Property and Casualty Insurance Market Size, Share & Industry Analysis, By Insurance Type (Residential Insurance, Commercial Insurance, Vehicle Insurance, and Others), By Distribution Channel (Direct Channels and Indirect Channels), By End User (Individuals, Business, and Government), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

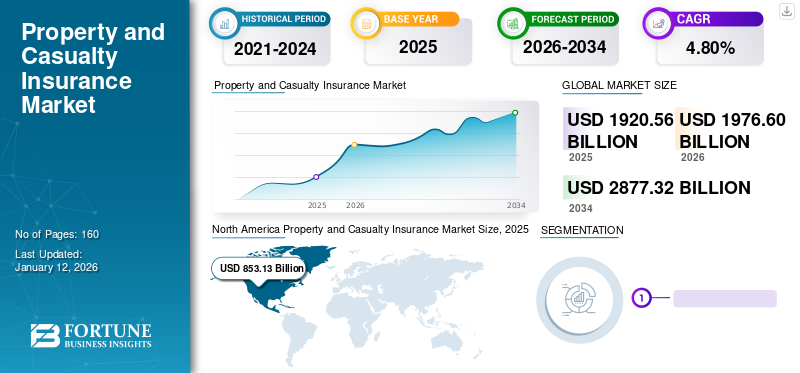

The global property and casualty insurance market size was valued at USD 1,920.56 billion in 2025. The market is projected to grow from USD 1,976.60 billion in 2026 to USD 2,877.32 billion by 2034, exhibiting a CAGR of 4.80% during the forecast period. North America dominated the global market with a share of 44.40% in 2025.

Several factors, including government regulations, frequent climate changes, technological innovations, and increasing consumer awareness, drive the growth. The P&C insurance market includes vehicle insurance, residential and commercial property insurance, renters insurance, and others. Climate risks, associated policies, economic development, and urbanization boost the demand for Property and Casualty (P&C) insurance across regions. State Farm, PICC, Berkshire Hathaway Inc., Allianz, and Lloyd's of London are a few of the top players in the market. These prominent players are penetrating their market share by investing in collaborative and partnership strategies.

Government regulatory policies are used to bring market opportunities to the non-life insurance market. For instance, in July 2024, the Indian Government proposed a new bill that includes composite licenses for insurers that will provide life, health, and general insurance together.

Download Free sample to learn more about this report.

GLOBAL PROPERTY AND CASUALTY INSURANCE MARKET OVERVIEW

Market Size:

- 2025 Value: USD 1,920.56 billion

- 2034 Forecast Value: USD 2,877.32 billion, with a CAGR of4.80% from 2026–2034

Market Share:

- Regional Leader: North America held 44.40% of the market share in 2025, driven by high insurance awareness and vehicle/home ownership.

- Fastest-Growing Region: Asia Pacific is expected to show the highest CAGR due to rising middle-class income and digital insurance channels.

- End-User Leader: The individual segment led in 2023, due to growing adoption of personal auto and property insurance.

Industry Trends:

- Digitalization: Use of AI and data analytics to streamline claims and underwriting.

- Climate Risk Management: Insurers developing advanced products to handle environmental threats.

- Online Distribution: Insurtech and digital platforms increasing accessibility and reach.

Driving Factors:

- Natural Disaster Surge: Greater demand for property coverage due to weather-related risks.

- Urban Growth: More homes, vehicles, and infrastructure are driving insurance needs.

- Regulatory Support: Government mandates and frameworks improving insurance adoption.

- Technology Integration: Digital transformation is reshaping operations and customer experiences.

Resilient infrastructure investment across developing and emerging countries to boost market share. Economic development, reduced interest rates, and high climate risks are also propelling the market. Awareness about insurance services and their benefits will increasingly support the expansion of the market across emerging and developing countries such as India.

However, the COVID-19 pandemic has displayed a significant impact on the market owing to limited digital infrastructure, and temporary lockdowns. Shifts in insurance offerings and operational changes have further supported digital transformation in the insurance sector. The evolving regulatory landscape, increasing risk awareness among consumers, and growing disposable incomes across countries bolster the market demand for non-life insurance.

