Precision Industrial Knife Market Size, Share & Industry Analysis, By Product Type (Straight Knife, Circular Knife, Tooth Knife, Tray Knife, and Custom Knife), By Material (High Speed Steel, Carbon Steel, Ceramic Blades, Tungsten Carbide Blades, Titanium Blades, and Others), By Application (Packaging, Food & Beverage Processing, Printing and Paper, Textile, Metal, Electronics, and Others), and Regional Forecast, 2026 – 2034

PRECISION INDUSTRIAL KNIFE MARKET SIZE AND FUTURE OUTLOOK

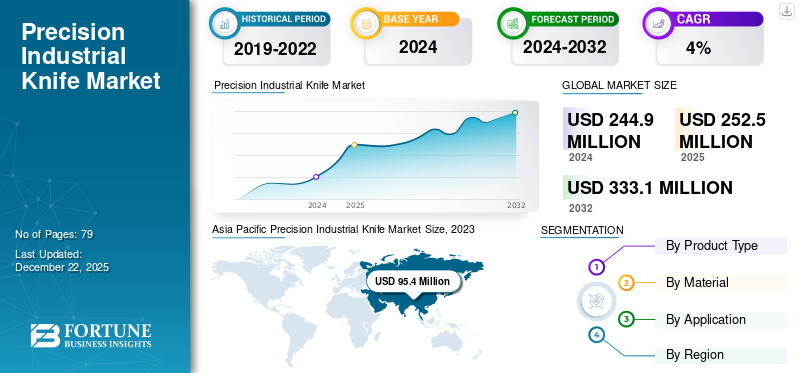

The global precision industrial knife market size was valued at USD 252.50 million in 2025 and is projected to grow from USD 260.80 million in 2026 to USD 368.60 million by 2034, exhibiting a CAGR of 4.40% during the forecast period. The Asia Pacific dominated global market with a share of 39.60% in 2025.

Precision industrial knife is used in cutting various materials such as paper, cardboard, polyester, foil, rubber, and metal and finds their application across a wide range of industries that include paper and pulp, packaging, food processing, electronics, metals, woodworking, and recycling. The demand for dependable cutting tools is expected to grow as industries progress both technologically and geographically, venturing into uncharted territories and emerging markets seeking opportunities for development. Manufacturers of industrial knives are required to continuously adapt to evolving regulations and environmental issues. In the current market, which prioritizes environmental awareness, companies must actively engage in sustainable practices to maintain their competitive edge. Kyocera Group, Ferrotec TOYO, EDGE Industrial Technologies, Fisher Barton, and Naucor GmbH are few of the prominent players in the market owing to expanding their market presence through strong dealer, and distributor networks, and mergers and acquisitions across geographies.

Download Free sample to learn more about this report.

Industry-specific applications and custom requirements of end-users, including food processing, plastics, and packaging for knives, are further bolstering the precision industrial knife market growth. Growing smart factories and demand for precision manufacturing across industries are expected to enhance the market share over the forecast period.

The economic downturn caused by the COVID-19 pandemic significantly affected the industrial cutting tools market. The growth of the market following the pandemic has been influenced by temporary closures of manufacturing plants, disruptions in the supply chain, and political unrest in certain countries. Nonetheless, owing to its extensive applications across various sectors such as electronics, automotive, general manufacturing, and packaging, it has supported the precision knife market growth. The market for these tools is expected to experience strong growth post pandemic because of their non-contact processes, high speed, and precise cutting capabilities on a range of materials, including metals and other alloys.

Precision Industrial Knife Market Trends

Integration of Sustainable Practices in Operations and Manufacturing to Bolster Market Growth

Sustainable practices are prominently growing across manufacturing facilities in order to lessen carbon footprint and ensure the best quality eco-friendly products. Several manufacturers are focusing on cutting-edge solutions with advanced materials and coatings to boost knife performance and durability. Manufacturing companies focus on investing in innovative technologies and research activities to develop high-performance knives for several end-use industries. Manufacturers are implementing sustainable sourcing methods for their raw materials and are focusing on the recyclability of their products at the end of their life cycle. This transition toward sustainability is influencing end-user preferences as well as the manufacturing practices in the industrial knife sector.

