Polyurethane Coatings Market Size, Share & Industry Analysis, By Product Type (Solvent-borne Coatings, Waterborne Coatings, Powder Coatings, and Radiation-based Coatings), By Application (Automotive & Transportation, Construction, Wood & Furniture, Aerospace, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

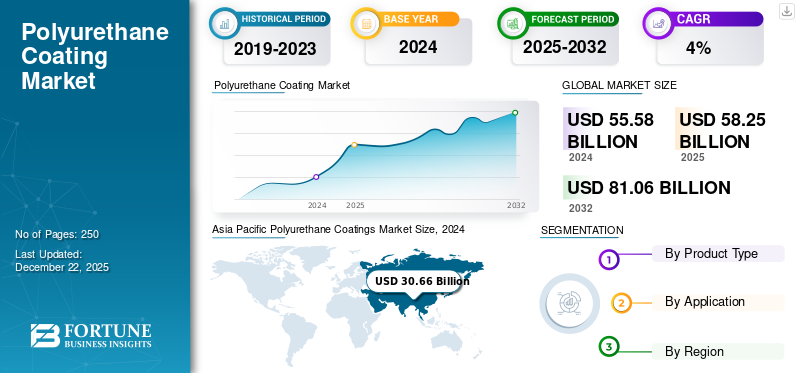

The global polyurethane coatings market size was valued at USD 53.07 billion in 2025 and is projected to grow from USD 55.92 billion in 2026 to USD 81.42 billion by 2034, exhibiting a CAGR of 4.8% during the forecast period. Asia Pacific dominated the polyurethane coatings market with a market share of 55% in 2025.

Polyurethane coating is a type of protective finish widely used in various industries for its durability, flexibility, and resistance to environmental factors. It is formed through a chemical reaction between polyols and isocyanates, resulting in a polymer that offers superior mechanical and chemical properties. These coatings are commonly applied to surfaces such as wood, metal, concrete, plastic, and textiles to enhance their lifespan and appearance. They are known for their excellent resistance to abrasion, chemicals, UV radiation, and moisture, making them ideal for both indoor and outdoor applications. These coatings are available in different formulations, including water-based, solvent-based, and 100% solid polyurethanes, each offering distinct benefits depending on the application requirements.

The market is a significant segment within the global coatings industry, driven by its extensive applications in the automotive, construction, aerospace, furniture, and industrial sectors. These coatings are applied on many types of surfaces, including metals, wood, concrete, and plastics, to enhance their lifespan and aesthetic appeal. The market is experiencing steady growth due to increasing demand from industries that require high-performance coatings with superior protection against harsh environmental conditions.

The driving factor of the market is the rising demand for protective coatings in the automotive and aerospace sectors. These coatings help enhance vehicle durability by providing resistance to corrosion, UV radiation, and extreme weather conditions. Similarly, in the construction industry, polyurethane (PU) coatings are widely used for flooring, roofing, and waterproofing applications, as they offer excellent adhesion, flexibility, and weather resistance. With rapid urbanization and infrastructure development, the demand for these coatings is expected to grow further.

AkzoNobel, Axalta Coating Systems, Jotun, PPG Industries, Inc., and RPM International Inc. are among the key players operating in the industry.

Global Polyurethane Coatings Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 53.07 billion

- 2026 Market Size: USD 55.92 billion

- 2034 Forecast Market Size: USD 81.42 billion

- CAGR: 4.8% from 2026–2034

Market Share:

- Asia Pacific dominated the polyurethane coatings market with a 55% share in 2025, driven by rapid industrialization, urbanization, and growth in the automotive and construction sectors across China, India, and Southeast Asia.

- By product type, solvent-borne coatings are expected to retain the largest market share in 2025, supported by their high durability, superior adhesion, and resistance to harsh environmental conditions, making them suitable for automotive, aerospace, marine, and industrial applications.

Key Country Highlights:

- China: Leads the market with strong manufacturing capabilities, extensive infrastructure development, and high automotive production driving demand for polyurethane coatings.

- India: Witnessing rapid growth due to expanding automotive, furniture, and construction industries, supported by government-backed infrastructure projects.

- United States: Market expansion is driven by high demand from the automotive, aerospace, and construction sectors, with leading manufacturers adopting advanced PU coating solutions for durability and protection.

- Europe: Growth is supported by stringent EU REACH regulations encouraging the adoption of bio-based and waterborne polyurethane coatings, especially in Germany, France, and the U.K.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand for Eco-Friendly and Low-VOC Polyurethane Coatings to Drive Market Growth

One of the most prominent drivers in the global market is the shift toward eco-friendly and low-VOC (Volatile Organic Compound) coatings due to increasing environmental concerns and stringent government regulations. Traditional solvent-based coatings release high levels of VOCs, which contribute to air pollution and pose health risks. As a result, regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) under the REACH regulations have imposed strict emission limits, encouraging industries to adopt greener alternatives. Waterborne coatings are becoming more popular as a sustainable alternative. These coatings use water as a carrier instead of harmful solvents, reducing VOC emissions while maintaining excellent adhesion, flexibility, and durability.

