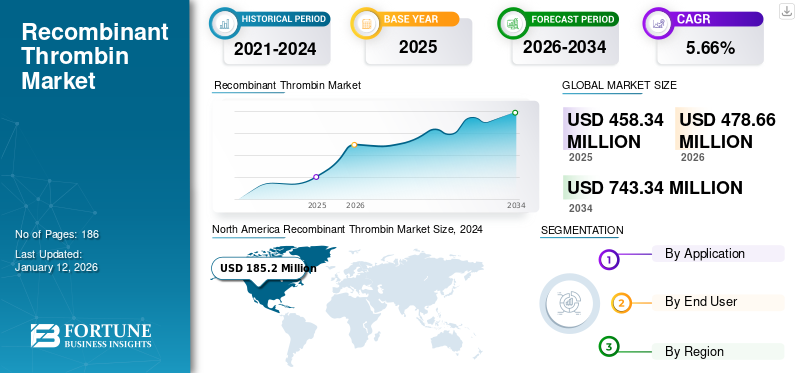

Recombinant Thrombin Market Size, Share & Industry Analysis, By Application (Therapeutic and Research), By End User (Hospitals and ASCs, Research Institutes, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global recombinant thrombin market size was USD 458.34 million in 2025. The market is projected to grow from USD 478.66 million in 2026 to USD 743.34 million in 2034 at a CAGR of 5.66% during the forecast period. North America dominated the recombinant thrombin market with a market share of 42.24% in 2025.

Recombinant thrombin is a genetically engineered form of thrombin, a key enzyme involved in blood coagulation, primarily used during surgical procedures to control bleeding. It is produced using recombinant DNA technology, unlike traditional human and bovine-sourced thrombin. Thus, it offers improved safety by minimizing the risk of immunogenic reactions, disease transmission, and allergic responses.

Globally, the market is witnessing significant growth owing to the increasing geriatric population and rising number of trauma and chronic diseases associated with it. Also, the product’s increased adoption in various surgical specialties, such as cardiovascular, orthopedic, and general surgeries, propels market growth.

- For instance, in October 2024, the data published by the World Health Organization estimated that the global population of people aged 60 or more increased from 1.00 billion in 2020 to 1.40 billion by 2030. By 2050, this number will double to 2.10 billion.

Moreover, rising awareness of product safety, advancements in biotechnology, and the growing demand for efficient hemostatic agents further support market expansion. Furthermore, major companies operating in the market, such as Baxter, and Merck KGaA offer significant products and different strengths for various chronic conditions. Also, the adoption of r Thrombin for research purposes will boost the company's share.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Number of Surgical Procedures to Boost Demand for Recombinant Thrombin

The rising prevalence of chronic diseases, such as cardiovascular, neurological, orthopedic, gynecological, and other conditions, has led to an increase in the number of surgical interventions. This is due to increasing geriatric population, prevalence of disorders, tobacco consumption and exposure, physical inactivity, and poor lifestyle. Such a scenario increases the demand for these products for hemostasis purposes during surgery.

- For instance, in 2023, as per the German Heart Surgery Report, the total number of heart surgery procedures reported was around 168,841 in 2023, which increased 4.1% compared to 162,167 procedures in 2022.

Additionally, the rising number of trauma cases and the increasing number of hospitalizations for surgical interventions are also catering toward the increased adoption of these products. Thus, driving the global recombinant thrombin market growth.

MARKET RESTRAINTS

High Cost of Products to Restrain the Adoption and Market Growth

The complex manufacturing process associated with thrombin products leads to its high cost, significantly restraining the market growth. These biologics involve advanced technologies and strict regulatory requirements, which increases production expenses. This results in the elevation of the end cost to healthcare facilities and patients compared to traditional thrombin products derived from human or bovine sources.

- For instance, as per the data published by commercial websites, the cost of Recothrom 20,000 intl units is around USD 377.23, which limits their widespread adoption, especially in lower economic regions and developing countries.

Additionally, limited reimbursement policies and coverage for these products may reduce its adoption and despite its superior safety profile, the high cost reduces overall market penetration.

MARKET OPPORTUNITIES

Adverse Drug Events Associated with Human and Bovine Thrombin to Offer Lucrative Growth Opportunities

The increasing safety concerns and adverse drug events associated with human- and bovine-derived thrombin present a significant opportunity for the growth of the market.

