Respiratory Infections Antibiotics Market Size, Share & Industry Analysis, By Drug Class (Penicillin, Cephalosporin, Tetracycline, Macrolides, Fluoroquinolones, and Others), By Indication (Upper Respiratory Tract Infections (URTIs) and Lower Respiratory Tract Infections (LRTIs)), By Route of Administration (Oral, Parenteral, and Inhalation), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

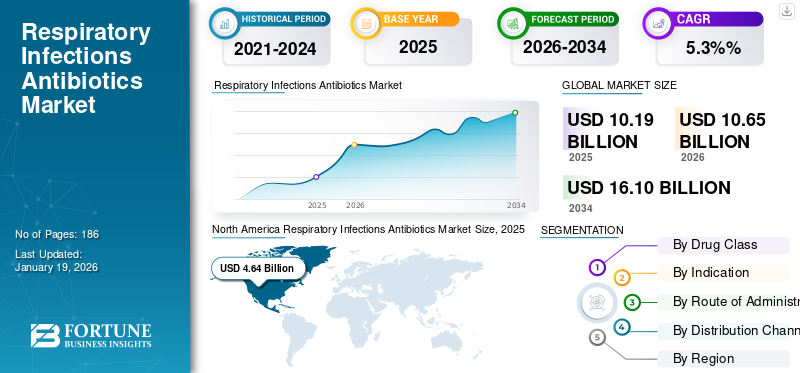

The global respiratory infections antibiotics market size was valued at USD 10.19 billion in 2025. The market is projected to grow from USD 10.65 billion in 2026 to USD 16.1 billion in 2034 at a CAGR of 5.30% during the forecast period. North America dominated the respiratory infections antibiotics market with a market share of 23.8% in 2025.

The respiratory infections antibiotics focuses on pharmaceutical treatments for upper and lower respiratory tract infections such as pneumonia, bronchitis, sinusitis, and others. The market is witnessing a notable growth trajectory owing to factors such as high prevalence of infectious respiratory diseases, increasing global awareness of antibiotic stewardship, and evolving bacterial resistance for antibiotics. These infections are one of the leading concerns associated with public health, hence antibiotics used for respiratory infections play a vital role in managing the same.

- For instance, as per the report titled “Global Tuberculosis Report 2024” published by the World Health Organization (WHO), in 2023, the number of individuals suffering from tuberculosis was around 10.8 million across the world. The disease is caused by Mycobacterium tuberculosis.

Furthermore, prominent players in the market, include Pfizer Inc., GSK plc., AbbVie Inc., and Merck & Co., Inc., among others. These companies are focusing on introducing new products to maintain their market positions.

MARKET DYNAMICS

MARKET DRIVERS

Rising Incidence of Respiratory Infections to Propel Market Growth

The prevalence of both acute and chronic respiratory infections is increasing globally, leading to higher demand for effective treatments. This growing prevalence is a significant global health concern and has a considerable impact on the on growth and development, particularly in children. Acute respiratory infections (ARIs), such as the common cold and pneumonia are among the most common illnesses worldwide, especially in children.

- For instance, according to UNICEF data published in November 2024, the incidence of pneumonia is more than 1,400 cases per 100,000 children around the world.

Additionally, adoption of rapid diagnostic tools for respiratory infections is increasing, allowing healthcare professionals to prescribe more targeted antibiotics instead of broad-spectrum drugs, reducing the risk of resistance. The confluence of all these factors is anticipated to significantly drive the respiratory infections antibiotics market growth over the forecast period.

MARKET RESTRAINTS

Increasing Antimicrobial Resistance (AMR) to Restrict Market Growth

Antimicrobial Resistance (AMR) is one of the major global concern associated with public health. It is exacerbated by misuse and overuse of antibiotics in treatment of various infectious diseases. This results in development of resistance mechanism by causative agent. Many upper respiratory tract infections are caused by viruses and these do not require antibiotics. However, they are often prescribed, leading to resistance development. Such scenarios create hindrance to the market growth up to a certain extent.

Additionally, the emergence and spread of drug-resistant bacteria, particularly Streptococcus pneumoniae, pose a significant threat to effective pneumonia treatment. In low-and middle-income regions, resistance to several antibiotics is relatively higher.