- For example, AkzoNobel, a leading coatings manufacturer, has developed waterborne polyurethane coatings that meet environmental standards while offering high-performance protection for wood, metal, and automotive surfaces.

- Similarly, PPG Industries launched the SIGMAZINC waterborne PU coating, which is used in marine and infrastructure projects to provide corrosion resistance without harmful solvent emissions.

MARKET RESTRAINTS

Raw Material Price Volatility and Stringent Environmental Regulations May Hamper Market Growth

Polyurethane coatings rely heavily on key raw materials such as isocyanates (TDI, MDI) and polyols, which are derived from petrochemical feedstocks. The prices of these materials are highly dependent on crude oil prices, which are prone to fluctuations due to geopolitical tensions, supply chain disruptions, and changing energy policies.

- The Russia-Ukraine conflict and OPEC production cuts have led to rising oil prices, directly impacting the cost of polyurethane production.

Another major hurdle is the increasing environmental regulations imposed on Volatile Organic Compound (VOC) emissions and hazardous chemicals used in polyurethane coatings. Many solvent-based substance contain high levels of VOCs, which contribute to air pollution and health hazards. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA), the European Chemicals Agency (ECHA), and China’s Ministry of Ecology and Environment have implemented strict emission limits, pushing manufacturers to develop waterborne and bio-based alternatives. However, transitioning to low-VOC or solvent-free coatings requires significant investment in R&D and reformulation, which can be costly and time-consuming.

- The European Union’s REACH regulations have restricted the use of certain isocyanates due to their potential health risks, forcing companies to explore alternative formulations or safer application methods.

MARKET OPPORTUNITIES

Technological Advancements and Development of Smart Coatings to Create Lucrative Opportunities in the Market

Innovation in polyurethane coatings has led to the development of smart coatings that offer enhanced performance, durability, and functionality beyond traditional coatings. One breakthrough is self-healing polyurethane coatings, which can automatically repair minor scratches and damages. These coatings contain microcapsules filled with healing agents that rupture upon surface damage, filling in the scratches and restoring the protective layer.

- For instance, in the automotive industry, companies such as Nissan and Mercedes-Benz have explored self-healing coatings for car exteriors, reducing the need for frequent repainting and maintenance.

Similarly, anti-corrosion polyurethane coatings are gaining traction in marine and industrial applications, where exposure to harsh environments can lead to rust and degradation. These coatings, infused with nanotechnology, create a stronger barrier against moisture, chemicals, and extreme temperatures, extending the lifespan of metal structures such as bridges, pipelines, and offshore oil rigs.

POLYURETHANE COATINGS MARKET TRENDS

Increased Product Application in the Automotive Industry to Drive Market Growth

Polyurethane coatings are gaining robust momentum in the automotive sector, driven by the need for lightweight, high-performance, and aesthetically appealing coatings. These coatings offer excellent abrasion resistance, durability, UV protection, and gloss retention, making them ideal for exterior vehicle applications. In addition, PU coatings help reduce the overall vehicle weight by allowing thinner yet highly effective coating layers, thereby improving fuel efficiency and contributing to emissions reduction, key concerns in today’s automotive industry. The rise of electric vehicles (EVs) has further boosted demand for specialized coatings that can protect sensitive components, such as battery enclosures and electronic parts, from thermal and chemical exposure. Automotive OEMs are increasingly turning to high-performance PU clear coats for advanced aesthetic finishes that remain durable under harsh environmental conditions.

For example, Axalta Coating Systems offers a line of polyurethane-based automotive coatings that combine high durability with visually striking finishes. Similarly, BASF’s polyurethane solutions are widely adopted for both OEM and aftermarket applications, offering scratch resistance and long-term gloss retention.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product Type

Solvent-borne Coatings Segment Holds Dominant Share Due to its Properties

Based on product type, the market is segmented into solvent-borne coatings, waterborne coatings, powder coatings, and radiation-based coatings.

The solvent-borne coatings segment held the most significant global polyurethane coatings market share in 2024. The demand for these coatings is growing in industries which require high-performance protection, superior durability, and resistance to harsh environmental conditions. They offer excellent adhesion, chemical resistance, and flexibility, making them suitable for applications in the automotive, aerospace, marine, and industrial sectors.

The waterborne coatings segment is set to exhibit significant growth during the forecast period due to growing environmental awareness and stringent VOC regulations. These coatings offer low toxicity, reduced odor, and eco-friendly benefits, making them the preferred choice in industries transitioning toward sustainable solutions. The construction and furniture industries are major growth drivers, as water-based PU coatings are widely used in wood coatings, flooring, and architectural finishes due to their low emissions and ease of application.

By Application

Automotive & Transportation Segment to Lead Due to High Utilization of Product

Based on application, the market is segmented into automotive & transportation, construction, wood & furniture, aerospace, and others.

