Pressure/Contact-activated Safety Lancet Market Size, Share & Industry Analysis, By Incision Type (Blade and Needle), By Age Group (Adult and Pediatric), By Application (Blood Glucose Monitoring, Hemoglobin Testing, Cholesterol Testing, and Others), By Gauge Size (22G and Below, 23G-28G, and Above 28G), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies/E-commerce Platforms), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

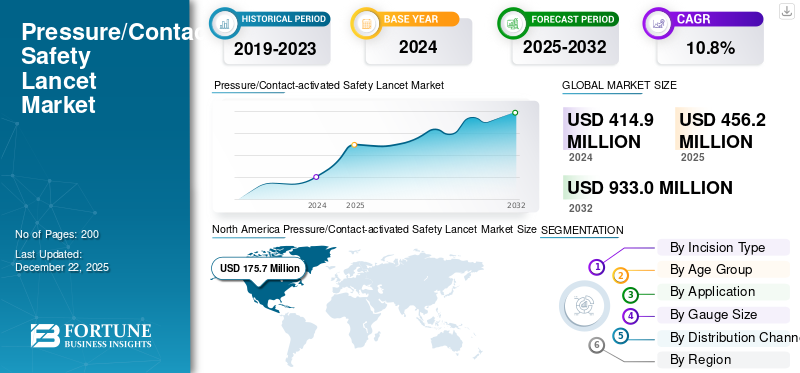

The global pressure/contact-activated safety lancet market size was valued at USD 456.23 million in 2025. The market is projected to grow from USD 502.67 million in 2026 to USD 1164.18 million by 2034, exhibiting a CAGR of 11.07% during the forecast period. North America dominated the pressure/contact-activated safety lancet market with a market share of 42.37% in 2025.

Pressure/contact-activated safety lancets are single-use, disposable devices designed for capillary blood sampling, primarily used in diabetes management and other diagnostic applications. The device features automatic retraction and does not require manual activation. They are activated when a small amount of pressure is applied on a fingertip.

The adoption of these devices is expected to be driven by the rising demand for blood glucose monitoring among diabetic patients owing to their ease of use, convenience, limited blood loss, and others.

The key market players include BD, Cardinal Health, and HTL-STREFA (MTD Medical Technology and Devices). These players are initiating new launches, entering collaborations, and expanding geographic reach to capitalize on the global market.

MARKET DYNAMICS

Market Drivers

Increasing Prevalence of Diabetes to Spur Demand for Pressure/Contact-activated Safety Lancets

Over the past few years, the burden of diabetes has increased massively, further increasing the demand for disease management. Diabetes management requires frequent blood glucose monitoring, which in turn necessitates the use of lancets for capillary blood sampling. Pressure-activated safety lancets offer a user-friendly, precise, and hygienic solution, particularly important for diabetic patients who self-monitor blood glucose daily. These lancets minimize pain, ensure consistent penetration depth, and reduce the risk of needlestick injuries or cross-contamination, making them highly suitable for home use and point-of-care testing.

- For instance, according to the International Diabetes Federation, in July 2025, approximately 589.0 million adults were living with diabetes globally in 2024, and this figure is projected to reach 853.0 million by 2050.

Additionally, the growing awareness about safe diabetes care in developing nations, coupled with rising adoption of minimally invasive technologies, is expected to propel the demand for products across hospitals, clinics, and home settings, fueling the global pressure/contact-activated safety lancet market growth.

Market Restraints

Competition from Button-activated Safety Lancets and Lancing Devices to Hamper Market Growth

Button-activated lancets are increasingly preferred in clinical and home settings due to their consistent depth penetration, ergonomic design, and reduced risk of misfiring during use. Unlike pressure/contact activated lancets that rely on user-applied force, button-activated models offer better control and predictability, key attributes for patients with limited skill, such as the elderly or those with neuropathy.

Additionally, manufacturers of button-activated lancets have introduced innovations such as multi-depth adjustment and quieter triggering mechanisms, enhancing user comfort and compliance. The greater availability of these advanced features at competitive pricing has led to increased adoption by healthcare providers and procurement departments. As a result, the demand for pressure/contact-activated lancets is expected to face significant competition, limiting its adoption and hindering the market growth during the forecast period.

