Polymer Matrix Composites Market Size, Share & Industry Analysis, By Type (Thermoplastics and Thermosetting Plastics), By Reinforcement (Glass Fiber, Carbon Fiber, and Others) By Manufacturing Process (Lay-up (Hand/Spray), Filament Winding, Pultrusion, Compression Molding, Injection Molding, and Resin Transfer Molding (RTM)), By Application (Automotive, Aerospace, Building & Construction, Electrical & Electronics, Sports Equipment, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

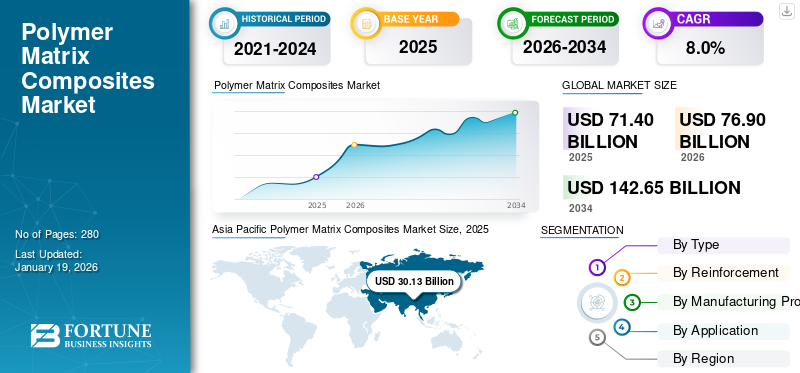

The global polymer matrix composites market size was valued at USD 71.4 billion in 2025. The market is projected to grow from USD 76.9 billion in 2026 to USD 142.65 billion by 2034, exhibiting a CAGR of 8.0% during the forecast period.

Polymer matrix composites (PMCs) are advanced materials made by reinforcing a polymer resin with carbon, glass, or aramid fibers, offering an ideal combination of strength, lightweight, and corrosion resistance. They are widely used in aerospace, automotive, construction, marine, and sports industries due to their superior mechanical properties and design flexibility. The market is witnessing notable growth due to increasing demand for fuel-efficient vehicles, lightweight aircraft components, and high-performance sports equipment. Moreover, the rising adoption of PMCs in wind energy, electronics, and medical devices is expected to drive market expansion further. The major manufacturers operating in the market include Toray Advanced Composites, Hexcel Corporation, DuPont, Owens Corning, and Mitsubishi Chemical Group Corporation.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Lightweight and High Strength Materials in Advanced Engineering Applications to Boost Market Growth

The demand for PMCs is rising steadily, driven by their unique ability to deliver lightweight characteristics and superior mechanical strength. Industries such as aerospace, automotive, and wind energy are actively shifting toward lightweight materials to improve fuel efficiency, reduce emissions, and enhance overall performance. PMCs offer added benefits such as corrosion resistance, making them ideal for manufacturing complex, high-performance components. As industries focus more on efficiency, sustainability, and advanced engineering solutions, the demand for high-strength and lightweight composites is expected to drive the global polymer matrix composites market growth.

MARKET RESTRAINTS

High Production Costs and Supply Chain Challenges to Limit Market Expansion

The production of PMCs involves using premium raw materials such as carbon fibers and glass fibers, along with complex and energy-intensive manufacturing techniques. These requirements significantly increase the production cost, making it difficult for manufacturers to cater to price-sensitive markets. Additionally, the industry faces ongoing supply chain challenges due to limited material availability, dependency on international suppliers, and transportation delays. These factors create operational inefficiencies and hinder timely product delivery, which slows down the wider adoption and restrains the growth of the market.

MARKET OPPORTUNITIES

Advancements in Bio-Based Resins to Drive Sustainable Growth in Market

The rising emphasis on sustainability is accelerating the development and adoption of bio based resins in PMCs. These resins, derived from renewable sources such as natural starches, offer an environmentally friendly alternative to conventional petroleum-based resins. Technological advancements further enhance their performance in terms of strength, thermal resistance, and durability, making them suitable for high-performance applications. As regulatory plant oils and pressures and environmental awareness continue to grow, the shift toward bio based resins presents a significant opportunity for manufacturers to expand their presence in the market.

