Secure Web Gateway Market Size, Share & Industry Analysis, By Deployment (Cloud-based, On-premises and Hybrid), By Enterprise Type (Small and Medium Enterprises (SMEs) and Large Enterprises), By End-user (BFSI, IT & Telecom, Healthcare, Retail & E-commerce, Government & Public Sector, Education, Manufacturing and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

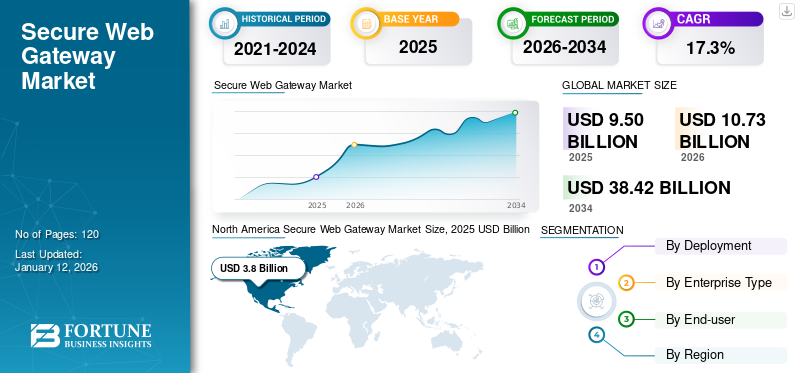

The global secure web gateway market size was valued at USD 9.50 billion in 2025 and is projected to grow from USD 10.73 billion in 2026 to USD 38.42 billion by 2034, exhibiting a CAGR of 17.3% during the forecast period. North America dominated the global market with a share of 37.54% in 2025.

A Secure Web Gateway (SWG) is a cybersecurity solution that serves as a barrier for internet traffic, managing and regulating access to web resources to safeguard users and networks from threats and breaches of policy. The market is undergoing a fundamental transformation, emerging as a critical nerve center for modern cybersecurity architectures in an era of distributed workforces and cloud-first strategies.

These next-generation solutions are rapidly evolving beyond basic url filtering to address the complex security challenges posed by sophisticated threats, encrypted traffic, and the explosion of SaaS applications.

Innovations from major market players such as Broadcom, Forcepoint, and Check Point now include autonomous threat response, encrypted traffic analysis, and API-aware security—ensuring consistent protection across apps, users, and devices. These advancements enable enterprises to balance security with performance, even in highly dynamic environments.

IMPACT OF AI

Implementation of AI Capabilities to Fuel the Growth of the Market

Artificial Intelligence (AI) is increasingly transforming the market to improve the speed, accuracy, and flexibility of threat detection and response initiatives. Traditional signature-based security models are overwhelmed by the speed and complexities of modern cyber threats that are polymorphic and behaviorally rich.

AI-enabled SWG solutions take advantage of machine learning algorithms and real-time analytics to detect zero-day threats, anomalous web behavior, phishing attacks, and advanced malware with greater accuracy and speed. For instance,

- In November 2024, F5 launched AI Gateway, a solution to secure and optimize AI/LLM traffic by enforcing security policies, reducing costs via semantic caching, and simplifying integrations. It addresses enterprise challenges including scalability, compliance, and API management for AI apps. The tool integrates with F5's portfolio (NGINX, BIG-IP) and supports multi-cloud deployment.

With enhanced monitoring capabilities, AI can also continually learn from web traffic characteristics and user behavior to reduce false positives and automate policy enforcement, enabling organizations to strengthen their security posture and operational efficiency

MARKET DYNAMICS

Secure Web Gateway Market Trends

Integration of Secure Web Gateway with Secure Access Service Edge (SASE) to be a Key Trend

The Secure Web Gateway (SWG) market is undergoing a substantial paradigm shift as it converges with Secure Access Service Edge (SASE) frameworks and Zero Trust initiatives. The current generation of SWG is not just a web filtering tool, but a legitimate enforcement point within the comprehensive ecosystem of SASE solutions.

Next-gen SWGs now have continuous authentication and adaptive access capabilities that take many risk inputs into account (e.g., user identity, device posture, location, and behavior patterns) before finally granting least-privilege access to web resources. This is particularly relevant given that hybrid work environments represent the new (ab)normal, in which perimeter-based security models can scarcely limit breaches of security. For instance, the latest SWG offerings can dynamically modify access rights directly based on statistically inferred risks, automatically blocking dubious sessions or enforcing step-up authentication when anomalous behavior is detected.