- For instance, according to a study published in July 2024 in the Journal of Pharmaceutical Health Care and Sciences, in Ethiopia, majority of the S. pneumonia strains are highly resistance to various antibiotics including clindamycin, azithromycin, and erythromycin.

MARKET OPPORTUNITIES

Development of Innovative Products for Less Common Pathogens Provides Lucrative Market Opportunity

With the surge in antibiotic-resistant bacteria, there is a growing need for the development of more effective and innovative medications to combat several respiratory infections. The research community is focusing on the development of products that can be managed through different routes apart from oral and parenteral.

Inhaled antibiotics offer targeted delivery to the lungs, potentially improving efficacy and reducing systemic side effects, especially for lower respiratory tract infections. They can be particularly useful in treating infections caused by antibiotic-resistant bacteria, such as Pseudomonas aeruginosa, which are common in cystic fibrosis. Thus, emphasis on offering inhaled antibiotic medications is anticipated to create growth opportunity for the market.

- For instance, according to a study published in Respiratory Medicine journal in June 2024, Colistin, Tobramycin, Ciprofloxacin, Levofloxacin, and Azithromycin are few inhaled antibiotic formulations that were investigated with promising outcomes.

MARKET CHALLENGES

Technological Challenges in Disease Diagnosis to Hamper Market Growth

The diagnosis of respiratory bacterial infections and deciding appropriate antibiotic treatment is one of the major challenge faced by the industry. Differentiating between bacterial and viral infections is a crucial part as repertory infections caused by both the agents share similar symptoms. For example, both viral and bacterial infections can cause cough, fever, and sore throat. This requires more precise and advanced diagnostic tools. Rapid and accurate diagnosis of respiratory infections is crucial for appropriate treatment, but some infections, including ventilator-associated pneumonia are difficult to diagnose. This leads to delayed treatment and poorer outcomes.

RESPIRATORY INFECTIONS ANTIBIOTICS MARKET TRENDS

Focus on Combination Therapies is a Significant Market Trend

To overcome the rapidly growing antibiotic resistance, various strategies are being undertaken by the market players and healthcare providers. The use of combinations of antibiotics or antibiotics with other therapies is one of the trends witnessed in the recent years. These combination therapies offer several advantages including reduced risk of resistance development, synergistic effect, and a broader spectrum of activity. These therapies are becoming more popular in outpatient care, reflecting demand for convenience and effectiveness.

- For instance, according to a study published in MDPI in June 2025, new β-lactam/β-lactamase combinations such as imipenem/relebactam, meropenem/vaborbactam, and ceftazidime/avibactam have shown effectiveness against carbapenem-resistant Enterobacterales.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Drug Class

Use of Penicillin as First-Line Treatment in Respiratory Infections Supports the Segment's Dominance

Based on the drug class, the global market is divided into macrolides, cephalosporin, penicillin, tetracycline, fluoroquinolones, and others.

The penicillin segment dominated the global market in 2024. This can be attributed to several factors such as its usage as first-line treatment for bacterial respiratory infections and its broad-spectrum activity. The common causes of respiratory infections include several gram-positive bacteria and penicillin and its derivatives such as ampicillin and amoxicillin are effective against these pathogens.

- For instance, according to an article published in American Family Physician Journal in November 2022, penicillin v or amoxicillin should be used in patients with group A beta-hemolytic streptococcal pharyngitis.

The tetracyclines segment held a substantial market share in 2024. Tetracyclines, especially given through oral route of administration are being used in clinical practice for several years to treat adult patients suffering from lower respiratory tract infections. Their increasing usage in treating community-acquired pneumonia (CAP) is one of the major factor supplementing the segment’s growth.

Other drug classes such as cephalosporin, macrolides, fluoroquinolones, and others are likely to witness a considerable growth in the coming years. Increasing cases of respiratory bacterial infections has driven this segmental growth.

By Indication

Rising Incidence of Lower Respiratory Tract Infections to Enhance Segment’s Growth

Based on indication, this market is segmented as upper respiratory tract infections (URTIs) and lower respiratory tract infections (LRTIs).

In 2024, the lower respiratory tract infections (LRTIs) segment dominated the market. Majority of the antibiotics are primarily used for lower respiratory tract infections and are highly effective. In LRTIs including pneumonia, bronchitis, and bronchiolitis, antibiotics are often an effective treatment. The rising cases of these infections is anticipated to drive the segment growth.