- For instance, adverse reactions such as allergic responses, bleeding complications, immune-mediated effects, and thromboembolic events, which are commonly observed with products such as THROMBIN-JMI (bovine thrombin), have limited their clinical use and raised concerns among healthcare providers.

In contrast, recombinant thrombin eliminates the risk of viral transmission and reduces the formation of anti-thrombin antibodies, offering a safer and more consistent alternative. Its non-human origin reduces dependency on blood donations and enhances product purity. The superior safety profile of such thrombin has led to growing clinical adoption, especially in high-risk surgical procedures.

Moreover, with only one FDA-approved recombinant thrombin product currently available (Recothrom), there is substantial scope for innovation and market entry of new recombinant formulations. This unmet need creates a lucrative opportunity for manufacturers to invest in research & development and expand their product portfolios.

MARKET CHALLENGES

Complex Manufacturing Process Challenges Market Growth

The market faces a major challenge in its complex and resource-intensive manufacturing process. Manufacturing such thrombin involves complicated biotechnological methods such as gene cloning, expression in host cells, and rigorous purification steps to ensure product safety and efficacy.

Additionally, these procedures require specialized infrastructure, a skilled workforce, and strict regulatory compliance, increasing the production cost and time. Furthermore, any disparity during manufacturing may lead to batch failures. Also, maintaining consistency across batches is technically demanding, which limits scalability and production. Overall, the complicated nature of production challenges the market’s ability to meet growing demand efficiently.

Recombinant Thrombin Market Trends

Increasing Demand for Clinical Studies to Develop Combination Products for Therapeutic Applications

There is a rising demand for recombinant thrombin for various medical conditions, including surgeries and trauma. Also, increasing concerns over contamination with plasma-derived products have increased the demand for safe and convenient hemostatic agents.

To address these issues, several leading companies are actively engaged in research & development to introduce combinations of these products for convenience and effective hemostasis during critical situations.

- For instance, in April 2023, Baxter launched Floseal + Recothrom flowable hemostat at the Association of periOperative Registered Nurses (AORN) Global Surgical Conference & Expo 2023. The company's new surgical portfolio product is the first and only active flowable hemostat using recombinant DNA technology. Such advancements tend to shift the global recombinant thrombin market trends.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Application

Increasing Adoption in Surgeries to Boost Therapeutic Segment’s Growth

By application, the market is divided into therapeutic and research.

The therapeutic segment held a significant global recombinant thrombin market share in 2024. The segment's growth is augmented by its vital role in managing surgical bleeding. It is extensively used in cardiovascular, liver, orthopedic, and neurosurgery procedures, where precise bleeding control is critical. It offers advantages over animal or human-derived forms by reducing the risk of immune reactions and disease transmission.

Furthermore, the increasing volume of surgical procedures globally, especially among the elderly population, leading toward adopting recombinant thrombin for intraoperative bleeding control, continues to drive demand.

- For instance, in March 2024, according to the data published by the National Institute of Health, more than 1.0 million transcatheter-based cardiovascular procedures across the spectrum of interventional cardiology were performed annually in the U.S. Such surgeries require recombinant thrombin for hemostasis.

The research segment held a considerable market share due to recombinant thrombin’s growing use in academic and industrial research settings. These products are widely utilized in molecular biology and protein purification processes, especially in the cleavage of fusion proteins at specific recognition sites. Also, its high purity and reduced risk of contamination makes it a preferred choice in laboratory experiments.

By End User

High Usage of Hemostatic Agents for Surgical Procedures in Hospitals to Boost Hospital and ASCs Segment

The market’s end user categories include hospitals and ASCs, research institutes, and others.

The hospitals and ASCs segment held the highest share of the market due to their extensive use of hemostatic agents during various surgical procedures. The large volume of surgeries and the need for effective bleeding control drive demand.

- For instance, according to the American Academy of Orthopedic Surgeons, in 2024, over 700,000 total knee replacement surgeries were carried out in the U.S.

The research institutes segment holds a considerable market share and is expected to grow during the forecast period backed by the increasing adoption of these products in molecular biology research and other biotechnology research.

Recombinant Thrombin Market Regional Outlook

Based on region, the global market is studied across Asia Pacific, Europe, the Middle East & Africa, and Latin America.