Market Drivers

Increasing Complexity of Web Based Threats to Drive the Market Growth

The increasing complication of web-based threats is one of the main drivers of the secure web gateway market growth. Today’s cyberattacks have transcended from simple malicious links and easily spotted malware to intricate threats involving file-less malware, obfuscated scripts, phishing-as-a-service, and zero-day vulnerabilities that can bypass security defenses, and many other techniques. For instance,

- According to Astra Security, a cyberattack occurs every 39 seconds, amounting to roughly 2,200 attacks per day. In the U.S., the average cost of a data breach stands at USD 9.4 million, contributing to a projected global cybercrime cost of USD 8 trillion by 2023.

These increasingly complex attack methods can now often be found coming from legitimate-looking websites, via cloud services, or through encrypted traffic. This results in an increased difficulties in detecting them and the threat landscape becoming even more unpredictable.

This is prompting organizations to find more intelligent and web-centric protection capabilities that SWGs are designed to provide. Critical to providing this advanced web protection and management capabilities is enabling organizations to take advantage of deep content inspection, real-time behavioral analysis, and contextual threat detection.

Market Restraints

User Pushback and Privacy Concerns Restrain Adoption of Secure Web Gateway

One of the significant limitations within the SWG market is the backlash from end users and team member advocacy groups due to privacy and surveillance concerns. SWGs are, by nature, inspecting and filtering all web traffic, which is typically comprised of personal browsing data and application usage.

The use and deployment of behavioral analytics tools inside SWGs that monitor users’ activities to identify risk is adding additional ethical and legal scrutiny regarding workplace surveillance. Employees have distrust of their organizations' policies as there is a lack of transparency regarding how policies are enforced, what data is being logged, and if monitoring is in place and what it entails.

- For instance, in August 2024, cybersecurity startup SquareX revealed that Secure Web Gateways (SWGs) are fundamentally flawed, showcasing 30+ bypass techniques that highlight serious architectural weaknesses.

This has led to backlash from employees and compliance agencies, which has led to hesitancy, resistance, and compromise in the use of SWG technologies in privacy-conscious industries and regions.

Market Opportunities

Shift to Remote and Hybrid Work Creates Lucrative Market Opportunities

The shift to remote and hybrid work is redefining the enterprise network perimeter, driven by global events and organizational work preferences.

- For instance, according to Forbes, as of 2024, 12.7% of full-time employees in India work remotely, while 28.2% follow a hybrid model, highlighting the growing shift toward flexible work environments. However, the majority—59.1%—still work entirely from office spaces.

- By 2025, an estimated 60 to 90 million Indians (approximately 10.1% to 15.2% of the total labour force) are expected to work remotely, signaling a gradual but sustained transformation in the country's work culture.

Employees now interact and access corporate systems, cloud applications, and private data from every imaginable endpoint in unsecured networks outside of their organization. This makes the opportunities for cybercriminals and bad actors to exploit vulnerabilities much more preferable.

For this reason, organizations are looking to SWG to enable secure web access, regardless of user location. Modern SWG solutions deliver remarkable capabilities for responding to pledged needs for all employees, virtual and in-site.

SEGMENTATION ANALYSIS

By Deployment

Surging Cloud-based Deployment Drives SWG Market Expansion

On the basis of deployment, market is divided into cloud-based, on-premises, and hybrid

Cloud-based deployment holds the majority share of 61.76% in 2026, the market driven by the need for flexibility, easy management, and protection that extends beyond the corporate firewall. As companies embrace cloud-first strategies, and move to more remote/hybrid work models, traditional perimeter-based security is no longer enough. Cloud-delivered SWG solutions provide easy scalability, faster updates, and are more broadly available for users accessing applications whenever and wherever they want, and on any device.

And the increasing integration of SWGs to cloud-native ecosystems such as SASE and Zero Trust keeps them relevant and functioning under a modern security strategy and will continue to bolster the cloud-delivery model which will undoubtedly remain the most adopted and fastest-growing implementation method in the coming years.