- According to the U.S. Department of Agriculture’s 2023 report, the U.S.' biobased products industry, including bio-based resins used in PMCs, contributed USD 489 billion to the national economy in 2021. This marked a 5.1% increase from USD 464 billion in 2020.

POLYMER MATRIX COMPOSITES MARKET TRENDS

Advancements in Automated Manufacturing Processes to Enhance Efficiency and Scalability

The market is witnessing a strong shift toward automation, driven by the need for higher production efficiency, precision, and scalability. Technologies such as resin transfer molding (RTM), automated fiber placement, and pultrusion are increasingly being adopted to enhance production efficiency, reduce labor dependency, and ensure consistent product quality. These technologies enable faster production cycles and support the growing demand for lightweight and high-performance components in the aerospace, automotive, and construction sectors. As manufacturers continue to invest in automation, these advancements are expected to significantly influence the future market growth.

MARKET CHALLENGES

Stringent Environmental Regulations and Rising Adoption of Alternative Materials Challenge Market Growth

The production of PMCs involves using synthetic resins and chemical processes that may emit volatile organic compounds (VOCs) and other pollutants, attracting increasing scrutiny from environmental regulatory bodies. Compliance with these evolving regulations requires manufacturers to invest heavily in sustainable materials and eco-friendly production technologies. Additionally, the growing popularity of natural fiber composites and other bio-based alternatives further intensifies competition in the market, compelling manufacturers to innovate and adopt greener formulations to maintain their competitiveness.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Rising Demand for Thermoplastics to Fueled Growth of Market in Lightweight and High-Performance Applications

Based on type, the market is segmented into thermoplastics and thermosetting plastics.

The thermoplastics segment held a dominant global market share in 2024, driven by its superior properties such as recyclability, lightweight nature, and high impact resistance. These materials are increasingly used in automotive, aerospace, and consumer electronics industries due to their ability to be reshaped and reused, aligning with sustainability goals. The growing need for fuel-efficient vehicles and aircraft is boosting demand for lightweight components, thereby accelerating the adoption of thermoplastic composites. Moreover, advancements in processing technologies, faster production cycles, and ease of fabrication further boost the demand.

The thermosetting plastics segment also holds a significant share, driven by their excellent mechanical strength, heat resistance, and dimensional stability. These properties make thermosetting composites ideal for structural applications across the aerospace, marine, and construction sectors. Their ability to retain shape and performance under extreme stress and high temperatures makes them suitable for long-term use in critical environments. Furthermore, increased infrastructure development, growing demand for durable materials, and advancements in resin formulations continue to support the growth of this segment.

By Reinforcement

Growing Use of Glass Fiber to Support Widespread Adoption of Polymer Matrix Composites in Cost-Effective Applications

Based on reinforcement, the market is segmented into glass fiber, carbon fiber, and others.

The glass fiber segment holds a dominant global market share in 2024, driven by its cost-effectiveness, excellent corrosion resistance, and good mechanical properties. It is widely used across industries such as automotive, construction, wind energy, and consumer goods due to its lightweight nature and ease of processing. The rising demand for fuel-efficient vehicles and the growth of renewable energy projects are key factors boosting the use of glass fiber composites. Moreover, the availability of raw material and advancements in molding technologies further accelerate the segment’s growth.

The carbon fiber segment also holds a notable share, driven by its high strength to weight ratio, high stiffness, and thermal resistance. These properties make carbon fiber composites ideal for aerospace, high-performance automotive, and sports equipment applications. The segment is gaining traction due to the rising demand for advanced materials in premium and performance-driven sectors. Furthermore, technological advancements in carbon fiber processing and efforts to reduce production costs are expected to support the growth of this segment.

By Manufacturing Process

Compression Molding Segment Held a Significant Share Due to Its Suitability for High-Volume Production

Based on the manufacturing process, the market is segmented into lay-up (hand/spray), filament winding, pultrusion, compression molding, injection molding, and resin transfer molding (RTM).

The compression molding segment held a dominant global market share in 2024, driven by its efficiency in producing high-strength, complex components at a large scale. This method is widely adopted in the automotive and industrial sectors for manufacturing body panels, bumpers, and electrical housings. The process allows for high-volume, low-cost production with minimal waste, which is appealing to mass-production industries. Moreover, the rising demand for lightweight and durable materials in automotive applications to improve fuel efficiency is further fueling segment growth.