IMPACT OF GENERATIVE AI

Operational and Customer Experience Benefits to Drive Market Progression

Generative AI or artificial intelligence platform tools allow easy engagement with customers by providing detailed analysis of insurance products. Several tools allow risk assessment for business assets, simplifying the need for the right insurance products for the customers. Furthermore, AI helps in analyzing and processing claims faster than human intervention, ultimately enhancing efficiency for the end users. AI applications aid customers in getting relevant information related to policies and insurance products.

IMPACT OF TARIFFS

Investment Volatility and Trade Tariffs to Slow Down Market Growth

Volatile investments and trade tariffs by the U.S. across borders would further limit the growth of the market. Unprecedented market conditions, investment volatility, and shifting consumer behavior would further slowdown the market growth for property and casualty insurance. Increased policy cost owing to trade tariffs is projected to have a significant short-term impact on the spending and financial decisions of consumers.

MARKET DYNAMICS

Property and Casualty Market Trends

Digital Transformation and Climate Risks to Enhance Market Growth

Frequent occurrence of severe and natural disasters, development of risk modeling tools, and application of IoT technology for real-time risk monitoring supported by regulatory landscape to propel the market demand for insurance, including vehicle, residential, and commercial property insurance. Key players are expanding their market presence through partnerships and collaboration with domestic players. Shifting demographics and consumer behavior further bolsters the demand for insurance products and services.

Market Drivers

Regulatory Policies and Climate Change to Boost Market Growth

A stringent regulatory environment, emerging new distribution channels, risk awareness among customers, technological advancements, and supportive economic factors contribute to bolstering market growth across regions. Key players in the market are focusing on developing and updating existing policies based on consumer preferences, which would further boost the growth of auto insurance, property and casualty insurance, and others. Climate change and growing liability landscapes are significantly driving the market for property and casualty insurance. Growing disposable income, rising risk awareness among consumers, and evolving distribution channels further propel the property and casualty insurance market growth.

Market Restraints

Premium Growth Across Non-Life Insurance Products to Limit Market Growth

Premium growth and operational challenges might limit the demand for non-life insurance products. High premiums for insurance products, especially in price-sensitive markets, might further constrain the growth of the market. In developed countries, the insurance market is found to be highly saturated with high insurance penetration and regulatory compliance. This may further limit the growth of the non-life or property and casualty insurance market.

Market Opportunities

Expanding Commercial Real-Estate Sector to Enhance Insurance Market across Regions

The growing e-commerce sector is generating strong demand for industrial facilities and warehouses to meet customer demands. In addition, facilities such as data centers, vertical farms, science laboratories, charging infrastructure, semiconductor manufacturing facilities, and others are all expanding across regions. Regulatory compliances and zero carbon-emission facilities are further gaining traction in developed and emerging countries across the globe. For instance, the Indian government, in September 2024 had virtually inaugurated 3 semiconductor manufacturing projects in Gujarat and Assam. Several such commercial infrastructures significantly enhance the demand for property insurance.

SEGMENTATION ANALYSIS

By Insurance Type

Vehicle Insurance Led the Market Owing to Stringent Regulatory Compliance

By Insurance type, the market is classified into residential insurance, commercial insurance, vehicle insurance, and others. The others segment includes marine insurance, pet insurance, and power sport insurance.

Vehicle insurance dominated the market with a share of 42.87% in 2026, followed by residential and commercial insurance. Rising ownership of vehicles, including two-wheelers and three-wheelers, further supported by transportation and mobility services and the e-commerce sector, has resulted in vehicle insurance dominating the insurance market. In 2023, according to the International Organization of Motor Vehicle Manufacturers, 92.8 million passenger vehicles were sold globally with a double-digit year-on-year growth of about 11.9% in 2023.

Similarly, growing cab services in developed and emerging regions expanding the e-commerce sector to tier 2 & tier 3 cities enhances the market for vehicle insurance. There are several new mobility service companies, such as Rapido, Gojek, and Grab, which might further generate the demand for vehicle insurance.

Commercial property insurance is estimated to witness the highest growth rate apart from all other segments including residential insurance, vehicle insurance, and others. Increasing investment in commercial infrastructure such as office spaces, entertainment venues, data centers, and warehouse facilities in developing countries such as India is expected to drive the demand for commercial lines insurance. Residential insurance and others segment to showcase moderate growth over the forecast period as a result of limited awareness and premium growth.

