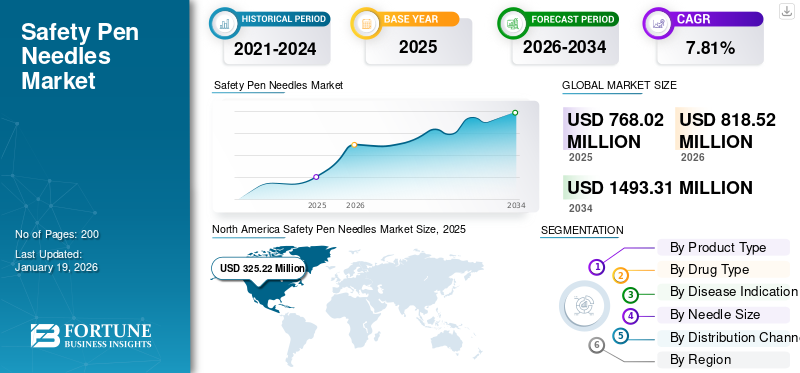

Safety Pen Needles Market Size, Share & Industry Analysis, By Product Type (Active Safety Pen Needles and Passive Safety Pen Needles), By Drug Type (Insulin, GLP-1, Growth Hormone, and Others), By Disease Indication (Diabetes, Obesity, Hormone Deficiency, and Others), By Needle Size (4 mm, 5 mm, 6 mm, 8 mm, and 12 mm), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global safety pen needles market size was valued at USD 768.02 million in 2025 and is projected to grow from USD 818.52 million in 2026 to USD 1,493.31 million by 2034, exhibiting a CAGR of 7.81% during the forecast period. North america dominated the safety pen needles market with a market share of 42.34% in 2025.

Safety pen needles are sterile, single-use needles designed for use with insulin pens, incorporating features to prevent accidental needlestick injuries. These features typically include a needle guard or shield that covers the needle after injection, preventing it from causing injury. They are designed to minimize the risk of accidental needlestick injuries with a used needle.

The rising prevalence of diabetes globally is expected to drive the demand for insulin administration, with safety mechanisms and the avoidance of needle prick injuries. In such a scenario, the safety pen needles become a vital choice over traditional syringes and standard pen needles, which is likely to increase their adoption.

Some of the major players in the market include Embecta Corp., Cardinal Health, and MTD Medical Technology and Devices. These companies are involved in strategic alliances, new launches, and growth initiatives.

MARKET DYNAMICS

Market Drivers

Increasing Prevalence of Diabetes to Drive Market Growth

The rising burden of diabetes is leading to increasing complications among the majority of the global population. This scenario is expected to propel the number of patients undergoing treatment with insulin, driving the usage of safety pen needles. Additionally, several factors, including rapid urbanization and a shift toward a sedentary lifestyle, especially in developing economies, have been responsible for the rapidly rising prevalence of diabetes.

- For instance, the latest IDF Diabetes Atlas (2025) reported that 11.1% of the adult population aged 20-79 years has diabetes.

Moreover, the increased prevalence of obesity has radically increased the risk of diabetes globally. However, the rate varies significantly by country due to lifestyle changes and diets. Even though there is no direct correlation between the obesity rate and the economic status of a country, it has been observed that the wealthy countries tend to implement more programs, campaigns, and initiatives to raise awareness and education among people about a healthy lifestyle. This is increasing the demand for safety pen needles, which is expected to fuel the global safety pen needles market growth.

Market Restraints

Introduction of Alternative Drug Delivery Systems to Hinder Market Growth

In recent years, clinical studies have been conducted to demonstrate the effectiveness of intranasal and topical routes of administration for delivering biologics and other novel drugs. There has been an increased focus on tailored and targeted drug delivery systems, such as needleless systems.

Despite merits and demerits, there has been an emerging interest in such systems among healthcare providers and patients. Henceforth, key players are exploring the capabilities of these systems to capitalize on the shifting trend in the alternative drug delivery systems.

- For instance, in November 2024, Sol-Millennium Medical Group launched its Insujet – Needle Free device in the U.S. market for insulin administration among the diabetic population.

Rapid emergence of such advanced products is expected to hamper the demand for safety pen needles, limiting market expansion during the forecast period.

Market Opportunities

Preferential Shift Toward Home Healthcare to Offer Lucrative Growth Opportunities

Over the past few years, there has been a significant rise in demand for home healthcare. The increased geriatric population has augmented the burden of diabetes, necessitating routine disease management and drug administration. Several patients are gradually managing chronic diseases, including diabetes, at home, which has surged the demand for user-friendly and safe injection devices.

