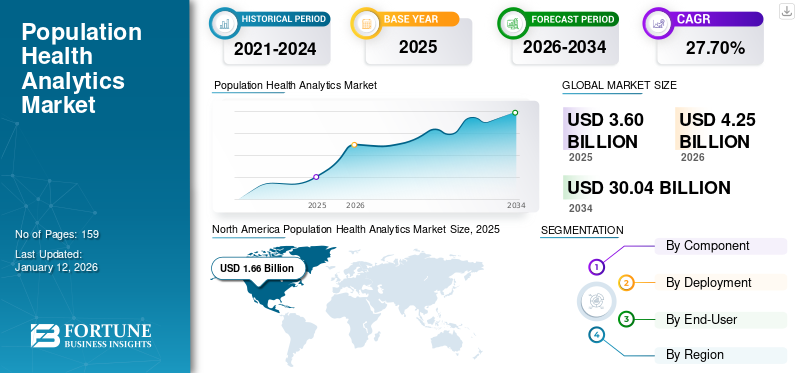

Population Health Analytics Market Size, Share & Industry Analysis, By Component (Software and Services), By Deployment (Cloud-based and On-premise), By End-User (Healthcare Providers, Healthcare Payers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global population health analytics market size was valued at USD 3.60 billion in 2025. The market is projected to grow from USD 4.25 billion in 2026 to USD 30.04 billion in 2034, exhibiting a CAGR of 27.70% over the forecast period. North America dominated the population health analytics market with a market share of 46.15% in 2025.

Population health analytics involves collecting and analyzing data to improve the health of a population. The global market is noticing an exponential growth, driven by the global healthcare industry’s push toward value-based care, predictive insights, and data-driven decision-making. Additionally, factors such as technological advancements, and the growing need to address health disparities are also supplementing the market growth. The market growth is further driven by the ability of population health analytics to identify trends, predict outcomes, and optimize resource allocation, ultimately leading to better patient outcomes and cost savings. Overall, the market has shown robust growth, with projections indicating a continued upward trajectory.

The market is a cornerstone of modern healthcare's transformation toward preventive and personalized care. With the adoption of AI, cloud computing, and big data, the market is poised for sustained expansion. However, its successful integration will depend on resolving data privacy issues, improving interoperability, and reducing the digital divide, especially in emerging economies.

Furthermore, prominent market players such as Oracle, Optum, OSP, and others are actively involved in offering innovative solutions with integration of AI and maintaining their market position by increasing their offerings and strategic initiatives.

MARKET DYNAMICS

MARKET DRIVERS

Shift Toward Value Based Care to Propel Market Growth

The market is witnessing significant growth owing to the increasing shift toward value based care. This transition plays a crucial role by providing data-driven insights that improve patient outcomes, reduce costs, and optimize care coordination. By analyzing large datasets of patient information, providers can identify high-risk individuals, implement targeted interventions, and measure the effectiveness of care strategies.

Healthcare systems are increasingly moving toward value-based care, which emphasizes quality and cost-effectiveness. Additionally, governments and private payers are transitioning to value-based reimbursement systems, highlighting outcomes over services. This shift drives demand for analytics that can relate treatment to outcome, optimize resource allocation, and improve population wellness metrics.

- For instance, Carle Health used population health management tools to reduce financial risks.

MARKET RESTRAINTS

Patient Privacy and Security Compliance to Limit Market Growth

Increasing number of clinical trials allows for rise in generation of sensitive data, making data security and privacy a significant concern. Growing incidences of data breaches and cybercrimes limit market growth. Regulatory compliance with frameworks such as HIPAA (U.S.), GDPR (EU), and local health data laws requires robust encryption, access control, and audit systems. Breach in these regulations may result in hefty penalties and damage to reputation.

Additionally, disparate data sources ranging from clinical and claims data to wearable technology pose challenges in standardizing and harmonizing health information for accurate population insights. This also creates a risk of data breaching.

- For instance, in February 2025, more than 1.6 million personal and medical records were compromised at DM Clinical Research amounting to 2 terabytes of data. Such breaches and data leaks, damage patient trusts.

Thus, these conditions require strict protocols for managing and storing patient data and critical laws to avoid data breaches and penalties.

MARKET OPPORTUNITIES

Technological Advancements to Offer a Lucrative Opportunity to the Market

In recent years, the market is witnessing a strong shift toward the development and integration of advanced technologies. This has created a lucrative growth opportunity for companies to capture untapped avenues.

