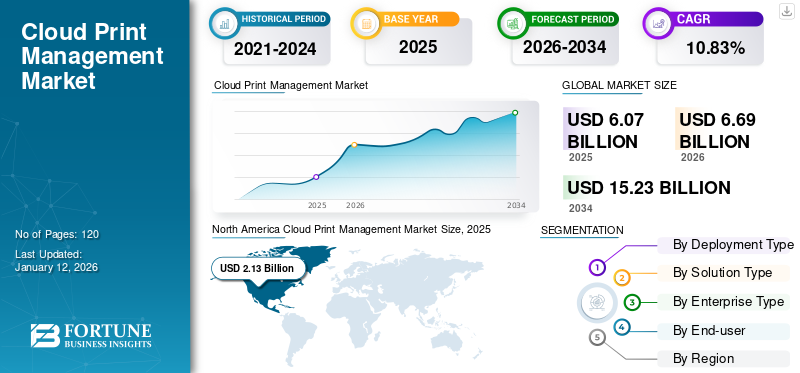

Cloud Print Management Market Size, Share & Industry Analysis, By Deployment Type (Public Cloud, Private Cloud, and Hybrid Cloud), By Solution Type (Print Management Software, Workflow and Document Management, and Device Management and Monitoring), By Enterprise Type (Large Enterprises and SMEs), By End-user (BFSI, Government, IT & Telecommunications, Healthcare, Retail & E-commerce, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global cloud print management market size was valued at USD 6.07 billion in 2025. The market is projected to grow from USD 6.69 billion in 2026 to USD 15.23 billion by 2034, exhibiting a CAGR of 10.83% during the forecast period. North America dominated the global market with a share of 35.06% in 2025.

Cloud print management is a technology solution that enables organizations to manage, control, and optimize their print infrastructure through cloud-based platforms. It eliminates the need for traditional on-premises print servers and drivers, allowing users to securely print documents from any location or device connected to the cloud. The system’s centralized control provides a single platform to monitor and manage all printing devices and workflows across multiple locations.

The market is poised for significant growth, driven by advancements in artificial intelligence (AI), mobile printing, and integration of the Internet of Things (IoT). The focus on sustainability and cost optimization is further propelling its adoption across industries globally.

Moreover, the market is dominated by established key players and emerging players, such as Canon, Inc., FUJIFILM Corporation, Ricoh Group, Konica Minolta, Inc., Xerox Corporation, HP, Inc., and PaperCut. These players are forming partnerships with cloud service providers and technology innovators to enhance their product offerings and gain a larger market share. For instance,

- In February 2024, Xerox announced a partnership with managed service providers (MSPs) to expand its cloud-based printing solutions for remote work environments.

The COVID-19 pandemic positively impacted the market, leading to a shift in demand, adoption patterns, and operational strategies. Businesses sought to reduce paper waste and operational costs during the pandemic, leading to increased adoption of cloud print solutions that optimize printing resources, reduce waste, and minimize infrastructure costs. The pandemic also accelerated digital transformation, pushing organizations to adopt paperless workflows and integrate cloud print management into broader IT ecosystems to support flexible working environments.

IMPACT OF GENERATIVE AI

Increasing Demand for Enhanced Automation and Predictive Maintenance Aids Market Growth

Generative AI plays a transformative role in the cloud print management market by introducing advanced capabilities that enhance efficiency, personalization, and automation. It can analyze vast amounts of data from printing devices to predict maintenance needs, reducing downtime and repair. For example, AI algorithms predict toner levels, identify potential hardware issues, and schedule maintenance proactively. Businesses are leveraging AI-powered solutions to automate workflows, improve efficiency, and enhance user experiences. For instance,

- In October 2024, Tungsten Automation, a provider of document automation and security solutions, launched a novel Hybrid Cloud Print solution in partnership with Printix and ControlSuite. This solution is enabled with generative AI technology to print and integrate operations across diverse IT infrastructures. Generative AI plays an important role in enhancing user experience and streamlining administration.

In addition, cloud printing solutions enabled with generative AI technology, predicts printer hardware issues, toner depletion, and other maintenance needs by analyzing real-time data and historical patterns. Thus, generative AI adoption is expected to grow rapidly as businesses prioritize automation, sustainability, and enhanced user experiences in their print operations.