The injection molding segment also holds a notable share, driven by its ability to produce intricate and precision-engineered composite parts at high speed. It is particularly used in consumer electronics, medical devices, and automotive interiors. The technique’s high repeatability, minimal material waste, and compatibility with thermoplastic composites make it suitable for mass production. Additionally, growing automation and advancements in mold design are enhancing its adoption across end-user industries.

The resin transfer molding (RTM) segment also holds a growing market share, driven by its ability to produce strong, lightweight components with smooth surface finishes. It is commonly used in aerospace, wind energy, and marine sectors. RTM supports complex fiber architectures and allows for greater design flexibility, making it suitable for performance-critical applications. Increasing demand for high-performance and customized composite parts is expected to drive the segment's growth in the coming years.

By Application

Automotive Segment Dominated due to Lightweighting Trends and Emission Norms Compliance

Based on application, the market is segmented into automotive, aerospace, building & construction, electrical & electronics, sports equipment, and others.

The automotive segment held a dominant global polymer matrix composites market share in 2024, primarily due to the increasing need for lightweight materials that help improve fuel efficiency and meet stringent emission regulations. Manufacturers are replacing conventional materials including steel and aluminium with PMCs in various vehicle parts due to their superior mechanical properties. These composites offer excellent mechanical strength, reduced weight, corrosion resistance, and enhanced design versatility, making them ideal for structural and aesthetic applications. Additionally, the rising demand for electric vehicles (EVs) and hybrid models is accelerating the use of PMCs in this segment.

The aerospace segment is witnessing significant growth in adopting PMCs, driven by the industry’s increasing need for lightweight and durable materials. These composites are widely integrated into aircraft components due to their superior strength-to-weight ratio, fatigue, heat, and corrosion resistance. As airlines and manufacturers prioritize fuel efficiency, longer flight ranges, and reduced maintenance costs, the demand for advanced composite materials continues to rise. Additionally, the resurgence of global air travel and growing investment in next-generation aircraft designs further accelerate the use of PMCs in this segment.

The building and construction segment is witnessing steady growth due to its superior strength and long-term durability. These materials offer excellent resistance to moisture, chemicals, and extreme temperatures. They are increasingly used in structural components such as bridge reinforcements, wall panels, roofing systems, and rebar. Their lightweight nature makes transportation and installation easier, reducing labor and structural load. As urban development accelerates, there is a rising focus on sustainable and low-maintenance materials. PMCs support this shift by offering a longer service life and lower lifecycle costs. With the global push toward green infrastructure, using PMCs in the construction sector is expected to grow.

Polymer Matrix Composites Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Polymer Matrix Composites Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 30.13 billion in 2025 and USD 32.56 billion in 2026. The Asia Pacific region dominates the global market, driven by expanding industrial manufacturing, urban development, and the booming automotive and aerospace industries in countries including China, India, Japan, and South Korea. Government initiatives promoting lightweight, fuel-efficient vehicles and renewable energy infrastructure are accelerating composite adoption. Moreover, increasing defense spending, rising demand for consumer electronics, and the growing presence of local and international manufacturers further contribute to market growth. The region’s focus on innovation and technological advancements ensures robust demand for PMCs across diverse applications.

North America

The market in North America is experiencing steady growth, fueled by advanced manufacturing, high aerospace and defense investments, and increasing demand for lightweight and durable materials in the automotive sector. Countries including the U.S. and Canada are key contributors, with a strong focus on technological innovation and adoption of composites in high-performance applications. Government support for sustainable energy projects such as wind turbine installations further propels market expansion. Additionally, stringent emission regulations and the push for fuel-efficient transportation solutions are driving the replacement of traditional materials with polymer composites across industries.

Europe

In Europe, the market is driven by strict environmental regulations encouraging the use of lightweight, recyclable, and high-performance materials across various industries. The region’s strong emphasis on sustainability accelerates the adoption of PMCs in automotive, aerospace, and wind energy applications. Countries including Germany, France, and the U.K. are at the forefront, investing in advanced composite technologies for electric vehicles, aircraft, and renewable energy systems. Additionally, the region’s well-established industrial base ensures steady demand for the product across multiple sectors.