The automotive & transportation segment held the most significant global market share in 2024. The growth of the segment is driven by increasing demand for high-performance, durability, and lightweight coatings. PU coatings are widely used in automotive exteriors, interiors, chassis, and underbody components to provide superior resistance to corrosion, UV radiation, abrasion, and chemicals.

The construction segment is expected to grow significantly during the forecast period. The growing popularity of protective coatings for bridges, highways, and industrial structures is also contributing to market expansion. Furthermore, PU coatings offer superior resistance against extreme weather conditions, UV exposure, and mechanical wear.

The wood & furniture segment is set to witness significant growth during the forecast period. The increasing demand for aesthetic appeal, durability, and surface protection drives the segment growth. PU coatings provide high-gloss finishes, scratch resistance, and protection against moisture, heat, and stains, making them ideal for wooden furniture, cabinets, flooring, and decorative items.

Polyurethane Coatings Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Polyurethane Coatings Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest market share in 2025, generating market revenue worth USD 28.98 billion. The polyurethane coatings market growth in the region is driven by rapid industrialization, urbanization, and expanding automotive and construction sectors. China, the largest producer and consumer of PU coatings, dominates the regional market due to its booming manufacturing industry, government-backed infrastructure projects, and high automotive production. India, Japan, and South Korea are also experiencing strong growth, with increasing demand for PU coatings in furniture, and aerospace applications.

North America

North America is expected to grow significantly over the forecast period, driven by rising demand from the automotive, aerospace, and construction sectors. The U.S. and Canada are key contributors, with major automotive manufacturers such as Ford, General Motors, and Tesla relying on polyurethane coatings for vehicle protection and durability.

Europe

Europe is projected to be the second-largest region in the global market, driven by sustainability initiatives, stringent environmental laws, and industrial applications. Countries such as Germany, France, and the U.K. are at forefront of adopting bio-based and waterborne polyurethane coatings due to strict EU REACH regulations that limit VOC emissions.

Latin America

The Latin American market is expected to grow moderately, attributed to the increased spending on commercial and residential projects, boosting demand for PU-based flooring, waterproofing, and insulation applications.

Middle East & Africa

The Middle East & Africa region is witnessing steady growth. The infrastructure projects, oil & gas industries, and urban development fuel the demand. Saudi Arabia, the UAE, and South Africa are investing heavily in construction, transportation, and industrial expansion, creating a strong demand for polyurethane coatings in protective applications such as steel structures, pipelines, and commercial buildings.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Devise Crucial Strategies to Maintain their Dominance in the Market

The major players operating in the market are AkzoNobel, Axalta Coating Systems, Jotun, PPG Industries, Inc., and RPM International, Inc. Most global companies have integrated raw material production and sales activities to maintain product quality and expand their regional presence. This gives businesses a competitive edge in the form of cost advantages that improves profit margins. To remain competitive and meet the changing demands of end-users, market players are placing more emphasis on their R&D efforts. Additionally, companies have adopted strategies, such as acquisition, partnership, and new product launches, to increase their presence in various regions.

LIST OF KEY POLYURETHANE COATINGS COMPANIES PROFILED

- AkzoNobel (Netherlands)

- Axalta Coating Systems (U.S.)

- Jotun (Norway)

- PPG Industries, Inc. (U.S.)

- RPM International Inc. (U.S.)

- The Sherwin-Williams Company (U.S.)

- Kansai Paint Co., Ltd. (India)

- DIC CORPORATION (Japan)

- Specialty Coating Systems Inc. (U.S.)

- Conpro Chemicals Private Limited (India)

KEY INDUSTRY DEVELOPMENTS

- March 2025: BASF’s Coatings division expanded its production capacity for polyester and polyurethane resin at its Caojing plant in Shanghai, China, with a capacity of 18,800 metric tons per year.

- July 2024: AkzoNobel has launched the Selva Pro range of 2K polyurethane and acrylic coatings systems for the professional and industrial woodworking community. The Selva Pro range comprises three systems and provides a complete spectrum of sheens from high gloss to dead flat, and offers limitless color possibilities for the most creative imaginations.

- August 2022: BASF launched Thermoplastic Polyurethane Paint Protection Film from RODI for improved car paint protection. It provides multifaceted and long-lasting protection for automotive coatings.

REPORT COVERAGE

The global market research report provides detailed market analysis and focuses on crucial aspects such as leading companies, technology, and applications. Also, the report offers insights into market trends and highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) & Volume (Kiloton) |

|

Growth Rate |

CAGR of 4.8% during 2026-2034 |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 55.92 billion in 2026 and is projected to reach USD 81.42 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 28.98 billion.

The market is expected to exhibit a CAGR of 4.8% during the forecast period.

By application, the automotive & transportation segment led the market.

Increasing preference for eco-friendly and low-VOC coatings drives market growth.

AkzoNobel, Axalta Coating Systems, Jotun, PPG Industries, Inc., and RPM International Inc. are the top players in the market.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us