Polyurethane Spray Foam Market Size, Share & Industry Analysis, By Cell Structure (Open-cell and Closed-cell), By Blowing Type (Water Blown, HFO Blown, and Others), By Application (Construction, Automotive, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

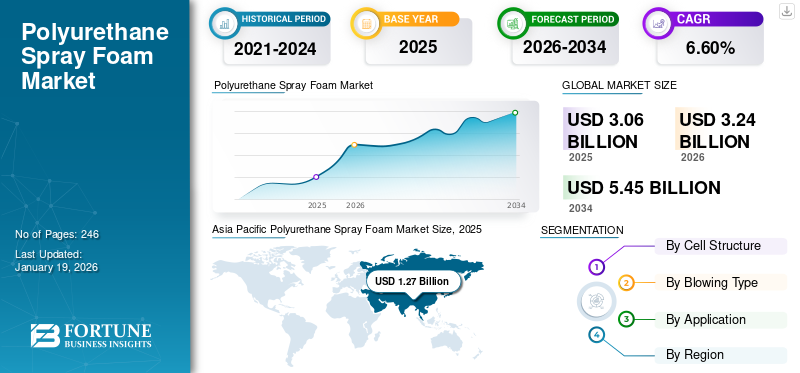

The global polyurethane spray foam market size was valued at USD 3.06 billion in 2025. The market is projected to grow from USD 3.24 billion in 2026 to USD 5.45 billion by 2034, exhibiting a CAGR of 6.60% during the forecast period. Asia Pacific dominated the polyurethane spray foam market with a market share of 42% in 2025.

The global polyurethane spray foam market is witnessing significant growth opportunities driven by various applications such as construction, automotive, and industrial sectors. Polyurethane spray foam is a liquid material that expands upon application, forming a rigid structure that provides thermal insulation, air sealing, and durability across various surfaces. Spray foam is lightweight yet effective, providing excellent coverage in hard-to-access areas. It is used to improve energy efficiency, control moisture, and enhance structural integrity in both new construction and renovation projects. The product supports lower energy consumption by reducing air leaks and limiting heat transfer. Rising demand for energy-efficient materials and sustainable construction practices will significantly drive the market’s growth. The main players working in the market include BASF SE, PPG Industries, Inc., Huntsman International LLC, Owens Corning, and Arkema.

GLOBAL POLYURETHANE SPRAY FOAM MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 3.06 billion

- 2026 Market Size: USD 3.24 billion

- 2034 Forecast Market Size: USD 5.45 billion

- CAGR: 6.60% from 2026–2034

Market Share:

- Asia Pacific led in 2025 with a 42% share, rising from USD 1.27 billion in 2025 to USD 1.36 billion in 2026.

- By cell structure: Open-cell foam is widely adopted for interior insulation, while closed-cell foam dominates in exterior and industrial applications.

- By application: Construction sector holds the largest share, driven by demand for energy-efficient insulation; automotive sector growing due to EV thermal management needs.

Key Country Highlights:

- China & India: Major growth in residential and commercial construction.

- Japan & South Korea: Investments in energy-efficient buildings and industrial applications.

- U.S. & Canada: Strict building codes and demand for sustainable construction materials.

- Germany, France & U.K.: Green building initiatives and energy-efficient renovation projects.

- Middle East & Africa: Rising infrastructure and urbanization boost demand.

- Latin America: Growing construction and urban development drive market expansion.

Polyurethane Spray Foam Market Trends

Shift toward Low-Emission and Eco-Friendly Formulations

The rapid shift in the industry toward low-emission and environmentally friendly products is prompting manufacturers to adopt technologies such as HFO-blown and water-blown spray foams to reduce global warming potential (GWP) and improve overall product safety. These innovations align with global sustainability targets and stricter environmental regulations that focus on reducing emissions from insulation materials. End-users, particularly in the construction sector and automotive sectors, are prioritizing products that enhance energy efficiency without compromising indoor air quality and also contribute to green construction. Asia Pacific witnessed a growth from USD 1.27 billion in 2025 to USD 1.36 billion in 2026.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Growing Importance of Energy-Efficient Buildings Fuel Market Growth

The rising focus on energy conservation is driving demand for high-performance insulation solutions across residential and commercial buildings. Spray foam is widely used to reduce heat loss, enhance indoor comfort, and lower energy consumption. It provides excellent air sealing, thermal resistance, and structural benefits, making it ideal for improving building performance. As energy costs rise, homeowners and businesses seek long-term solutions to reduce utility expenses. Renovation projects also contribute to the market, as older structures are upgraded with better insulation. These factors are collectively anticipated to push the polyurethane spray foam market growth.

MARKET RESTRAINTS

Health and Safety Concerns Associated with Spray Foam Could Restrain Market Growth

Health and safety risks associated with spray foam application represent a restraint for wider market adoption. During installation, certain chemicals used in spray foam can emit fumes or particulates that require proper handling, ventilation, and the use of protective equipment. Inadequate safety measures may lead to short-term respiratory irritation or skin reactions among workers or occupants. Additionally, improper application techniques can compromise insulation quality, resulting in underperformance, material waste, or the need for costly rework. These concerns contribute to hesitation among some builders, contractors, and homeowners.

