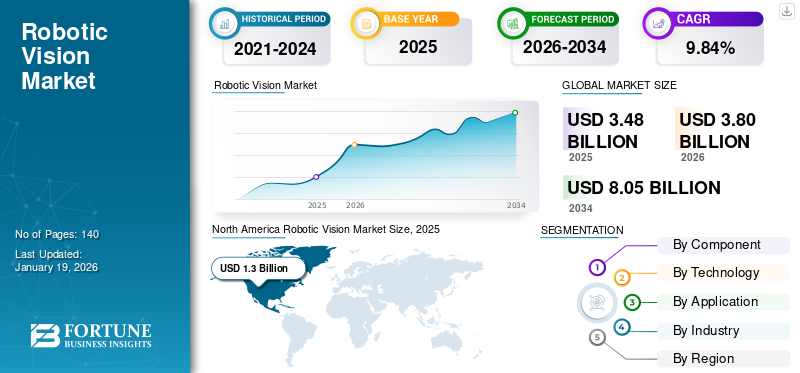

Robotic Vision Market Size, Share & Industry Analysis, By Component (Hardware (Cameras, LED Lighting, Optics, Processors & Controllers, and Frame Grabbers) and Software), By Technology (2D Vision, 3D Vision, Laser-based Vision, Structured Light Vision, and Others), By Application ,By Industry (Automotive, Electronics and Electrical, Food & Beverage, Metals and Machinery, Logistics, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global robotic vision market size was valued at USD 3.48 billion in 2025 and is projected to grow from USD 3.8 billion in 2026 to USD 8.05 billion by 2034, exhibiting a CAGR of 9.84% during the forecast period. North America dominated the global robotic vision market with a share of 37.38% in 2025.

Robotic vision is the technology that allows robots to perceive and understand their surroundings by analyzing visual information. Major players in this market are Cognex Corporation, Keyence Corporation, FANUC Corporation, ABB Group, Sick AG, Teledyne DALSA, Omron Corporation, Basler AG, Hexagon AB, and Qualcomm Technologies, Inc.

The market’s expansion is primarily driven by the rising implementation of 3D vision systems in industrial robotics and the emergence of Industry 4.0. Additionally, government initiatives promoting industrial automation, along with the rising use of machine vision systems in various end-use sectors, will increase market share. Rising need for better quality control further pushes market growth, since firms aim to cut down defects and raise efficiency in operation. According to PatentPC, Vision systems reduce inspection errors by over 90% compared to manual inspection.

The COVID-19 pandemic accelerated the development of vision-guided robots that minimize human interaction across various sectors. For example, the U.S. company, Orrbec, partnered with Chinese robot manufacturers to integrate its 3D camera technology into robots for healthcare applications. Following the pandemic, the market is expanding rapidly due to the growing acceptance of cognitive humanoid robots.

IMPACT OF GENERATIVE AI

Generative AI is redefining robotic perception by enabling them to see, understand, and interact with the world in increasingly sophisticated ways. Leveraging generative models and large-scale data-driven learning, the current capability of robots to create, process, and critically synthesize visual information has taken a new dimension, leading to enhanced perception, control, and adaptability. In March 2025, Google introduced its most advanced vision language model, Gemini Robotics, a Gemini 2.0-based model designed for robotics.

IMPACT OF RECIPROCAL TARIFFS

In 2025, U.S. reciprocal tariffs are dramatically changing the robotic vision industry, increasing costs, forcing a restructuring of global supply chains, and incentivizing domestic production and integration. While these tariffs present substantial obstacles for firms dependent on imports and may potentially slow innovation, they also create avenues for domestic enterprises and supply chain collaborators that can rapidly realign their approaches.

MARKET DYNAMICS

Market Drivers

Rising Adoption of Smart Cameras in Robotic Vision Systems to Aid Market Growth

A smart camera is a compact device that combines image capture, processing, and analysis into a single unit capable of performing data processing in real-time for improved speed and efficiency. It can be easily integrated across different industries, helping reduce costs by cutting down on hardware requirements and lowering the need for data transfer. The use of smart cameras in robotic vision is increasingly playing an important role in driving drastic changes in sectors such as manufacturing, logistics, or automotive, enabling improved automation accompanied by enhanced precision.