- For instance, in July 2025, Netgear has completed its acquisition of Exium to enter the SASE market, with a strong focus on delivering cloud-based Secure Web Gateway (SWG) capabilities. By integrating Exium’s cloud-native security technology into its Insight platform, Netgear aims to offer SMEs and MSPs a unified solution that combines networking and advanced security tools—such as SWG, SD-WAN, CASB, NGFW, and ZTNA.

Hybrid SWG deployments is expected to grow with the highest CAGR as hybrid deployments can address more of an organization’s regulatory and operational requirements. The industries served include those that require strict adherence to data sovereignty—e.g. regulations in healthcare and pharmaceuticals, or compliance requirements for government entities with data regulation needs—use hybrid to allow the organization to achieve cloud scale while exercising more control over the data hosted locally.

By Enterprise Type

Rising Large Enterprise Demand to Drive Market Growth

On the basis of enterprise type, the market is bifurcated into small and medium enterprises (SMEs) and large enterprises.

Large enterprises are expected to hold the largest share of 66.47% in 2026 and are expected to grow with the highest compound annual growth rate (CAGR). This is due to the overall complexity and magnitude of their security requirements, larger than typical IT budgets, and strict compliance mandates.

These large enterprises also rely on large-scale hybrid cloud environments and distributed workforces, which obligate them to use advanced SWG solutions that incorporate threat protection, data loss prevention (DLP), and Zero Trust policies. Unlike small and medium-sized enterprises (SMEs), large enterprises endure heightened risk from advanced cyber threats, while also being subjected to strict industry regulations such as GDPR, HIPAA, and PCI DSS. For instance,

- For instance, in 2023, 32% of U.K businesses reported cyber-attacks last year, rising to 59% for medium and 69% for large firms, highlighting their heightened vulnerability.

As large enterprise organizations become increasingly comfortable using AI-driven security automation and consolidate SWG using Secure Access Service Edge (SASE) architecture in the future, their investment in next-generation web gateways is expected to outpace small business budgets, further solidifying their majority share throughout the SWG market.

By End-user

To know how our report can help streamline your business, Speak to Analyst

BFSI's Heavy Adoption Drives Next-Gen SWG Market Growth

On the basis of end-user, the market is categorized into BFSI, IT & telecom, healthcare, retail & e-commerce, government & public sector, education, manufacturing, and others.

The Banking, Financial Services, and Insurance (BFSI) segment to hold the majority of the market share of 32.70% in 2026 as it has increased vulnerability to cyber-attacks and an urgent requirement for data security. Banks are key targets for ransomware, malware, and phishing attacks, as they handle high amounts of sensitive customer information and financial transactions every day.

- For instance, according to CRN India, in 2024, Indian banks face over 2,500 cyberattacks per week, far above the global average. Ransomware attacks and USD 20 billion in losses over two decades’ highlight growing threats.

IT & Telecom are expected to grow with the highest CAGR due to their dynamic business models, high-volume data environments, and greater dependence on distributed cloud infrastructure. With the increasing complexity of networks managed by worldwide technology companies, hosting cloud applications, and supporting remote workforces, technology companies, service providers, and telecom operators need scalable web security solutions that can evolve in real time,

SECURE WEB GATEWAY MARKET REGIONAL OUTLOOK

By region, the global market is categorized into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America Secure Web Gateway Market Size, 2025 USD Billion

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 3.8 billion in 2025 and USD 4.29 billion in 2026. North America holds a majority in the secure web gateway market share due to its unparalleled confluence of digital maturity, evolving cyber risk profiles, and aggressive cloud-first strategies of enterprises.

In most cases, global regions invest in cybersecurity and SWGs from a reactive standpoint. At the same time, North America is the only region that leverages cybersecurity as a strategic asset, implementing it into enterprise-long digital transformation roadmaps.

- For instance, according to IBM, for fiscal year 2025, the U.S. government suggested a budget of almost USD 13 billion dollars for cybersecurity, marking a rise from the prior fiscal year.

In conclusion, the SWG ecosystem in North America is rich enough that organizations are not only adopting these solutions but integrating them into a holistic security architecture that includes Zero Trust, SASE, and tools that turn AI-driven threat response and threat intelligence.