Latin America

In Latin America, the market is growing steadily, supported by increasing demand from the automotive, construction, and wind energy sectors. Countries including Brazil and Mexico are witnessing a rise in composite usage due to expanding vehicle manufacturing, infrastructure projects, and renewable energy initiatives. The region is also benefiting from growing applications of PMCs in consumer goods and industrial equipment, driven by the need for lightweight, corrosion-resistant, and cost-effective materials. Additionally, government support for industrial development and the gradual adoption of advanced manufacturing technologies are further propelling the market growth across the region.

Middle East & Africa

In the Middle East and Africa, the market is witnessing growth due to increasing infrastructure development, industrial diversification, and rising demand for lightweight materials in automotive and aerospace applications. Countries such as South Africa are investing heavily in large-scale construction, transportation, and renewable energy projects, which create opportunities for composite material integration. Additionally, local manufacturing growth and sustainability are driving the adoption of advanced materials across the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Investments in R&D to Introduce New Products by Key Companies to Maintain Their Dominating Position in Market

The global market is highly competitive, with key players focusing on technological advancements, mergers & acquisitions, and capacity expansion to increase their market presence. Global companies include Toray Advanced Composites, Hexcel Corporation, DuPont, Owens Corning, and Mitsubishi Chemical Group Corporation. These companies compete based on purity levels, cost-effective processing techniques, supply chain integration, and regional dominance while investing in sustainable extraction technologies to address environmental concerns. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY POLYMER MATRIX COMPOSITES COMPANIES

- Toray Advanced Composites (U.S.)

- Hexcel Corporation (U.S.)

- SGL Carbon (Germany)

- DuPont (U.S.)

- TEIJIN LIMITED (Japan)

- TPI Composites Inc. (U.S.)

- Owens Corning (U.S.)

- Mitsubishi Chemical Group Corporation (Japan)

- Solvay (Belgium)

- BASF (Germany)

KEY INDUSTRY DEVELOPMENTS

- July 2025: Toray Advanced Composites partnered with Airborne Aerospace B.V. to supply space-grade composite materials for solar arrays used in mega-constellation satellites, highlighting their reliability, low weight, and suitability for automated space manufacturing.

- August 2023: Toray Advanced Composites announced a 50% increase in production capacity at its California plant by adding 74,000 square feet (68,00 square meters) to meet rising global demand for thermoplastic and thermoset polymer matrix components.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.0% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Type · Thermoplastics · Thermosetting Plastics |

|

By Reinforcement · Glass Fiber · Carbon Fiber · Others |

|

|

By Manufacturing Process · Lay-up (Hand/Spray) · Filament Winding · Pultrusion · Compression Molding · Injection Molding · Resin Transfer Molding (RTM) |

|

|

By Application · Automotive · Aerospace · Building & Construction · Electrical & Electronics · Sports Equipment · Others |

|

|

By Region · North America (By Type, By Reinforcement, By Manufacturing Process, By Application, and By Country) o U.S. (By Application) o Canada (By Application) · Europe (By Type, By Reinforcement, By Manufacturing Process, By Application, and By Country) o Germany (By Application) o U.K. (By Application) o Italy (By Application) o France (By Application) o Russia (By Application) o Rest of Europe (By Application) · Asia Pacific (By Type, By Reinforcement, By Manufacturing Process, By Application, and By Country) o China (By Application) o India (By Application) o Japan (By Application) o South Korea (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Type, By Reinforcement, By Manufacturing Process, By Application, and By Country) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Type, By Reinforcement, By Manufacturing Process, By Application, and By Country) o GCC (By Application) o South Africa (By Application) · Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 71.4 billion in 2025 and is projected to reach USD 76.9 billion by 2034.

In 2025, the market value stood at USD 30.13 billion.

The market is expected to exhibit a CAGR of 8.0% during the forecast period of 2026-2034.

The key factors driving the polymer matrix composites market are the rising demand for lightweight and high-strength materials and the growing focus on sustainability.

Toray Advanced Composites, Hexcel Corporation, DuPont, Owens Corning, and Mitsubishi Chemical Group Corporation are the top players in the market.

Asia Pacific dominated the market in 2025.

The growing advancements in composite manufacturing technologies, and the increasing use of these materials across automotive, aerospace, and construction sectors are some of the key factors expected to favor the adoption of polymer matrix composites.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us