- For instance, according to the World Health Organization report in 2023, the highest number of new tuberculosis (TB) cases was reported in the Southeast Asia Region, accounting for 45.0% of total cases.

On the other hand, the upper respiratory tract infections (UTI) segment is likely to witness a notable growth throughout the forecast period. The increasing prevalence of bacterial respiratory infections such as whooping cough and others leads to increased demand for antibiotics.

By Route of Administration

High Effectiveness of Parenteral Antibiotics to Support Segmental Dominance

In terms of route of administration, the market is divided into oral, parenteral, and inhalation.

In 2024, the parenteral segment captured a leading respiratory infections antibiotics market share. This growth can be attributed to the rapid absorption and enhanced bioavailability of the parenteral dosage form. In addition, increasing regulatory approvals and strong clinical pipeline further supplement the segment growth.

- For instance, in September 2022, Evopoint Biosciences Co., Ltd. received the notice of drug clinical trial approval from the State Food and Drug Administration. This approval initiated Phase III clinical trial evaluating XNW4107 in combination with Imipenem/Cilastatin Sodium for the treatment of hospital-acquired bacterial pneumonia (HABP) and ventilator-associated bacterial pneumonia (VABP) caused by gram-negative bacteria.

On the other hand, the inhalation segment is expected to grow with a sustainable rate during the study period. Increasing number of candidates in clinical pipeline is anticipated to boost the segment growth.

- For instance, in May 2024, MannKind Corporation announced that the U.S. Food and Drug Administration (FDA) has granted Fast Track designation of Clofazimine Inhalation Suspension (MNKD-101) for the treatment of nontuberculous mycobacterial (NTM) lung disease.

By Distribution Channel

Online Pharmacy Segment to Exhibit Highest Growth Due to Its Advantages

The global market is divided into retail pharmacy, hospital pharmacy, and online pharmacy, based on distribution channels.

The online pharmacy segment is projected to grow at the highest CAGR during the forecast period due to increasing internet penetration, smartphone adoption, and digital transformation in the emerging countries. It offers improved convenience, addresses medication shortages, and expands access to healthcare products, especially in underserved regions.

Hospital pharmacy segment accounted for the largest market share in 2024. Hospital pharmacies are a major distribution channel for antibiotics, with a large proportion of patients obtaining their antibiotics through these settings. This fact supports the dominance of the segment. The number of infected individuals treated in hospital settings, particularly those requiring antibiotic therapy, influences the demand for antibiotics within these facilities. Additionally, the presence of pharmacists and other healthcare professionals within these settings also contributes to the growth of the segment.

RESPIRATORY INFECTIONS ANTIBIOTICS MARKET REGIONAL OUTLOOK

In terms of region, the global market is segmented into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Respiratory Infections Antibiotics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2024, the North America respiratory infections antibiotics market size was valued at USD 4.44 billion. The region is probable to maintain its dominance over the forecast period. Increasing cases of bacterial infectious diseases associated with respiratory tract, presence of advanced diagnostic infrastructure, and comprehensive antibiotic stewardship programs boosts the growth of the market.

- For instance, according to the study published in National Center for Biotechnology Information (NCBI) in June 2022, during the period 2019–2020, pneumonia was the sixth leading cause of hospitalization across the individuals of all ages in Canada.

U.S.

The U.S. captured a dominating share of the North America market in 2024. Key factors contributing to this includes rising number of respiratory infectious disease cases, new product launches by the key players, and strong presence of well-established and emerging companies in the country. Furthermore, strategic initiatives undertaken by operating players further supported the U.S. market growth.

Europe

European market captured the second-leading position of the market in 2024. Higher investment in research and development across European countries is projected to boost the market growth in the region. Additionally, active involvement of organizations & committees to increase awareness coupled with growing incidence of respiratory diseases supports the region’s growth.

- For instance, in England, the U.K. Health Security Agency (UKHSA) provisionally reported 14,905 laboratory-confirmed cases of pertussis from January to December 2024.

Asia Pacific

The market in Asia Pacific is projected to grow with the fastest rate over the study period. High disease burden of respiratory infections, and rising anti-microbial drug resistance cumulatively propel the regional market's growth. Additionally, presence of large population and growing geriatric individuals, which is more liable to respiratory infections in Asian countries, drive the market growth.

