Print Management Software Market Size, Share & Industry Trends Analysis, By Type (Integrated, Standalone), By Deployment (Cloud and On-premise), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, IT & Telecommunications, Government, Healthcare, Retail & e-Commerce and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

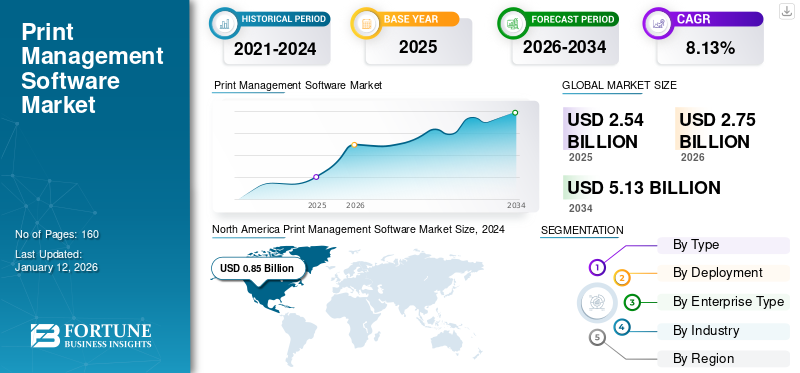

The global print management software market size was valued at USD 2.54 billion in 2025 and is projected to grow from USD 2.75 billion in 2026 to USD 5.13 billion by 2034, exhibiting a CAGR of 8.13% during the forecast period. North America dominated the print management software market with a market share of 35.71% in 2024.

Print management software market refers to the industry segment that deals with the development, distribution, and implementation of software solutions designed to optimize and manage printing processes within organizations. Print management software allows organizations to manage their printing infrastructure from a centralized platform. Organizations spend around 1% - 3% (USD 750 per employee annually) of their annual revenue on printing. This includes tools and services that help monitor, control, and reduce printing costs, improve document security, and enhance workflow efficiencies across various sectors. According to industry experts, businesses are saving up to 30% by using print management software solutions.

Global Print Management Software Market Overview

Key Trends and Drivers

- Generative AI integration: Enhances document security, customizes print workflows, and automates quality control tasks like image correction and color enhancement.

- Sustainable printing demand: 95% of decision-makers prioritize eco-friendly solutions; software helps cut toner, paper, and carbon emissions.

- BYOD & mobile printing adoption: Surge in personal device usage boosts demand for remote printing tools with encryption, authentication, and role-based access controls.

- Zero trust printing approach: Rise of hybrid workplaces drives implementation of secure print protocols and identity-verified access.

Market Size & Share

- 2025 Market Value: USD 2.54 billion

- 2026 Estimate: USD 2.75 billion

- 2034 Forecast: USD 5.13 billion

- CAGR (2026–2034): 8.13%

- Top Region: North America (35.71% in 2024)

- Top Industry: BFSI

- High-Growth Region: Asia Pacific

Market Challenges

- Data privacy risks: BFSI, healthcare, and legal sectors remain cautious due to metadata tracking and cyberattack concerns.

- Tariff impact on hardware: Reciprocal tariffs increase costs of importing printers and multifunction devices, indirectly affecting software deployment.

GENERATIVE AI IMPACT

Adoption of Generative AI among Print Management Software Vendors is Increasing for Enhanced Security

Generative AI is significantly transforming software by enhancing security, personalizing user experience, and streamlining various print services. Integrating AI into print management enhances security by providing features including forensics accounting and intrusion prevention. Generative AI helps print management software providers offer customized solutions by analyzing insights about the print environment and specific customer requirements. Generative AI streamlines tasks, including file analysis, color correction, image enhancement, and quality control, leading to faster production times and reduced errors.

IMPACT OF RECIPROCAL TARIFF

The impact of reciprocal tariffs on print management software is indirect but is significant as tariff affects the printing hardware system. The software relies on compatible hardware, including printers, servers, and networking devices. If reciprocal tariff is imposed between countries the cost of importing printers and multi-function printers can rise. This increases the total cost of implementing a print management system.

PRINT MANAGEMENT SOFTWARE MARKET TRENDS

Trend of Sustainable Printing Drives Market Growth

Adopting sustainable printing helps organizations to achieve their sustainable goals and stay competitive in the market. Around 95% of business decision-makers consider environmental sustainability when choosing print solutions. Sustainable software monitors the toner usage to prevent waste, helps to plan eco-friendly procurement, and also alerts users about the excessive use of toner. Embracing technology, including print-on-demand, digital printing, digital printing presses, and real-time analytics, increases operational efficiency while promoting environmental sustainability, thus reducing the company’s cost.

Sustainable printing practices, such as using eco-friendly inks and paper, help lower carbon emissions associated with traditional printing. Companies are implementing double-sided and recycled paper printing that helps to cut down paper usage drastically. The potential reduction in paper usage reaches upto 50%. To maintain sustainability companies are using eco-friendly inks such as soy-based inks that are more biodegradable than petroleum-based inks. This helps companies to achieve their sustainability goals.

