Road Haulage Market Size, Share & Industry Analysis, By Service Type (Full Load (FTL) and Partial Load (LTL)), By Distance (Long Haul and Short Haul), By End-user Industry (Mining & Quarrying, Construction, FMCG, Agriculture, Manufacturing, Automotive, Healthcare, and Others), By Cargo Type (Dry Cargo, Refer Cargo, Liquid Cargo, and Specialized Cargo), By Route (Domestic and International), By Vehicle Type (Light, Medium, and Heavy), and Regional Forecast, 2026-2034

Road Haulage Market Size

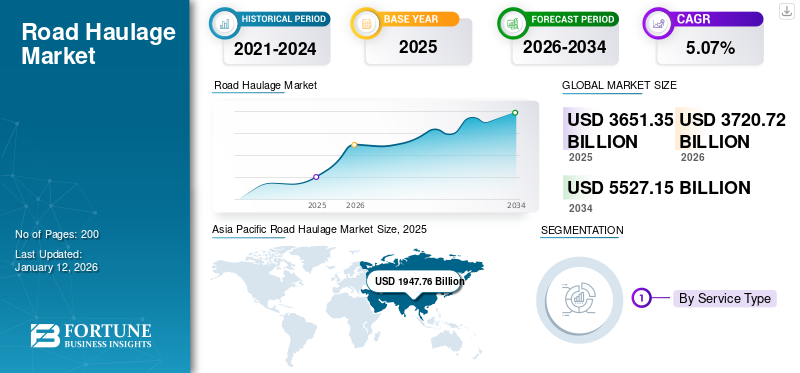

The global road haulage market size was valued at USD 3,651.35 billion in 2025 and is projected to grow from USD 3,720.72 billion in 2026 to USD 5,527.15 billion by 2034, exhibiting a CAGR of 5.07% during the forecast period. Asia Pacific dominated the market, accounting for 53.34% of the market share in 2025.

Road haulage refers to the transportation of goods by road using vehicles such as trucks, lorries, vans, and others. It plays a decisive role in the logistics and supply chain industry, providing flexibility for delivering products over both short and long distances. Road haulage operations can be local, regional, or international, and usually entail transporting goods directly from one point to another.

The road haulage market is witnessing a growing trend in the adoption of electric and autonomous vehicles, aiming to reduce carbon emissions and improve efficiency. However, high initial equipment cost restrains market growth. The growing demand for e-commerce and last-mile delivery services is fueling market growth, as businesses seek fast and efficient road transport solutions.

DHL, XPO Logistics, DB Schenker, and UPS, among others, are expected to lead the market in 2024. These companies are focused on improving service efficiency, network reach, and technological development, such as digital freight management. Strategic partnerships, acquisitions, and fleet expansions further shape the competitive landscape of the market.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Globalization and Supply Chain Expansion Drives Market Growth

Globalization and supply chain expansion are key drivers of market growth, increasing the need for efficient transportation networks to connect manufacturers, suppliers, and consumers across regions. As businesses source raw materials from diverse global locations and distribute products worldwide, road freight transportation plays a crucial role in ensuring the timely and cost-effective movement of goods.

The demand for reliable and flexible road haulage services continues to grow as companies expand into new markets. This globalization trend boosts road transport demand for cross-border and regional deliveries, making it a critical component of modern supply chains. According to TRIP, the U.S. freight transportation network plays a vital role in facilitating the movement of raw materials, intermediate goods, and finished products across various locations. This essential supply chain, crucial to the nation’s quality of life, consists of a complex, intermodal system that includes over four million miles of roads in 2021.

Market Restraints

High Initial Equipment Cost Restrains Market Growth

The high initial cost significantly restrains the growth of the market, as these trailers require substantial investment due to their complex design, customization, and advanced features. This upfront cost causes a barrier for smaller businesses or those with limited budgets.

Additionally, ongoing maintenance and operational costs further challenge market expansion. These trailers require specialized parts and skilled technicians for repairs, leading to high maintenance expenses. Regular inspections and operational upkeep add to the total cost of ownership, making it a financial burden for buyers, especially during economic uncertainty. As a result, companies may hesitate to invest in customizable trailers, slowing market adoption and growth. The high costs also create a barrier to entry for businesses considering modular transport solutions.