Advancements in data analytics, artificial intelligence, and machine learning are enabling more sophisticated and accurate insights into population health. Furthermore, the deployment of Artificial Intelligence (AI) in PHA is accelerating, thereby enabling real-time risk stratification, early disease detection, and population-level forecasting. The adoption of predictive analytics is rapidly increasing over the past few years. AI-driven platforms now assist in identifying high-risk patients, improving care delivery, and reducing hospitalization costs.

Moreover, researchers and medtech device companies are engaged in developing digital health research using mobile and wearable devices for various diseases clinical trials, which is boosting the market growth during the forecast period.

- For instance, Creative Information Technology, Inc. is one of the prominent players in the market that offers AI driven software for population health analytics.

MARKET CHALLENGES

High Cost of Implementation and Shortage of Skilled Analysts to Pose a Critical Challenge to Market Growth

Even though the usage of analytics tools for population health is constantly increasing, high cost of implementation coupled with shortage of skilled professionals present significant challenges for the market. The initial cost for setting up a comprehensive PHA infrastructure including data warehousing, artificial intelligence engines, training, and integration is still high-priced for smaller healthcare entities. This leads to slower adoption of these tools, thereby slowing down the overall population health analytics market growth.

In addition, the market is witnessing a gap in trained health data scientists who understand both medical contexts and data analytics, thus creating a bottleneck in optimal utilization of advanced tools.

POPULATION HEALTH ANALYTICS MARKET TRENDS

Integration of Cloud-Based Healthcare Analytics with EHR and Telehealth is a Significant Market Trend

Population health analytics, coupled with cloud-based healthcare analytics, offers a powerful approach to improve community well-being by leveraging data to gain insights and make informed decisions. Cloud-based solutions enable efficient data aggregation, analysis, and sharing, allowing healthcare providers to identify high-risk groups, predict adverse events, and design targeted interventions. With a significant increase in cloud solution adoption, healthcare institutions are favoring these platforms for their ability to aggregate data across multiple sources and locations.

Furthermore, modern PHA solutions are seamlessly integrated with Electronic Health Records (EHRs) and telehealth systems, supporting a unified data flow from diagnosis to follow-up care. These factors are supplementing the overall market growth.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Component

Rise in Number of Service Providers and Launch of New Services Led Segment’s Dominance

Based on component, the market is divided into software and services.

In 2024, the services segment dominated the market. These services include consulting, maintenance, training, and data management services. The dominance of the segment can be driven by increase in deployment of these services by various healthcare facilities including clinics, hospitals, and others. Additionally, a rise in the number of service providers across the globe is also anticipated to support the segment growth.

- For instance, in August 2022, COPE Health Solutions (CHS) and Hawaii Health Network (HHN) launched population health analytics collaboration. As a part of this partnership, CHS provided population health management analytics services to the other company.

The software segment accounted for a substantial share of the market. This robust market share is driven by its ability to process and analyze vast amounts of healthcare data efficiently. These tools facilitate real-time insights, predictive modeling, and decision making, improving patient outcomes and operational efficiency. Additionally, the rising new launches of software & solutions by key players are driving the growth of the segment.

- For instance, in February 2024, Innovaccer introduced an AI-powered health platform to boost data modernization, enhance health equity, and drive whole-person care.

By Deployment

Advantages Associated with Cloud-based Platforms Support Segment’s Dominance

Based on deployment, the market is bifurcated into on-premise and cloud-based.

The cloud-based segment held the largest population health analytics market share in 2024 due to their scalability and real-time access capabilities. These tools are considered as the most popular delivery model due to its flexibility, scalability, and lower upfront costs. In addition, increasing focus of operating players on offering cloud-based solutions as per the demand of the end users is also expected to propel the segment growth.

- For instance, in March 2024, Innovaccer received top rankings for its AI-Cloud software from hospital and health system customers.

On the other hand, the on-premise segment is expected to grow with a considerable CAGR over the study period. These tools are often preferred by institutions with strict data governance needs or in areas with data sovereignty regulations.

By End-user

Healthcare Providers are Leading End-Users as PHA’s Data Analytics Help to Improve Patient Care

On the basis of end-user, the market is segmented into healthcare providers, healthcare payers, and others.

The healthcare providers segment held the dominant share of the market in 2024. These tools empower healthcare providers to improve patient care and outcomes by analyzing data about entire patient populations rather than individuals. This approach allows for proactive identification of high-risk individuals, targeted interventions, and more efficient resource allocation. Some of the benefits offered by PHA to healthcare providers include improved patient outcomes, reduced healthcare costs, enhanced resource allocation, and others.