MARKET DYNAMICS

Market Drivers

Precision Manufacturing Across Diverse Industries to Boost Market Demand

Modern facilities in diverse industries such as electronics, medical devices, food and beverages, and packaging are striving for precision manufacturing driven by technological advancements. Growing automation and increasing demand for CNC machines are further generating a market for enhanced precision and repeatability.

Multiple industries often demand precision cutting and efficient operation across manufacturing sectors. Industrial knives accurately aid in cutting various types of materials across industries, including food processing, packaging, printing, metal, and plastic. Growing projects in emerging sectors such as robotics, the semiconductor industry, and others are expected to influence the market for industrial knives.

Market Restraints

Heavy Cost Associated with Advanced Cutting Tools to Hinder Market Growth

Industrial knives manufactured from carbide and ceramic materials tend to be expensive, restricting the expansion of precision industrial knife usage among small and medium-sized enterprises with constrained budgets. Additionally, the rising costs associated with maintenance and replacement may further elevate operational expenses for end users, thereby impeding the market growth for precision industrial knives.

The considerable upfront capital needed for the development and installation of precision industrial knife solutions, especially in the context of large-scale projects, represents a major obstacle to market expansion. Unpredictability related to governmental policies and regulations, including alterations in subsidies or tax incentives, can lead to instability for investors and hinder market expansion.

Market Opportunities

Growing Investment in Semiconductor Manufacturing to Widen Precision Cutting Market

Semiconductor equipment manufacturing generates a strong demand for precision industrial knives for cutting and dicing applications. Semiconductor wafers require precise cutting and grinding in the packaging and assembly processes, bolstering the market growth.

Equipment that is used in wafer slicing requires precise dimensions to ensure consistent thickness of the semiconductor wafers. Semiconductor wafers require high dimensional accuracy and fine surface quality, bolstering the market demand for precise cutting solutions. Significant investment and supportive domestic policies by emerging and developing countries are expected to further propel the market growth of precision cutting tools, including industrial knives and other cutting solutions. For instance, the Indian Prime Minister in February 2024 inaugurated three new semiconductor manufacturing units in India that include Semiconductor Fabrication, Semiconductor Assembly, Test, Marking, and Packaging (ATMP), and Semiconductor ATMP units for specialized chips in Gujarat and Assam.

SEGMENTATION ANALYSIS

By Product Type

Circular Knife to Lead Market Owing to its Versatile and Wide Array of Application

By product type, the market is segmented into straight knife, circular knife, tooth knife, tray knife, and custom knife.

The Circular knife segment to cater the highest revenue share, followed by straight knives throughout the forecast period as a result of their applications across diverse industries, including food processing, paper, metal, and textile cutting applications. The segment led the market share by 43.14% of the market share by 2026.

Circular knife segment is expected to experience the highest growth rate during the forecast period. Circular knives find utility in various sectors, including food processing, plastics, foam, textiles, paper, and glass. Due to their precise and efficient cutting capabilities, the demand for circular knives will grow substantially during the forecast period.

However, the straight knife segment caters to significant revenue shares and is prominently used in cutting rigid materials such as metal, wood, and food products. Other types of knives, such as tooth knives, tray knives, and custom knives, are used in cutting, slicing, and shaping across industries, including packaging, food, leather, textiles, metals, and wood.

To know how our report can help streamline your business, Speak to Analyst

By Material

High-Speed Steel Material Dominates Market Owing to its Hard and Sharp Material Properties

By material type, the market is segregated into High Speed Steel (HSS), carbon steel, ceramic blades, tungsten carbide blades, titanium blades, and others.

High-speed steel finds its prominent application in precise industrial cutting owing to its sharpness and hardness at high speeds. High-speed steel, accounting for the highest revenue share, is strongly resistant to vibrations and fractures and allows efficient and high-precision cutting. The segment is likely to acquire 41.60% of the market share in 2026.

The ceramic blades segment is expected to showcase a CAGR of 5% during the forecast period as a result of high durability and enhanced sharpness in comparison to other materials.

Knives made of tungsten carbide blades, titanium blades, and other alloys to support the market growth over the forecast period.

By Application Analysis

Food and Beverages Processing to Hold Largest Revenue Share Owing to Growing Demand for Packaged Food

By application, the market is segmented into packaging, food & beverage processing, printing and paper, textile, metal, electronics, and others. Other applications include rubber manufacturing, woodworking, glass, and tire manufacturing.