Market Opportunities

E-commerce Boom to Present Significant Market Opportunities

As online shopping increases, the demand for fast and reliable delivery services grows. Road freight transportation companies are crucial in moving goods from warehouses to consumers, especially for last-mile deliveries. The rise in consumer expectations for quicker, more flexible deliveries has further strengthened the importance of road transport in meeting these needs. E-commerce giants require efficient logistics networks, including real-time tracking, fast transit times, and the ability to handle smaller, frequent shipments. These factors are driving demand for road freight transportation, fueling market expansion.

In November 2024, the Census Bureau of the Department of Commerce announced that retail e-commerce sales for the third quarter of 2024, adjusted for seasonal disparity but not for price changes, totaled USD 300.1 billion, reflecting a 2.6% increase from the second quarter of 2024. Total retail sales for the same period were estimated at USD 1,849.9 billion, marking a 1.3% increase from the second quarter. E-commerce sales for Q3 2024 grew by 7.4% compared to Q3 2023, while total retail sales rose by 2.1% during the same period. E-commerce accounted for 16.2% of total retail sales in Q3 2024, highlighting its growing influence on the market.

Market Challenges

Driver Shortages Are a Significant Obstacle for Market Expansion

A lack of qualified drivers leads to operational inefficiencies, increased labor costs, and delays in deliveries, ultimately affecting the reliability and profitability of logistics companies. The shortage is aggravated by an aging workforce, long working hours, and the demanding nature of the job, which deters younger people from entering the profession. This results in a higher turnover rate and recruitment difficulties, especially in regions such as North America and Europe.

Consequently, companies may struggle to meet rising demand, especially in e-commerce-driven markets, hampering the sector's ability to scale effectively. Addressing this issue is crucial for maintaining competitiveness and ensuring the efficacy of transportation networks. In July 2024, IRU reported preliminary findings indicating that 48% of European companies anticipate greater challenges in filling truck driver positions in the coming year.

ROAD HAULAGE MARKET TRENDS

Growing Adoption of Electric and Hybrid Vehicles Drives Market Development

Electric and hybrid vehicles are becoming one of the key road haulage market trends driving the growth, due to increasing sustainability concerns and regulatory pressure on emissions. These vehicles help companies reduce their carbon footprint while ensuring compliance with stricter environmental regulations. Additionally, they offer long-term cost savings by lowering fuel and maintenance expenses, making them an attractive investment. As technology advances, electric trucks are becoming more efficient, with better range and charging infrastructure.

Additionally, governments and businesses are incentivizing the adoption of green transport solutions. This shift toward cleaner vehicles is crucial for reducing emissions and helping companies enhance their environmental responsibility, making them appealing to eco-conscious consumers and business partners, which fuels market growth. In July 2024, UCSF Logistics made a notable stride toward environmental sustainability by adding its first Electric Vehicle (EV) to its fleet. This move represents a key milestone in UCSF’s ongoing efforts to reduce carbon emissions and promote eco-friendly practices throughout its operations.

Impact of COVID-19

Disruption in the Global Supply Chain and Reduced Freight Demand Hampered Market Growth

The COVID-19 pandemic had a significant effect on the global market. Initially, lockdowns and travel restrictions disrupted global supply chains, leading to reduced freight demand and delays in deliveries. Many businesses faced temporary closures, resulting in a decline in road transport activities. However, the rise in e-commerce and essential goods transportation, including medical supplies and groceries, drove increased demand for road hauling services, especially for last-mile deliveries.

The pandemic also highlighted the need for flexible and resilient logistics networks. On the downside, the industry faced labor shortages, health concerns, and stricter safety protocols, which added operational challenges. Despite these disruptions, the pandemic accelerated the adoption of technology, such as digital freight platforms and contactless solutions, shaping the future of the market in the post-pandemic era.

SEGMENTATION ANALYSIS

By Service Type

Full Load (FTL) Segment Dominated due to its Cost-effectiveness

On the basis of service type, the market is segmented into Full Load (FTL) and Partial Load (LTL).

The Full Load (FTL) segment held the largest market with a share of 80.00% in 2026. The growth of the Full Load (FTL) segment is primarily driven by the increasing demand for direct, efficient transportation of large volumes of goods. FTL offers cost savings through dedicated truckloads, reducing handling and transit times, making it ideal for businesses with bulk shipments. This service is particularly attractive for industries such as manufacturing, retail, and e-commerce, where timely and secure delivery of large quantities is crucial for maintaining supply chain efficiency.