The healthcare payers and others segment is anticipated to witness a notable growth in the coming years. This is primarily due to the increasing adoption of PHA tools by healthcare payers and research facilities recently.

POPULATION HEALTH ANALYTICS MARKET REGIONAL OUTLOOK

By region, the market is divided into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Population Health Analytics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in North America was valued at USD 1.98 billion in 2026 and is anticipated to continue to dominate the global market in the future. Advanced healthcare ecosystem, government mandates for EHR adoption, and presence of key vendors and rapid cloud adoption are few key factors promoting the market's growth in the region.

The U.S. is dominating the North American region with the highest market share. The well-established digital healthcare infrastructure coupled with growing adoption of PHA solutions among healthcare providers as well as healthcare payers are some of the key factors supplementing the country’s dominance. Additionally, collaborations between key market players further propelled the growth.

- For instance, in September 2024, HealthEC, and VirtualHealth signed a partnership agreement to bring together HealthEC’s advanced population health analytics capabilities and VirtualHealth’s population health management platform, HELIOS.

Europe

Europe is expected to grow with a considerable market share during the forecast period. The growth is driven by chronic disease burden in the region, digital health strategies across Germany, U.K., France, and strong public healthcare systems investing in predictive analytics.

- For example, in October 2023, Oracle Health launched a new Health Support Hub in Barcelona to improve patient outcomes and care.

Asia Pacific

Asia Pacific is expected to grow with the fastest CAGR during the forecast period. The rising prevalence of chronic diseases, rapidly expanding healthcare infrastructure in India, China, Southeast Asia, and government-led digital health initiatives have boosted the regional market growth.

- For instance, in September 2021, the Government of India launched Ayushman Bharat Digital Mission with an aim to develop integrated digital health infrastructure in the country.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa regions accounted for a comparatively lesser market share in 2024. However, these regions are considered to be the emerging markets for PHA adoption. This is driven by investments through public-private partnerships and international health organizations in these regions.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Innovative Product Offerings and Technological Advancements by Key Players to Propel Market Progress

The market represents a semi-consolidated competitive landscape featuring players such as Optum, Oracle, OSP, and others. These players are investing heavily in partnerships, platform expansion, and acquisitions to strengthen their presence in the analytics-driven healthcare space.

Other notable players in the global market include Inovalon, Innovaccer, Health Catalyst, Arcadia Solutions, LLC., Azara, and others. These companies are prioritizing the integration of AI and ML in their offerings and collaborations to boost population health analytics market share during the forecast period.

LIST OF KEY POPULATION HEALTH ANALYTICS COMPANIES PROFILED

- Inovalon (U.S.)

- Innovaccer (U.S.)

- Health Catalyst (U.S.)

- Outsource2india (India)

- OSP (U.S.)

- Arcadia Solutions, LLC. (U.S.)

- Azara (U.S.)

- VigourSoft Global Solutions (India)

- Oracle (U.S.)

- Optum (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2025: MedeAnalytics introduced Health FabricTM on the Snowflake AI Data Cloud. This is a next generation data platform.

- October 2024: Henry Ford Health launched a new subsidiary company to advance population health. It is a non-profit company that provides support to doctors, hospitals and health plans by offering value-based care services.

- August 2024: Innovaccer Inc. launched the Government Health AI Data and Analytics Platform (GHAAP) with an aim to support public sector agencies. This new platform accelerates data modernization along with other benefits.

- April 2024: Pine Park Health adopted Innovaccer’s leading healthcare AI platform for the optimization of population health analytics.

- February 2024: Persistent Systems in collaboration with Microsoft introduced Generative AI-powered Population Health Management (PHM) Solution.

REPORT COVERAGE

The global market report comprises of key aspects such as an overview of cutting-edge technologies, the regulatory environment in major countries, and the challenges faced in adopting and implementing tech-based solutions. The market analysis also provides notable industry developments, including mergers, partnerships, and acquisitions. Furthermore, it includes detailed regional analysis of various segments and the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 27.70% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

|

|

By Deployment

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 4.25 billion in 2026 and is projected to reach USD 30.04 billion by 2034.

In 2025, North America stood at USD 1.66 billion.

Registering a CAGR of 27.70%, the market will exhibit rapid growth over the forecast period (2026-2034).

Based on component, the services segment is expected to lead the market during the forecast period.

Rising adoption of artificial intelligence and machine learning are some of the key factors driving the market.

Oracle, Optum, and Arcadia Solutions, LLC., are some of the major players in the global market.

North America dominated the market in terms of share in 2024.

The increasing need to reduce healthcare costs, improve patient outcomes, and address social determinants of health drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us