainage, and cosmetics and textiles as a thickener. Its efficiency and adaptability make PAM a vital component in many industrial and environmental processes globally, driving market growth. SNF, Kemira, Solenis, and Anhui Jucheng Fine Chemicals Co., Ltd are key players operating in the market.

Global Polyacrylamide Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 4.37 billion

- 2026 Market Size: USD 4.63 billion

- 2034 Forecast Market Size: USD 7.56 billion

- CAGR: 6.30% from 2026–2034

Market Share:

- Asia Pacific dominated the polyacrylamide market with a 45% share in 2025. This leadership is fueled by rapid industrialization, increasing water treatment infrastructure, and strong demand from the mining and oil & gas sectors in countries such as China and India.

- By type, anionic polyacrylamide is expected to retain the largest market share in 2025, driven by rising demand from municipal and industrial water treatment applications due to its high flocculating efficiency.

Key Country Highlights:

- China: The country's rapid urbanization and industrial development, especially in water treatment and mining, make it a leading consumer of PAM. Its Belt and Road Initiative further drives demand across infrastructure sectors.

- United States: Shale oil production and strict water treatment regulations fuel significant use of PAM, particularly in enhanced oil recovery (EOR) and municipal wastewater treatment facilities.

- India: With ongoing infrastructure development, increased focus on water quality, and expanding textile and agriculture sectors, India represents one of the fastest-growing PAM markets in Asia Pacific.

- Europe: Strong environmental regulations, emphasis on sustainable water treatment, and increasing adoption of green polyacrylamide formulations support market growth in this region.

POLYACRYLAMIDE MARKET TRENDS

Rising Product Adoption in Enhanced Oil Recovery (EOR) Projects to Positively Impact Market Growth

The growing adoption of polyacrylamide in enhanced oil recovery is a key driver of global market growth. As oil fields mature, operators increasingly turn to polymer flooding, especially using anionic PAM, such as hydrolyzed polyacrylamide, to improve extraction efficiency. PAM enhances the viscosity of injected water, boosting oil displacement and recovery rates. This trend is gaining momentum in regions such as the Middle East and North America, where EOR projects are expanding to meet energy demands. The cost-effectiveness and performance benefits of PAM in EOR fuel steady demand growth, prompting further investment in production capacity. As a result, rising product use in EOR is an emerging trend, reshaping the overall market growth.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Surging Product Demand from Water Treatment Industry to Drive Market Growth

The growing use of the product in water and wastewater treatment is a major factor driving global polyacrylamide market growth. With rising urbanization, industrialization, and tightening environmental regulations, there is an increasing demand for effective water treatment solutions across the municipal and industrial sectors. PAM, especially in its anionic and cationic forms, plays a critical role as a flocculant and coagulant aid, efficiently removing suspended solids and organic matter.

Emerging economies are rapidly expanding water infrastructure, while developed nations are upgrading aging systems, both trends fueling product consumption. In addition to this, the shift toward zero-liquid discharge and sustainable water reuse is expanding PAM’s role in advanced treatment processes. As water scarcity and quality concerns intensify across the globe, product demand is anticipated to keep rising, driving market growth in tandem

MARKET RESTRAINTS

Environmental and Health Risks Associated with Residual Raw Materials to Hinder Growth

The environmental and health concerns associated with residual acrylamide monomers, a potential neurotoxin and carcinogen, are a major deterrent to the market's growth. Even though the final PAM products have minimal acrylamide levels, regulatory bodies, especially in Europe and North America, enforce stringent limits on allowable concentrations, particularly in drinking water and food-related applications. This pressure manufacturers to invest in costly purification processes and quality control to meet safety standards. Furthermore, the potential health risks and environmental impact associated with acrylamide limit its use in environmentally sensitive industries, limiting broader market adoption and growth despite its effectiveness in industrial applications.