The Partial Load (LTL) segment is expected to grow at the fastest CAGR during the forecast period. The growth of the Partial Load (LTL) segment is driven by the rising demand for cost-effective transportation solutions for smaller shipments. LTL allows businesses to share truck space, reducing transportation costs for shipments that don’t require a full truckload. This model is particularly beneficial for small to medium-sized businesses, offering flexibility, lower shipping costs, and the ability to consolidate shipments, making it a cost-effective and fuel-efficient option across diverse industries.

For instance, U.S. less-than-truckload (LTL) carriers are proactively preparing for an anticipated surge in demand by expanding their terminal capacity, despite the current sluggish freight market. Industry players expect increased demand for industrial freight and retail goods in 2025 and believe the market lacks sufficient LTL capacity to meet that growth. In January 2025, Central Transport and R+L Carriers finalized agreements to acquire real estate from the bankrupt Yellow Corp, with purchase deals totaling USD 66.5 million for four of Yellow’s LTL terminals.

By Distance

Growing Global Trade and E-commerce Activities Drive Long Haul Segment Growth

By distance, the market is segregated into long-haul and short-haul.

The long-haul segment dominates the market with a share of 56.94% in 2026. The segment is also estimated to progress with the fastest-growing CAGR over the forecast period. The expansion of the long-haul segment is fueled by the rising demand for transporting goods over long distances, especially in global trade and e-commerce. Long-haul services provide cost-effective solutions for moving large volumes of goods across regions and countries. As international trade grows and supply chains become increasingly interconnected, businesses need efficient and reliable transportation to cover extensive distances, driving continued growth in the long-haul segment. The segment is expected to capture 57% of the market share in 2025.

The short-haul segment market held a sustainable share of the market in 2024. The growth of the segment is attributed to the rising demand for quick and flexible transportation of goods over shorter distances, particularly within regional or local markets. Short-haul services are crucial for last-mile delivery, supporting e-commerce, retail, and perishable goods sectors. These services offer fast turnaround times, reduced fuel costs, and more frequent deliveries, making them ideal for industries requiring timely, small-scale shipments over relatively short distances. This segment is likely to grow with a considerable CAGR of 4.70% during the forecast period (2025-2032).

By End-user Industry

Increasing Demand for Raw Materials Boosted the Mining & Quarrying Segment Growth

Based on end-user industry, the market is categorized into mining & quarrying, construction, FMCG, agriculture, manufacturing, automotive, healthcare, and others.

The mining & quarrying segment dominated the market with a share of 22.86% in 2026. The growth of the mining and quarrying segment is propelled by the increasing demand for raw materials such as minerals, metals, and aggregates. Road haulage plays a vital role in transporting heavy, bulky goods from mines and quarries to processing plants or distribution centers. As infrastructural developments, construction, and manufacturing sectors expand, the need for efficient, reliable transport of these materials grows, boosting demand for freight transportation services within the mining and quarrying industries. This segment is poised to hold 23% of the market share in 2025.

The healthcare sector is expected to experience the highest growth rate, with a CAGR of 6.8% during the forecast period from 2025 to 2032. The increasing demand for the timely and safe transportation of pharmaceuticals, medical devices, and supplies drives the growth of the segment. Road freight transportation plays a crucial role in ensuring efficient, temperature-controlled deliveries for sensitive healthcare products, such as vaccines and biologics. The expansion of the healthcare sector, particularly in e-commerce and online pharmacies, has heightened the need for reliable, fast, and secure transportation. This trend boosts the demand for specialized services within this industry.

The construction segment is estimated to grow with a substantial CAGR of 6.30% during the forecast period (2025-2032).

By Cargo Type

Increasing Demand for Non-Perishable Goods Encouraged the growth of the Dry Cargo Segment Growth.

Based on cargo type, the market is divided into dry cargo, refrigerated cargo, liquid cargo, and specialized cargo.

The dry cargo segment dominated the market with a share of 53.80% in 2026. The growth of the segment is driven by the increasing demand for the transportation of non-perishable goods such as textiles, machinery, chemicals, and consumer products. Dry cargo transportation is essential for industries requiring safe, efficient, and cost-effective delivery of bulk or packaged goods. The rise in global trade, e-commerce, and manufacturing activity further fuels the demand for reliable dry cargo services. This segment is anticipated to capture 53.90% of the market share in 2025.