- For instance, according to the data published by the NCBI in September 2023, around 60.0% of the global insulin users use a pen.

Safety pen needles, with features such as auto-retraction and single-use mechanisms, have reduced the risk of needlestick injuries and cross-contamination, making them ideal for self-administration by elderly patients or caregivers. Additionally, the proliferation of remote patient monitoring and personalized care models has fostered the adoption of these devices outside traditional clinical settings. In such a scenario, emerging markets in Asia Pacific and Latin America, where home-based diabetes management is on the rise, are expected to present untapped potential for market growth in the coming years.

Market Challenges

High Cost of Safety Pen Needles to Limit Market Growth

Safety pen needles are comparatively more expensive than other products, leading to decreased prescription rates and less adoption. For instance, in June 2025, the NHS mentioned that safety needles should not be prescribed on the FP10 form because they are up to 8 times more expensive than standard needles.

In several regions, particularly in developing countries, such as China, India, and others, there is a lack of sufficient reimbursement for safety pen needles, further exacerbating the affordability issue. This is expected to hamper its adoption, limiting the market growth in the forthcoming years.

SAFETY PEN NEEDLES MARKET TRENDS

Integration of Safety Features with Ultra-Thin Needle Technology

Integration of advanced safety mechanisms with ultra-thin needle technology has enhanced user comfort and compliance. Manufacturers are developing pen needles with reduced outer diameters as low as 4mm and 32-34 gauge, while incorporating safety shields or passive needle retraction systems.

These innovations have minimized injection pain and anxiety, critical for long-term therapy adherence, especially for insulin-dependent diabetic patients. Combining finer needles with auto-disable or hidden needle systems is gaining traction among healthcare professionals and patients. Safety-enhanced devices are being co-developed with pharmaceutical companies for exclusive use with insulin pens and GLP-1 receptor agonists.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The market witnessed positive growth in 2020 due to COVID-19. Lockdown restrictions and the temporary closure of healthcare facilities led to a preferential shift in home healthcare, ultimately increasing the adoption of safety pen needles and supporting the growth of the market.

The market also witnessed steady growth in post-pandemic years and is expected to continue further due to the rising incidence of diabetes and demand for advanced solutions to administer medicals, with easy use and convenience.

SEGMENTATION ANALYSIS

By Product Type

Satisfactory Results of Active Safety Pen Needles to Spur Its Demand

Based on product type, the market is classified into active safety pen needles and passive safety pen needles.

The active safety pen needles segment dominated the market in 2024. The segment's growth is attributed to certain advantages of active safety pen needles, such as ease of use, convenience, and the ability to deliver a full insulin dose. Several studies have found satisfactory results with this product, which is expected to fuel its adoption in the coming years.

- For instance, in July 2025, Owen Mumford mentioned that a study on the pediatric population regarding medication administration via a safety pen needle concluded that 55.0% nurses were very satisfied with the active safety pen needle.

On the other hand, the passive safety pen needles segment held a substantial share of the global market in 2024. These needles are easier for individuals who struggle with manual dexterity. It reduces the risk of needle stick injuries by eliminating the need for manual activation. These advantages have spurred its adoption.

By Drug Type

Increasing Launch of Insulin Drugs to Fuel Usage of Safety Pen Needles

Based on drug type, the market is classified into insulin, GLP-1, growth hormone, and others.

The insulin segment dominated the market in 2024. There is an increasing launch of insulin products by key players for treating diabetes globally. These initiatives by key players are influenced by rising awareness about self-administration of insulin and the convenience of safety pen needles compared to older methods including syringes.

- For instance, in January 2025, Novo Nordisk A/S announced the launch of Awiqli (insulin icodec) for treating diabetes in the Japanese market.

On the other hand, the GLP-1 segment held the second-largest market share in 2024. The growth is attributed to increasing recommendations of administering GLP-1 (Glucagon-like peptide-1) agonists to patients due to their effectiveness in managing type 2 diabetes and their potential for weight loss. Safety pen needles offer convenience, reduced pain, and improved patient adherence in such scenarios.

By Disease Indication

Diabetes Segment to Dominate Due to Increasing Launch of Next Generation Safety Pen Needles

Based on disease indication, the market is classified into diabetes, obesity, hormone deficiency, and others.