MARKET DYNAMICS

Market Drivers

Increased Adoption of Cloud Infrastructure by Enterprises Fuels Market Growth

Cloud infrastructure has been a crucial enabler for the growth of cloud printing, allowing businesses and consumers to print from anywhere, on any device, and with greater security and efficiency. The convergence of cloud computing with print technologies has reshaped the way printing services are delivered and managed.

Cloud infrastructure allows print services to scale effortlessly. With cloud-based print solutions, enterprises are stress-free concerning the maintenance and scaling of print servers in-house. Whether a small business or global enterprise, cloud printing supports a wide range of devices (e.g., smartphones, tablets, desktops) and printers without the need for a dedicated on-premise infrastructure. For instance,

- According to the International Data Corporation (IDC), cloud infrastructure deployments grew by 61.5% year-over-year in 2024 to USD 42.9 billion. Cloud infrastructure spending continued to outpace non-cloud spending, growing 41.4% in 2024 to USD 19.4 billion.

Thus, the above features highlight the strategic importance of cloud infrastructure in advancing cloud printing solutions and ensuring its sustained growth in the coming years.

Market Restraints

Privacy Concerns and Lack of Proper Internet Connection to Hinder Market Growth

Although the market caters to a variety of users, there are several barriers to market expansion. The cloud print industry is constrained by data protection challenges, privacy concerns, and management that requires detailed reporting of user activity. When users send print works to a cloud-based service, sensitive documents often pass through third-party servers before being printed. This raises concerns over unauthorized access, data breaches, and the potential misuse of personal or confidential information. For businesses operating in the market, these risks are concerning, as sensitive materials could be exposed to cyber threats or unauthorized parties. For instance,

- Industries, such as healthcare, finance, and law, which handle highly confidential data, are particularly cautious about using cloud printing due to the risk of violating regulatory frameworks such as General Data Protection Regulations (GDPR) in Europe or the Health Insurance Portability and Accountability Act (HIPAA) in the U.S.

The above privacy concerns could result in severe legal and financial repercussions, which deters companies from fully embracing cloud printing solutions.

Market Opportunities

Digital Camera and Instant Photo Systems Create a Potential Opportunity for Market Growth

The digital camera and instant photo systems present significant opportunities for the market, owing to increased demand for a seamless, high-quality photo printing experience. As consumers increasingly embrace digital photography and expect instant, accessible, and cloud-integrated printing solutions, the cloud printing market benefits in several ways. Cloud-based services, such as Google Photos or Apple iCloud, allow users to upload their photos to the cloud and print them from virtually anywhere, bypassing the need for physical storage or a direct connection to a printer. Further, major companies, including Canon, Fujifilm, and Nikon, are introducing digital cameras with varying features to cater to different segments, from casual photographers to professional creators. For instance,

- In October 2024, Fujifilm launched the “FUJIFILM X-M5” mirrorless digital camera. The X-M5 is fully equipped with functions, including subject detection AF, that can detect moving objects using AI.

The above factors are considered to be one of the major opportunities for cloud print management market growth.

Cloud Print Management Market Trends

Rapid Technological Progress and Digital Transformation Accelerate Market Growth

The emergence of digital transformation initiatives across multiple industries is a major trend in the market. As organizations invest in digital technologies to modernize their operations, cloud printing is emerging as a key part of these strategies. A growing focus on environmental responsibility is driving the adoption of cloud printing solutions as organizations strive to achieve their digital transformation goals. Businesses are shifting to a more digital workflow, where cloud printing seamlessly integrates with document management systems and other digital tools. This strategy is considered as part of the broader digital transformation. For instance,

- Ricoh’s cloud print solution is integrated with enterprise software, such as Microsoft 365, Google Workspace, and other cloud-based platforms. This integration enables users to print directly from these platforms with minimal setup.

Thus, these factors play a crucial role in fueling the market growth.

SEGMENTATION ANALYSIS

By Deployment Type

Growing Demand for Cost-efficient and Scalable Printing Solutions Fuels Adoption of Public Cloud Deployment

Based on deployment type, the market is divided into public cloud, private cloud, and hybrid cloud.