Market Opportunities

Preferential Shift Toward Home Healthcare Monitoring to Fuel Market Expansion

In recent years, there has been a noticeable shift toward self-monitoring of blood glucose and other parameters at home, due to the increased incidence of chronic conditions, including diabetes, hyperlipidemia, and anemia. This is driven by the need for cost-effective, convenient, and continuous care, especially among the aging population and those living in remote or under-resourced regions.

- For instance, in December 2023, a study by the Indian Journal of Medical Specialties reported that 35.0% of the 100 patients used a glucometer to self-monitor blood glucose at home.

Contact-activated safety lancet devices have eliminated the need for preloading or activation buttons, making them ideal for untrained users, including elderly and pediatric patients. This growing shift toward home diagnostics is expected to accelerate product penetration globally, further offering lucrative opportunities for market growth.

Market Challenges

Limited Accessibility in Middle and Low-Income Countries to Restrict Market Growth

In emerging and low-income countries, the less-developed healthcare infrastructure and limited spending on advanced chronic disease monitoring products are projected to hamper the adoption of pressure-activated safety lancets due to affordability and accessibility issues.

- For instance, in January 2024, ScienceDirect’s article stated that the Bangladesh government spends the lowest on the public healthcare system among Asia Pacific countries, at only 2.34% of the national GDP.

Moreover, these accessibility issues are expected to create hesitation among manufacturers for distributing products in these regions. Also, the significant gap in awareness about the benefits of using these devices is projected to decrease their adoption rate, posing a major challenge in market expansion.

Pressure/Contact-activated Safety Lancet Market Trends

Integration of Ultra-Fine Gauge Technology is a Key Market Trend

Integration of ultra-fine gauge technology with user-centric ergonomic designs has enhanced patient comfort and accuracy. As a result, manufacturers are innovating with 21G-30G ultra-thin needles and spring-loaded activation mechanisms to enable nearly painless capillary blood collection.

These innovations are further supported by stringent regulatory standards favoring safety-engineered sharps to prevent needlestick injuries in clinical settings. In addition, sustainability-focused design upgrades, such as reduced plastic usage and biodegradable components, are emerging in response to environmental concerns. This trend reflects a broader movement toward patient-friendly and safe medical consumables.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The market witnessed negative growth in 2020 due to the COVID-19 pandemic. The negative growth was attributed to supply chain disruption, which reduced product availability. Moreover, the decrease in certain tests, such as HBA1C, also led to less utilization of lancets, including pressure-activated safety lancets. This led to a significant decline in market growth in 2020.

- For instance, in February 2021, an article by NCBI stated that HBA1C testing significantly decreased to around 66.0% in the first 8 weeks of March and April 2020.

The market growth also declined in 2021, as there was still a smaller number of blood glucose tests performed. The market started regaining momentum in 2022 due to the increasing volume of SMBG users and increasing patient visits to diagnostic laboratories and hospitals for various other tests.

Segmentation Analysis

By Incision Type

Needle Segment to Lead the Market Due to Superior Safety Features

Based on incision type, the market is segmented into blade and needle.

The needles segment dominated the market in 2024. The segment’s growth is attributed to an increased preference for needle lancets due to their superior safety features, lesser pain during blood sampling, and ease of use. These benefits are anticipated to influence key players to launch more advanced needle lancets, increasing availability.

- For instance, a study published by NCBI in April 2020 reported that the pain caused by the needle version was comparatively less than the blade version while obtaining samples.

The blade segment is expected to register a substantial CAGR in the forthcoming years. Blade-equipped lancets yield higher blood volumes than needles, making them suitable for several tests in home care and clinical settings. Moreover, the increased usage of blade lancets in neonatal screening is expected to drive their adoption.

By Age Group

Adult Segment to Dominate Due to Higher Demand for Various Applications

Based on age group, the market is bifurcated into adult and pediatric.

The adult segment dominated the market in 2024. Increasing HbA1c or glycated hemoglobin testing, cholesterol testing, and coagulation testing among adults are expected to drive the usage of pressure/contact-activated safety lancets. Moreover, the increasing blood glucose monitoring in type 2 diabetic patients is also driving the adoption of these products among adults.

The pediatric segment held a lower share. The segment's growth is attributed to the high usage of these products among the type 1 diabetes population to monitor blood glucose daily. The guidelines for self-monitoring of blood glucose by healthcare organizations are spurring the usage of these products among children and adolescents.

