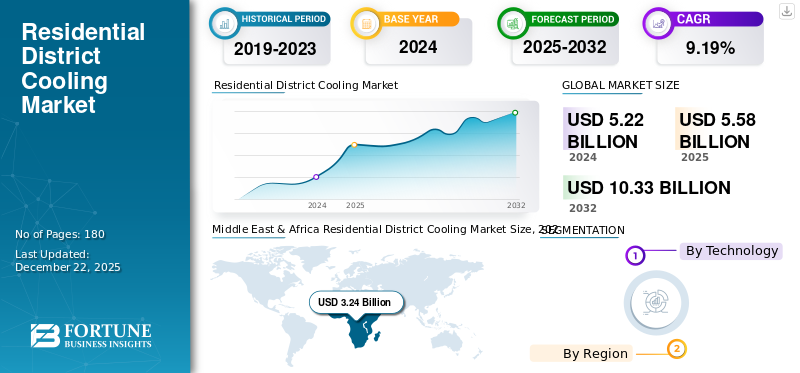

Residential District Cooling Market Size, Share & Industry Analysis, By Technology (Electric Chillers, Absorption Chillers, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global residential district cooling market size was valued at USD 5.58 billion in 2025. The market is projected to grow from USD 6.49 billion in 2026 to USD 12.13 billion by 2034, exhibiting a CAGR of 7.17% during the forecast period. Middle & Africa dominated the residential district cooling market with a share of 69.12% in 2025.

Residential district cooling is a centralized system that provides chilled water or air to multiple homes within a neighborhood or housing complex for air conditioning. Instead of each home using individual air conditioners, a central plant produces cooling and distributes it through a network of insulated pipes. This approach improves energy efficiency, reduces greenhouse gas emissions, lowers maintenance needs, and frees up building space, making it a sustainable alternative for densely populated residential areas.

The market is driven by urbanization, population growth, and the need for energy-efficient and sustainable cooling solutions. Government initiatives promoting energy efficiency and reduced emissions also play a significant role, making district cooling a viable option for large residential developments.

Emicool, a UAE-based district cooling market company holds a substantial global market share as it offers cost effective, efficient, and sustainable district cooling system that delivers cooling solutions at lower cost and higher efficiency. The company has a district cooling plant located in Fujairah, designed to supply the chilled water services and requirements of the Fujairah Business Centre. It also has a project in Jumeirah Bay island and is designed to supply chilled water services to Meraas residences and Bulgari hotel and residences.

MARKET DYNAMICS

RESIDENTIAL DISTRICT COOLING MARKET TRENDS

Expansion of Smart Cities to Lead the Market Growth

Smart city and infrastructure development play a vital role in advancing residential district cooling by promoting integrated, energy-efficient urban planning. As cities adopt smart technologies, they prioritize centralized systems that reduce energy consumption and emissions. District cooling fits well within this vision, offering a sustainable solution for densely populated residential areas. Smart infrastructure enables real-time monitoring, predictive maintenance, and efficient load management, enhancing the reliability and performance of these systems. By aligning with the goals of smart city initiatives, residential district cooling becomes a key component in creating more livable, climate-resilient urban environments.

MARKET DRIVERS

Rapid Urbanization and Infrastructure Development Augments the Market Growth

District cooling is a crucial component of smart and sustainable urban development which offers advantages such as energy efficiency, reduced environmental impact, and improved reliable cooling infrastructure. District cooling systems centralize cooling production and distribution, leading to significant energy savings as compared to individual cooling units.

District cooling systems are ideal for addressing the growing cooling demands of crowded urban centers. Municipalities and urban planners are directing funds into infrastructure projects that support urban expansion and enhance residents' quality of life, which is anticipated to drive the global market growth.

MARKET RESTRAINTS

High Initial Capital Requirements to Limit the Market Expansion

The substantial upfront capital requirement for developing district cooling infrastructure is anticipated to hinder global residential district cooling market growth. The initial expenses involved in the planning, designing, and construction of district cooling systems discourage potential investors, developers, and utility companies from implementing these alternatives. Although these systems provide long-term cost savings and operational efficiencies, the initial investment payback period is quite extended, which greatly hinders the growth of the market. This creates a financial obstacle for stakeholders who are looking for quicker returns on their investment, particularly in areas with restricted financing options or where energy prices are low.

MARKET OPPORTUNITIES

Government Policies and Energy Efficiency Regulations to Stimulate Market Opportunities

Globally, governments are implementing policies and offering incentives to promote energy-efficient cooling solutions. For instance, programs such as the High-Efficiency Electric Home Rebate Act (HEEHRA) provide significant rebates for installing high-efficiency HVAC systems. Local governments also play a role by encouraging energy efficiency in new homes through incentives to homebuilders who incorporate energy-efficient practices, such as the ENERGY STAR-qualified home specification. These initiatives aim to reduce energy consumption, lower carbon footprints, and make energy-efficient cooling more accessible.

Download Free sample to learn more about this report.

Segmentation Analysis

By Technology

Heat Consumption Technology to Drive the Absorption Chillers Market Share

Based on technology, the market is classified into electric chillers, absorption chillers, and others.

Absorption chillers are anticipated to dominate the global residential district cooling market share. Absorption chillers utilize heat in place of electrical energy to drive the refrigeration cycle. District cooling with absorption chillers offers a more energy-efficient and environmentally friendly cooling solution than traditional methods.

Electric chillers are the second leading segment in the global market as electric chillers are refrigeration systems that use electric motors to power a vapor compression cycle, effectively removing heat from a liquid coolant, which is then used to cool buildings or other applications. District cooling systems powered by electric chillers offer benefits such as reduced energy consumption, lower greenhouse gas emissions, and cost savings by leveraging economies of scale.