Market Restraints

Shortage of Highly Skilled Personnel to Hinder Market Expansion

The shortage of skilled employees can lead to delays and lower efficiency in using robotic vision systems. Companies have trouble finding engineers and technicians with the right skills. Hiring might get even more complicated due to the need for experts in machine learning, computer vision algorithms, and sensor technology.

Market Opportunities

Increase in Industry 4.0 Practices to Create Lucrative Market Opportunities

The widespread adoption of cutting-edge technologies such as IoT, AI, and cloud computing has driven the rising need for automation in industrial manufacturing. Robotic vision is a supporting element for automation and serves as a key enabler of Industry 4.0 strategies. Imaging technologies, such as 3D machine vision systems, mostly require low-latency, uncompressed data to enable decision-making at the speed of automation. The advanced level of technologically based artificial intelligence that can be built into robotic vision permits integration among many sources of images and data.

Robotic Vision Market Trends

Integration of AI and Deep Learning Algorithms into Vision Systems to Emerge as a Key Market Trend

AI and deep learning empower robotic vision technology to surpass simple image capturing and pattern recognition. Advancements in robotics and computer vision are allowing the development of technologies that can learn from large datasets, adapt to changing object positions and lighting conditions, or execute complex functions, including defect detection in real time and adaptive automation with less human intervention. With the help of AI, vision systems can identify small imperfections and adapt to shifting environments, leading to a reduction in false positives and an improvement in quality management.

SEGMENTATION ANALYSIS

By Component

Improvements in Systems Integration Boosted the Expansion of the Hardware Segment

Based on component, the market is segmented into hardware and software.

In terms of share, the hardware segment dominated the market with a share of 73.45% in 2026. This includes components allowing robots to take images, analyze visual data, and make decisions with instant feedback on which to act. Hardware improvements in sensor resolution, image processing, and systems integration are driving the growth of the segment. ABB, SICK AG, and others are integrating advanced vision systems in their robot arms for use in pick-and-place operations, quality assurance, and assembly line inspection.

The software segment is set to achieve the highest compound annual growth rate (CAGR) during the forecast period, driven by advances in AI, ML, and deep learning performance. The software helps robots analyze visual data received from the hardware, identify objects, and make a vast range of other intricate decisions. These capabilities have important implications for the autonomy and precision of robots in unsteady environments.

By Technology

2D Vision Segment Dominated the Market due to their Ability to Automate Assembly Lines

Based on technology, the market is categorized into 2D vision, 3D vision, laser-based vision, structured light vision, and others.

In 2026, the 2D vision market segment dominated the market contributing 30.11% globally. This technology generally employs cameras and sensors to assess the surroundings, detect objects, and deliver essential information for functions such as inspection, sorting, and object identification. In sectors such as logistics, manufacturing, and automotive, these systems are mainly utilized for material handling, quality assurance, and automating assembly lines.

The laser-based vision segment is estimated to have the highest CAGR during the forecast period. The growth of this segment is driven by its precise depth measurements, ability to perform reliably under various environmental conditions, and integration with AI, which enables smarter robotics operations.

By Application

Material Handling Segment Dominated the Market with Rising Labor Costs and Productivity Needs

Based on application, the market is categorized into welding & soldering, packaging & palletizing, material handling, assembling & disassembling, measurement and inspection, cutting, pressing, and deburring, and painting.

In 2026, the material handling segment accounted for the largest robotic vision market with a share of 38.97%. Rising labor costs and the demand for higher productivity have been prompting companies to automate processes. Robotic vision systems employed in material handling are contributing to automating repetitive or risky jobs while improving efficiency and decreasing the need for labor.

