Primary Alkaline Battery Market Size, Share & Industry Analysis, By Size (AA, AAA, 9 Volts, and Others), By Application (Remote Control, Consumer Electronics, Toys & Radios, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

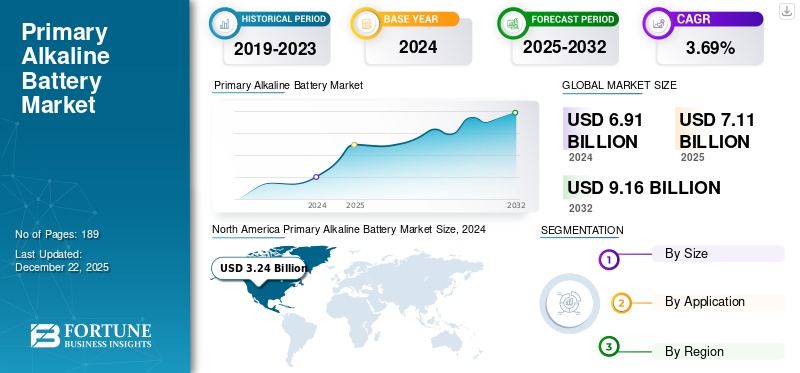

The global primary alkaline battery market size was valued at USD 6.91 billion in 2024 and is projected to grow from USD 7.11 billion in 2025 to USD 9.16 billion by 2032, exhibiting a CAGR of 3.69% during the forecast period. North America dominated the primary alkaline battery industry with a market share of 45.73% in 2024

Primary alkaline batteries are non-rechargeable batteries that use the chemical reaction between zinc and manganese dioxide, with potassium hydroxide as the electrolyte. These batteries are widely used in consumer electronics due to their high energy density, long shelf life, and ability to deliver a consistent voltage. Market growth can be attributed to technological advancements in alkaline battery technology and increasing demand for consumer electronics.

Duracell Inc. is one of the prominent primary alkaline battery producers in the market. The company manufactures and offers different battery sizes, such as AA, AAA, 9V, and others, for applications such as toys, remote controls, flashlights, calculators, clocks, radios, portable electronics, wireless mice, and keyboards. Duracell has a strong business presence in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

MARKET DYNAMICS

MARKET DRIVERS

Cost-Effectiveness and Affordability of Alkaline Batteries to Support Market Growth

Affordability plays a significant role in the popularity of alkaline batteries. They are easily accessible in retail stores and online, and are offered in various pack sizes. Their extended shelf life, reliable performance, and minimal maintenance requirements make them a practical and cost-effective option for numerous uses. For devices with low to moderate power demands that do not need frequent battery replacements, alkaline batteries typically offer better long-term savings compared to some rechargeable options, particularly when immediate or unplugged power is necessary.

MARKET RESTRAINTS

Availability of Alternative Options to Hinder Market Expansion

Alkaline batteries are facing competition from other battery technologies such as lithium-ion batteries, nickel-metal hydride, and rechargeable batteries. These alternative methods provide benefits such as greater energy density, extended lifespan, and the ability to be recharged, making them more appealing choices for consumers and businesses needing power solutions. As awareness of environmental issues rises, there is an increasing inclination toward using eco-friendly alternatives to conventional alkaline batteries. Rechargeable batteries, in particular, are considered more environmentally friendly since they can be reused multiple times, thus minimizing the amount of disposable waste produced. This environmental consideration may contribute to a transition away from alkaline batteries in favor of more sustainable choices.

MARKET OPPORTUNITIES

Advancements in Products to Create New Opportunities for Market Growth

Progress in battery technology results in better performance characteristics, including energy density, longevity, and power efficiency. These improved capabilities enable alkaline batteries to serve broader applications, especially in high-drain devices such as digital cameras, electronic toys, and portable gadgets. As consumers seek batteries that provide extended usage and dependability, advancements in product design are expected to drive acceptance of alkaline batteries. As new electronic devices and technologies are introduced, there is an increasing demand for batteries that meet the specific needs of these applications, further driving the primary alkaline battery market growth.

PRIMARY ALKALINE BATTERY MARKET TRENDS

Growing Demand for Consumer Electronics in Emerging Economies to Promote Market Expansion

The increasing demand for consumer electronics is significantly boosting the primary alkaline battery sales. Alkaline batteries are a popular choice for a wide range of battery-powered devices, including remote controls, toys, and portable electronics, due to their affordability, long shelf life, and reliability. The growth in consumer electronics sales, particularly in emerging economies, is driving the primary alkaline battery demand. Rising disposable incomes and urbanization in countries such as India and China are also increasing sales, which is directly impacting the demand for alkaline batteries.

Download Free sample to learn more about this report.

Segmentation Analysis

By Size

AA Segment to Dominate Due to Its Extensive Usage in Electronic Devices

Based on the size, the market is classified into AA, AAA, 9 Volts, and others.

The AA segment is anticipated to dominate the primary alkaline battery market share. AA batteries are the most popular size for alkaline batteries, commonly used in a wide range of electronic devices such as toys, remote controls, digital cameras, and portable stereos. The rise of e-commerce platforms has made it easier for consumers to purchase batteries online, expanding the market reach and accessibility. This convenience, coupled with increased consumer spending, is expected to drive the demand for AA alkaline batteries.

AAA alkaline batteries are commonly used in small, low-power electronic devices. They are favored for their long shelf life, affordability, and ability to provide consistent power for extended periods. Common applications include remote controls, clocks, gaming accessories, personal care devices, and flashlights.