Food & beverage processing applications are expected to dominate the market throughout the forecast period as a result of the increasing population across developing nations and the growing demand for processed food. The segment is expected to hold 21.8% of the market share in 2025.

The precise cutting of semiconductors and electronics products is expected to increase the market growth for industrial knives in the electronics industry.

The electronics sector is expected to experience a CAGR of 5.9% over the forecast period. Packaging, paper and printing, textile, metal, and all other industries would boost the market growth for precision industrial knives across regions.

PRECISION INDUSTRIAL KNIFE MARKET REGIONAL OUTLOOK

By region, the market is classified as North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific

The Asia Pacific region is expected to hold the largest revenue market share in 2025, followed by Europe and North America. The regional market value in 2026 was USD 103.3 million, and in 2025, the market value led the region by USD 100.1 million. Asia Pacific region dominated the precision industrial knife market share in 2023. Supportive policies and investment in infrastructure across developing countries will further bolster the market growth over the forecast period. For instance, Malaysia has attracted investment of about USD 107 billion for Semiconductor Strategy as a result of the National Semiconductor Strategy in May 2024.

Growing population, increasing investment in manufacturing facilities, and considerable investment in electronics and semiconductor plants are a few of the factors boosting the market demand for industrial cutting tools. For instance, in November 2024, CKD Corporation, an automated machinery and equipment manufacturer, announced the development of a manufacturing facility in Malaysia with advanced technologies and supply chain management systems. Emerging countries, including Indonesia, Malaysia, and others, are focusing on sustainable manufacturing practices with the help of efficient and high-performing cutting tools.

Asia Pacific Precision Industrial Knife Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Rising end-user demand, technology development, high demand for precision manufacturing, and the emerging semiconductor industry are a few of the factors bolstering the growth of the precision knife market in China. Precision industrial knives are highly durable and offer precision cutting of varied materials. The market in China is expected to hit USD 61.4 million in 2026, whereas India is likely to reach USD 14.6 million and Japan is projected to hit USD 11.4 million in 2026.

Europe

Precision industrial knife are gaining traction across diverse industry sectors, including paper, woodworking, and packaging. The region is anticipated to account for the second-highest market size of USD 72.5 million in 2025, exhibiting the second-fastest growing CAGR of 3.5% during the forecast period. Growing food and beverage processing and increasing demand for packaged food products are further influencing the growth of precision-cutting technologies in the region. Several end users are largely focusing on automation and smart machinery with efficient cutting technologies, which is generating a strong demand for precision industrial knives. For instance, according to the European Union, exports of food and drinks have doubled in the past 10 years, reaching over USD 184 billion. The market value in U.K. is expected to be USD 6.7 million in 2026.

On the other hand, Germany is projecting to hit USD 17.2 million in 2026 and France is likely to hold USD 12.1 million in 2025.

North America

North America region is to be anticipated as the third-largest market with USD 64.9 million in 2025. End users across industries such as packaging, textiles, electronics, food, and beverages are all focusing on sustainable manufacturing practices. Owing to sustainable practices, key players in the market are looking forward to upcoming manufacturing projects and trade exhibitions. Rising demand from textile and packaging industries in the North American market is expected to propel the market demand for precision industrial knives over the forecast period. The U.S. market size is estimated to be USD 53.8 million in 2026.

Middle East & Africa

Steady industrial growth, supportive policies, and strategic investments across sectors bring market opportunities for the industrial knife market. High demand for food products, packaged products, textiles, rubber, and plastic manufacturing are expected to enhance the growth of precision cutting tools in the region. The GCC market size is estimated to be USD 3.1 million in 2025.

South America

South America region is to be anticipated as the fourth-largest market with USD 82.9 million in 2025. Strong demand for efficient and precise cutting technologies from the food and beverage processing and packaging sector to boost the market growth in South America. Several expansion projects and sustainable packaging facilities are expected to enhance the market demand in South American countries, such as Brazil and Argentina. For instance, in June 2024, Nefab invested about USD 1 million to develop its new facility named Viña del Mar, Chile.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Strong Networking and Collaborations Strategies to Bolster Market Growth

Manufacturing companies are focusing on expanding their market presence through strong dealer and distributor networks, as well as mergers and acquisitions across geographies. The precision industrial knives market is highly consolidated at the global level owing to the presence of a countable number of market participants. Manufacturers are also striving to widen their product portfolio by adding durable and high-quality industrial knives to their portfolio. For instance, Groz-Beckert and TKM Group have signed an agreement confirming the acquisition of TKM GmbH in October 2022. Groz-Beckert expanded its product offerings by adding all business units and locations under its umbrella.