MARKET OPPORTUNITIES

Expansion of Electric Vehicle Production Poses a Strong Opportunity for the Market

The growing electric vehicle (EV) market creates new opportunities for advanced insulation materials, including spray foam. EV manufacturers require efficient thermal management solutions to regulate battery temperatures, ensure passenger comfort, and improve vehicle energy efficiency. Spray foam offers lightweight, insulating properties that align with these needs, helping reduce vehicle weight and enhance overall performance. Its expanding use in vehicle panels, battery compartments, and refrigeration systems for electric transport highlights the growing demand within the automotive sector.

- As per the India Brand Equity Foundation (IBEF), India’s electric vehicle (EV) industry is rapidly increasing. India’s EV battery market is projected to surge from USD 16.77 billion in 2023 to a remarkable USD 27.70 billion by 2028, driven by government incentives and rising environmental concerns. This growth brings opportunity for the polyurethane spray foam sector as it is used in EVs.

MARKET CHALLENGES

Raw Material Price Volatility Could Challenge Market Growth

Polyurethane foam production relies on raw materials such as isocyanates and polyols, which are subject to price fluctuations driven by global supply and demand dynamics. Instability in the petrochemical industry, changing crude oil prices, and supply chain disruptions can significantly impact production costs for spray foam manufacturers. Price volatility makes it challenging for producers to maintain consistent pricing, especially in highly competitive markets. Sudden increase in raw material prices can reduce profit margins, affect product affordability, and delay construction projects relying on spray foam insulation.

TRADE PROTECTIONISM

Trade protectionism is emerging as a critical factor influencing the global market. Increasing tariffs, import restrictions, and local content requirements implemented by various governments are reshaping international trade flows for raw materials and finished products. Key raw materials such as polyols, isocyanates, and specialty additives are often imported, making manufacturers vulnerable to geopolitical tensions, trade disputes, and fluctuating regulatory policies.

Segmentation Analysis

By Cell Structure

Growing Adoption of Open-cell Based Polyurethane Foam in Various Applications Drive Market Growth

Based on cell structure, the market is classified into closed-cell and open-cell.

Open-cell spray foam is known for its lightweight, flexible structure and excellent sound-absorbing properties. This type of foam expands significantly upon application, making it ideal for filling wall cavities, ceilings, and irregular spaces in residential and commercial buildings. Open-cell foam allows for vapor permeability, helping to manage moisture levels within structures while providing effective air sealing. It is widely chosen for interior insulation due to its affordability and ability to enhance acoustic comfort.

Closed-cell spray foam offers higher density, superior thermal resistance, and enhanced structural strength compared to open-cell alternatives. Its rigid, compact structure provides excellent insulation, making it ideal for both exterior and interior applications. Closed-cell foam is widely used in building blocks, roofing, foundations, and industrial equipment where moisture resistance and durability are critical. It contributes to improved energy efficiency by minimizing air leaks, reducing heat transfer, and adding structural integrity to walls or roofs.

By Blowing Type

Growing Use of Water Blown Type in Various Foam Products is Fueling Market Growth

Based on blowing type, the market is classified into water blown, HFO blown, and others.

Water-blown spray foam utilizes water as the primary blowing agent during application, producing an eco-friendly insulation product with lower emissions compared to traditional alternatives. It is commonly used in open-cell and some closed-cell insulation applications, offering reliable thermal resistance and air sealing. By using water in the production process, manufacturers reduce the use of harmful chemicals, aligning with global sustainability goals and stricter environmental regulations.

HFO-blown spray foam uses hydrofluoroolefin (HFO) as a next-generation blowing agent, delivering superior insulation performance with minimal environmental impact. HFO technology offers low global warming potential and zero ozone depletion potential, addressing concerns associated with older, high-GWP blowing agents. HFO-blown foam is primarily applied in closed-cell insulation systems, providing excellent thermal resistance, moisture protection, and structural strength.

By Application

Construction Sector Drives Substantial Demand for Polyurethane Spray Foam

Based on application, the market is classified into construction, automotive, and others.

The construction sector holds the largest market share, driven by increasing demand for energy-efficient insulation and improved building durability. Spray foam is widely used in walls, roofs, floors, and foundations for both residential and commercial buildings, offering thermal insulation, air sealing, and structural support. Its ability to expand and fill gaps ensures uniform coverage and reduces heat loss, contributing to lower energy consumption and enhanced indoor comfort. The material also provides moisture resistance and strengthens building structures, making it suitable for both new construction and renovation projects.

In the automotive sector, spray foam is gaining popularity for its lightweight, insulating, and structural reinforcement properties. It is applied to improve thermal management, acoustic insulation, and air sealing within vehicles, contributing to enhanced passenger comfort and energy efficiency. Spray foam helps reduce vehicle weight, which supports better fuel efficiency and lower emissions. Additionally, its use in electric vehicles (EVs) is expanding, as manufacturers seek advanced materials to insulate battery compartments and regulate temperatures.

Polyurethane Spray Foam Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, and the rest of the world.