The diabetes segment dominated the market in 2024. The rising home healthcare for diabetes is encouraging key players to launch advanced drug administration solutions such as safety pen needles, which are expected to increase market availability.

- For instance, in September 2019, Owen Mumford Limited announced the launch of Ateria SafeControl, the next generation of safety pen needles, at the 55th European Association for the Study of Diabetes (EASD) Annual Meeting in Barcelona, Spain.

On the other hand, the obesity segment held the second-largest market share in 2024. The segment’s growth is attributed to increased prevalence of obesity, as it is a risk factor for type 2 diabetes, often requiring insulin injections. This is expected to fuel the demand for safety pen needles.

By Needle Size

4 mm Needle Size Dominates Due to its Significant Benefits and Fewer Side Effects

Based on needle size, the market is classified into 4 mm, 5 mm, 6 mm, 8 mm, and 12 mm.

The 4mm segment dominated the market in 2024. The segment’s growth is attributed to the significant benefits of this needle size and the limited side effects associated with its usage. This is expected to drive the adoption of 4 mm needles among healthcare providers and patients during the projection period.

- For instance, according to the data published by the MDPI in July 2024, the usage of a 4 mm needle poses fewer side effects, including skin damage, intramuscular or intradermal injection, even in obese individuals.

On the other hand, the 5 mm segment accounted for the second-largest market share in 2024. The growing focus of market players on the development and launch of 5 mm pen needles is one of the major factors behind its increased availability in the market.

By Distribution Channel

Retail Pharmacies Segment to Lead Due to New Openings Globally

Based on distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy.

The retail pharmacies segment dominated the market in 2024. The increasing opening of new retail pharmacies globally is contributing to higher availability and accessibility of safety pen needles in the market. This significant availability is leading to higher sales from retail pharmacies.

- For instance, in March 2025, CVS Pharmacy announced its plan to open new retail pharmacy stores across the U.S.

The online pharmacies segment is projected to register the highest growth rate during the forecast period. Online channels offer a seamless shopping experience, with home delivery and convenient prescription ordering, making it easier for patients to access their supplies. Additionally, online platforms often provide discounts and bundled deals, making them an attractive option for consumers.

SAFETY PEN NEEDLES MARKET REGIONAL OUTLOOK

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Safety Pen Needles Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market in 2025, with the safety pen needles market size reaching USD 325.22 million. The region’s growth is attributed to key players ensuring a regular supply of safety pen needles, and unhealthy lifestyles, contributing to the rising incidence of diabetes, which is expected to fuel the need for insulin administration.

Moreover, in the U.S., there are increasing regulatory approvals and the launch of growth hormone products used to treat pediatric growth hormone deficiency, creating a favorable condition for using safety pen needles.

- For instance, in June 2023, Pfizer Inc. and OPKO Health Inc. announced that the U.S. Food and Drug Administration (FDA) had approved NGENLA (somatrogon-ghla), a once-weekly, human growth hormone analog indicated for the treatment of pediatric patients aged three years and older who have growth failure due to inadequate secretion of endogenous growth hormone.

Europe

The market in Europe held the second-largest share in 2024. In recent years, a significant number of medical devices, including safety pen needles, have been prescribed for treating diabetes in this region, which is expected to result in a high penetration rate in the region. Moreover, increasing key players’ campaigns to create product awareness among consumers is one of the main factors driving the product’s demand.

- For instance, according to the data provided by the National Health Service (NHS) in August 2024, there were 71.0 million items prescribed for treating diabetes in the U.K., an increase of 21.0 million items since 2016.

Asia Pacific

Asia Pacific is expected to witness the highest CAGR during the forecast period. Asia Pacific has the highest prevalence of diabetes among all regions globally, increasing the need for specialized insulin administration devices such as safety pen needles. This is attracting key players to sign a strategic agreement to distribute their products in the Asia Pacific, which is expected to increase product penetration.

- For instance, in March 2024, Owen Mumford announced a partnership with Duopharma Biotech to distribute Owen’s diabetes products in Malaysia and Brunei. As per the agreement, Duopharma Biotech started distributing Owen’s diabetes products, including safety pen needles, in the Malaysian and Brunei markets.

Latin America and the Middle East & Africa

The Latin America and the Middle East & Africa markets are expected to grow significantly in the coming years. The high burden of obesity among children and adults in Latin American countries is one of the main factors driving the adoption of safety pen needles in the region. Moreover, the increasing awareness about advanced drug administration devices, including safety pen needles and the entry of market players in the Middle East & Africa region, is expanding the product availability, which is anticipated to fuel the market expansion over the forecast period.