The specialized cargo segment is anticipated to grow at the highest CAGR of 6.10% during the forecast period from 2025 to 2032. The growth of the specialized cargo segment is fueled by the increasing need to transport high-value, fragile, or temperature-sensitive goods such as electronics, pharmaceuticals, and perishable items. These goods require specialized equipment, such as refrigerated trucks or secure containers, to ensure safe and efficient delivery. As industries such as healthcare, technology, and food processing expand, the demand for tailored transport solutions to handle these specific types of cargo continues to rise, driving the expansion of the specialized cargo segment.

To know how our report can help streamline your business, Speak to Analyst

By Route

Increasing Demand for Local Goods Drives the Domestic Segment Growth

Based on the route, the market is divided into domestic and international.

The domestic market held the largest road haulage market share in 2024. The increasing demand for proficient, cost-effective transportation of goods within national borders drives the growth of the domestic segment. Domestic haulage plays a crucial role in facilitating regional trade, e-commerce, and supply chain management. As consumer expectations for faster deliveries rise, businesses are focusing on optimizing domestic routes to reduce costs and improve delivery speed. Enhanced infrastructure, technological advancements, and a growing demand for local goods further fuel the growth of this segment. This segment is expected to gain 68.00% of the market share in 2025.

The international segment is projected to grow at the highest CAGR of 5.20% during the forecast period from 2025 to 2032. The expansion of global trade and cross-border logistics drives the growth of international road haulage during the forecast period. As international commerce increases, efficient transportation of goods between countries becomes essential.

Road freight transportation is a cost-effective solution for long-distance freight movement, especially between neighboring countries or regions with well-developed road networks. Additionally, improvements in border infrastructure, customs processes, and the rise of free trade agreements further support the growth of international road transport, meeting the demand for faster and more reliable deliveries.

In July 2023, the American Trucking Association reported that trucks transported 61.9% of the value of surface trade between the United States and Canada and 83.5% of cross-border trade with Mexico, totaling USD 947.92 billion in goods in 2022.

By Vehicle Type

Increasing Demand for Cost-Effective Transportation Solutions Helps the Light Segment to Lead

By vehicle type, the market is segmented into light, medium, and heavy.

The light segment dominated the market in 2024. The growth of the light vehicle segment is driven by the increasing demand for small, flexible, and cost-effective transportation solutions, particularly for urban and last-mile deliveries. Light commercial vehicles, such as vans and small trucks, are ideal for delivering smaller shipments quickly within cities, serving e-commerce, retail, and service industries. Their ability to navigate congested urban areas and reduce transportation costs for smaller loads makes them highly attractive, fueling growth in this segment. This segment is foreseen to attain 40.30% of the market share in 2025.

The heavy segment is expected to experience the highest CAGR of 5.20% during the forecast period from 2025 to 2032. The growth of the segment is supported by the increasing demand for the transportation of bulk goods, machinery, and large-scale industrial products. Heavy commercial vehicles, such as flatbeds, tankers, and heavy-duty tractors, are essential for industries such as construction, mining, and manufacturing. Their ability to transport large volumes over long distances efficiently supports global trade and road infrastructure projects. The expansion of industrial sectors and infrastructure development further boosts the demand for heavy vehicles.

ROAD HAULAGE MARKET REGIONAL OUTLOOK

Asia Pacific

Asia Pacific Road Haulage Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific led the market with a value of USD 1947.76 billion in 2025 and USD 1994.07 billion in 2026, and is also projected to achieve the fastest compound annual growth rate (CAGR) during the forecast period from 2026 to 2034. The Asia Pacific road haulage market is expanding rapidly due to urbanization, industrialization, and the growing e-commerce sector, particularly in China, India, and Japan.

The region’s infrastructure development, including improvements to road networks, toll systems, and logistics hubs, is enhancing efficiency in transport. In addition, the rise of manufacturing in China and Southeast Asia has led to increased demand for raw materials and goods transportation. The Japanese market is projected to reach USD 84.87 billion by 2026, and the Chinese market is projected to reach USD 978.46 billion by 2026. The growing middle class also fuels demand for fast delivery services, particularly in urban centers.