MARKET OPPORTUNITIES

Development of Green Chemistry-Based Products to Create Market Growth Opportunities

The development of environmentally friendly, green chemistry-based polyacrylamide is expected to drive market growth opportunities. As industries focus on sustainability, there is a rising demand for eco-conscious alternatives to traditional synthetic PAM. Green PAM, derived from renewable resources and designed with reduced toxicity and biodegradable properties, helps address environmental concerns. This innovation aligns with stricter regulations and growing consumer preference for sustainable solutions, offering a competitive advantage to producers. The increased adoption of green PAM in sectors such as water treatment, mining, and enhanced oil recovery will open up new growth opportunities, especially in regions with stringent environmental standards. This shift to sustainable products is likely to prompt wider adoption and drive market growth during the forecast period.

MARKET CHALLENGES

Availability of Natural Substitutes May Hamper Market Growth

The rise of natural flocculants presents a growing challenge to the market. Alternatives such as chitosan, guar gum, and starch derivatives are becoming more popular due to their biodegradability, non-toxicity, and sustainability. These natural products are seen as more environmentally friendly, making them attractive in industries such as water treatment and mining, where eco-conscious solutions are increasingly prioritized. Although natural flocculants may face performance or cost efficiency limitations compared to PAM, their lower environmental impact and compliance with stringent regulations give them a competitive edge. As sustainability becomes a greater focus, natural flocculants are expected to compete more directly with PAM in various industries, challenging the overall market growth.

TRADE PROTECTIONISM AND ITS EFFECTS

Trade War Among Global Economic Powers to Influence Market Dynamics

The ongoing global tariff tensions, particularly the U.S.–China trade war, are reshaping the market by disrupting supply chains and altering trade flows. U.S. tariffs on Chinese chemical imports. This leads buyers to seek alternative suppliers and invest in domestic production, while Chinese exporters redirect shipments to Southeast Asia, increasing regional competition. These shifts are causing price volatility, even amid declining raw material costs. Major players are diversifying sourcing and delaying expansion plans due to tariff uncertainty. As a result, the global market is witnessing increased localization, rising investment in non-Chinese regions, and intensified competition across key application sectors.

SEGMENTATION ANALYSIS

By Type

Anionic Segment to Hold Major Market Share Owing to Rising Demand from Water Treatment Industry

Based on the type, the market is segmented into anionic, cationic, non-ionic, and amphoteric.

The anionic segment is expected to hold the largest global polyacrylamide market share during the forecast period with a share of 46.87% in 2026. The demand for anionic products is primarily driven by their critical role in water and wastewater treatment. It is highly effective in removing suspended solids, making it essential for municipal and industrial water clarification processes. With growing global concerns over water quality and stricter discharge regulations, mining, textiles, and municipal utilities increasingly adopt the anionic product type. Its ability to treat high-turbidity water cost-effectively makes it highly valuable in developing regions expanding their water infrastructure. As environmental compliance becomes more important, the use of anionic products in efficient, large-scale water treatment solutions continues to support its market growth worldwide.

The growth of the cationic segment is driven by its use in sludge dewatering and pulp and paper processing. Its strong binding to negatively charged particles makes it ideal for reducing sludge volumes in wastewater treatment, helping reduce disposal costs and enhancing plant efficiency. In the pulp and paper industry, it improves retention and drainage, boosting operational performance. As industries prioritize sustainability and efficient waste handling, the role of cationic products in supporting cleaner production and cost savings becomes more important. With increasing industrial activity and rising environmental standards, the cationic product type continues to gain higher traction across various markets, especially in regions focused on resource-efficient operations.

By End-Use Industry

To know how our report can help streamline your business, Speak to Analyst

Water Treatment to Dominate Market Due to Product Adoption in Industrial and Residential Water Treatment Facilities

Based on the end-use industry, the market is segmented into water treatment, oil & gas, pulp & paper, mining, and others.

