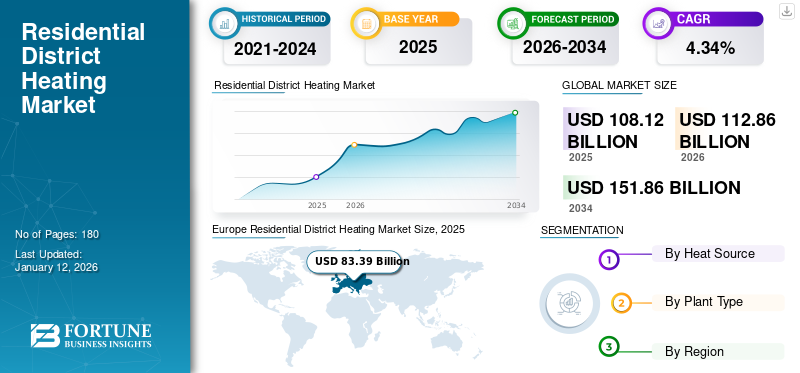

Residential District Heating Market Size, Share & Industry Analysis, By Heat Source (Coal, Natural Gas, Renewable, Oil & Petroleum Products, and Others), By Plant Type (Boiler, CHP, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global residential district heating market size was valued at USD 104.32 billion in 2025. The market is projected to grow from USD 112.86 billion in 2026 to USD 151.86 billion by 2034, exhibiting a CAGR of 4.34% during the forecast period. Europe dominated the global market with a share of 77.13% in 2025. Europe accounted for largest market share owing to the government inclination towards adoption and integrated heating systems and sustainable energy. Hence, these are factors are also anticipated to fuel the market growth in the region.

Residential district heating systems distribute thermal energy generated at a central plant through a network of insulated pipes to provide space heating and hot water to multiple buildings, including apartments, houses, and housing complexes. The market is driven by the increasing demand for energy-efficient, cost-effective, and environmentally sustainable heating solutions.

Danfoss, one of the major market players, provides comprehensive solutions for district heating systems, including substations, controls, and overall system optimization. The company focuses on improving energy efficiency and emission reduction, thereby enhancing comfort in residential buildings connected to district heating networks. Danfoss’s solutions are designed to balance heat supply with growing demand, ensuring optimal performance and minimizing energy consumption.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Government Policies and Energy Efficiency Regulations to Support the Market Growth

The residential district heating market is driven by the promotion of clean energy use, energy efficiency, and carbon reduction by governments and regulatory bodies. Government mandates and incentives across regions are encouraging developers and municipalities to adopt district heating systems. For instance, in Europe, the EU Energy Efficiency Directive and the European Green Deal promote energy-efficient heating systems to reduce carbon emissions and combat climate change. Provision of financial support for expanding or modernizing district heating systems further supports the market growth.

MARKET RESTRAINTS

High Initial Costs and Retrofitting Difficulties to Limit Market Expansion

The high upfront capital required to install heating systems is one of the primary factors affecting the market growth. This includes the cost of central heating plants, extensive underground pipeline networks, metering systems, and connection infrastructure. For new residential developments, this can add considerable expense, and often deter developers and municipalities from adopting these methods. Further, integrating district heating into existing residential spaces, particularly in older infrastructure, presents a set of technical challenges. Older residential buildings were not necessarily designed for integrating heating systems and thus may require crucial modifications. Hence, restraining the residential district heating market growth.

MARKET OPPORTUNITIES

Growing Urbanization to Provide Lucrative Opportunity for the Market Growth

Rapid urbanization and population growth are anticipated to influence the residential district heating market positively. The need for employment, better education, and improved standard of living has fueled urbanization. This surge leads to the development of residential buildings and other spaces, which necessitates the need for district heating solutions. Countries such as Germany, France, and others align their urban planning with district heating networks to optimize heating efficiency, reduce emissions, and lower costs for consumers. As cities continue to develop, the role of district heating in providing scalable, reliable, and clean residential heating is anticipated to grow.

RESIDENTIAL DISTRICT HEATING MARKET TRENDS

Integration of Renewable Energy and Smart Grid Technology Fuels the Market Growth

Latest trends in residential district heating focus on increased integration of renewable energy sources, smart grid technology, digitalization, and the development of more localized, decentralized systems. These advancements aim to improve efficiency, reduce carbon emissions, and enhance the flexibility of district heating networks. These renewable sources are becoming more prevalent in district heating systems to reduce reliance on fossil fuels and lower carbon footprints. Biomass, including wood and other organic matter, is being used, and waste heat from industrial processes and wastewater treatment plants is being captured and reused for the residential district heating purposes.

Segmentation Analysis

By Heat Source

Renewables Segment is Anticipated to Dominate Market Share Owing to the High Adoption Across Globe

Based on Heat Source, the market is classified into coal, natural gas, renewables, oil & petroleum products, and others.

The renewables segment is anticipated to dominate the market over the forecast period. Renewables are increasingly being integrated into district heating systems to promote sustainability and reduce carbon footprints. A variety of renewable sources, including biomass, solar thermal, geothermal, and waste heat recovery, can power residential district heating systems. These renewable sources can be used directly or indirectly to heat water and circulate it through a network of insulated pipes to supply heat to residential buildings.

Coal is widely used owing to its vast availability, widespread use, and cost-effectiveness. However, environmental concerns and stringent regulations have led to a decline in coal-based residential district heating.