List of Precision Industrial Knife Companies Profiled:

- TKM GmbH (Groz-Beckert Group) (Germany)

- Baucor (Naucor GmbH) (U.S.)

- DIENES Werke für Maschinenteile GmbH & Co. KG (Germany)

- Hyde Industrial Blade Solutions (U.S.)

- International Knife and Saw (IKS) (U.S.)

- EDGE Industrial Technologies (U.S.)

- Fisher Barton (U.S.)

- Ferrotec TOYO Sdn Bhd (Malaysia)

- Kyocera Corporation (Japan)

- Cerataizit Group (Luxembourg)

- DURIT Hartmetall GmbH (Germany)

- KINETIC Precision (India)

- Fernite Machine Knives and Sharpening (England)

- Ma'anshan Henglida Machine Blade Co. Ltd. (China)

- Accu Grind (U.S.)

- Precision Industrial Knife (U.S.)

- Messer Cutting Systems (India)

- York Saw and Knife (U.S.)

- Lorenzon & C. Srl (Italy)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: American Cutting Edge, a division of C.B. Manufacturing & Sales Co., Inc., acquired Great Lakes Industrial Knife Company Inc. The acquisition is expected to maintain the Great Lakes brand under a new legal entity named GLIK Holdings LLC.

- September 2023: CERATIZIT S.A. acquired all shares of Xceliron Corp., a round tool manufacturer based in Chatsworth, CA, specializing in solid carbide tools for the aerospace and automotive industries. This acquisition enhances CERATIZIT's portfolio and supports its global growth strategy, providing access to new customer groups.

- August 2023: CERATIZIT S.A. acquired 70% of Changzhou CW Toolmaker Inc., a Chinese company specializing in tungsten carbide cutting tools for various industries, including electronics and aviation. This acquisition, part of CB-CERATIZIT's growth strategy in Asia, aims to strengthen CERATIZIT's production capabilities in solid carbide cutting tools and expand its market reach in the 3C sector (computers, communications, and consumer electronics).

- October 2022: TKM and Groz-Beckert signed the purchase agreement for the acquisition of TKM GmbH by Groz-Beckert. This acquisition integrated TKM's business units while maintaining its operations as an independent entity within Groz-Beckert. Most of TKM's management team will continue in their roles, ensuring continuity for business partners.

- February 2019: Hyde Industrial Blade Solutions, a division of Hyde Tools, Inc., acquired the slitting knives product line from Thurston Manufacturing. This acquisition leverages the long-standing history between the two companies in producing circular blades and knives since the late 1800s.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.40% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type

By Material

By Application

By Region

|

|

Companies Profiled in the Report |

TKM GmbH (Groz-Beckert Group ), Baucor (Naucor GmbH) (U.S.), DIENES Werke für Maschinenteile GmbH & Co. KG (Germany), Hyde Industrial Blade Solutions (U.S.), International Knife and Saw (IKS) (U.S.), EDGE Industrial Technologies (U.S.), Fisher Barton (U.S.), Ferrotec TOYO Malaysia Sdn Bhd (Malaysia), Kyocera (Japan), Cerataizit S.A. (Luxembourg). |

Frequently Asked Questions

The market is projected to record a valuation of USD 368.60 million by 2034.

In 2025, the market was valued at USD 252.50 million.

The market is projected to grow at a CAGR of 4.40% during the forecast period.

The circular knife segment is expected to lead the market throughout the forecast period.

Growing demand for precision manufacturing, along with technological advancements, are key factors driving market growth.

Kyocera Group, Ferrotec TOYO, EDGE Industrial Technologies, Fisher Barton, and Naucor GmbH are a few of the top players in the market.

Asia Pacific is expected to hold the highest market share.

By application, the electronics industry is expected to grow with the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us