- For instance, in July 2025, the NHS.UK guidelines suggests that people with Type 1 diabetes (T1DM) must perform self-testing four times a day (at least five times a day for children) to gain optimal control, avoid hypoglycemia, and diabetic ketoacidosis.

By Application

Increasing Usage of SMBG Devices to Drive Blood Glucose Monitoring Segment

Based on application, the market is segmented into blood glucose monitoring, hemoglobin testing, cholesterol testing, and others.

The blood glucose monitoring segment held a dominating market share in 2024. There has been a surge in individuals self-monitoring their blood glucose, which is increasing the utilization of lancets. This growth is influenced by rising cases of diabetes globally, which is expected to fuel the segment’s growth.

- For instance, in July 2025, the International Diabetes Federation (IDF) projected that approximately 783 million individuals will have diabetes by 2045.

The hemoglobin testing segment is expected to grow at the fastest CAGR in the forthcoming years. The growing demand for HBA1C testing worldwide is surging the utilization of pressure/contact-activated lancets to prevent needlestick injuries.

By Gauge Size

High Preference for Above 28G Needles to Drive Segment’s Growth

Based on gauge size, the market is trifurcated into 22G and below, 23G-28G, and above 28G.

The above 28G segment dominated the market in 2024. The lancets with thinner diameters are highly preferred for blood glucose monitoring as they reduce skin trauma, cause less blood loss, and speed up healing. This has made them ideal for routine use in disease management, thereby increasing their usage, especially when a small blood volume is required. These benefits associated with above 30G lancets are expected to fuel their usage.

- For instance, the study published by the Journal of Medical Laboratory and Diagnosis in January 2019 demonstrated that migrating to thinner needles with reduced penetration depth minimized pain perception during the puncture by up to 42.0% compared to thicker safety lancets (18G – 0.8 mm).

The 22G and below segment held the second-largest market share in 2024. Lancets with this gauge size are usually deployed in clinical laboratories and diagnostic facilities for their sample yield and reliability, particularly when blood flow is difficult to obtain.

By Distribution Channel

Hospital Pharmacies to Dominate Due to a Significant Number of Patient Visits to Hospitals

Based on distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies/e-commerce platforms.

The hospital pharmacies segment held a dominating share in 2024. The growth is attributed to a significant number of diabetes patients visiting hospitals for routine checkups. This has necessitated the availability of lancets in hospital pharmacies, offering convenience to patients, which is expected to contribute to the sale of contact-activated safety lancets from these channels.

The online pharmacies segment is anticipated to register the highest CAGR during the forecast period due to the increased online purchase rate in the past years. These pharmacies offer at-home delivery and time-saving benefits with significant discounts. Moreover, the increased launch of online platforms is also expected to support the online sale of contact-activated safety lancets globally in the coming years.

- For instance, in October 2024, Amazon announced its plans to open 20 new pharmacies in 2025, enabling customers to get rapid delivery of their lancets through the online pharmacies.

PRESSURE/CONTACT-ACTIVATED SAFETY LANCET MARKET REGIONAL OUTLOOK

The market has been analyzed regionally into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America to Dominate Global Market Due to Strong Demand for Advanced Products

North America Pressure/Contact-activated Safety Lancet Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market in 2025. The region’s pressure/contact-activated safety lancet market value stood at USD 456.23 million in 2025. The strong demand for advanced products in the region is attracting the key players to enhance the availability of such products.

Moreover, the substantial reimbursement for chronic disease monitoring products, including lancets, is expected to fuel the usage of such products in the U.S.

- For instance, as recorded in July 2025, Medicare Preventive Services for Diabetes Part B covers 300 lancets/3 months for diabetic patients on insulin therapy.

Europe

The market in Europe accounted for the second-largest market share in 2024. The growth is attributed to higher spending on purchasing sharp objects for diabetes monitoring by regional healthcare organizations, which is expected to increase the penetration rate of pressure/contact-activated safety lancets. Moreover, the robust healthcare infrastructure of the region is also projected to support the utilization of these devices.

- For instance, in October 2020, NHS Somerset stated that the total spending on lancets was around USD 13.4 million across England and Wales.