The measurement and inspection segment is expected to record the highest CAGR during the forecast period. Manufacturers are tasked with conducting consistent quality checks and providing accurate measurements for an increasing number of products. Robotic vision systems can leverage robotic capabilities for locating defects, measuring sizes, sorting products, and helping improve quality assurance while reducing human error.

By Industry

To know how our report can help streamline your business, Speak to Analyst

Automotive Segment Dominated the Market due to the Increasing Need for Customization

Based on industry, the market is categorized into automotive, electronics and electrical, food & beverage, metals and machinery, logistics, and others.

The automotive segment held the largest share of the market with a share of 27.67% in 2026. The growing demand for customization, labor shortages, and cost pressures are some of the reasons robotic vision systems are being utilized in the automotive market. According to the WHO, Neuromation states that traffic accidents account for 2.2% of deaths across the globe. By employing 2D and 3D machine vision along with intelligent transportation systems (ITS), a safety net is created for drivers.

The metals and machinery segment is poised to witness the highest CAGR during the forecast period, driven by a mix of technological progress, cost-effectiveness, regulatory mandates, and the shift toward smart manufacturing and automation. The significant demand for thorough quality inspection and the need to address workforce challenges are particularly compelling reasons for growth in these sectors.

ROBOTIC VISION MARKET REGIONAL OUTLOOK

By region, the market is divided into North America, Europe, South America, the Middle East & Africa, and Asia Pacific.

North America

North America Robotic Vision Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America dominated the market with a valuation of USD 1.3 billion in 2025 and USD 1.41 billion in 2026.. The rising deployment of robotics across various sectors is a key driver of the market's growth. According to the IFR, in the Americas, the number of robot installations surpassed 50,000 units for the third consecutive year. In 2023, a total of 55,389 units were installed, only 1% lower than the all-time high achieved in 2022. The U.S. market is valued at USD 1.07 billion by 2026.

Download Free sample to learn more about this report.

The production of machine vision systems is expected to increase as a result of government initiatives such as the Advanced Manufacturing Partnership, which seeks to promote investment in future automation technologies from businesses, universities, and the federal government. The MAPI (Manufacturers Alliance for Productivity and Innovation) predicted that industrial production in the U.S. will grow by 2.8% compared to the previous year, supporting the wider adoption of robotic vision technologies across the country.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is expected to experience the second-largest growth throughout the predicted time frame. The growth is strongly driven by the automotive industry investment in traditionally strong car manufacturing countries. As per the International Federation of Robotics, Industrial robots witnessed an annual growth of 9% in 2024. The UK market is valued at USD 0.14 billion by 2026, while the Germany market is valued at USD 0.13 billion by 2026.

South America

While there is an increasing need for automation in South America, awareness and spending capacity for robotic vision systems among businesses remain limited.

Middle East & Africa

The region faces challenges such as political instability, varying regulatory environments, and inadequate digital infrastructure in some areas, all of which contribute to slower market development. On the other hand, the smart manufacturing technologies and Industry 4.0 are gradually being adopted.

Asia Pacific

Asia Pacific is expected to register the largest CAGR during the forecast period. The rising use of machine vision systems for inspecting and evaluating product quality in industrial applications, along with the increasing demand for enhanced inspection systems aimed at producing high-quality and defect-free goods, is driving the robotic vision market growth. Additionally, the government's efforts in nations such as India, China, and South Korea to encourage foreign direct investment in the manufacturing sector are also fueling the growth of the region. The Japan market is valued at USD 0.29 billion by 2026, the China market is valued at USD 0.48 billion by 2026, and the India market is valued at USD 0.18 billion by 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Notable Players Focus on Holding Contracts to Expand their Business

Key players in this market are offering robotic vision solutions that enable optical inspections, object sorting, measurements, and more. They concentrate on holding contracts with small and local businesses to grow their business. Moreover, such mergers & acquisitions, partnerships, and investments will create a surge in demand for this technology.

List of Key Robotic Vision Companies Studied (including but not limited to)

- Cognex Corporation (U.S.)