According to Niti Aayog, India transported approximately 4.6 billion tons of freight in 2022, generating a transport need of 2.2 trillion ton-kilometers (ton-km). With rising demand for goods driven by urbanization, population growth, the expansion of e-commerce, and increasing income levels, freight movement via roads is expected to grow significantly, reaching 9.6 trillion ton-km by 2050. India is set to gain USD 394.9 billion in 2026, while Japan is predicted to stand at USD 383.39 billion in the same year.

North America

North America is the third-largest market, expected to reach USD 749.65 billion in 2026. North America held a sustainable market share in 2026, driven by the strong demand for e-commerce and logistics services, particularly in the U.S. Increasing cross-border trade with Canada and Mexico also plays a key role. Additionally, infrastructure investments, including the expansion of highways and logistics hubs, boost operational efficiency. The adoption of advanced technologies such as fleet management systems, telematics, and autonomous vehicles further supports market growth by enhancing efficiency and safety and reducing operational costs.

According to the International Trade Administration, U.S. Department of Commerce, global e-commerce sales for B2B businesses have been consistently increasing year after year. The global B2B e-commerce market is likely to reach USD 36 trillion by 2026. The majority of this B2B sales value is driven by sectors such as advanced manufacturing, energy, healthcare, and professional business services. The U.S. market is expected to grow with a value of USD 625.16 billion in 2026.

Europe

Europe is the second-largest market, anticipated to be valued at USD 857.74 billion in 2026, exhibiting a CAGR of 3.60% during the forecast period (2026-2034). The region held the second-largest market share in 2024. Several factors, including stringent environmental regulations and increasing demand for sustainable transportation solutions, influence Europe’s road haulage market growth. The shift toward electric vehicles and hybrid vehicles is accelerating due to government incentives and emission reduction targets.

The region’s robust manufacturing industry and strong intra-European trade also contribute significantly to the demand for road freight. Furthermore, advanced logistics infrastructure, including major port hubs and highways, facilitates efficient transport, boosting growth in Germany, France, and the U.K. The Polish market is projected to reach USD 161.58 billion by 2026, and the German market is projected to reach USD 112.92 billion by 2026.

Rest of the World

The rest of the world is the fourth leading region set to acquire USD 110.91 billion in 2025. In the rest of the world, regions such as the Middle East, Africa, and Latin America are witnessing growth in the market due to improving infrastructure, expanding trade, and industrialization. Investments in transportation networks, including roads and ports, are enhancing connectivity and operational efficiency. In the Middle East, the oil and gas sector drives demand for heavy cargo transport, while in Africa, rapid urbanization and rising consumer demand fuel last-mile delivery services. Additionally, increased trade with Europe and Asia is boosting road transport needs across these regions.

Competitive Landscape

Key Market Players

Sustainability Practice with EV Fleet Adoption Provides Competitive Edge

The global road haulage market is highly competitive, with numerous companies operating across various segments, from small regional carriers to large multinational logistics companies. Key players, including DHL, XPO Logistics, DB Schenker, and UPS, dominate the market by leveraging advanced technologies, extensive fleets, and global networks to offer comprehensive transport solutions. Smaller regional companies compete by focusing on specialized services, such as last-mile delivery, pharmaceuticals, or perishable goods.

Competition is further intensified by the rise of digital platforms, which connect shippers with carriers, increasing efficiency and reducing costs. Companies are increasingly embracing sustainable practices, such as using electric vehicles, to differentiate themselves in an environmentally conscious market and maintain their position in the market. DHL is a leading player in the market, offering extensive freight transportation services. The company operates a vast logistics network, providing Full-Truckload (FTL) and Less-Than-Truckload (LTL) solutions across Europe, Asia, and the North American region.

List of Key Road Haulage Companies Profiled:

- DHL Logistics (Germany)

- XPO Logistics (U.S.)

- DB Schenker (Germany)

- UPS (U.S.)

- FedEx (U.S.)

- Kuehne + Nagel (Switzerland)

- C.H. Robinson (U.S.)

- Geodis (France)

- Yusen Logistics (Japan)

- Toll Group (Australia)

- Penske Logistics (U.S.)

- CEVA Logistics (Switzerland)

- J.B. Hunt Transport Services (U.S.)

- Maersk Logistics (Denmark)

Key Industry Developments

December 2024: At Saudi Arabia’s leading supply chain and logistics conference, IRU showcased how AI and digital innovation can enhance road transport efficiency and sustainability. The IRU Examiner introduced standardized methodologies and transparent certification processes to support road transport qualifications, ensuring compliance and trust. Additionally, IRU RoadMasters provided a digital skill-profiling solution for drivers, helping companies assess knowledge and competencies to mitigate performance gaps.