Therefore, the trend of sustainable printing is driving the print management software market growth.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand for BYOD and Mobile Printing Propels Market Expansion

Recently, the use of mobile devices across all industries has increased to a great extent, and due to this, the demand for mobile printing has surged. This smart printing solution enables all users to print using any mobile device. They can also access printers that are networked and web-enabled. This smart solution enables users to print web pages, photos, emails, documents, and any other kind of printable file and is done from a mobile phone, laptop, or tablet. This advanced service helps enhance the efficiency of a business to a significant extent.

The trend of Bring Your Own Device (BYOD) is rapidly growing among employees across various industries, as it provides the convenience of working from their preferred locations and at their chosen times. This increase in BYOD usage is driving the demand for BYOD printing solutions, allowing employees to print on the go from their mobile devices or PCs, which enhances productivity and responsiveness.

BYOD printing solutions also help companies save on the costs of purchasing and maintaining devices. However, implementing BYOD in the workplace presents significant challenges, particularly regarding printing. To address these challenges, companies are integrating print management tools that support mobile printing, offering features such as encryption and authentication.

Additionally, companies are adopting role-based access control to limit users' printing privileges based on their specific roles and responsibilities within the organization. This approach ensures that users have access only to the printing resources necessary for their job functions, thereby reducing the risk of unauthorized printing.

Thereby, growing demand for BYOD and mobile printing is boosting the market share.

MARKET RESTRAINTS

Data Privacy and Security Concerns to Limit Market Expansion

Print management software tracks user activity, printing habits, and document metadata, and this increases concerns regarding data privacy, particularly in sectors including BFSI, healthcare, and legal. If the software is not properly secured, these platforms can become targets for cyberattacks or result in compliance violations. This risk may limit the adoption of software among organizations with stringent data policies.

Therefore, data privacy and security concerns are restricting market growth.

MARKET OPPORTUNITIES

Growing Popularity of Zero Trust Printing is Expected to Create Opportunities for Players in Market

The hybrid workplace is rising, and due to these users printing from different locations and devices every day, this results in the adoption of a Zero Trust Printing approach for security. Printers are often overlooked in terms of security, but they are more than just the box that prints cat pictures. Business printers collect, process, and transfer highly sensitive data and convert them into physical articles such as orders, invoices, contracts, and agreements. These printers contain confidential information such as personal and financial data that are alluring targets to cybercriminals. Printers can be hacked and used to access networks, data, and systems or to launch ransomware or malware attacks. Therefore, zero trust printing is increasing.

A zero-trust approach is particularly important for print security in hybrid workplaces, where users print from various locations and devices. Traditional network-based security measures are not adequate for mobile or remote printing scenarios. By adopting zero-trust principles, such as an “always verify” approach, organizations can enhance the security of their print environment, regardless of the users' locations or the devices they are using.

Increasing adoption of zero trust printing is creating opportunities for software providers as the providers can offer premium features, including secure print release, user identity verification, data encryption, and audit trails. Also, the players offer cloud-based input management with zero trust security so that users can access from any location.

Thereby, the growing popularity of zero trust printing is expected to create opportunities for players in the market.

SEGMENTATION ANALYSIS

By Type

Adoption of Standalone Software to Optimize Printer Usage Boosted Segmental Growth

Based on type, the market is bifurcated into integrated and standalone.

Among these, the standalone segment dominated the market share in 2024. Standalone software helps businesses to manage print fleet more effectively, optimize printer usage and ensure efficient resource allocation, including paper and toner.

The integrated segment is estimated to grow with the highest CAGR during the forecast period. Integrated software syncs with active directory, LDAP, and SSO platforms for secure authentication and supports the zero-trust principle. Integrated software combines print data with other systems for more informational insights.

By Deployment

Rising Need to Reduce Downtime and Errors by Ensuring Reliability of Printers Boosted Cloud Segment Growth

Based on deployment, the market is classified into on-premise and cloud.

Among these, the cloud segment dominated the market in 2024 and is estimated to register the highest CAGR during the forecast period, as the cloud helps to reduce downtime and errors by ensuring the high availability and reliability of printers. Cloud-based software eliminates the need for expensive, on-premise infrastructure costs, including print servers, office space, and IT support.

The on-premise segment is estimated to grow steadily in the coming years. The on-premise solution has a higher upfront cost due to the need for purchasing hardware and software. On-premise software is highly customizable and meets exact requirements, from integrating with other software to specific print workflows.

By Enterprise Type

Large Enterprises Led Market Due to Increasing Adoption of Software for Enhancing Productivity

Based on enterprise type, the market is segmented into SMEs and large enterprises.

Among these, large enterprises dominated the market share in 2024. Print management software helps large enterprises to improve productivity, optimize printing, and reduce costs. By centralizing the printing process large enterprises control and monitor access and usage and ensure compliance with organizational policies.

SMEs are estimated to register the highest CAGR during the forecast period. Print management software helps SMEs to keep track of their printing expenses accurately and offers robust security features that are critical to SMEs dealing with sensitive information.