North America

North America Recombinant Thrombin Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The market in North America accounted for a valuation of USD 193.59 million in 2025 and is anticipated to hold a leading position in the global market during the projected timeframe due to the presence of advanced healthcare and surgical facilities for chronic diseases such as neurological, cardiovascular diseases, and gynecology. Also, awareness regarding recombinant thrombin as a safe hemostatic agent increases its adoption, driving market growth in the region.

- As per The National Heart, Lung, and Blood Institute published data in December 2023, about 20.5 million adults have coronary artery disease in the U.S.

U.S.

The U.S. held a dominating position in North America, due to high surgical volumes, well-established healthcare infrastructure, and the presence of major players in the pharmaceutical and biotechnology sectors.

Europe

Europe accounted for the second-largest market share due to the rising geriatric population and chronic and trauma injuries associated with increased surgical interventions. Additionally, increasing biotechnology R&D activities will collectively boost the region's growth.

- For instance, in February 2020, as per the data published by the NHS, around 81,130 hip replacement procedures and 93,911 knee replacement procedures took place in 2018-2019, in which most patients were 50 years old or older.

Asia Pacific

Asia Pacific is projected to grow at the highest CAGR driven by the rising patient pool, increasing surgeries, and presence of advanced research facilities with investment activities, fueling the adoption of recombinant thrombin.

- For instance, in March 2025, AstraZeneca invested around USD 2.5 billion to develop a world-class R&D center, in Beijing, with an aim to advance life sciences in China.

Latin America and the Middle East & Africa

The Middle East & Africa and Latin America are estimated to hold a substantial share of the market. Rising initiatives in the region to boost healthcare infrastructure for patient comfort is bound to bolster the region’s market growth.

- For example, in October 2024, Burjeel Holdings launched one-day surgery centers in Saudi Arabia. These centers aimed to offer minimally invasive procedures across specialties such as oncology, advanced gynecology, orthopedics, and neurology.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Prominent Product Offerings by Major Players to Maintain Their Positions in the Market

This market is semi-fragmented, with Baxter and Merck KGaA accounting for a substantial share in 2024. Currently, only one product for the hemostasis indication is provided by Baxter, and thus, it holds the leading position. Moreover, Merck KGaA offers a variety of products for research purposes. Such significant roles of these companies are expected to help maintain their strong positions throughout the forecast period.

Other key players including Bio-Techne and AMSBIO will concentrate on expanding their product offerings to increase market share.

List of Key Recombinant Thrombin Companies Profiled

- Baxter (U.S.)

- Merck KGaA (Germany)

- Bio-Techne (U.S.)

- AMSBIO (England)

- Enzyme Research Laboratories Ltd. (U.K.)

- Proteintech Group, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- January 2025: Bio-Techne designed and engineered innovative recombinant proteins using advanced Artificial Intelligence (AI) based design platforms.

- April 2024: Merck KGaA invested more than USD 324.6 million to establish an advanced research center in Germany, with an aim to accelerate biopharmaceutical product development.

- December 2021: Fibriant, a biotech scale-up specializing in the RECOFIB platform, received up to USD 17.9 million from the European Innovation Council Accelerator. The platform is an innovative recombinant manufacturing system based on Chinese Hamster Ovary (CHO) cells for producing human fibrinogen and thrombin. The funds were utilized for R&D to expand the platform’s therapeutic dosage forms to support scaling and initial clinical trials.

- February 2019: Enzyme Research Laboratories Ltd announced the launch of new recombinant human alpha thrombin for research use.

- January 2018: Baxter acquired two hemostat and sealant products from Mallinckrodt. Recothrom Thrombin topical and PREVELEAK Surgical Sealant were added to the company’s product portfolio.

REPORT COVERAGE

The global recombinant thrombin market report provides detailed industry analysis. It focuses on key aspects, such as an overview of the number of surgeries, by key disease, key countries or regions. Also, the report offered a detailed overview of the product for research purposes. Additionally, it includes key industry developments such as mergers, partnerships, & acquisitions, and new product launches. Besides these, it offers insights into the market trends and opportunities.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.66% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Application

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 458.34 million in 2025 and is projected to reach USD 743.34 million by 2034.

In 2025, market value in North America stood at USD 193.59 million.

Registering a CAGR of 5.66%, the market will exhibit steady growth over the forecast period.

Based on application, the therapeutic segment is expected to lead during the forecast period.

The rising prevalence of chronic diseases and trauma injuries and the increasing surgeries associated with them are the major factors driving the growth of the market.

Baxter is one of the major players in the global market.

North America dominated the market in terms of share in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us