The water treatment segment is anticipated to hold the dominant share during the forecast period contributing 36.07% globally in 2026. The rising demand for the product in water treatment is driven by increasing urbanization, industrial growth, and strict environmental regulations. As the need for clean water and effective wastewater management intensifies, PAM plays a key role in improving treatment efficiency. It acts as a flocculant and coagulant aid, helping to remove suspended solids and reduce sludge volumes in municipal and industrial plants. Its effectiveness at low dosages and ability to enhance water clarity make it essential for sustainable water management. With growing water scarcity and regulatory pressure, the use of water treatment is expected to continue expanding, driving segmental growth.

Polyacrylamide demand in enhanced oil recovery is driven by the need to maximize output from aging oil fields. As conventional reserves decline, operators increasingly use polymer flooding, where PAM improves the viscosity of injected water to enhance oil displacement and extraction. This method significantly boosts recovery rates and extends the life of oil wells. With rising global energy needs and a focus on efficient extraction technologies, countries including China, the U.S., and those in the Middle East are expanding enhanced oil recovery operations. As a result, product usage in oil recovery is expected to grow, supporting long-term segment expansion.

POLYACRYLAMIDE MARKET REGIONAL OUTLOOK

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Polyacrylamide Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is expected to dominate the market with a valuation of USD 2.1 billion in 2026. Rapid industrialization and urbanization are major drivers of product demand in the Asia Pacific region. The expanding industrial base in countries, including China and India, and increased infrastructure development have led to higher demand for efficient water treatment solutions. The China market is projected to reach USD 1.13 billion by 2026, and the India market is projected to reach USD 0.45 billion by 2026. PAM is used in municipal water treatment and industrial wastewater management to address pollution and improve water quality. In addition, the booming mining industry, especially in China, and the growth of the oil and gas industry in countries such as India are driving the use of the product for flocculation, sludge treatment, and enhanced oil recovery. The region's large population and urban expansion increase product demand, driving market growth.The Japan market is projected to reach USD 0.13 billion by 2026

To know how our report can help streamline your business, Speak to Analyst

North America

In North America, the major factor driving the product demand is the stringent regulatory environment surrounding water treatment and wastewater management. With increasing focus on water conservation, sustainability, and stringent discharge regulations, industries and municipalities are adopting efficient solid-liquid separation and water purification products. In addition to this, the growing shale oil production in the U.S. drives the product demand for enhanced oil recovery. As regulatory pressures rise and environmental concerns grow, municipal and industrial sectors increasingly rely on PAM to comply with environmental standards, making it a key driver for market expansion across the region. The U.S. market is projected to reach USD 0.79 billion by 2026.

Europe

In Europe, the demand for the product is primarily driven by the region’s strict environmental regulations and the growing emphasis on water recycling and treatment. With water scarcity becoming a concern, European industries are adopting products to enhance wastewater treatment processes, especially in municipal and industrial settings. Moreover, Europe’s strong commitment to sustainable practices and green chemistry encourages developing and adopting eco-friendly options. The region’s focus on reducing chemical pollution and improving water quality further boosts the product demand, particularly in industries such as mining, pulp and paper, and agriculture. The UK market is projected to reach USD NA billion by 2026, while the Germany market is projected to reach USD 0.34 billion by 2026.

Latin America

In Latin America, the demand for the product is primarily driven by the region’s growing mining industry and the need for efficient water treatment solutions. Countries including Brazil, Chile, and Argentina, which have significant mining operations, rely on PAM for mineral processing, flocculation, and wastewater treatment. Furthermore, the agricultural sector's growing product use in irrigation and soil stabilization contributes to regional market growth. As environmental concerns rise and industries seek to comply with water use and waste management regulations, the demand for products in water treatment and other industrial applications continues to increase in Latin America, driving market growth.