- Keyence Corporation (Japan)

- FANUC Corporation (Japan)

- ABB Group (Switzerland)

- Sick AG (Germany)

- Teledyne DALSA (Canada)

- Omron Corporation (Japan)

- Basler AG (Germany)

- Hexagon AB (Sweden)

- Qualcomm Technologies, Inc. (U.S.)

- Yaskawa Electric Corporation (Japan)

- Universal Robots (Denmark)

- Industrial Vision Systems Ltd (U.K.)

- Motion Technique India Pvt. Ltd. (India)

- OnRobot US Inc. (Denmark)

- SERVO-ROBOT INC. (Canada)

- Vision Robotic India (India)

- ViTrox Corporation Berhad (Malaysia)

- Nikon Corporation (Japan)

- Mech-Mind Robotics (China)

…and more

KEY INDUSTRY DEVELOPMENTS

- August 2024: Cognex Corporation improved its In-Sight SnAPP vision sensor by enlisting a newly developed AI-powered counting tool. This feature allows manufacturers to automate the verification of assemblies and verify the quantity of items.

- January 2024: STMicroelectronics launched the VL53L8CX, its next-generation time-of-flight ranging sensor. The new sensor features dual metasurface lenses, a 940 nm vertical cavity surface-emitting laser, a multi-zone single-photon avalanche diode array, and an optical system with filters and diffractive optical elements.

- June 2023: Omron Corporation introduced the F440 Smart Camera, a flexible solution for implementing autonomous vision systems inside equipment. The camera extends the capabilities of robotic vision applications by improving integration and efficiency.

- October 2022: ABB formed a strategic alliance with the U.S. startup Scalable Robotics to enhance its range of user-friendly robotic welding solutions. The technology developed by Scalable Robotics, which incorporates 3D vision and built-in process awareness, allows users to program welding robots without the need for coding.

- August 2022: Visionary.ai, a provider of software-based image signal processing (ISP) technology, and Innoviz, a provider of automotive-grade LiDAR sensors and perception software, announced a collaboration to combine the imaging-related innovations of Visionary.ai with Innoviz's LiDAR sensors and perception software. Both companies believe their collaboration would improve 3D machine vision capabilities across many applications, such as robotics and drones.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The investment environment among top robotics companies in 2025 demonstrates a growing emphasis on artificial intelligence, growth of platforms, partnerships, engagement, and investment into new growth areas. These actions are transforming the design, delivery, and adoption of robots across various industries globally. Additionally, investors are supporting companies in seeking out more opportunities. For instance,

- In January 2025, NEURA Robotics, a pioneer in cognitive robotics and the sole humanoid robotics firm in Germany, announced it had secured approximately USD 130 million in a Series B funding round. This considerable investment highlights NEURA Robotics' pivotal position in cognitive robotics. It demonstrates its unique capability to lead the European robotics sector and emerge as a significant player in the worldwide robotics arena.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product types, and the leading Industry of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.84% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Technology

By Application

By Industry

By Region

|

|

Companies Profiled in the Report |

Cognex Corporation (U.S.) Keyence Corporation (Japan) FANUC Corporation (Japan) ABB Group (Switzerland) Sick AG (Germany) Teledyne DALSA (Canada) Omron Corporation (Japan) Basler AG (Germany) Hexagon AB (Sweden) Qualcomm Technologies, Inc. (U.S.) |

Frequently Asked Questions

The market is projected to reach a valuation of USD 8.05 billion by 2034.

In 2025, the market was valued at USD 3.48 billion.

The market is projected to record a CAGR of 9.84% during the forecast period.

By component, the hardware segment led the market in 2025.

Rising adoption of smart cameras is a key factor driving market growth.

Cognex Corporation, Keyence Corporation, FANUC Corporation, ABB Group, Sick AG, Teledyne DALSA, Omron Corporation, Basler AG, Hexagon AB, and Qualcomm Technologies, Inc. are the top players in the market.

North America held the highest market share in 2025.

By Industry, the metals and machinery segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us