Asia Pacific

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The major factor behind the high adoption rate of pressure/contact-activated safety lancets is the highest prevalence of diabetes in the region across the globe. This is influencing key players to expand their distribution network in India and China, which is expected to drive the market growth in the coming years.

- For instance, according to the data published by the International Diabetes Federation, there were about 147,981,200 cases of diabetes in adults.

Latin America and the Middle East & Africa

The Latin America and the Middle East & Africa market accounted for a lower share in 2024. The growth can be attributed to increasing awareness regarding the use of the product and expanding healthcare spending in these regions. Additionally, the rising healthcare complications and nutritional imbalances in these regions are driving the need for various tests such as cholesterol, hemoglobin, blood glucose, and lipid profiling, boosting the usage of pressure-activated safety lancets.

COMPETITIVE LANDSCAPE

Key Market Players

Strategic Initiatives and New Product Launches Led to Dominance of HTL-STREFA, BD, and Cardinal Health

The global market witnessed a consolidated structure. BD, HTL-STREFA, BD, and Cardinal Health accounted for the major global pressure/contact-activated safety lancet market share in 2024. This higher share was attributed to increasing initiatives such as expanding manufacturing capacities and new launches by these players.

Moreover, the B. Braun SE, Medline Industries, LP, and other prominent players are focused on strategic alliances and geographic expansions to enhance their market reach for products. Additionally, these players are promoting their products at various conferences to improve their brand reputation.

LIST OF KEY PRESSURE/CONTACT-ACTIVATED SAFETY LANCET COMPANIES PROFILED:

- Braun SE (Germany)

- Cardinal Health (U.S.)

- Greiner Bio-One International GmbH (Austria)

- BD (U.S.)

- HTL-STREFA (MTD Medical Technology and Devices) (Poland)

- Medline Industries, LP. (U.S.)

- Aeras Medical Pte Ltd. (Singapore)

- Owen Mumford (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- April 2025 – SteriLance Medical (Suzhou) Inc. participated in the CMEF Spring 2025, to showcase its products, including pressure-activated safety lancets.

- January 2025 – BD increased investments in its U.S. manufacturing network to increase production capacity for essential medical devices, including lancets, to meet the country’s growing demands.

- November 2024 – Sterilance Medical (Suzhou) Inc. attended MEDICA 2024 in Germany to highlight its innovative product range, including pressure-activated safety lancets.

- May 2021 – Owen Mumford launched the Unistik Touch family of pressure-activated safety lancets to collect up to 500 μl of blood.

- January 2019 – MediPurpose agreed with Premier Inc. to include SurgiLance contact-activated safety lancets.

REPORT COVERAGE

The market report provides a detailed analysis on leading companies, incision type, age group, application, gauge size, and distribution channel. Additionally, it offers market dynamics and insights into the latest market trends. In addition, it encompasses key industry developments and several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.07% from 2026-2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Incision Type, Age Group, Application, Gauge Size, Distribution Channel, and Region |

|

By Incision Type |

· Needle · Blade |

|

By Age Group |

· Adult · Pediatric |

|

By Application |

· Blood Glucose Monitoring · Hemoglobin Testing · Cholesterol Testing · Others |

|

By Gauge Size |

· 22G and Below · 23G-28G · Above 28G |

|

By Distribution Channel |

· Hospital Pharmacies · Retail Pharmacies · Online Pharmacies/E-commerce Platforms |

|

By Region |

· North America (By Incision Type, Age Group, Application, Gauge Size, Distribution Channel, and Country) o U.S. o Canada · Europe (By Incision Type, Age Group, Application, Gauge Size, Distribution Channel, Country/Sub-Region) o Germany o U.K. o France o Italy o Spain o Scandinavia o Rest of Europe · Asia Pacific (By Incision Type, Age Group, Application, Gauge Size, Distribution Channel, Country/Sub-Region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Incision Type, Age Group, Application, Gauge Size, Distribution Channel, Country/Sub-Region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Incision Type, Age Group, Application, Gauge Size, Distribution Channel, Country/Sub-Region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 456.23 million in 2025 and is projected to record a valuation of USD 1164.18 million by 2034.

The market will exhibit a steady CAGR of 11.07% during the forecast period.

By incision type, the needle segment will lead the market.

The increasing incidence of diabetes globally and the increasing demand for homecare diagnostics are driving the market growth.

HTL-STREFA, BD, and Cardinal Health are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us