Asia Pacific

Asia Pacific Polyurethane Spray Foam Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the fastest-growing region in the polyurethane spray foam market, fueled by urbanization, infrastructure development, and increasing awareness of energy conservation. China, India, Japan, and South Korea are investing in residential and commercial construction that prioritizes energy efficiency and improved indoor comfort. Spray foam is also gaining traction in cold chain logistics, automotive production, and industrial insulation applications. The region’s construction boom, particularly in developing economies, drives market growth.

North America

North America holds a significant polyurethane spray foam market share, driven by strict building regulations and high awareness of energy-efficient construction practices. The U.S. and Canada focus on sustainable building materials to reduce energy consumption and improve indoor comfort. Spray foam is widely used in residential, commercial, and industrial construction projects to meet evolving energy codes. The region also benefits from significant demand in the automotive and transportation sectors, where lightweight materials and improved insulation are essential.

Europe

Europe remains a significant market for spray foam, supported by ambitious energy efficiency targets and a strong focus on reducing environmental impact. Germany, France, and the U.K. promote insulation upgrades through green building initiatives and financial incentives. Spray foam is used extensively in renovation projects to improve thermal performance and meet stricter energy standards. Additionally, the automotive sector adopts spray foam for noise reduction and thermal insulation in vehicles.

Latin America

Latin America presents steady growth opportunities for spray foam, driven by increasing construction activities, urban development, and efforts to improve building energy efficiency. Brazil, Mexico, and other countries are focusing on modernizing infrastructure and promoting energy-saving solutions in the residential and commercial sectors. Spray foam’s ability to improve thermal performance and enhance building durability makes it a demanding option in construction projects.

Middle East & Africa

The Middle East & Africa are emerging markets for spray foam products, supported by increasing construction activities, urbanization, and the need for improved building performance. The UAE, Saudi Arabia, and South Africa are investing heavily in residential and commercial construction to meet growing population demands. Spray foam’s ability to enhance thermal insulation, seal air leaks, and strengthen building structures aligns well with the region's infrastructure development needs.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in Their Dominating Position

The polyurethane spray foam market is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key players include BASF SE, PPG Industries, Inc., Huntsman International LLC, Owens Corning., and Arkema, among others. These companies compete based on product innovation, cost efficiency, and regional dominance. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY POLYURETHANE SPRAY FOAM COMPANIES PROFILED

- BASF SE (Germany)

- Johns Manville. A Berkshire Hathaway Company (U.S.)

- PPG Industries, Inc. (U.S.)

- Huntsman International LLC (U.S.)

- Owens Corning. (U.S.)

- Carlisle Spray Foam Insulation (U.S.)

- Arkema (France)

- VASmann (Latvia)

- Shakun Industries (India)

- Laxmi Engineering Works. (India)

KEY INDUSTRY DEVELOPMENTS

- September 2024: BASF and Future Foam have come into collaboration to launch the first commercially available flexible foam product named Lupranate T 80 toluene diisocyanate (TDI). The product is manufactured using domestically produced Biomass Balance (BMB) for the bedding industry.

- May 2024: Huntsman International LLC announces the launch of the all-new Icynene Series spray polyurethane foam insulation product line. The new product line offers the highest performance available in the industry.

- April 2024: Huntsman International LLC has launched a new product to protect electric vehicle batteries named SHOKLESS, which is a durable polyurethane foam. The new product offers a flexible choice for helping to safeguard the structural integrity of EV batteries in case of impact or a thermal event.

- September 2021: Johns Manville. A Berkshire Hathaway Company introduced the addition of JM Corbond High Yield Open-Cell Spray Polyurethane Foam to its line of building insulation products. The product is used for its superior performance and exceptional spray ability.

- February 2020: Huntsman International LLC. announced that they have completed the acquisition of Icynene-Lapolla, a leading North American manufacturer and distributor of spray polyurethane foam (SPF) insulation systems for residential and commercial applications. Huntsman International LLC completed this acquisition from FFL Partners, LLC, for USD 350 million.

REPORT COVERAGE

The global polyurethane spray foam market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and trends expected to drive the market in the forecast period. It offers information about key regions/countries, industry growth, new product launches, details on partnerships, mergers & acquisitions, and a number of polyurethane spray foam manufacturers in key countries. The report covers a detailed competitive landscape with information on market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.60% from 2026-2034 |

|

Unit |

Value (USD Billion) Volume (Kiloton) |

|

Segmentation |

By Cell Structure

|

|

By Blowing Type

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.06 billion in 2025 and is projected to reach USD 5.45 billion by 2034.

In 2025, the market value stood at USD 1.27 billion.

The market is expected to exhibit a CAGR of 6.60% during the forecast period of 2026-2034.

The open-cell segment led the market by cell structure in 2025.

The growth of the construction industry is set to be the key factor in driving the market.

BASF SE, PPG Industries, Inc., Huntsman International LLC, Owens Corning., and Arkema are some of the leading players in the market.

Asia Pacific dominated the market contributing 42% globally in 2025.

The growing demand for the sustainable construction industry in developing countries is likely to drive the adoption of the product in the forthcoming years.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us