- For instance, according to the World Health Organization report in 2023, approximately 87.0% of new TB cases were concentrated in 30 high-burden countries, with over two-thirds of the total coming from the Democratic Republic of the Congo, Bangladesh, India, Indonesia, China, Pakistan, and the Philippines.

Latin America and Middle East & Africa

The Middle East & Africa and Latin American markets are likely to grow with a moderate rate in the coming years. Increasing cases of bacterial respiratory infections such as tuberculosis, pertussis, pneumonia, sinusitis, and others among these regions is anticipated to augment the regional market growth.

- For instance, as per the report published by WHO in 2023, in South Africa an incidence rate of 468 per 100000 of the population has resulted in a particularly high burden of tuberculosis.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players are focusing on Strategic Initiatives to Strengthen their Market Positions

The competitive landscape for market demonstrates a fragmented structure. It comprises of numerous entities offering branded as well as generic products. Some of the prominent players include GSK plc., Pfizer Inc., Merck & Co., Inc., Bayer AG and others. These companies undertake various strategic initiatives to maintain their market positions.

- For instance, in 2020, Bayer AG, pharmaceutical company in collaboration with GSK, Merck & co., and other major pharmaceutical giants invested USD 1.0 billion and launched AMR action fund for discovery of new antibiotics at the end of decade.

Other key players with a notable presence in the global market include Cipla, Bristol-Myers Squibb Company, and AdvaCare Pharma. These companies focus on launch of new innovative products, and launch of generic products to increase their market presence.

LIST OF KEY RESPIRATORY INFECTIONS ANTIBIOTICS COMPANIES PROFILED

- Pfizer Inc. (U.S.)

- GSK plc. (U.K.)

- Sandoz Group AG (Switzerland)

- Bayer AG (Germany)

- Bristol-Myers Squibb Company (U.S.)

- Merck & Co., Inc. (U.S.)

- Cipla (India)

- AbbVie Inc. (U.S.)

- AdvaCare Pharma (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2024: Pfizer Inc. revealed its scientific advancements in respiratory and other infectious diseases at the IDWeek 2024.

- August 2024: Merck & Co., Inc., evaluated ZERBAXA (ceftolozane and tazobactam) in a Phase I PK and safety study of pediatric patients with HABP/VABP, following it’s previous approval for the treatment of HABP/ VABP in adults caused by certain gram-negative pathogens

- July 2024: Johnson & Johnson Services, Inc. received the U.S. FDA approval for SIRTURO for the treatment of pulmonary tuberculosis. It is a diarylquinoline antibiotic prescription medicine.

- October 2022: Merck &Co., Inc. in collaboration with Bill & Melinda Gates Medical Research Institute revealed licensing agreement for novel tuberculosis antibiotic candidates.

- May 2021: Teva Pharmaceuticals Inc. introduced generic Erythromycin tablets in 250 mg and 500 mg strengths. The erythromycin tablets are indicated for treating various bacterial infections including respiratory bacterial infections.

REPORT COVERAGE

The global respiratory infections antibiotics market report provides detailed in-depth industry analysis. It focuses on key aspects, such as new product launches, the rising number of respiratory tract infections in key countries, and guidelines or considerations for the use of these products across the world. Additionally, it includes key industry developments such as mergers, partnerships, & acquisitions, and brand analysis. Besides these, market analysis offers insights into the market trends and comprises a detailed pipeline analysis of new drugs.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.30% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Drug Class

|

|

By Indication

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 10.19 billion in 2025 and is projected to reach USD 16.1 billion by 2034.

In 2025, market value in North America stood at USD 4.64 billion.

Registering a CAGR of 5.3% the market will exhibit steady growth over the forecast period.

Based on drug class, the penicillin segment leads the market.

The rising incidence of respiratory tract infections is the prominent aspect propelling the market growth.

GSK plc., Pfizer Inc., Abbvie Inc., and Merck & Co., Inc. are some of the leading players in the global market.

North America dominated the global market with a share of 23.8% in 2025

The increasing cases of respiratory infections across the world and the rising awareness regarding these diseases are likely to drive the growth and adoption of the products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us