By Industry

Adoption of Print Management Software to Enhance Print Infrastructure Fueled BFSI Segment Growth

Based on industry, the market is segmented into BFSI, IT & Telecom, government, healthcare, retail & e-commerce, and others.

Among these, the BFSI segment dominated the print management software market share in 2024. Organizations in the sector are investing in secure print solutions as protecting the security of their print infrastructure becomes costly for organizations, with 68% reporting a data loss as a result of unsecured printing practices.

The retail & e-commerce segment is estimated to register the highest CAGR during the forecast period. Print management software helps businesses in the retail sector to keep track of printing usage, boost security and reduce environmental impact.

PRINT MANAGEMENT SOFTWARE MARKET REGIONAL OUTLOOK

By geography, the market is categorized into North America, South America, Europe, Middle East & Africa, and Asia Pacific.

North America

North America Print Management Software Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the market with the highest share. Organizations in North America are increasingly adopting print management software solutions due to increasing pressure to comply with regulations, including HIPAA, GDPR, and CCPA. The software offers organizations secure printing audit trails and aligns with the Zero Trust Security model.

Download Free sample to learn more about this report.

The U.S. is estimated to witness significant growth in coming years, owing to a rise in remote working. According to a survey of 595 firms in the U.S., around 8.9% of their full-time employees work remotely, while 18.1% work with the hybrid model. This increase in remote work culture is surging the demand for print management software solutions, as these solutions fulfil the need for efficient and secure printing that supports distributed teams.

Asia Pacific

Asia Pacific is estimated to grow with the highest CAGR during the forecast period. The rapid growth of SMEs, particularly in India, ASEAN countries, and China, is creating demand for cost-effective and scalable print management solutions.

Europe

Europe is the second-largest market for print management software. Many countries in the region are pushing for carbon neutrality and reducing environmental impact. For this, the organizations in the region are adopting this software as the software helps to reduce the usage of paper, toner, and also energy consumption and offers sustainability reporting.

Middle East & Africa

Middle East & Africa is estimated to witness significant growth in the coming years. Governments in UAE and Saudi Arabia are investing in digital transformation, and as organizations move toward digital workflow to manage and modernize printing infrastructure the software demand is increasing.

South America

The market in South America is likely to register a steady growth rate over the forecast period. Organizations in the region are facing issues, including rising operational costs and budget constraints, and due to this, software adoption is increasing in the region.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Continuous Development and Introduction of New Products by Key Companies Resulted in their Dominating Positions in the Market

Key players in the market form strategic alliances and collaborations to enlarge the business, products, technologies, and other offerings with year-on-year revenue growth. Partnerships and collaborations vary according to business requirements, such as the enlargement of the product portfolio, which helps to expand the global presence and acquire a new customer base. Players are expanding their operations into emerging markets to tap into new customer bases. Companies are investing in research and development to innovate and improve their offerings and stay competitive in the market.

List of Key Print Management Software Companies Profiled

- PaperCut Software Pty Ltd (Australia)

- MyQ (U.S.)

- Vasion, Inc. (U.S.)

- PressWise (U.S.)

- InfoFlo Print (Canada)

- DocketManager (Canada)

- Xerox (U.S.)

- HiFlow (U.S.)

- DynamicsPrint (Denmark)

- ePS Pace (U.S.)

- Printers Plan (U.S.)

- OnPrintShop (India)

- QuickEasy BOS ERP (South Africa)

- Tungsten (U.S.)

- MyQ X (Czech Republic)

and more…

KEY INDUSTRY DEVELOPMENTS

- April 2025: Print ePS has extended its partnership with PlanProphet. This enhanced collaboration combined powerful CRM capabilities powered by Salesforce to more Print ePS users, including customers of the Midmarket Print Suite powered by ePS Pace.

- January 2025: OnPrintShop launched version 12.0 with AI-driven W2P capabilities. This new version helps customers easily personalize large-format prints and textile products. The update includes features such as artificial intelligence (AI)-based website language translators, image generation tools, and smart text translators.

- December 2024: PaperCut Software launched the latest version of PaperCut MF software. The latest version allows organizations to understand better and manage their print and scan activities.

- January 2023: DocketManager acquired Printers Software to offer customers the latest in Web-enabled MIS and e-commerce offerings.

- January 2023: Xerox Holdings Corporation acquired Advanced UK to strengthen its presence in the U.K.

REPORT COVERAGE

The global print management software market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the prevalence of malocclusion in key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions, and the number of orthodontists in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.13% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Deployment

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 2.54 billion in 2025 and is projected to reach USD 5.13 billion by 2034.

In 2025, the market value stood at USD 2.54 billion.

The market is expected to exhibit a CAGR of 8.13% during the forecast period of 2026-2034.

By type, the standalone segment led the market.

Growing demand for BYOD and mobile printing is propelling the market growth.

Printix.net, Lenovo, ePaper Ltd, HID Global, Xerox, Nuance Communications, Maprinter, Canon Inc., and PaperCut Software International are the top players in the market.

North America dominated the market in 2024.

The retail & e-commerce segment is estimated to register the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us