Public cloud deployment captured 50.60% of the market share in 2026. Organizations favor public cloud-based print management for its affordability, as it eliminates the need for on-premises infrastructure. Businesses can scale up or down based on their requirements without investing in hardware. Moreover, SMEs are increasingly adopting public cloud printing to leverage advanced features without the high costs of maintaining infrastructure.

Hybrid cloud deployment is expected to grow at the highest CAGR during the forecast period, as it allows businesses to store sensitive print data in private clouds while using public clouds for less critical operations. Further, organizations are increasingly using hybrid solutions to ensure seamless printing operations, even during server failures or downtime.

By Solution Type

Increasing Demand for Risk Assessment and Secure Printing Boosts the Popularity of Print Management Software

Based on solution type, the market is categorized into print management software, workflow and document management, and device management and monitoring.

Print management software is expected to capture 40.74% of the market share in 2026. The software provides a secure print release feature to protect sensitive documents by allowing user authentication before printing. Print management software solution tracks and monitors print usage by department, team, or individual. In addition, print management software offers audit trails, which help to track document access and can be used for compliance purposes.

Device management and monitoring is expected to grow at the highest CAGR of 15.60% in coming years, as it monitors printer status, toner levels, and hardware health in real time. It provides alerts for low supplies or technical issues to prevent disruptions in workflow. Additionally, it reduces the need for manual intervention by automating tasks, including firmware updates, which plays an important role in fueling the segment growth during the forecast period.

By Enterprise Type

Rising Need for High-volume Printing across Multiple Locations Propels the Adoption of Cloud Printing Solutions in Large Enterprises

Based on enterprise type, the market is bifurcated into large enterprises and SMEs.

The large enterprises segment captured the largest market share in 2024. Cloud printing supports high-volume printing across multiple locations, making it ideal for large organizations with distributed offices. The solution’s centralized management capability enables IT departments to manage a large fleet of printers and users from a single cloud-based dashboard. Moreover, cloud printing solutions reduce operational costs by monitoring and controlling printing activities and optimizing resource allocation. This factor fuels the adoption of cloud print solutions in large enterprises. The large enterprises is projected to capture 53.98% of the revenue share in 2026.

SMEs are expected to grow at the highest CAGR of 13.90% in the coming years, as cloud print solutions need minimal setup and maintenance requirements to make the adoption easier for smaller IT organizations. In addition, multiple startups are leveraging cloud printing to focus on core business activities without worrying about IT infrastructure, which plays an important role in fueling the segment growth during the forecast period.

By End-user

To know how our report can help streamline your business, Speak to Analyst

Surge in Demand for Centralized Management Solutions in BFSI to Improve Customer Experience

Based on the end-user, the market is classified into BFSI, government, IT & telecommunications, healthcare, retail & e-commerce, and others (media & entertainment).

BFSI captured the highest market share in 2024. Cloud print is a centralized management solution that facilitates control over a distributed network of branches and offices globally. Moreover, features, such as encrypted data transfer, secure print release, and user authentication are essential for handling confidential client information. Also, banks use cloud printing solutions for document handling, such as securely printing financial statements, contracts, and sensitive customer data. These factors play a vital role in enhancing customer experience in banks. BFSI segment is anticipated to attain 27.40% of the market share in 2026.

The retail & e-commerce segment is expected to grow at the highest CAGR of 15.60% during the forecast period. Retailers and e-commerce platforms print invoices, shipping labels, price tags, and promotional materials at scale owing to high-volume printing needs. Cloud printing eliminates the need to maintain separate on-premises servers for each location. Also, it simplifies the supply chain and order management processes to improve workflow in the retail sector.

CLOUD PRINT MANAGEMENT MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Cloud Print Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North American market value stood at USD 2.13 billion in 2025 and USD 2.29 billion in 2026.

This region held the largest cloud print management market share in 2024, driven by technological advancements, robust IT infrastructure, and a high focus on digital transformation. The region’s enterprises and public sector organizations are increasingly leveraging cloud-based printing solutions to enhance operational efficiency, reduce costs, and meet sustainable goals. Also, North America’s well-established IT ecosystem supports the seamless implementation and integration of cloud print management systems. Moreover, U.S. and Canadian enterprises are prioritizing eco-friendly practices, and cloud printing helps reduce waste through print monitoring and optimization. These factors play a vital role in fueling the market growth in the region.

Download Free sample to learn more about this report.