The U.S., in particular, holds up the region's dominance by being the largest consumer and the main provider of SWG technologies. With a cybersecurity ecosystem rife with advanced persistent threats (APTs), ransomware, and nation-state attacks, the U.S. enterprises have approached, and continues to approach secure web access as a need. The U.S. market is projected to reach USD 3.14 billion by 2026.

Download Free sample to learn more about this report.

South America

South America is expected to grow with a significant CAGR in the SWG market due to the region's growing exposure to advanced cyber threats and the rapid shift toward cloud-based business operations.

- For Instance, according to reports from Trend Micro and Kaspersky, Brazil is the second most vulnerable country to cyberattacks, only behind the U.S., with over 1,500 malware attack attempts per minute. In the first half of 2023 alone, Trend Micro blocked 85.6 billion global threats, with Brazil among the top three targeted nations.

Organizations in more mature markets may often adopt SWG technologies as part of fulfilling compliance requirements; adoption in South America is driven by collectively heightened threat awareness, the ability to mitigate operational risk, and the need to source scalable and cost-effective solutions.

Europe

Europe is expected to grow at a slow and consistent CAGR for the market due to the current maturity of its cybersecurity landscape and solid baseline adoption of web security solutions. Many enterprises in Europe, particularly in Western Europe, have well-established security infrastructures, meaning growth is mainly driven by upgrades and compliance in some areas rather than first-time deployment. The UK market is projected to reach USD 0.56 billion by 2026, and the Germany market is projected to reach USD 0.26 billion by 2026.

Stricter regulatory frameworks including GDPR have already forced organizations to implement data protection and secure access control, which means SWG adoption is more incremental than transformational. However, there is an ongoing emphasis on Zero Trust architectures, modernization of legacy systems, and an increasing attack surface as organizations continue to become targeted attacks in some sectors including manufacturing, finance, and healthcare which is likely to continue to drive moderately consistent growth in the region.

Middle East and Africa

The Middle East & Africa is expected to develop at a steady CAGR within the market, as the region strikes a balance between increasing cyber threats and continuous digital infrastructure development.

Countries such as the UAE, Saudi Arabia, and South Africa are aggressively pursuing cloud adoption, digital banking, and national cybersecurity strategies, thus establishing a definite necessity for secure web access and traffic monitoring.

While demand for secure web from enterprises is on the rise, particularly within government and energy markets, overall adoption among smaller organizations continues to be slow due to cost consciousness and lagging cybersecurity preparedness. Expanding exposure to cyber threats, greater investment in digital services, and wider availability of cloud-based SWG platforms are setting the stage for steady, if measured, growth across the region.

Asia Pacific

Asia Pacific region is expected to grow with the highest CAGR in the secure web gateway market due to its transitional state of the digital economy. Asia Pacific is transitioning from perimeter-based cybersecurity to intelligent, cloud-native architecture, in which SWGs are a central player.

We observe many Asia Pacific enterprises, specifically those in India, Vietnam, and Thailand, moving into fully digitized and cloud-connected worlds for the first time. Additionally, recent partnerships in the region regarding secure web gateway solutions also support this trend. For instance,

- In June 2025, Absolute Software partnered with Internet Initiative Japan (IIJ) to integrate its cloud-based Secure Web Gateway (SWG) into IIJ’s Flex Mobility Service/ZTNA platform. This enhancement enables secure internet access for remote and hybrid workers, addressing modern cybersecurity needs beyond traditional perimeter defenses.

The accelerating number of international cybersecurity vendors establishing regional offices, localized data centers, and affordable cloud-based licensing options is ushering in enterprise-grade SWG solutions that are more accessible than ever across Asia Pacific. The Japan market is projected to reach USD 0.49 billion by 2026, the China market is projected to reach USD 0.88 billion by 2026, and the India market is projected to reach USD 0.66 billion by 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Strategic Alliances, Mergers, and Acquisitions by Key Players Fuels Innovating Technology

Leading SWG vendors are aggressively pursuing strategic acquisitions, technological partnerships, and R&D investments to stay ahead in the evolving cybersecurity landscape. With rising demand for cloud-native security, AI-driven threat prevention, and Zero Trust integration, key players are accelerating innovation in encrypted traffic inspection, API security, and SASE convergence. Mergers, alliances, and ecosystem expansions remain critical as companies compete to deliver scalable, automated SWG solutions that address sophisticated cyber threats and hybrid workforce challenges.