Middle East & Africa

In the Middle East & Africa, the increasing product demand is largely driven by water scarcity and the need for effective water treatment solutions. With many regions facing extreme water shortages, PAM is extensively used in desalination plants, wastewater treatment, and municipal water purification systems. In addition, the booming oil and gas industry in the Middle East is a significant driver for the market, particularly for enhanced oil recovery applications. As the region continues to invest in sustainable water management and oil recovery technologies, PAM plays a vital role in improving water reuse and extraction efficiency, contributing to the market growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on Innovation and Sustainability to Create Market Differentiation

The global market is highly competitive, with major players such as SNF, Kemira, Solenis, and Anhui Jucheng Fine Chemicals Co., Ltd leading through strong production capabilities and wide product offerings. Competition is intensified by cost-effective Chinese manufacturers, particularly in price-sensitive markets. While global firms focus on innovation and sustainability to differentiate their products, regional suppliers compete mainly on price. Trade measures, such as U.S. tariffs on Chinese imports, reshape global supply dynamics and open opportunities for non-Chinese producers. Increasing demand for high-performance and eco-friendly formulations further pressures suppliers to innovate. Both global and regional players strive for higher market share through product development, strategic partnerships, and cost optimization in a rapidly evolving regulatory and commercial landscape.

LIST OF KEY POLYACRYLAMIDE COMPANIES PROFILED

- SNF (France)

- Kemira (Finland)

- ANHUI JUCHENG FINE CHEMICALS CO., LTD (China)

- ZL GROUP (Canada)

- Black Rose Industries Ltd. (India)

- Dongying Kechuang Biochemical Co., Ltd. (China)

- YIXING BLUWAT CHEMICALS CO., LTD (China)

- Solenis (U.S.)

- CHINAFLOC (China)

- Shandong Crownchem Industries Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS

- May 2025 – ZL GROUP announced that its first phase, a USD 300 million polymer project at Sohar Port and Freezone in Oman, will launch in the first quarter of 2026. This project will produce polyacrylamide and related monomers. The facility will occupy a 240,000 square meter area and produce high-quality polyacrylamide products to support growing demand within oilfield operations across the Middle East and the export market.

- July 2024 – Solenis signed an agreement to acquire BASF's flocculants business for mining applications. This acquisition will enable Solenis to offer a broader range of products and services, ultimately improving the mining industry's operational efficiency and environmental performance.

- June 2024 – SNF completed a USD 18 million upgrade to its polyacrylamide manufacturing plant in Lara, Australia. The investment enables SNF to produce its acrylamide, a key raw material in its diverse polymer products. This move is expected to strengthen the company's supply chain by reducing reliance on imported raw materials and will enhance its global production footprint.

- February 2022 – Kemira launched the first full-scale production line for its newly developed, bio-based polyacrylamide polymer. The first commercial shipment was delivered to a wastewater treatment plant in Helsinki, Finland. The move demonstrates the company’s commitment to developing sustainable, green chemistry-based products.

- May 2021 – Kemira announced that it has started a new dry production plant in Ulsan, South Korea. The plant is a joint venture with Yongsan Chemicals that produces high-quality dry polyacrylamide for use in retention and drainage applications within the pulp and paper industry, particularly in the Asia Pacific region.

REPORT COVERAGE

The global market report provides a detailed analysis of the market. It focuses on key aspects such as profiles of leading companies, types, and end-use industries of the product. Besides this, it offers insights into analyzing key market trends and highlights key industry developments. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Volume (Kiloton), Value (USD Billion) |

|

Growth Rate |

CAGR of 6.30% during 2026-2034 |

|

Segmentation |

By Type

|

|

By End-Use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 4.37 billion in 2025 and is projected to record a valuation of USD 7.56 billion by 2034.

Registering a CAGR of 6.30%, the market will exhibit steady growth during the forecast period of 2026-2034.

In 2025, Asia Pacific stood at USD 1.96 billion.

The water treatment end-use industry is expected to lead the market during the forecast period.

Surging polyacrylamide demand from the water treatment industry is driving market growth.

SNF, Kemira, Solenis, and Anhui Jucheng Fine Chemicals Co., Ltd are the major players operating in the market.

Asia Pacific dominated the polyacrylamide market with a market share of 45% in 2025.

Rising usage in enhanced oil recovery projects is expected to drive higher adoption and positively impact market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us