July 2024: The IRU released the European road freight rates for Q2 2024. The Upply x Ti x IRU European Road Freight Rates Index revealed a 1.3-point decline in the contract index Quarter-on-Quarter (q-o-q). On the other hand, the spot rate index increased by 3.5 points Q-o-Q. Compared to the previous year, the spot index rose by 0.8 points, while the contract index decreased by 0.7 points. The Q2 2024 European Road Freight Spot Rate Benchmark Index reached 127.7 points, marking a 3.5-point increase from Q1 2024 and a 0.8-point rise year-on-year.

June 2024: The EU and Ukraine agreed to extend and update their existing road transport agreement. The agreement is designed to support Ukraine's access to global markets by easing transit through EU countries and strengthening its connections with the EU market. Initially signed on 29 June 2022 following Russia's full-scale invasion of Ukraine, the agreement has significantly boosted road trade between Ukraine and the EU, benefiting both economies. The agreement is extended until 30 June 2025, with an automatic six-month renewal, unless either party objects with strong evidence of a major disruption in its road transport market or a clear failure to meet the agreement’s objectives.

March 2024: The EU and Moldova agreed to extend the validity of their existing road transport agreement until 31 December 2025. The agreement is designed to support Moldova's access to global markets by easing transit through EU countries and enhancing its connections with the EU market. Originally signed on 29 June 2022, this agreement has significantly boosted road exports from Moldova to the EU, benefiting both economies.

March 2023: Iran and Uzbekistan signed an agreement to establish comprehensive transport cooperation. Iran's Deputy Transport Minister announced the country's readiness to facilitate the transit of one million tons of freight from Central Asia and to attract investment to Iran's southern ports.

February 2022: AS Bercman Technologies, the University of Tartu, Tartu Linnatransport, Traffest OÜ, and Modern Mobility OÜ signed a cooperation agreement to test self-driving vehicles for on-demand transport services and validate the required technological solutions and processes.

Investment Analysis and Opportunities

Rising Vehicle Demand and Technological Advancements Fuel Market Opportunity

The global road haulage market offers significant investment opportunities driven by technological advancements, sustainability trends, and expanding demand for logistics services. Investments in fleet modernization, including electric and hybrid vehicles, are becoming crucial due to growing environmental regulations and the need for cost-effective, low-emission transport solutions. Additionally, the adoption of automation, artificial intelligence, and telematics for route optimization, real-time tracking, and enhanced efficiency presents lucrative prospects for investors.

As e-commerce and global trade continue to develop, especially in emerging markets, the demand for reliable and efficient road transport services is increasing. Strategic investments in infrastructure, including logistics hubs, smart transport systems, and digital freight platforms, have the potential to drive significant growth in this expanding market in the coming years.

In January 2025, DHL Supply Chain acquired Inmar Supply Chain Solutions, a division of Inmar Intelligence specializing in retail e-commerce returns solutions. This acquisition positions DHL as the largest reverse logistics provider in North America, integrating 14 return centers and 800 associates into its network of over 520 warehouses and 52,000 employees. The deal enhances DHL's capabilities in product remarketing, recall management, and supply chain analytics while expanding value-added services for customers. Amid rising e-commerce returns, this move supports DHL's goal of offering comprehensive supply chain solutions and aligns with its sustainability and growth strategy targeting 50% revenue growth by 2030.

Report Coverage

The global road haulage market research report analyzes the market in-depth. It highlights crucial aspects such as prominent companies, market segmentation, competitive landscape, service type, distance, end-user industry, cargo type, route, and vehicle type. Besides this, the market research report provides insights into the market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, the report encompasses several factors contributing to the market growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.07% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service Type

By Distance

By End-user Industry

By Cargo Type

By Route

By Vehicle Type

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 3,720.72 billion in 2025 and is anticipated to reach USD 5,527.15 billion by 2034.

The market will exhibit a CAGR of 5.07% over the forecast period (2026-2034).

In 2025, the Full Load (FTL) segment held the largest market share.

Rising demand for electric vehicles is a key factor propelling market growth.

DHL, XPO Logistics, DB Schenker, and UPS Logistics are some of the leading players in the market

In 2025, Asia Pacific region led the global market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us