By Plant Type

Combined Heat & Power (CHP) Plant is Anticipated to Grow Fastest Owing to its High Efficiency

The market is segmented based on plant type into boiler, CHP, and others.

Combined Heat and Power (CHP) segment is expected to dominate the market and is also expected to grow at fastest growth rate as CHP plant-powered residential district heating system is an economical and environmentally friendly method of producing electricity and heat for residential buildings. CHP facilities use the same fuel source, such as biomass or natural gas, to produce both heat and electricity. The excess electricity is either used to power the buildings or supply to the grid. The heat is then transferred to residential buildings via a system of pipes, giving hot water and heat.

Furthermore, Residential district heating (DH) demand through boiler plants is increasing due to factors like rising urbanization, growing environmental concerns, and the need for efficient and cost-effective heating solutions in densely populated areas. Boiler plants are a significant part of the DH market, offering flexibility and cost-effectiveness in meeting varying heat demands.

Residential District Heating Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

Europe

Europe Residential District Heating Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market with a valuation of USD 83.39 billion in 2025 and USD 87.05 billion in 2026. Europe leads the residential district heating market share adoption owing to its well-established infrastructure and supportive policies. Countries such as Germany, Denmark, and others have focused on district heating and promoted the adoption through incentives and regulations aimed at reducing carbon emissions. Further, these countries are increasingly integrating renewable energy sources into district heating networks. This supports the dual objective of increasing energy independence and supporting environmental goals.

North America

In North America, the push for energy-efficient solutions and the reduction of greenhouse gas emissions are significant driving factor for the market in the region. District heating offers a centralized approach that can be more efficient than individual heating units, aligning with regional sustainability objectives. Further, growing urbanization and modernization have necessitated reliable and efficient heating solutions. District heating provides a scalable solution that can meet the needs of urban areas and help in infrastructure modernization.

U.S.

The district heating market in the U.S. is experiencing growth, driven by factors like the need for energy efficiency, decarbonization goals, and urbanization. District heating systems offer a sustainable and cost-effective way to provide heating to multiple buildings from a central source, particularly in dense urban areas.

Asia Pacific

Rapid urbanization in Asia Pacific countries such as China, South Korea, and others leads to an increase in energy demand for efficient heating solutions, making district heating a crucial factor. Governments in the region are investing in district heating infrastructure to meet energy efficiency and address environmental issues. Investment in infrastructure development, including the expansion of heating networks and the integration of district heating systems into smart city initiatives, supports the growth of the market.

Rest of the World

In the rest of the world, a growing focus on energy efficiency is anticipated to promote the region’s growth. Growing awareness of the benefits of energy efficiency is supporting market growth as district heating helps reduce energy consumption and emissions and assists in meeting sustainability development objectives.

COMPETITIVE LANDSCAPE

Key Industry Players

Strategic Acquisition by Key Market Players to Seize Growing Opportunities is Growing in the Market

Private investment firms are looking for opportunities in different markets to diversify their portfolio as well as seize the benefits from growing sectors. For instance, in March 2021, Private investment firm – Partners Group acquired the District Heating Platform in the Baltics from Fortum Corporation, a Finland-based energy company. The acquisition is set to include 74 generation assets, with a heat generation capacity of 881 MW and power capacity of 130 MW across 387 kilometers of district heating networks.

LIST OF KEY RESIDENTIAL DISTRICT HEATING COMPANIES PROFILED

- Danfoss (Denmark)

- DALL ENERGY (Denmark)

- Veolia (France)

- ALFA LAVAL (Sweden)

- Engie (France)

- GE Vernova (U.S.)

- Fortum (Finland)

- Vattenfall (Sweden)

- Statkraft (Norway)

- SHINRYO CORPORATION (Japan)

KEY INDUSTRY DEVELOPMENTS

- April 2025: NTT Data unveiled a waste heat recovery project in Berlin with Quartierswerk Gartenfeld GmbH. 8MW of waste heat from NTT’s 17MW Berlin 1 Data Center will be provided to “Das Neue Gartenfeld,” a residential and commercial project in Berlin.

- October 2024: Equinix and Helen collaborated to supply heat generated at an Equinix data center, HE5 Viikinmäki, in nearby residential and commercial spaces. The project implements a heat pump system to capture leftover heat from the data center. The surplus heat generated by the data center is projected to satisfy the yearly heating needs of nearly 1,500 one-bedroom units.

- September 2024: Leeds’s South Bank secured approximately USD 26 million in funding to expand the Leeds PIPES district heating network further. The expansion will consist & benefit up to 28 buildings and up to 8,000 residents.

- May 2024: Google announced its offsite heat recovery project in association with city-owned energy provider Haminan Energia in Finland. The heat recovered from these Google Hamina data center will be sent to the district heating network and supplied to local households, schools, and public service buildings.

- November 2023: The government of the U.K. awarded approximately USD 44.5 million to a district heating system in West London to share data center waste heat with around 10,000 new homes.

REPORT COVERAGE

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.34% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (GWth) |

|

Segmentation |

By Heat Source

|

|

By Plant Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 104.32 billion in 2025 and is projected to reach USD 151.86 billion by 2034.

In 2025, the market value stood at USD 83.39 billion.

The market is expected to exhibit a CAGR of 4.34% during the forecast period.

The CHP segment led the market, by plant type.

Government policies and energy efficiency regulations anticipated to support market growth.

Danfoss, Veolia, and Vattenfall are the top players in the market.

Europe dominated the global market share in 2025.

Growing urbanization to influence market growth positively.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us