RESIDENTIAL DISTRICT COOLING MARKET REGIONAL OUTLOOK

By geography, the global market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Middle East & Africa

Middle East & Africa Residential District Cooling Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Middle East & Africa dominated the market with a valuation of USD 4.49 billion in 2025 and USD 4.9 billion in 2026, owing to the presence of hot and arid climates in many countries across the region. Elevated temperatures and humidity levels drive up the requirement for air conditioning and cooling, making district cooling systems a desirable solution for effectively addressing the region's increasing demand for cooling. Nations such as the United Arab Emirates (UAE), Qatar, and Saudi Arabia have been experiencing considerable investments in real estate and infrastructure initiatives. This encompasses large-scale projects, urban expansions, hospitality and tourism developments, and industrial areas, all of which necessitate dependable and scalable cooling systems.

North America

In North America, increasing urbanization, population growth, and focus on energy efficiency and sustainability are significant market driving factors. Renewable energy policies and incentives also play a significant role. Smart city initiatives and the presence of existing infrastructure further contribute to the market's expansion.

U.S.

Residential district cooling in the U.S. is gaining considerable traction, driven by growing interest in sustainable urban development and energy-efficient infrastructure. While traditionally focused on commercial and institutional applications, district cooling is expanding into residential areas through utility-led initiatives and mixed-use developments. Projects like the geothermal system at Barry Farm in Washington, D.C., and deep lake cooling at Cornell University highlight innovative approaches to centralized cooling.

Europe

In Europe, residential district cooling is experiencing growth due to factors such as rising temperatures, increased welfare and comfort expectations, and the need for energy efficiency and decarbonization. As temperatures increase and living standards improve, the demand for district cooling systems, particularly in residential buildings, is growing. EU policies and regulations aimed at reducing energy consumption and emissions, such as the Clean Energy for all Europeans package, are driving the adoption of district cooling and other energy-efficient technologies.

Asia Pacific

The Asia Pacific region is experiencing notable expansion in the global market due to quick urban development and increased awareness of energy efficiency. The rising need for sustainable cooling options in nations such as China, Singapore, and Japan is fueling market growth. Furthermore, governmental efforts to encourage renewable energy and energy-efficient cooling technologies are facilitating the deployment of these systems across the area.

Latin America

The residential sector in Latin America is witnessing significant expansion, driven by the increasing need for energy-efficient cooling options in urban environments. As cities grow and climate change impacts the region, the need for district cooling systems is rising, presenting a sustainable substitute for conventional air conditioning. Furthermore, government programs and funding to enhance infrastructure are accelerating market progress, creating a promising opportunity for investors and stakeholders.

COMPETITIVE LANDSCAPE

Key Industry Players

Partnerships & Joint Venture for the Development of District Cooling Projects Aid in Enhancing the Market Share of Key Players

KJTS Group Berhad has emerged as a significant player in market. The company, through its engineering and operations expertise, has deployed district cooling systems in sustainable urban developments, most notably the Medi-City project in Penang, Malaysia where KJTS leads the design, operation, and maintenance of a centralized chilled-water network to serve residential and commercial buildings. It utilizes digital and IoT-based “smart” cooling technologies, including real-time monitoring and predictive maintenance, to improve energy performance and reduce carbon emissions. In March 2025, KJTS Group, Malaysia-based energy-efficient cooling solutions provider and investment firm Stonepeak, created a joint venture for developing and investing in district cooling facilities.

LIST OF KEY RESIDENTIAL DISTRICT COOLING COMPANIES PROFILED

- Danfoss (Denmark)

- ARANER (UAE)

- ALFA LAVAL (Sweden)

- Engie (France)

- Empower (UAE)

- Emicool (UAE)

- SP Group (Singapore)

- Tabreed (UAE)

- Adani Cooling Solutions Limited (India)

- Vicinity Energy (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2024: Tata Power Trading Company Limited and Keppel, a Singapore-based global asset manager, have entered into a collaboration arrangement to launch sustainable Cooling-as-a-Service (CaaS) solutions in India. The partnership aims to provide state-of-the-art CaaS solutions delivered through the deployment of District Cooling Systems.

- March 2024: Saudi Arabia-based City Cool Cooling Company received a contract to develop a district cooling public-private partnership (PPP) project catering to Riyadh’s Diriyah tourism project.

- April 2023: Empower is working on a modernization and upgradation project for the Jumeirah Beach Residence (JBR) district cooling plant in Dubai. Advanced technologies will be integrated to improve the energy efficiency and reliability of the cooling system.

- May 2022: Daikin Singapore and SP Group allied to install the largest district cooling system in Singapore. The joint venture will focus on designing and developing the DCS, with SP providing chilled water-as-a-service to meet both the manufacturing and spatial cooling needs of STMicroelectronics.

- March 2022: District cooling service provider Empower received a contract worth USD 52.55 million for the construction of the plant. Total plant capacity is anticipated to reach 47,000 RT and will provide services to the Dubai Land Residence Complex (DLRC) region.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.17% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Thousand RT) |

|

Segmentation |

By Technology

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 5.58 billion in 2025 and is projected to reach USD 12.13 billion by 2034.

In 2025, the market value stood at USD 4.49 billion.

The market is expected to exhibit a CAGR of 7.17% during the forecast period.

The Absorption Chillers segment led the market by technology.

Urbanization and infrastructure development anticipated to support market growth

Danfoss, Araner, and Emicool are the top players in the market.

Middle East and Africa dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us