By Distribution Channel

Indirect Channels Held Highest Revenue Market Share as a result of its Strong Reach

On the basis of distribution channel, the market is segmented into direct channels and indirect channels. Direct channels are further classified into e-commerce and own sales force, whereas indirect channels are divided into agents or brokers, retailers & banks, and others.

Indirect channels that include agents, brokers, retailers, and others catered to a large revenue market with a share of 56.68% in 2026. Increased trust values, smooth claims processing, negotiated insurance costs, and established relations with indirect channels enhance the loyalty of customers. Customers require credible and trusted partners for high-value transactions, generating strong demand through indirect channels such as brokers and banks. This segment is estimated to grow with a substantial CAGR of 4.05% during the forecast period (2025-2032).

Direct channels segment is estimated to attain 43% of the market share in 2025.

However, insurance purchasing prominently through e-commerce platforms witnessed strong growth during the projected years. Increasing customer awareness about insurance products, analytical insurance platforms such as Policybazaar in India are set to create strong market opportunities for the market.

By End User

Individuals Dominated the Market Revenue Share Owing to Disposable Income and Stringent Policies

Based on end user, the market is segmented as individuals, business, and government.

Individuals catered to the highest revenue market share, accounting for about 56.31% in 2026. Shifting demographics, growing population, and increasing disposable income are a few of the primary factors influencing the market for property and casualty insurance purchased by individuals. Furthermore, stringent regulatory policies across countries, and increasing consumer awareness about security and safety bolster the growth of individual insurance. The segment is set to hold 56% of the market share in 2025.

Economic growth, and increasing asset values in industrial and commercial businesses to generate demand for insurance during the forecast period. Business segment is anticipated to showcase the highest growth rate over the forecast period.

The business segment is likely to grow with a considerable CAGR of 4.60% during the forecast period (2025-2032).

To know how our report can help streamline your business, Speak to Analyst

PROPERTY AND CASUALTY INSURANCE MARKET REGIONAL OUTLOOK

By region, the market is divided into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America Property and Casualty Insurance Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest revenue share valued at USD 853.13 billion in 2025 and USD 885.55 billion in 2026. The North American market dominates the property and casualty insurance share market owing to several factors, including high disposable income, considerable count of vehicle owners, established insurance market, stringent regulatory frameworks, and high-value residential and commercial infrastructure. The U.S. market is projected to reach USD 758.71 billion by 2026.

Furthermore, well-accomplished broker networks, distribution channels, and high literacy rates for insurance products play significant roles in making the North American market dominant for property and casualty insurance. The U.S. is estimated to cater to the highest revenue market share in North America. Canada and Mexico are to witness moderate growth over the forecast period as a result of the growing real estate and industrial sectors.

An increasing number of vehicles and personal and commercial properties is driving the demand for insurance in the country. In addition, stringent regulatory policies and risk management approaches in the commercial and industrial sectors further bolster the market for property and casualty insurance in the U.S. The U.S. market is expected to hold USD 733.03 billion in 2025.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is the third largest market expected to hit USD 358.04 billion in 2026. Growing automotive fleet, premium growth, volatile climate conditions, and regulatory policies are a few of the prominent factors driving the growth of the market. The U.K. market continues to grow, projected to reach a market value of USD 103.9 billion in 2026. Post-pandemic, several key players in the region are striving to adopt technologies and enhance their distribution channels to expand their reach, raise capital investment in emerging European countries, and develop new business facilities to generate market opportunities further. Germany is estimated to be valued at USD 68.46 billion in 2026, while France is set to gain USD 46.19 billion in the same year.

Asia Pacific

Asia Pacific is the second leading region expected to hold USD 545.89 billion in 2026, registering a considerable CAGR of 4.81% during the forecast period (2026-2034). Demographic shifts, risk awareness among consumers, and stringent regulatory policies are prominent factors driving the demand for property and casualty insurance in the developing nations of the Asia Pacific region. Infrastructure development in countries such as India is set to further strengthen the market for non-life insurance. China is set to reach USD 276.05 billion in 2026.

Developed economies such as Japan and Australia account for a significant number of assets, have a strong culture for insurance, and are highly prone to climate change. Several such factors have resulted in considerable revenue generation for non-life insurance from these countries: growing awareness, digital transformation, and urbanization to drive the market across the region. India is poised to acquire USD 31.28 billion in 2026, while Japan is expected to hold USD 75.12 billion in the same year.