The U.S. market is expected to be USD 1.62 billion in 2026. Businesses and governments in the U.S. are transitioning from traditional to digital workflows, with cloud printing being a critical component. Integration with cloud-based document management systems accelerates this adoption. These factors play an important role in fueling the market growth across the U.S.

- Over 70% of the organizations in the U.S. have fully implemented sustainable strategies. In 2022, the Quocirca research group surveyed an approx. 200 IT companies with over 500 employees. Through this research, it was found that 74% of organizations plan to cut paper use by 30% or more by 2025. Through this strategy, the organizations in the region are aiming to adopt digital technologies.

Asia Pacific

Asia Pacific region to be anticipated as the second-largest market with USD 2.16 billion in 2026, recording the second-largest CAGR of 14.90% during 2025-2032, owing to growing small and medium-sized enterprises (SMEs), rapid digitization, and the increasing focus on cost-efficient and secure IT infrastructure. Countries in Asia Pacific are leveraging cloud technologies to modernize their printing solutions, driven by rising internet penetration, hybrid work models, and sustainability goals. For instance,

- In December 2024, Canon India launched a new range of 10 printers across its imageCLASS and PIXMA MegaTank series. These printers are developed to meet diverse user needs for large enterprises and SMEs. These printers provide high print quality and enhanced productivity.

In addition, demand for mobile and remote printing capabilities is rising, especially in highly mobile industries, such as retail and logistics. This trend plays a vital role in boosting the adoption of cloud print solutions in the region. The market in China is estimated to be USD 0.38 billion in 2026.

Japan’s market size is foreseen to be valued at USD 0.47 billion and India’s market size is likely to be USD 0.22 billion in 2026.

South America

The adoption of cloud print management solutions in South America is steadily growing as businesses and governments recognize its potential to streamline operations, reduce costs, and improve sustainability. Despite challenges, such as infrastructure limitations and budget constraints, advancements in digital transformation and increasing reliance on cloud-based solutions are driving its adoption in the region. Moreover, businesses in the region are increasingly shifting to digital workflows by integrating cloud print management to modernize operations and reduce reliance on traditional printing systems. Governments in the region are adopting cloud solutions to enhance public services and support e-governance.

Europe

Europe is projected to become the third-largest market with a value of USD 1.29 billion in 2026. In Europe, the market is growing at a prominent pace. A robust emphasis on digital transformation, sustainability, and stringent data protection regulations drives the regional growth. Governments and enterprises across the region are increasingly integrating cloud-based print management systems to enhance efficiency, reduce costs, and meet compliance requirements. European countries, including the U.K., France, and Germany, have led the adoption of cloud-based printing solutions driven by advanced IT infrastructure and regulatory compliance. For instance,

- In February 2024, Atomyx launched Four Pees, a cloud-based print production management platform, at its tradeshow debut at Drupe, Germany. This platform is developed to facilitate a shift from mass production to mass customization.

The market in U.K. is estimated to be USD 0.25 billion in 2026. The Germany’s market size is foreseen to be valued at USD 0.24 billion in 2026. France’s likely to be USD 0.19 billion in 2025.

Middle East & Africa

The Middle East & Africa is expected to be the fourth-largest market with a value of USD 0.56 billion in 2026, showcasing noteworthy growth during the forecast period. The growth is driven by increasing digital transformation initiatives, growing awareness of cost-effective IT solutions, and the need for secure, flexible printing systems. Despite challenges, such as infrastructure limitations in some areas, the market is expanding as businesses and governments embrace cloud technologies to modernize their operations. Moreover, Governments in the Gulf Cooperation Council (GCC) countries, such as the UAE and Saudi Arabia, are increasingly adopting cloud technologies to enhance e-governance and public service delivery. These factors play an important role in propelling the region's market growth. The UAE market is projected to be USD 0.16 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Companies Focus on Partnership and Acquisition Strategies to Expand Their Services Globally

Major companies concentrate on increasing their global geographical presence by offering industry-specific solutions. Top players are introducing new solutions to increase their consumer base. Key market participants are strategically focusing on acquisitions and collaborations with regional players to maintain dominance across regions. An increase in constant R&D investments for product innovations is also enhancing market expansion. Hence, prominent companies are rapidly implementing these strategic initiatives to sustain their competitiveness in the market.