Major Players in the Secure Web Gateway Market

Check Point Software Technologies, Zscaler, Forcepoint, Broadcom, Palo Alto Networks, Netskope, and Versa Networks, among others, are the key players in the market.

Long List of Companies Studied

- Check Point Software Technologies Ltd. (Israel)

- Zscaler, Inc. (U.S.)

- Barracuda Networks, Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- F5, Inc. (U.S.)

- Forcepoint (U.S.)

- Palo Alto Networks (U.S.)

- Cloudflare, Inc. (U.S.)

- Lookout, Inc. (U.S.)

- Broadcom (U.S.)

- Musarubra US LLC (U.S.)

- Netskope, Inc. (U.S.)

- Sophos Ltd (U.K)

- Versa Networks, Inc. (U.S.)

…and more

KEY INDUSTRY DEVELOPMENTS

- July 2025: Versa Networks has been recognized in the 2025 Gartner Magic Quadrant for SASE Platforms for the third consecutive year. The company is one of only three vendors globally recognized in Gartner's Magic Quadrants for Security Service Edge, SD-WAN, and SASE Platforms.

- June 2024: Check Point Software Technologies has launched an India-based data residency instance for its Harmony Secure Access Service Edge (SASE) platform. This initiative aims to boost cybersecurity and compliance for Indian enterprises by providing low-latency access and adhering to local data protection laws including the Digital Personal Data Protection Act (DPDPA).

- January 2024: SonicWall has acquired Banyan Security, a leading provider of identity-centric Secure Service Edge (SSE) solutions. This strategic move aims to enhance SonicWall's platform by extending its security coverage to cloud environments, remote workforces, and traditional networks.

- May 2023: Barracuda Networks launched "Barracuda SecureEdge," a new enterprise-grade Secure Access Service Edge (SASE) platform. It integrates Secure SD-WAN, Firewall-as-a-Service, Zero Trust Network Access, and Secure Web Gateway capabilities into a single cloud-delivered service.

- May 2023: CBC Tech has partnered with Fortinet to deliver next-generation SASE (Secure Access Service Edge) solutions for enterprises in China. The new CBC SASE service, powered by Fortinet, integrates CBC Tech's SD-WAN eNet fabric with Fortinet's security capabilities—including secure web gateway, zero trust network access, and firewall as-a-service—into a single, unified cloud offering.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The SWG market presents compelling investment opportunities driven by the escalating need for robust cybersecurity solutions amid rising cloud adoption, sophisticated cyber threats, and stringent regulatory requirements. Enterprises across sectors are prioritizing investments in AI-powered SWG solutions that integrate seamlessly with Zero Trust architectures and SASE frameworks, creating significant growth potential. Key drivers include mandatory compliance with evolving data protection laws (such as NIS2 and GDPR), the rapid expansion of hybrid work models, and increased cybersecurity budgets.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 17.3% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By End-user

By Region

|

|

Companies Profiled in the Report |

• Check Point Software Technologies Ltd. (Israel) • Zscaler, Inc. (U.S.) • Barracuda Networks, Inc. (U.S.) • Cisco Systems, Inc. (U.S.) • F5, Inc. (U.S.) • Forcepoint (U.S.) • Palo Alto Networks (U.S.) • Cloudflare, Inc. (U.S.) • Lookout, Inc. (U.S.) • Broadcom (U.S.) • Musarubra US LLC (U.S.) • Netskope, Inc. (U.S.) • Sophos Ltd (U.K) • Versa Networks, Inc. (U.S.) |

Frequently Asked Questions

The market is projected to reach USD 38.42 billion by 2034.

In 2025, the market was valued at USD 9.50 billion.

The market is projected to grow at a CAGR of 17.3% during the forecast period.

The cloud-based deployment is expected to hold the highest share.

Increasing complexity of web-based threats to drive the market growth.

Check Point Software Technologies, Zscaler, Forcepoint, Broadcom, Palo Alto Networks, Netskope, and Versa Networks are the top players in the market.

North America is expected to hold the highest market share.

By end-user, IT & Telecom is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us