- For instance, according to the New Mexico Childhood Obesity 2024 report published in March 2025, around 30.8% of kindergarten students and 41.1% of third-grade students had BMIs that met the criteria for overweight or obesity, respectively in New Mexico in 2024.

COMPETITIVE LANDSCAPE

Key Industry Players

New Launches and Collaboration Initiative Enhances Market Share of Embecta Corp. and Cardinal Health

Embecta Corp. and Cardinal Health accounted for the major global safety pen needles market share in 2024. This share is attributed to their focus on launching new products and increasing R&D investments to enhance their product features and reputation.

Moreover, other key players, such as MTD Medical Technology and Devices, UltiMed, Inc., Allison Medical, Inc., Owen Mumford, and other companies, focus on participating in various conferences and events to strengthen their brand presence. Additionally, they are signing distribution agreements to enter untapped markets, which is expected to help them capture a significant market portion.

LIST OF KEY SAFETY PEN NEEDLES COMPANIES PROFILED IN THE REPORT:

- Embecta Corp. (U.S.)

- Cardinal Health (U.S.)

- MTD Medical Technology and Devices (Poland)

- UltiMed, Inc. (U.S.)

- Allison Medical, Inc. (U.S.)

- Owen Mumford (U.K.)

- VMG (Denmark)

- Neon Diagnostics Limited (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- November 2024: Cardinal Health announced its plan to acquire the Advanced Diabetes Supply Group (ADSG), one of the country's leading diabetic medical supplies providers, for approximately USD 1.1 billion in cash.

- August 2024: MTD Medical Technology and Devices announced it had increased its production capacity to over 2.5 billion pen needles.

- July 2024: Embecta Corp. announced its partnership with Genpact to strengthen its footprint in the diabetes technology market.

- May 2024: UltiMed, Inc. announced its plan to participate in the Cencora ThoughtSpot 2025, which will occur from July 16th to 19th, 2025, in Las Vegas, U.S., to showcase its products, creating product awareness among healthcare professionals.

- April 2022: Embecta Corp. completed the spin-off from BD and was listed on NASDAQ as one of the major companies in the diabetes care industry.

REPORT COVERAGE

The global safety pen needles market report provides market size & forecast by product type, drug type, disease indication, needle size, and distribution channel. It includes market dynamics, trends, and various associated factors projected to propel the market expansion during the projection period. It offers information on the prevalence of diabetes and obesity and key industry developments. The report covers a detailed competitive landscape with information on the market share and company profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.81% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type, Drug Type, Disease Indication, Needle Size, Distribution Channel, and Region |

|

By Product Type |

· Active Safety Pen Needles · Passive Safety Pen Needles |

|

By Drug Type |

· Insulin · GLP-1 · Growth Hormone · Others |

|

By Disease Indication |

· Diabetes · Obesity · Hormone Deficiency · Others |

|

By Needle Size |

· 4 mm · 5 mm · 6 mm · 8 mm · 12 mm |

|

By Distribution Channel |

· Hospital Pharmacy · Retail Pharmacy · Online Pharmacy |

|

By Region |

· North America (By Product Type, Drug Type, Disease Indication, Needle Size, Distribution Channel, and Country/Sub-region) o U.S. o Canada · Europe (By Product Type, Drug Type, Disease Indication, Needle Size, Distribution Channel, and Country/Sub-region) o U.K. o Germany o France o Italy o Spain o Scandinavia o Rest of Europe · Asia Pacific (By Product Type, Drug Type, Disease Indication, Needle Size, Distribution Channel, and Country/Sub-region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Product Type, Drug Type, Disease Indication, Needle Size, Distribution Channel, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Product Type, Drug Type, Disease Indication, Needle Size, Distribution Channel, and Country/Sub-region) o GCC o South Africa o Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 768.02 million in 2025 and is projected to reach USD 1,493.31 million by 2034.

In 2025, the market value stood at USD 325.22 million.

The market is expected to exhibit a CAGR of 7.81% during the forecast period of 2026-2034.

Retail pharmacies are expected to lead the market by distribution channel.

The key factors driving the market are the increasing prevalence of diabetes and the rising demand for home healthcare.

Embecta Corp. and Cardinal Health are the top players in the market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us