Major Players in the Cloud Print Management Market

To know how our report can help streamline your business, Speak to Analyst

The global cloud print management market is consolidated, with the top 5 players accounting for around 47% of the market share. As a part of their growth strategy, these companies aim to engage in collaboration, partnership, mergers, and acquisitions (M&A) activities to expand their business and geographical presence.

List of Key Cloud Print Management Companies Profiled:

- Canon Inc. (Japan)

- FUJIFILM Corporation (Japan)

- Ricoh Group (Japan)

- Microsoft Corporation (U.S.)

- HP, Inc. (U.S.)

- Xerox Corporation (U.S.)

- Konica Minolta, Inc. (Japan)

- Toshiba Corporation (Japan)

- PaperCut (Australia)

- YSoft Corporation (Czech Republic)

- Lexmark International, Inc. (U.S.)

- Brother (Japan)

- Seiko Epson Corporation (Japan)

- Kyocera Corporation (Japan)

- Sharp Corporation (Japan)

- MyQ (U.S.)

- Pharos Systems International (U.S.)

- Tungsten Automation Corporation (Printix) (Denmark)

- ThinPrint GmbH (Germany)

- Hexicom Software (Australia)

…and more

KEY INDUSTRY DEVELOPMENTS:

- December 2024: Canon India launched 10 new advanced printers for modern offices, offering users better print speed and enhanced versatile connectivity. It is designed to provide different user needs for small and medium businesses (SMBs), small office/home offices, and enterprises. It will deliver exceptional print quality and provide cost-effective solutions.

- November 2024: Microsoft announced that its universal print macOS app is available in the App Store. After installing the app and signing in to a Universal Print, users are eligible for a Microsoft Entra ID account and can search for printers by name.

- October 2024: FUJIFILM launched three new devices for the Apeos series- all of which are A3 digital color multifunction printers with features that enhance the integration with business solutions.

- October 2024: Ricoh, Ltd. announced the formation of a new company, Ricoh Printing Solutions Europe Limited, which will oversee its industrial printing operations in Europe.

- September 2024: Xerox introduced the Xerox PrimeLink C9200 Series Color Press in Las Vegas. This production press combines Xerox’s premium production capabilities, space-saving design, and automated workflows to help print service providers and customers deliver high-quality results within budget and on time.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key players operating in the market plans to invest in cloud infrastructure in various regions across the globe. Through these investments, companies aim to strengthen their cloud services worldwide. In addition, they invest in product innovation and development to expand their technological capabilities, customer bases, and market reach. These factors are expected to create a lucrative opportunity for the market growth. For instance,

- In June 2024, Amazon Web Services (AWS) aims to launch an AWS cloud infrastructure in Taiwan by early 2025. Also, AWS plans to invest billions of U.S. dollars in Taiwan over the next 15 years. This major investment is expected to play a vital role boost the demand for cloud services in Taiwan and across the Asia Pacific.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.83% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment Type, Solution Type, Enterprise Type, End-user, and Region |

|

Segmentation |

By Deployment Type

By Solution Type

By Enterprise Type

By End-user

By Region

|

|

Companies Profiled in the Report |

Canon, Inc. (Japan), FUJIFILM Corporation (Japan), Ricoh Group (Japan), Microsoft Corporation (U.S.), Xerox Corporation (U.S.), HP, Inc. (U.S.), Konica Minolta, Inc. (Japan), Toshiba Corporation (Japan), PaperCut (Australia), YSoft Corporation (Czech Republic), and Lexmark International, Inc. (U.S.). |

Frequently Asked Questions

The market is expected to reach USD 15.23 billion by 2034.

In 2026, the market was valued at USD 6.69 billion.

The market is projected to grow at a CAGR of 10.83% during the forecast period.

By deployment type, the public cloud leads the market.

Increased adoption of cloud infrastructure by enterprises fuels market growth.

Canon, Inc., FUJIFILM Corporation, Ricoh Group, Konica Minolta, Inc., Xerox Corporation, HP, Inc., Microsoft Corporation, Toshiba Corporation, PaperCut, YSoft Corporation, and Lexmark International, Inc. are the top players in the market.

North America dominates the global market with a share of 35.06% in 2025

By end-user, the retail & e-commerce segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us