Middle East & Africa

Economic growth and mandatory regulations related to insurance are the primary factors driving the growth of the market. Growing business sectors such as renewable energy, oil, and gas sectors will bring opportunities for the market through asset insurance and the introduction of insurance products. Increasing middle-income population and innovative insurance for sectors such as agriculture, supported by distribution channels to enhance the market growth in the region. The GCC market is foreseen to stand at USD 30.82 billion in 2025.

South America

South America is the fourth leading region anticipated to reach a valuation of USD 110.29 billion in 2025. Growing infrastructure development, strong regulatory environments, and increasing vehicle ownership with changing climatic conditions to surge the growth of the market. Increasing mining and other exploration activities to drive the growth of insurance for several assets such as construction equipment.

KEY INDUSTRY PLAYERS

Strategic Collaboration and a Strong Distribution Network Strengthened Key Players' Presence

The P&C Insurance market is moderately fragmented by a few of the insurance companies such as State Farm, Berkshire Hathaway, Liberty Mutual, and Allstate. These players are collaborating with domestic participants to expand their comprehensive product portfolio to a wide range of customers. Key market participants have partnered with retailers and banks to expand their network and reach through a wide range of distribution channels, including online platforms. A few of the key players accounting for significant revenue share in the market include State Farm, PICC, Berkshire Hathaway, and Lloyd’s of London.

List of Key Property and Casualty Insurance Companies Profiled:

- State Farm (U.S.)

- PICC (China)

- Berkshire Hathaway Inc. (U.S.)

- Allianz SE (Germany)

- Lloyd's of London (U.K)

- AXA (France)

- Progressive (U.S.)

- Allstate (U.S.)

- Ping An Insurance (China)

- Liberty Mutual (U.S.)

- Tokio Marine Holdings (Japan)

- Chubb Limited (Switzerland)

- Travelers Group (U.S.)

- Nationwide Group (England)

- Fairfax Financial Group (Canada)

- Erie Ins Group (U.S.)

- Everest Re U.S. Group (U.S.)

- Cincinnati Ins Cos (U.S.)

- Great Amer P&C Ins Grp (U.S.)

- Zurich Ins U.S. PC Group (Switzerland)

- CSAA Ins Group (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2024: Orion180 launched its new residential property and casualty insurance with comprehensive coverage for flood zone areas.

- December 2024: Trucordia acquired the insurance business of Archibald Insurance in 2024. Archibald Insurance specializes in providing individuals and businesses insurance products.

- November 2024: Oyster has introduced a suite of digital products for the insurance market designed for small and medium-scale businesses. The new AI model will allow easy processing of policy quotes, review, and certification management.

- November 2024: Skyward Specialty Insurance Group, Inc. has launched its new liability coverage for life sciences. The new liability coverage will include the unique needs of the life sciences, cosmetic, and nutraceutical industries.

- October 2024: RSA Insurance unveiled a new financial risks product for businesses targeted at the U.K. market.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, insurance type, distribution channels, and end users of the services. Besides, the report offers insights into the market trends and highlights key insurance industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

To know how our report can help streamline your business, Speak to Analyst

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Insurance Type, Distribution Channel, End User, and Region |

|

Segmentation |

By Insurance Type

By Distribution Channel

By End User

By Region

|

|

Companies Profiled in the Report |

State Farm (U.S.), PICC (China), Berkshire Hathway Inc. (U.S.), Allianz SE (Germany), Lloyd's of London (U.K), AXA (France), Progressive (U.S.), Allstate (U.S.), Ping An Insurance (China), Liberty Mutual (U.S.) |

Frequently Asked Questions

The market is projected to reach USD 2,877.32 billion by 2034.

In 2025, the market was valued at USD 1,920.56 billion.

The market is projected to grow at a CAGR of 4.80% during the forecast period.

Digital transformation and climate risks are the key factors driving market growth.

State Farm, PICC, Berkshire Hathway Inc., Allianz SE, and Lloyds of London are a few of the top players in the market.

North America is expected to hold the highest market share.

By insurance type, commercial insurance to witness the highest growth rate during the forecast period.

Individual insurance led the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us