By Application

Expanding Use of Batteries in Consumer Electronics to Support Segment’s Growth

Based on application, the market is divided into remote control, consumer electronics, toys & radios, and others.

The consumer electronics segment dominates the market share. These batteries serve as adaptable energy sources that are applicable to a variety of consumer electronics uses. They provide dependable performance, extended shelf life, and steady voltage output, making them ideal for powering a wide range of devices across different categories. The consumer electronics sector is marked by the widespread presence of portable devices such as calculators, radios, portable electronics, and wireless mice and keyboards. The accessibility and user-friendliness of alkaline batteries contribute to their popularity for energizing portable electronic devices.

PRIMARY ALKALINE BATTERY MARKET REGIONAL OUTLOOK

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Primary Alkaline Battery Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is anticipated to dominate the market. The market’s expansion is linked to the increasing demand for consumer electronics and the growing adoption of technological advancements in the region. The strengthening presence of leading consumer electronics manufacturers and the growing investments in technology and power battery development in the U.S. and Canada are propelling the regional market growth.

U.S.

The U.S dominates the North American market, as demand for primary alkaline batteries in this country remains high across the residential sector. Some major players in the country are Duracell Inc. and Energizer Holdings, among others.

Europe

The market in Europe is projected to experience considerable growth during the forecast period, driven by factors such as rising disposable incomes, increasing urbanization, and the expansion of internet access. Additionally, the market is influenced by the region's strict regulations regarding battery disposal and recycling, which encourage the development of innovative and sustainable battery technologies.

Asia Pacific

The Asia Pacific region has emerged as a key global center for the production of consumer electronics, appliances, toys, and other products that require alkaline batteries. China, South Korea, India, and others are home to vast electronic goods manufacturing operations, which support the need for alkaline batteries both locally and in export markets. The trend of urbanization in the region has resulted in a greater use of portable electronic devices and gadgets. Alkaline batteries are essential for powering these devices, further driving demand in urban areas throughout the region.

Latin America

In Latin America, the alkaline battery market is primarily driven by the increasing demand for consumer electronics and the need for reliable, portable power sources in areas with limited access to consistent electricity. Factors such as rising consumer spending, growing urbanization, and the expanding use of electronic devices contribute to this demand.

Middle East & Africa

The market in the Middle East & Africa is mainly driven by the increasing adoption of consumer electronics, urbanization, and the need for reliable power sources, especially in areas prone to power outages. Cost-effectiveness and long shelf life also contribute to their popularity, particularly in regions with diverse income levels.

COMPETITIVE LANDSCAPE

Key Industry Players

Strategic Mergers & Acquisitions to Influence Market Development

Strategic mergers & acquisitions are some of the key tactics utilized by market players to expand their business, enter new markets, enhance product offerings, and others. A similar trend can also be observed in the primary alkaline battery market. For instance, in June 2025, Maxell, Ltd. entered into a share purchase agreement with Murata Manufacturing Co., Ltd. for the acquisition of their micro primary battery business. This strategic initiative is in line with Maxell’s mid-term management strategy to reshape its business portfolio by concentrating on sectors that demonstrate high growth potential and profitability.

LIST OF KEY PRIMARY ALKALINE BATTERY COMPANIES PROFILED

- Duracell Inc. (U.S.)

- Energizer Holdings (U.S.)

- Camelion Batterien GmbH (Germany)

- NANFU BATTERY CO., LTD. (China)

- Sony (Japan)

- Maxell Holdings, Ltd. (Japan)

- Toshiba International Corp (U.S.)

- Zhejiang Mustang Battery Co., Ltd. (China)

- Panasonic Corporation (Japan)

- FDK Corporation (Japan)

- GPB International Limited (Hong Kong)

- Varta AG (Germany)

KEY INDUSTRY DEVELOPMENTS

- May 2025: Energizer Holdings, Inc. acquired Advanced Power Solutions (APS) NV, a manufacturer and marketer of AA and AAA Panasonic-branded batteries. APS NV caters to a large customer base in key European markets, including Germany, the U.K., Poland, and Spain.

- February 2025: Duracell Inc. established its new global headquarters for research and development in Georgia, U.S., with an investment of USD 56 million.

- January 2025: Energizer Holdings, Inc., a manufacturer and distributor of primary batteries, introduced 100% recyclable plastic-free packaging for its portfolio of Energizer® batteries. The innovative paper-based packaging features a modern, easy-to-use design that enhances the experience of shopping, opening, and storing for consumers.

- July 2024: Call2Recycle Canada, a battery collector and recycler, in association with EVSX, another battery recycler, launched a new battery processing plant in Ontario. It aims to recycle the increasing volumes of alkaline and carbon zinc batteries.

- July 2023: The European Parliament and the Council approved the new Batteries Regulation on 12th July 2023. This regulation aims to reduce the environmental effects associated with the rapid increase in battery usage, taking into account evolving socioeconomic conditions, technological advancements, market trends, and various battery applications.

REPORT COVERAGE

The global primary alkaline battery market report delivers a detailed insight into the market. It focuses on key aspects, such as leading companies in the global market. Besides, it offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, it encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 3.69% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Size

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 6.91 billion in 2024 and is projected to record a valuation of USD 9.16 billion by 2032.

In 2024, the North America market value stood at USD 3.24 billion.

The market is expected to exhibit a CAGR of 3.69% during the forecast period.

The AA segment is leading the market by size.

Cost-effectiveness and affordability of alkaline batteries support market growth.

Duracell Inc., Energizer Holdings, GPB International Limited, and others are some of the key players in the market.

North America is expected to hold the largest market share during the forecast period.

The growing demand for consumer electronics in emerging economies is expected to promote market expansion.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us